Oat Prices AND the Truth Behind the "White Gold" Rush

Commodities / Agricultural Commodities Mar 12, 2021 - 12:48 PM GMTBy: EWI

Oat futures' recent surge to 7-year highs wasn't caused by the oat milk craze; think "market psychology" instead

Generally speaking, the idea of oats is about as exciting as, well, a bowl of steel cut oatmeal.

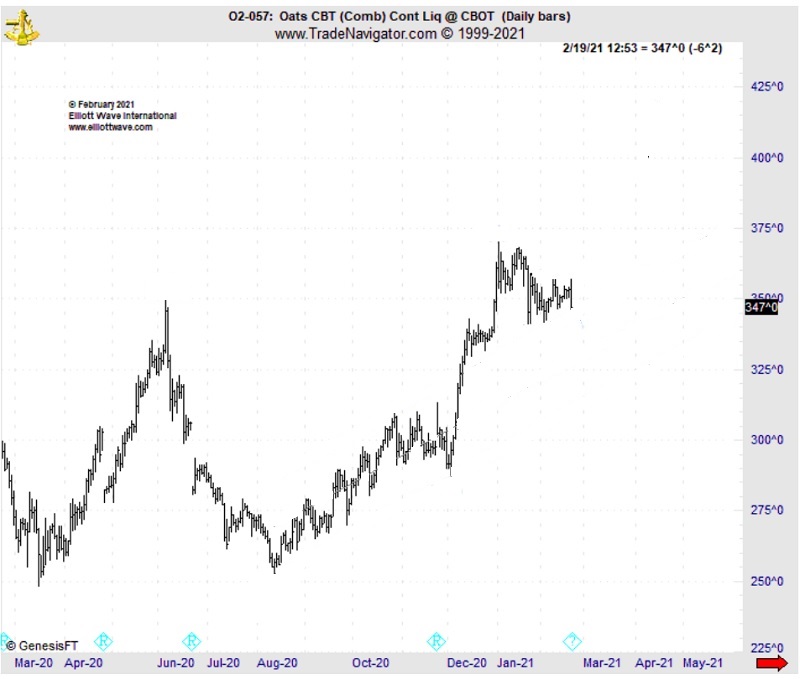

But this chart of oat futures shows why this ordinarily ordinary grain has stolen the commodity spotlight. For starters, February 2021 saw oat prices soar to their highest level in 7 years.

As for what's behind this newfound dev-oat-tion -- mainstream experts like these below cite the craze for alternative milk products and oat milk specifically.

"Oat Milk is Everywhere.... In fact, oat milk is the second most popular plant milk now, right behind almond milk, racking up over $249 million in sales last year." (Feb. 9 Today.com)

"Industry Sewing Seeds as Oat Milk Popularity Rises." (Feb. 4 RNZ)

For some perspective, fever for the world's most popular oat milk producer Oatly is so hot it was featured in this year's Super Bowl ad lineup in a still talked about spot featuring the company's CEO, sitting in a field of oats behind a single keyboard awkwardly singing "Wow No Cow!" over and over for 30 seconds! The spot became the butt of jokes across the globe and was dubbed the "Worst Superbowl Ad Ever" by Australia's news.com.au:

Speaking of Wow Holy Cow! Oatly also announced in February its plans to go public in the U.S. Thanks to investments in the company by famous celebrities like Oprah Winfrey, Natalie Portman and Jay-Z, its IPO is estimated to be worth between $5 and $10 billion.

Ergo, the oat-milk craze caused the late 2020 rally in oat futures to 7-year highs -- right?

Not exactly. We believe this line of thinking is a bit -- well -- lact-oat intolerant of the facts. See, the oat bloat trend is not a new phenomenon. For those following these trends for more than a hot minute, there was the summer of 2018, when a shortage on oat milk prompted news sites across the country to riff satirical about how hip cities like Brooklyn, NY would survive the alt-dairy deficit. See this August 15, 2018 Guardian headline, for example:

In January 2019, the Guardian coined the term "white gold" for oats amidst the mania for alternative milk products

In September 2020, oat milk was crowned #2 plant-based dairy alternative in the world.

In February 2020, many experts warned that the ever-expanding "oat bubble was about to burst" (Feb. 28, 2020 Bloomberg)

And, in June-July 2020, the star-studded line to board the Oatly bandwagon began to form with the likes of Oprah Winfrey and Blackstone Group.

Yet -- as you can see on the chart of oat futures below, the consistent craze for oat products during this period did not materialize as soaring prices, but rather as a down-up-down holding pattern that didn't end until late August 2020.

In late August, the soaring commercial demand for oat products didn't change; however, the slacking trend in oat prices did -- from down to way UP! The question is, was there a way to anticipate the latter?

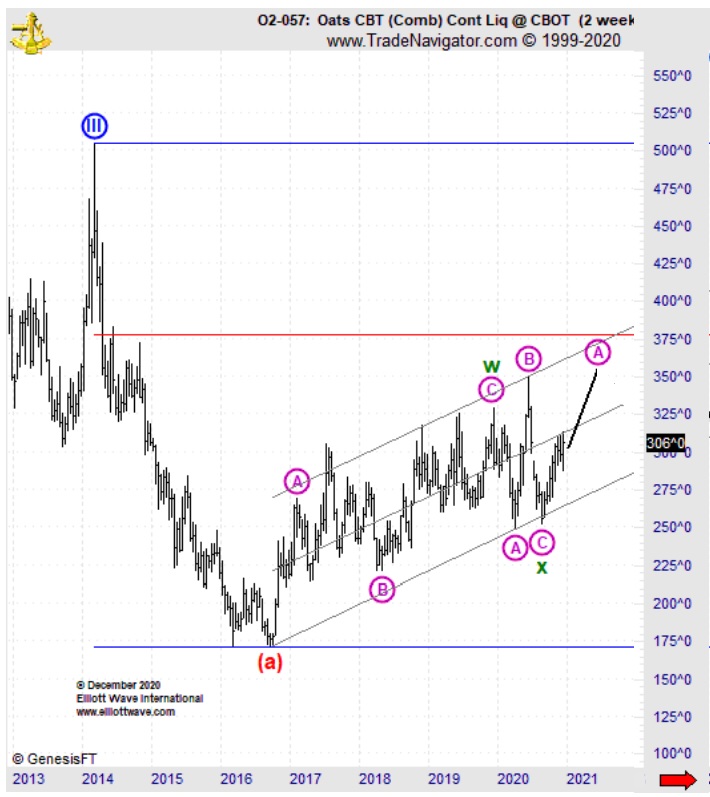

Yes. In our September 11, 2020 Daily Commodity Junctures, we presented the oat chart below, which identified the August low as the end of a three-wave correction and start of a strong advance:

From there, oat prices soared into the $3/bushel level. In the December 4 Daily Commodity Junctures, we revisited the grain to address its upside potential. Our chart extended its up arrow into the $3.75 levels of 2014, seen here:

And from there, oat futures rallied to the upside target projected by Daily Commodity Junctures some two months earlier.

At the end of the day, there will always be a perfect reason in the news to explain market action --- after the fact. For traders and investor, however, the goal is to arrive at those turns in advance.

Here, our Commodity Junctures Service keeps you in front of high-confident setups in the world's leading markets in grain, livestock, meat, softs, and more. See below to read the latest forecasts now.

Commodity Opportunities Abound: We'll Drink to That

Whether you like oat milk or not, everyone likes the taste of anticipating market turns -- before they become front page news!

FREE REPORT: Want to discover more about Elliott waves?

You're in luck: For a limited time, we are offering "Learn How the Wave Principle Can Improve Your Trading" free (a $39 value).

Here's how to read it instantly, right now.

This article was syndicated by Elliott Wave International and was originally published under the headline Oat Prices AND the Truth Behind the "White Gold" Rush. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.