Bitcoin: Speculative Investment or Value Asset?

Currencies / Bitcoin Mar 17, 2021 - 03:12 PM GMTBy: Boris_Dzhingarov

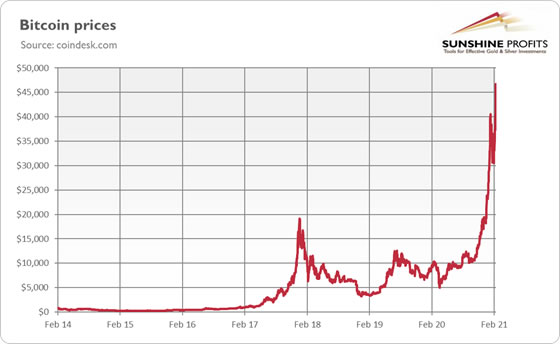

Bitcoin joined the trillion-dollar market club on February 19, 2021, as the price of the cryptocurrency crossed the $56,000 mark. The world’s most popular cryptocurrency soared 1,000% over the past year, after struggling to break out of the $15,000 level throughout 2019, and the better part of 2020.

The rising prices of bitcoins have launched several discussions regarding the efficacy and sustainability of cryptocurrencies and Bitcoins in particular, as the deregulated currency is associated with a copious number of risks. There are a number of bitcoin margin trading exchanges as well that are providing leverage to users given the rising popularity of digital currencies.

Irrespective of the risks the cryptocurrency bears, its surging acceptance cannot be overlooked. One of the biggest factors behind Bitcoin’s surging values is wider acceptance among institutional investors and multinational companies.

With the wealthy pouring in their funds into Bitcoin, retail investors are following suit by passively investing in the cryptocurrency, particularly amid the volatile macroeconomic conditions. The threat of a weak US dollar and projected inflation rates are some of the surrounding factors incentivizing companies to accept cryptocurrency as a form of payment.

The Changing Face of Digital Currency

Bitcoin has been labeled as the next big thing, as most businesses are rapidly changing their payment models to accept cryptocurrency payments. Renowned electric vehicle manufacturer Tesla, Inc. purchased $1.50 billionworth of Bitcoins on February 8, 2021, to diversify its current asset holdings as well as maximize returns.

Moreover, Tesla CEO Elon Musk announced that the company will be accepting cryptocurrency payments for vehicle purchases. Following these developments, Bitcoin prices have surged over 40% since February 8th. Musk has been bullish about cryptocurrencies for quite some time and has invested heavily in the same.

A widespread acceptance of decentralized digital currencies among banks has played a key role in boosting Bitcoin prices as well. Bank of New York Mellon, which is the oldest bank in the United States, announced on February 11, 2021, that it would offer financing services for cryptocurrencies and digital currencies soon, with the aim of establishing an integrated digital currency payment system.

This news catapulted Bitcoin prices over $56,000, allowing it to hit a total market capitalization value of $1 trillion. Investment banks JP Morgan & Chase and Morgan Stanley are reportedly considering acquiring a stake in Bitcoin as the cryptocurrency rallies, with JP Morgan launching a new cryptocurrency-focused bond.

Several institutional investors and celebrities have advocated for Bitcoin, often terming it as the future of finance. Institutional investor George Soros, commonly known as the “Man who broke the pound”, is pro-Bitcoin. In fact, he has invested heavily in the Bitcoin firm NYDIG, as announced yesterday.

Twitter and Square, Inc. CEO Jack Dorsey and billionaire investor Mark Cuban have publicly stated their interests in Bitcoin, as well as stated the untapped potential of the cryptocurrency markets. Apart from institutional investors, celebrity interest in cryptocurrency has stirred the interest of the masses. Kanye West, Mike Tyson, and Game of Thrones star Maisie Williams are some of the well-known people advocating Bitcoin.

Why is Bitcoin Rising?

Macroeconomic pressures on the global economy have accelerated Bitcoin’s growth trajectory over the past couple of months, allowing the cryptocurrency to nearly double in value year-to-date. In addition to the weak US dollar, the prolonged near-zero interest rates have been raising the expected inflation, making decentralized cryptocurrency a viable alternative.

With US Treasury yields reaching one-year highs leading to global equity sell-off, along with the expansionary fiscal policies leading to further devaluation of the US dollar, investors rapidly shifting towards decentralized cryptocurrencies. Moreover, the falling prices of safe-haven assets such as gold have also boosted the popularity of blockchain currencies. Cryptocurrencies have registered higher gains compared to bonds, equities or safe have assets in 2020.

The Coinbase direct listing IPO could be another turning point for Bitcoin valuation, paving the way for the most popular currency to reach new highs. As one of the largest cryptocurrency exchange platforms in the world, Coinbase IPO is expected to be valued at $100 billion. The stock was trading at $350 on the Nasdaq Private Market auction, thereby providing a pre-IPO valuation range of $90-$100 billion.

The limited supply of bitcoins amid the rising demand should allow Bitcoins to hold on to their valuation in the near term, as investors remain bullish regarding the future of cryptocurrency. Moreover, the decentralized blockchain system minimizes transaction and conversion fees while ensuring speedy transfers.

With international trade regaining volume post-vaccine disbursal as countries reopen borders, Bitcoins are projected to ease the global monetary flow as well as eliminate bulky and repetitive fees.

Will the Bitcoin Frenzy Continue?

The cryptocurrency rally is unlikely to stop anytime soon, providing room for Bitcoin to soar even further in the near term. However, the sustainability of such a bull run is in question, as the rapid growth of blockchain technology is largely unprecedented. While many people expect cryptocurrencies to become the most acceptable payment form in the near future, a significant proportion, including Microsoft CEO Bill Gates, believe the current rally to be a speculative bet, prone to a sharp pullback.

By Boris Dzhingarov

© 2021 Copyright Boris Dzhingarov - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.