The Future of FINRA, Regulatory Defense and Bad Stockbrokers

Stock-Markets / Financial Markets 2021 Mar 08, 2021 - 06:56 PM GMTBy: Steve_Barker

FINRA stands for the Financial Industry Regulatory Authority. This tends to be the first line of defense against a bad experience with a securities broker, and it also has many other benefits. FINRA is an independent nongovernmental organization that focuses on the root of problems, securities sold to investors, and selling them to investors. It is the single largest independent regulatory body for securities firms operating in the United States. It writes and enforces the rules governing broker-dealer and registered brokers firms in the United States.

The agency oversees about 4,200 brokerage firms, 162,000 branch offices, and 629,000 registered securities representatives. This organization monitors the products and services each of them offers, thereby safeguarding investors and the public's interests in general against fraud and bad practices.

The Future of FINRA

In recent times the ranks of broker-dealers have been decreasing, so this means FINRA may become an organization in search of a mission in the end. FINRA has not less than 19 offices across the United States and also has over 3,000 employees.

The future of FINRA holds a great deal. FINRA benefits the public in a lot of ways. Its main benefit is to protect investors from abuses and make sure there is ethical conduct within the financial industry. FINRA resources like the Broker Check help investors determine if someone claiming to be a broker is indeed a legit member. Most importantly, FINRA made all these functions more clear by making them all available in one organization.

The Future of Regulatory Defense

The regulatory defense in the stock market is vitally important. With the regulatory defense's help, concerns that used to be challenges for investors, such as the lack of transparency and market manipulation, are no longer basic challenges today. But individually, American investors are now more exposed to stock market fluctuations and are thereby asked to make more financial decisions that will significantly impact their future. You can go here to learn more about the regulations. They are put in place to protect all parties in every transaction.

The Future of Bad Stockbrokers

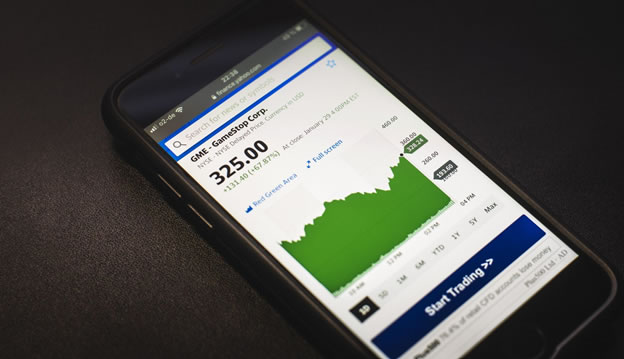

Digitalization has radically shaped the stockbroking markets. The way stockbrokers interact with potential investors has undergone a massive change in recent times. While the full-service brokers have always enjoyed preference among the investors and a dominant presence, the rate of technology improvement has made the new breed of stockbrokers more developed, known as discount brokers.

However, in recent years, stockbrokers have enjoyed quite a success, though there are multiple challenges which they are gradually overcoming, thankfully with the services of FINRA. But be careful as markets change and also adapt to the swing in trading. The stock markets are quite volatile, and despite the challenges, expert guidance provided by stockbrokers is necessary. With the technological advancement and rise of DIY (do it yourself) customers, stockbrokers have a lot to offer in the coming years.

FINRA also faces criticism, just like almost all other self-regulatory organizations. This article shows that FINRA, regulatory defense, and stockbrokers' future is bright because they must protect investors. Investors are advised to keep believing that any listing on a regulated exchange is a sign of good quality.

By Steve Barker

© 2021 Copyright Steve Barker - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.