What Could Slay the Stock & Gold Bulls

Stock-Markets / Financial Markets 2021 Apr 01, 2021 - 03:15 PM GMTBy: Monica_Kingsley

Put/call ratio didn‘t lie, and the anticipated S&P 500 upswing came on Friday – fireworks till the closing bell. Starting on Thursday, with the rising yields dynamic sending value stocks higher – and this time technology didn‘t stand in the way. What an understatement given the strong Friday sectoral showing, acocmpanied by the defensives swinging higher as well. And that‘s the characterization of the stock market rise – it‘s led by the defensive sectors with value stocks coming in close second now.

Still last week, the market confirmed my early Friday‘s take:

(…) While it‘s far from full steam ahead, it‘s a welcome sight that the reflation trade dynamic has returned, and that technology isn‘t standing in the way. I think we‘re on the doorstep of another upswing establishing itself, which would be apparent latest Monday. Credit markets support such a conclusion, and so does the premarket turn higher in commodities – yes, I am referring also to yesterday‘s renewed uptick in inflation expectation.

Neither running out of control, nor declaring the inflation scare (as some might term it but not me, for I view the markets as transitioning to a higher inflation environment) as over, inflation isn‘t yet strong enough to break the bull run, where both stocks and commodities benefit. It isn‘t yet forcing the Fed‘s hand enough, but look for it to change – we got a slight preview in the recent emergency support withdrawal and taper entertainment talking points, however distant from today‘s situation.

Commodities have indeed turned again higher on Friday, as seen in both copper and oil – and so did inflation expectations. While some central banks (hello, Canada) might be ahead in attempting to roll back the emergency support, the Fed isn‘t yet forced by the bond market to act – which I however view as likely to change over the coming months.

With 10-year Treasury yields at 1.67%, last week‘s decline didn‘t reach far before turning higher. Remembering stock market woes the first breach of 1.50% caused, stocks have coped well with the subsequent run up – while in the old days of retirees actually being able to live off interest rate income, a level of 4% would bring about trouble for S&P 500, now the level is probably just above 2%. Yes, that‘s how far our financialized economy has progressed – and I look for volatility to rise, and stocks to waver and likely enter a correction at such a bond market juncture. As always, I‘ll be keeping a close eye on the signs, emerging or not, as we approach that yield level.

Again quoting my Friday‘s words, what else to expect as the bond markets takes notice:

(…) Now, look for the fresh money avalanche, activist fiscal and moterary policy to hit the markets as a tidal wave. Modern monetary theorists‘ dream come true. Unlike during the Great Recession, the newly minted money isn‘t going to go towards repairing banks‘ balance sheets – it‘s going into the financial markets, lifting up asset prices, and over to the real economy. So far, it‘s only PPI that‘s showing signs of inflation in the pipeline – soon to be manifest according to the CPI methodology as well.

Any deflation scare in such an environment stands low prospects of success.

For deflation to succeed, a stock market crash followed by a depression has to come first. And as inflation is firing on just one cylinder now (asset price inflation not accompanied by labor market pressures), it isn‘t yet strong enough to derail the stock bull run. The true inflation is a 2022-3 story, which is when we would be likely in a full blown financial repression and bond yields capped well above 2% while inflation rate could run at double that figure. Then, the Fed wouldn‘t be engaged in a twist operation, but in yield curve control, which the precious metals would love, for they love low nominal and negative real rates.

Gold might be already sensing that upcoming pressure on the Fed to act – remember their run for so many months before the repo crisis of autumn 2019 broke out:

(…) After the upswing off the Mar 08 lows faltered, the bears had quite a few chances to ambush this week, yet made no progress. And the longer such inaction draws on, the more it is indicative of the opposite outcome.

Not only that gold miners outperformed the yellow metal on Friday, with their position relative to silver, the king of metals is sending a signal that it would be the one to take leadership in the approaching precious metals upswing.

And the dollar wouldn‘t be standing in the way – let‘s continue with my Friday‘s thoughts:

(…) When I was asked recently over Twitter my opionion on the greenback, I replied that its short-term outlook is bullish now – while I think the world reserve currency would get on the defensive and reach new lows this year still, it could take more than a few weeks for it to form a local top. Once AUD/USD turns higher, that could be among its first signs.

Once higher rates challenge the stock market bull, the dollar would do well in whiff of deflationary environment (remember the corona runup of spring 2020), but it would be the devaluation that would break it – and it‘s my view that devaluation would not happen against other fiat currencies, but against gold (and by extension silver). With devaluation (it‘s still far away in the future), a true inflation would arrive and stay, which forms a more drastic scenario to the more orderly one I discussed earlier in today‘s article.

Another challenge for the stock market bull comes from taxes, as the current and upcoming infrastructure stimuli (wait, there is the $2T one to move the U.S. to a carbon-neutral future on top) would result in higher tax rates next year, which would further hamper productive capital allocation as people and institutions would seek to negate their effect. Needless to say, gold, miners and real assets would do very well in such an environment.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

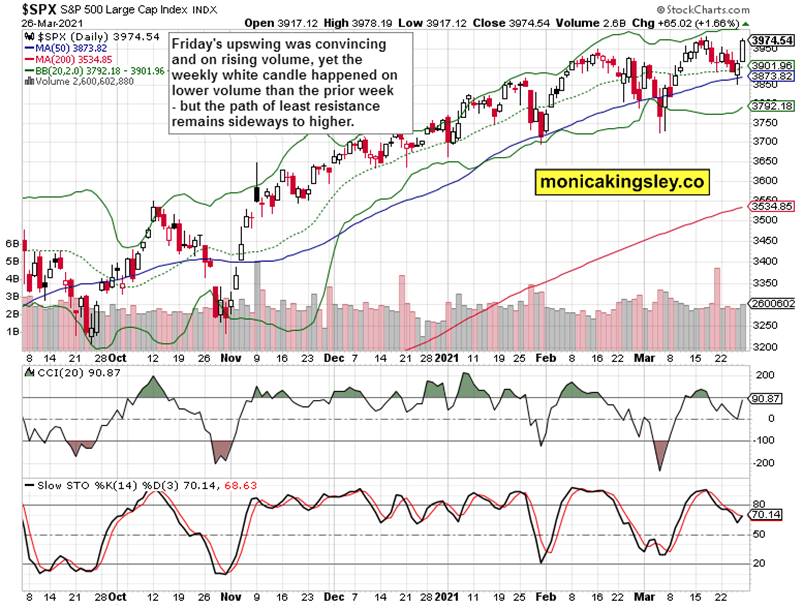

S&P 500 Outlook

Strong S&P 500 upswing on Friday, on a not too shabby volume. The key question is whether the bulls can keep the momentum on Monday, and ideally extend the gains at least a little. Signs are they would be able to achieve that.

Credit Markets

High yield corporate bonds (HYG ETF) reached the mid-Mar highs, and need to confirm Friday‘s upswing – odds are they would continue higher on Monday as well, because the volume comparison is positive and daily indicators don‘t appear yet ready to turn down.

Inflation Expectations

Inflation expectation as measured by Treasury inflation protected securities to long-dated Treasuries (TIP:TLT) ratio, keep making higher highs and higher lows – the market is recalibrating towards a higher inflation environment, but not yet running ahead of the Fed as the 10-year Treasury yield (black line) shows. It‘s so far still orderly.

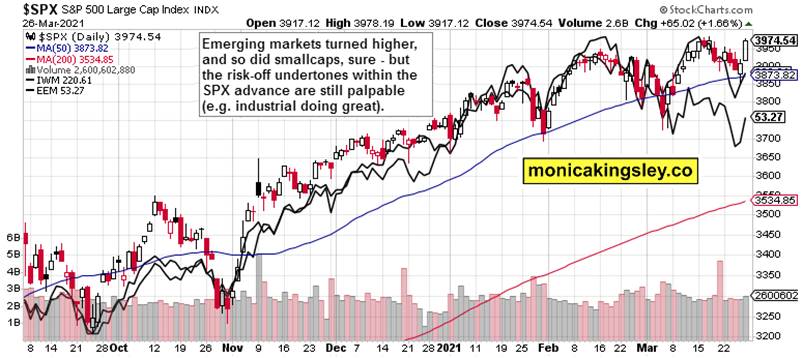

Smallcaps and Emerging Markets

The Russell 2000 (IWM ETF, upper black line) is underperforming the S&P 500, and so are the emerging markets (EEM ETF) – both signals of the defensive nature of the stock market upswing. The animal spirits aren‘t there to the full extent (don‘t be fooled by the strong VTV showing), but have been making a return since Thursday.

Gold, Silver and Miners

A new turn is taking shape within the Tuesday-challenged precious metals upswing – the miners appear yet again assuming leadership. The call I made on Thursday, hinting at a change, appears materializing to the bulls‘ benefit.

Comparing gold and silver at the moment, results in the conclusion of the yellow metal leading higher after all – and the positive turn in copper (which is also reflected in the copper to 10-year Treasury yield ratio) confirms that.

Crude Oil

Black gold keeps defending the 50-day moving average, showing the reflation trade in both commodities and stocks isn‘t over yet. The oil index ($XOI) is once again pointing higher, and so is the energy ETF (XLE). While Friday‘s volume was relatively modest, oil has good prospects to keep recovering this week.

Summary

The odds of an S&P 500 upswing were confirmed by the Friday‘s upswing, in line with the put/call ratio indications. Credit markets concur, and while the sectoral constellation isn‘t totally bullish, it can still carry the index to new highs.

Miners made an important turn higher relative to gold, and the sector can enter today‘s trading on a stronger footing than was the case on Friday. The green shoots in the precious metals sector appear likely to take a turn for the better this week and next. As always, keeping a close eye on the gold‘s relationship to nominal yields, is essential – be it decoupling from rising ones, or a strong upswing on retreating ones.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.