US Housing Market Trend Forecast 2021

Housing-Market / US Housing Mar 02, 2021 - 11:11 AM GMTBy: Nadeem_Walayat

Given the US governments continuing catastrophic response to the coronavirus virus resulting in severe economic contraction then one would assume that the crowing from the rooftops perma bear deflationistas would finally be proven right with their decade long perma bear messages of a US housing market crash finally being fulfilled. So is that what happened? Were the perma bears finally proven right by chance, a black swan event courtesy of a leak from a wuhan bio lab?

We'll in economic terms the US as is the case for all western nations has come under severe economic pressures following the panic lockdown responses to an out of control pandemic with further economic pain expected during Q1 2021 in a race against time to deliver vaccines into american arms.

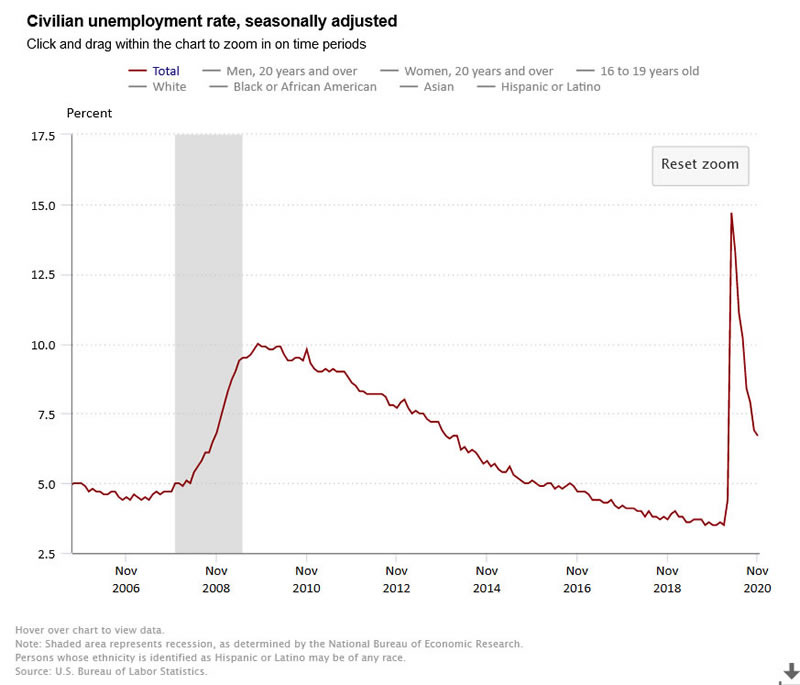

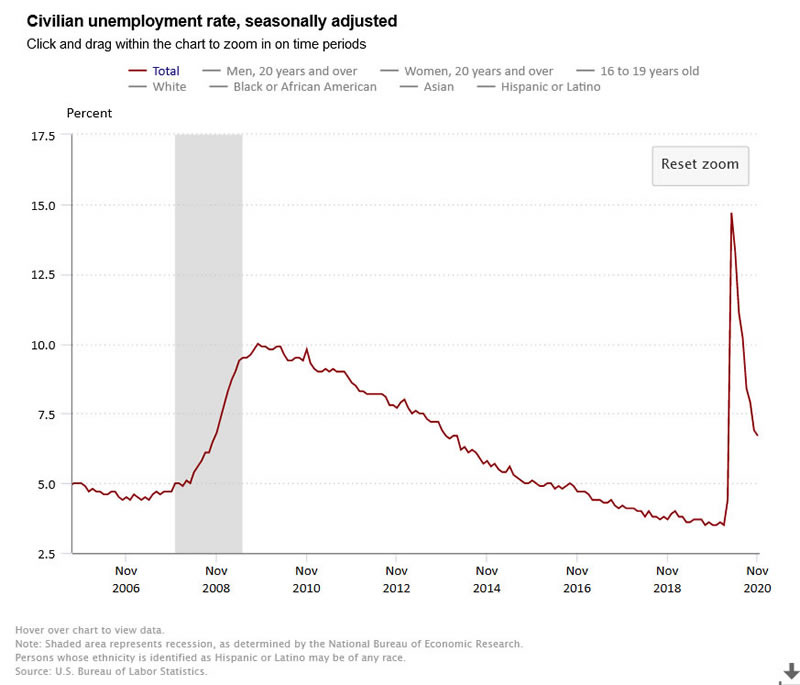

The recovery in US employment has started to flat line as the US heads into new lockdown's as the pandemic Wave 4 starts to materialise, thus expect US unemployment to increase though to nowhere near the extent of the first wave.

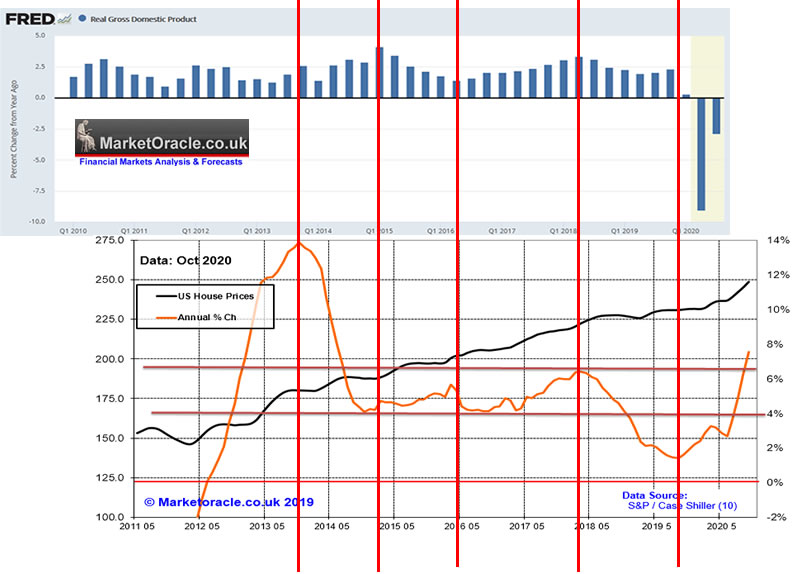

Whilst GDP recovery has proven more robust which after Q2 contraction of 31.4% with overall expectations for US GDP to end 2020 down between 2% to 3%. Whilst GDP is expected to take a further hit in Q1 that could shave off 1% of GDP expectorations for 2021.

So the US economy in GDP terms is proving far more resilient than most western nations due to stimulus bailouts and weaker lockdown measures than elsewhere.

The whole of this extensive analysis that concludes in a detailed trend forecast for US house prices into 2022 was first made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

Which includes access to my most recent analysis on the prospects for the stock market for 2021 and AI stocks buy ratings, valuations and levels for 2021. https://www.patreon.com/Nadeem_Walayat.

US House Prices 2020

Did the perma bears finally get their US house prices crash that they have been crowing so loudly for a decade now?

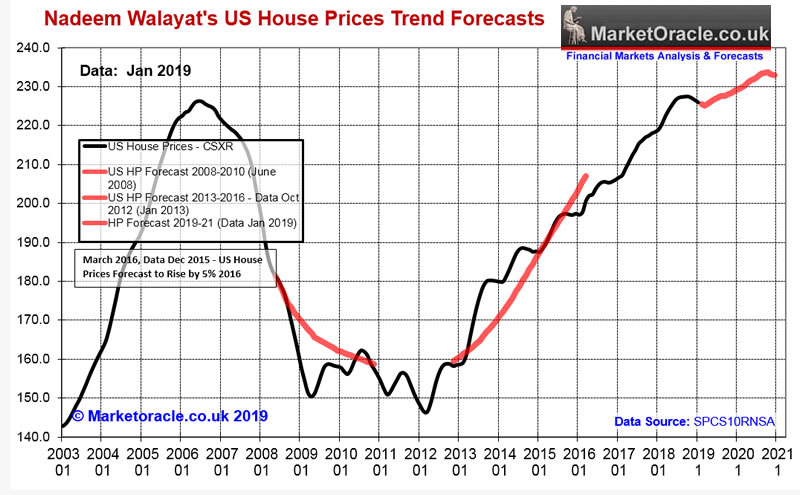

Firstly a recap of my existing US house prices trend forecast.

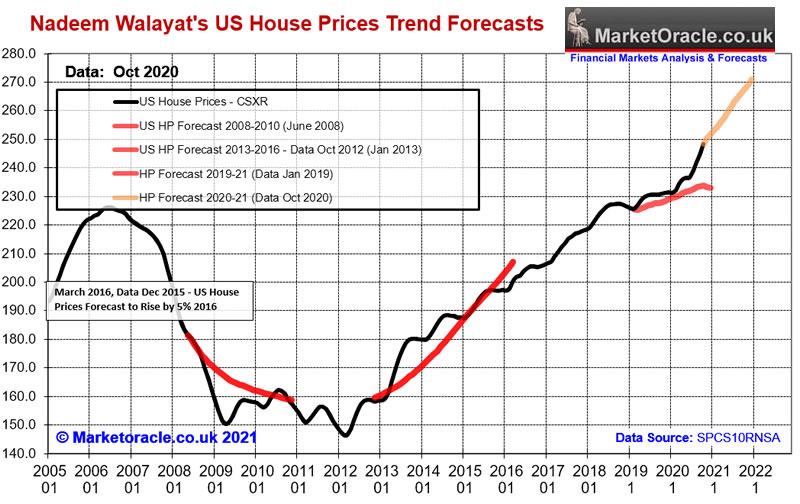

30th April 2019 - US House Prices Trend Forecast 2019 to 2021

Therefore my forecast conclusion is for a relatively weak continuation of the US housing bull market into late 2020 at a much shallower pace than experienced in recent years for a likely gain of just 3% over the next 2 years (Jan 2019 to Jan 2021) before entering into a downtrend going into 2021 i.e. Case Shiller 10 city Index (SPCS10RNSA ) rising from 225.9 (Jan 2019 data) to just 232.4 (Jan 2021 data) as illustrated by my trend forecast graph.

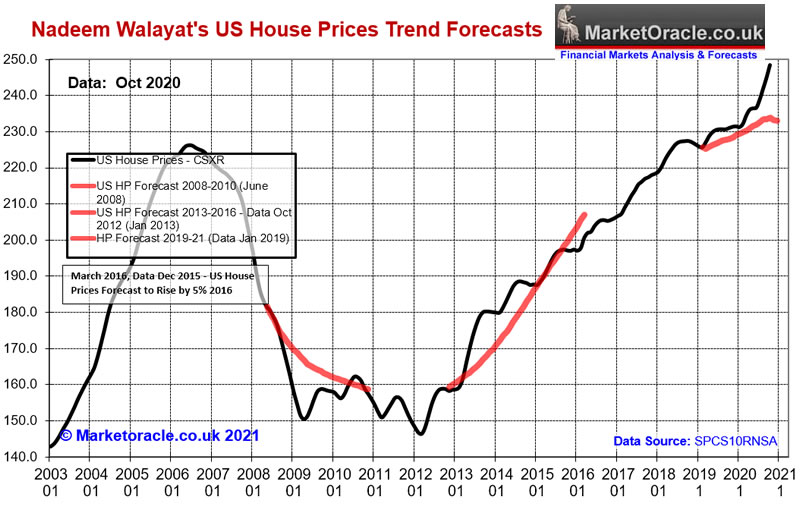

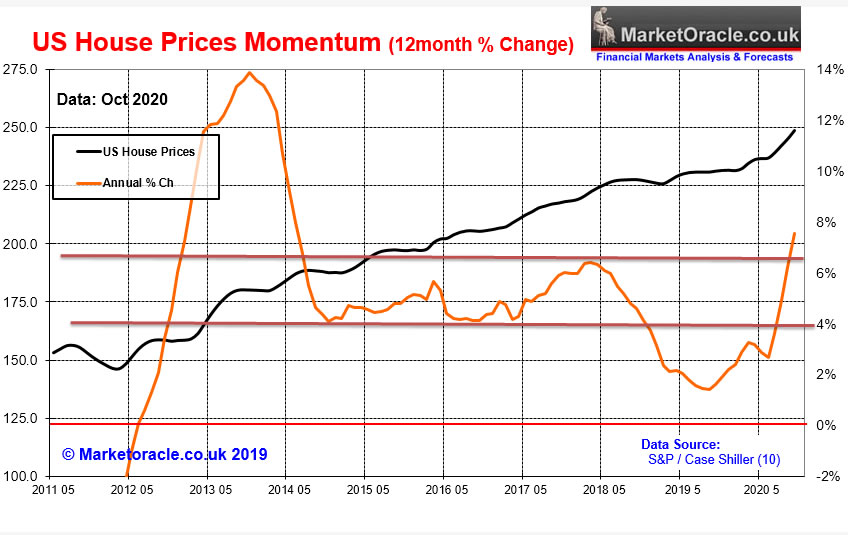

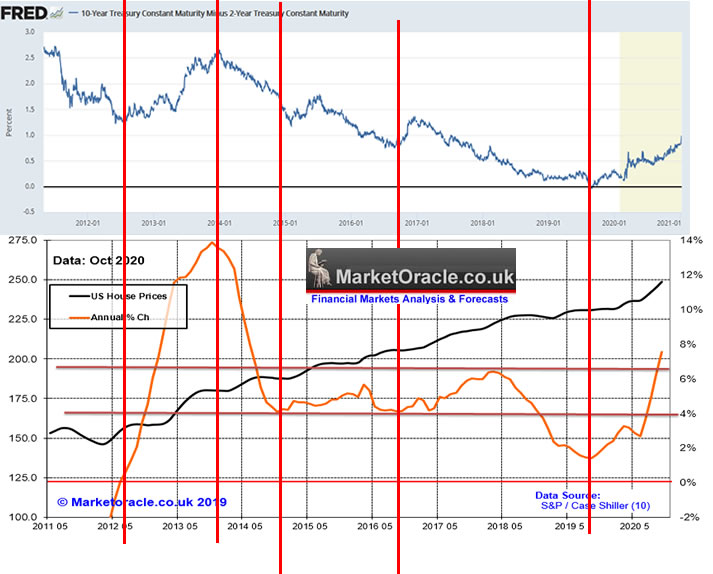

Here is the updated chart for what has transpired since my forecast of April 2019.

Whilst the US stock market had a panic attack crash into Mid March. The crash where US house prices are concerned was UPWARDS! Which should not come as much of a surprise to those who have been following my analysis for the past 10 years! Money printing, MONEY PRINTING! When you know the Fed is about to print a shit load of money whatever they call it, will mean that assets that cannot be easily printed will surge higher, this IS the INFLATION MEGA-TREND IN ACTION!

The primary mega-trend IS THE INFLATION MEGA-TREND! Those who bet against it on hopes of a repeat of the 1930's depression will keep going BROKE!

THE INFLATION MEGA-TREND QE4EVER!

A reminder folks that regardless of Fed propaganda and what you read in the mainstream press QE is 4 EVER! Once it starts it will not stop. As I have been iterating for a decade now as the following excerpt from 2 years ago illustrates (Stock Market Trend Forecast March to September 2019) that CRISIS ARE MONEY PRINTING EVENTS TO CAPITALISE UPON BY INVESTING IN ASSETS THAT ARE LEVERAGED TO INFLATION!

So why has the the stock market soared, what is that the stock market knows that most commentators and economists fail to comprehend? We'll for one thing there are the dovish signals out of the Fed which go beyond a pause in their interest rate hiking cycle in response to a subdued inflation outlook. Similarly the worlds other major central banks have their own reasons to avoid rate hikes, most notable of which is the Bank of England that has been busy propagandising the prospects of a NO Deal Brexit Armageddon in attempts to scare Westminister into avoiding EXITING the European Union in anything other than an ultra soft BrExit.

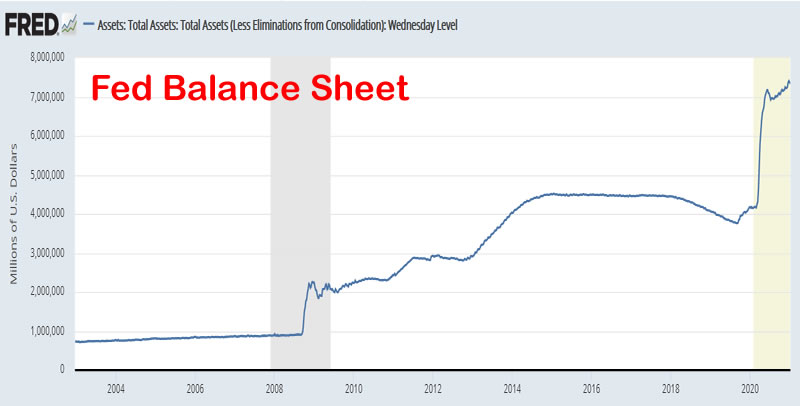

So on face value the stock market is clearly discounting not just a more accommodative interest rate environment but that QE REALLY IS FOREVER! Once it starts it DOES NOT STOP! As evidenced by the Fed's balance sheet first having exploded from about $800 billion to over $4.5 trillion, all to bailout the banking crime syndicate by inflating asset prices such as housing and stocks so as to generate artificial profits for the central bankers banking brethren. But none of this news, for I have written of it for a good 10 years now that QE will never stop as the worlds central banks will repeatedly expand QE to monetize government debt.

So I would not be surprised that WHEN the next crisis or recession materialises, QE will resume, by the end of which the Fed balance sheet will likely have DOUBLED to at least $8 trillion. And it is this which the stock market is DISCOUNTING! Just as has been the case for the duration of this QE driven stocks bull market that clearly paused during 2018 in the wake of mild Fed unwinding of its balance sheet. So forget any lingering Fed propaganda for the continuing unwinding it's balance sheet, the actual rate of of which has slowed to a trickle and thus we are probably near the point when the Fed ceases unwinding it's balance sheet because as I have often voiced that once QE starts it does NOT STOP!

So whatever form the NEXT crisis takes, the Fed will be at hand to print money and double its balance sheet, as it will periodically continue to supports asset prices such as housing which cannot be printed. We'll not until we see start seeing house building 3D printing drones emerge from the machine intelligence mega-trend that will fly around in swarms and erect designer houses anywhere on the planet.

All whilst clueless fools that populate the mainstream press and blogosfear who probably never put their money where their mouths are continue to bang the drums of NON EXISTANT DEFLATION! As I stated in opening line in my January 2010 Inflation Mega-trend ebook (download).

The worlds economies swim in an ocean of inflation that is punctuated by occasional ripples of deflation which is illustrated by the perpetual upward curve of general prices as measured by the Consumer Price Index (CPI). Inflation in the long-run impacts on virtually all commodities and asset prices.

Here's the current state of the Fed Balance Sheet that's looking pretty parabolic, pouring rocket fuel onto the inflation fire.

At the end of the day the money printing induced Inflation Mega-trend is the primary mega-trend that people really need to beware of and focused on so as to leverage themselves to this mega-trends consequences which is the loss of purchasing power of currencies which is why savings should not be viewed as long-term holdings and why the likes of housing should. To further illustrate this point since the Federal Reserve bank came into being in 1913 the US dollar has lost over 96% of it's value! PRICE INFLATION! Which is why you need to hedge or leverage yourselves to MONEY PRINTING INFLATION! This is what the world's central banks do at every crisis, PRINT MORE MONEY that causes REAL INFLATION.

U.S. House Prices Analysis 2021

Work From Home Inflationary BOOM?

The pandemic has resulted in many tens of millions more americans working from home. As someone who has been working form home for a good 15 years I can well understand why house prices have rocketed higher as prospective home buyers both seek out properties that are better suited to working from home, more suburban, quiet office spaces, plenty of storage, or view properties with scope to being upgraded into work from home environments.

And then we have the demand for home working tech where demand has soared through the roof during 2020 and looks set to continue into the END OF 2021. Which is why I went on a personal spending spree upgrading virtually whole of my home tech whenever the opportunity presented itself i.e. Prime Day, Black Friday and Cyber Monday of which Black Friday turned out to present the best value for money discounts.

Where upgrading your homes and tech for home working is concerned then the key thing is to act sooner rather than later as there is a GREAT DEAL OF inflation in the pipeline for home working technology i.e. computers, DELAYING purchases in the hopes of price drops IS NOT GOING TO WORK. If you need a new computer then bite the bullet and buy it now because prices look set to increase during 2021! Which is something that the tech reporters don't realise as they scratch their heads and keep suggesting that stock and prices will soon start to normalise which is usually what one expects tech to do i.e. get cheaper over time. Instead the likes of the Ryzen 5000 processors and and RTX 3000 series GPU's rather than falling in price will INCREASE in price because we are in an inflationary working from home BOOM!

So make lists of what you need to efficiently work from home and then go and buy it ASAP because prices are going to go much higher during 2021!

Where the housing markets are concerned then it should not be so surprising that house prices have gone up when the consensus expectations were that they would fall, and will go up further for many homes are now also part commercial office space and thus price rises are reflecting that added value, and at some point we will probably see governments attempt to levy extra taxes onto home workers, perhaps during 2022. Conversely commercial real estate especially office space is going to experience more pain during 2021 which perhaps could present opportunities to pick up some cheap commercial office space for those seeking to expand out of their home offices.

Momentum Analysis

Houston we have Lift OFF! If it were not clear from the house prices graph then it should be clear form the momentum graph that US house prices have taken off! Rising at their fastest pace since 2012! Likely to end 2020 up about 8% on the year. Furthermore the breakout above the 2018 peak suggests further strong house prices gains to come during 2021 i.e. this sort of powerful up thrust in trend usually does not turn on a dime.

By Mid 2021 we could see average US house prices rising by over 10% per annum! IMAGINE THAT! 10 PERCENT PER ANNUM! Though after the summer mania I would expect momentum to slow during the second half of 2021 so likely fall back sharply towards 6% per annum.

So momentum suggests to expect another strong year for the US housing bull market, probably end the year up between 5 to 9% after about an 8% gain for 2020.

US ECONOMY

The Vaccine Indicator

In my opinion one of the primary indicators for economic recovery for the US and the rest of the world is the percentage of the the adult population that has been vaccinated, and especially the segment of the population at highest risk of hospitalisation and death from covid-19 i.e. the over 50's. In which respect US vaccinations currently stand at 6.2 million with approx 1 million americans being vaccinated per day (1st dose) or about 0.3% of the population. Which frankly is just not good enough. So unless things step up a gear perhaps after Biden takes office then under the current pace the US is not going to have vaccinated 50% of the population until late May and that is just with the first dose!

![]()

So currently in vaccine indicator terms the Covid crisis looks set to continue and likely worsen for most of Q1 2021 and likely only really start to diminish in severity as US enters April when enough people have been vaccinated so as to induce herd immunity and thus result in a sharp drop off in the number of cases during the summer months and especially ahead of Winter 2021.

So more economic Covid pain for the duration of Q1. With strong recovery starting early April as the rate of vaccinations jumps to perhaps 1.6 million per day that should see the covid crisis evaporate as we enter May by the end of which perhaps 50% of the US population will have gained immunity of sorts with perhaps 25% having received their second doses by then. Therefore the covid vaccine indicator implies to expect a Summer economic boom of sorts following the end of the Pandemic as all those who survive go on a spending binge! Which implies to expect HIGH REAL INFLATION! Your dollars are going to buy you far less than they do even now after the great Covidflation of 2020 which is the price paid for handing the population free money.

Though the US also has a healthy dose of the anti-vaxers to contend with that could derail the US vaccinations programme from achieving anywhere near herd immunity by early Summer, something to definitely keep a close eye on.

Whilst the UK appears about 2 weeks ahead of the US in terms of vaccinations with 3% of the population vaccinated. Though that advantage is more than offset by having to contend with the London / Dutch strain that is 50% more virulent, rather than more deadly. Though when one crunches the numbers, a strain that is 50% more virulent than if it were 50% more deadly is actually worse! As far more people become infected soon resulting in hospitals becoming overwhelmed with ill patients. So the MSM broadcasters have got things WRONG again as they confidently report that the new strain is not any more deadly than the strain let out of the wuhan bio lab some 14 months ago. Which implies to expect deeper covid economic pain during Q1. Though this more virulent strain has already appeared in the US. So now is definitely time for both the US and UK to up their game in the delivery of jabs into peoples arms where every single day counts! and where the likes of the Pharmacies in Supermarkets and High Street chemists should be co-opted to hasten the pace of at least the delivery of first jabs into peoples arms in a race against time to prevent collapse of health care systems that in the UK at least is less than 2 weeks away.

GDP

The US economy is recovering fast from the corona crash with annualised GDP down just 2.8% for Q3, a remarkable performance and far better than most western nations.

Whilst it is a bit early to suggest an economic boom for 2021, still everything is pointing towards at least a 2.5% gain for the year, where the US housing market is LEADING the recovery, which given potential momentum of 10% implies US GDP for 2021 should easily exceed 3% and could nudge above 4% by the end of 2021. Which means that the US will have more than recovered from the pandemic crash by the end of 2021.

US Unemployment

Official US Unemployment should continue to recover from the pandemic collapse, though as my earlier graph illustrates momentum has greatly slowed which means it's going to be tough going to get to pre-corona levels. At best US unemployment could reach 5% by the end of 2021, so still supportive of rising house prices.

US Inflation

CPI, the highly doctored official measure of US inflation stands at just 1.2% for November 2020. Real inflation is far higher, probably quadruple the official rate i.e. at above 4% hence why the likes of US house prices are rocketing higher as the real value of money falls as a consequences of rampant money printing. Still official US inflation of just 1.2% gives the Fed cover to continue printing money and for the Biden administration to go on a socialist spending spree which is supportive of rising house prices. Whilst the expected post Pandemic spending boom will push CPI inflation higher during the second half of 2021. However, this time round one key element is lacking in sustaining any rise in prices which is a tight labour market. And 2021 will be yet another year that the deflationistas' will get very badly wrong.

Therefore high real inflation with rising GDP are BULLISH for US house prices for the duration of 2021.

Yield Curve (spread between 2 year and 10 year US bonds)

One of the reasons why my analysis of April 2019 was more subdued in terms of the prospects for US house prices than it would otherwise have been is because the yield curve was flirting with inversion, that I concluded that the Fed would not allow to take place and thus adopt whatever measures were necessary to PREVENT inversion that tends to foreshadow lower inflation and recessions.

The Fed succeeded in preventing a sustained inversion during 2019, with the yield curve massaged to hover around 0.2% that is until the pandemic broke and the Fed panicked and opened the monetary flood gates sending the yield curve soaring to currently stand at 1% as the bond market is discounting higher future inflation as the consequence of rampant money printing.

A steep yield curve is signaling FUTURE INFLATION, more money printing stimulus which is good for house prices because basically investors are selling long dated bonds to buy inflation proof assets such as housing. So the yield curve trend is strongly bullish for US house prices.

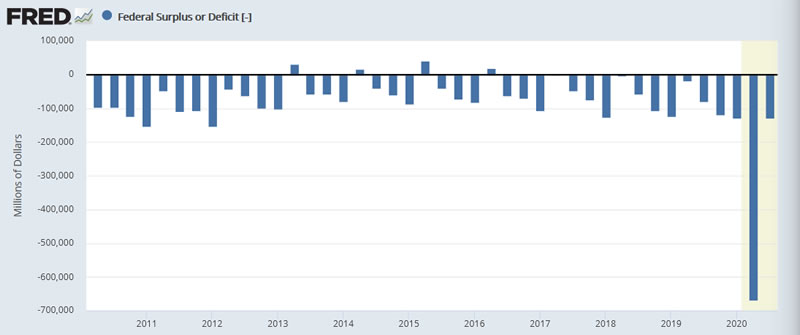

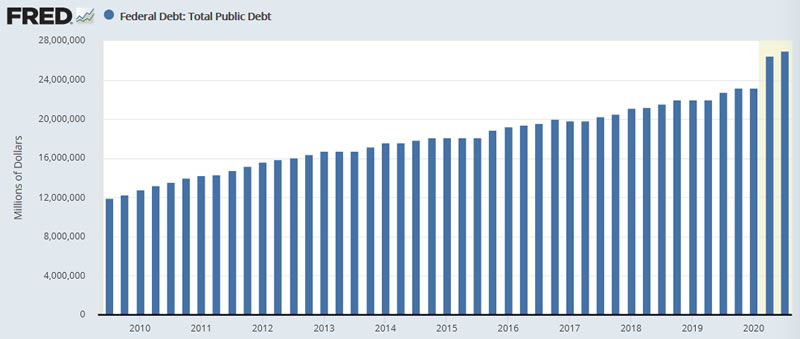

US Debt

Of all the noise the politicians make the reality is that Democrat or Republicans both are socialists in the practice of deficit spending as the following graph illustrates that if one ignored the Pandemic crash then one would be hard pressed to see the difference between Obama and Trump years.

The US debt mountain has now passed £27 trillion, 100% of GDP after adding nearly $4 trillion for 2020!

What are the consequences of the US government printing and spending $4 trillion dollars during 2020 and at least another $1.5 trillion during 2021? HIGH REAL INFLATION! So what should you do? Invest in assets such as real estate that cannot be easily printed. Thus in this one graph you have your housing bull market smoking gun. All whilst the perma fools continue to bang the decades long drums of the always imminent debt bubble bursting deflation. All whilst the money printing induced inflation mega-trend continues on it's exponential trend trajectory.

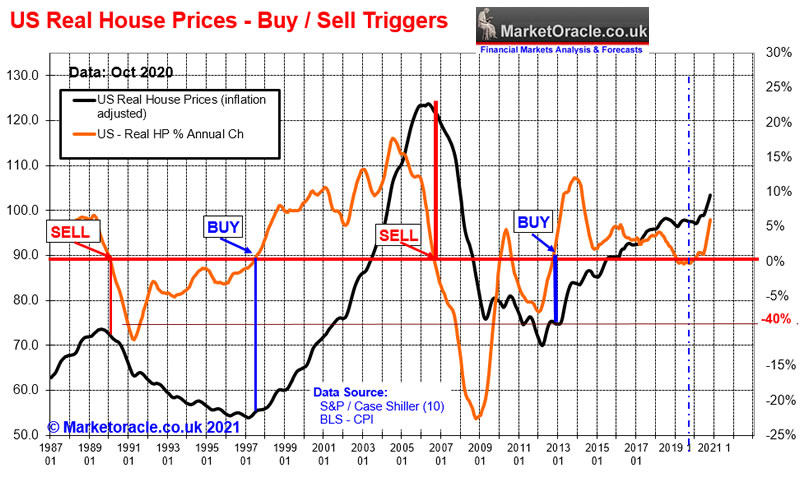

US Housing Market Real Terms BUY / SELL Indicator

What does my primary indicator on the health of the US housing market say that has proven accurate for literally decades! Catching every major bull and bear market of the past 30 years! From it's first SELL signal in 1990 to it's last BUY in 2012. What do real terms US prices say for the prospects for 2021?

a. There has been a sharp increase in real terms house prices during 2020, the reversal of which looks highly improbable for 2021. Therefore US house prices look set for at least another bullish year.

b. Real terms US house prices are nowhere near the their early 2007 highs, therefore there is plenty of scope for US house prices to continue to trend higher for a number of years.

c. real terms momentum is nowhere near reaching an overbought state, which suggests the 2020 bull run is more than sustainable for 2021 and into 2022.

Therefore the real terms indicator confirms a strongly bullish outlook for US house prices for 2021.

Formulating a US House Prices Forecast

Pandemics end, momentum, economic, trend and real terms prices analysis ALL point towards a US house prices boom of sorts for 2021. Targeting a bull run into the end of 2021 of about +10% on the most recent Case Shiller 10 city Index (SPCS10RNSA ) rising from 248.5 (Oct 2020 data) to about 273 for Dec 2021 data.

US House Prices 2020 to 2021 Trend Forecast Conclusion

Therefore my forecast conclusion is for the US housing market bull market to further accelerate to an annualised momentum of just over 10% per annum during Mid 2021 before momentum slows to end 2021 with a gain of about 7.7% for the year, on top of again of 1% for November and December 2020. For a total house prices gain of about 9% by the end of 2021. i.e. Case Shiller 10 city Index (SPCS10RNSA ) rising from 248.5 (Oct 2020 data) to 271 (Dec 2021 data) as illustrated by my trend forecast graph.

General Artificial Intelligence Was BORN in 2020!

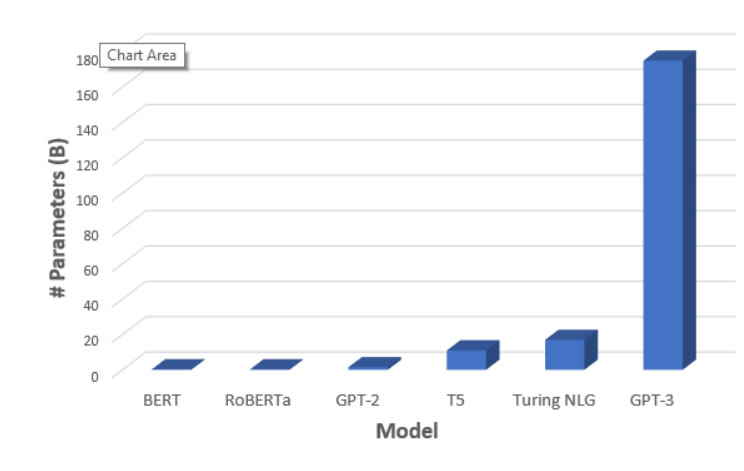

During 2020 the fictional general artificial intelligence of the movies to some degree become reality in the form of GPT-3 that performs exponentially better than AI that preceded it as the following graph illustrates,

What is GPT3?

GPT-3 generates texts using pre-trained algorithms created by Open AI which was co-founded by Elon Musk. GPT-3 has basically hoovered up most of the text published online much as Google's search engine has indexed web pages throw regular crawls. The result is that GPT-3 can answer questions, write essays, summarise texts, translate languages, take memos, virtually anything a human can do involving text GPT-3 can do!

In my opinion this means THE AI has now been born, where the only question mark is how quickly will it grow? Where if you follow my analysis and conclusions you should understand I expect it to develop exponentially in capability, and perhaps on the cusps or leaving human level intelligence behind.

So how to profit from GPT-3. Well ensure you own stock in the No 3 company on my AI stocks list, because Microsoft has effectively BOUGHT GPT-3! Yes, it was supposed to be open source, but Microsoft UNDERSTOOD what it was looking at when it saw what GPT-3 could do and BOUGHT IT! Has an EXCLUSIVE right to the SOURCE CODE!

Anyway, there will be plenty more competing GPT-3's out there as each tech giant will have their own AI.

AI has now been born so it is no longer a future we are trending towards, it has now HAPPENED, Pandora's box has been OPENED!

And once more all we can do is to -

a.Own a piece of the AI

b. Ensure we understand the technology so we can deploy AI to improve productivity for which we are witnessing signs of everywhere, i.e. from neural engines incorporated into CPU's and GPU's such as Apples new M1 processor and Nvidia RTX GPU's.

c. To stay one step ahead as individuals we need to start offloading processing power onto AI, because we cannot compete against AI so HAVE to USE IT to our advantage i.e. in our decision making processes, an example of which is Google, where we let Google answer our queries and guide our actions in every day life from the routes we take following Google Maps, to answering a myriad of how to queries we pump into Google search every day.

How AI will come to rule the world

Ai's foot print in controlling and ruling over mankind is not going to happen with terminator style robots roaming the world, though that may be our fate several decades down the road. Instead to see how AI will rule mankind one needs to take a look at exactly what is fostering and nurturing the AI mega-trend which are the intelligence agencies as a means of controlling populations and expressing power over other nations. So whilst the likes of Google may be seen by most to be trading as a profit driven corporation focused on corporate earnings, in reality whether the heads at Google like it or not IS part of the CIA's intelligence umbrella as are all of the other tech giants, just as once upon a time the primary expression of power was through the print media, which is why a large number of journalists were on the payroll of the intelligence agencies. Which means there won't be any respite or pause for thought for the consequences of what is being unleashed onto the planet, artificial intelligence and the intelligence agencies go hand in hand, are flips side of the same coin.

Thus artificial intelligence is already being used by state intelligence agencies to for instance interfere in elections right across the globe, where AI over time will increasingly act on their own accord, far beyond the comprehension of those with just 1350cc of grey matter to comprehend the direction of travel as all they will beware of are disparate events just as human Intelligence agencies do today, will have a hand in towards a particular outcome of control.

The consequences of which is that we are all going to be living in a less free world, less freedom of thought and expression as the AI will increasingly be successful in silencing competing narratives through either brain washing, mind control and silencing of opposition, much as the Democrats in congress are doing this very day. The successors to CIA's experiments of the 1970s that we know of namely "MK Ultra" and outright assassinations just as the CIA has been engaged in so will the Central Intelligence Entity continue to unchecked.

The bottom line is to remain invested in AI stocks, don't make the mistake of exiting early because we are NOT on an Linear curve but EXPONENTIAL! i.e. the market will likely not give you an opportunity to buy back in cheaper later so we basically got lucky with the pandemic that resulted in severe Mis-pricing of AI stocks during March 2020 that I hope my Patrons took full advantage of to stock up on to the hilt.

Again the whole of this analysis was first made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

Including my recent analysis that concludes in a detailed stock market trend forecast for 2021 -

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

And my most recent analysis posted 1st of March - AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

My analysis schedule includes:

- High Risk Tech Stocks

- UK house prices trend forecast

- Bitcoin price trend forecast

- How to Get Rich

- US Dollar and British Pound analysis

* UK Housing Market Trend Forecast 2021

Will the UK follow the US inflationary lead or has Brexit and Covid combined to press the pause button on the UK housing bull market for 2021?

* Bitcoin trend forecast 2021

Everyone's now bullish on bitcoin at $50k, well my patrons got to buy it at under $10k!

Last two updates forecast conclusions -

17th Sept 2019 Bitcoin Price Analysis and Trend Forecast

Forecast Conclusion

Therefore my forecast conclusion is for the Bitcoin price to hold support at $9,400 in preparations for an assault on $12k, a break of which would target a break of $14k. However if support at $9.4k fails than Bitcoin could trade down as low as $6k BEFORE heading higher.

31st March 2020 - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

Forecast Conclusion

My forecast conclusion is for the Bitcoin price to mark time by trading down to as low as $7,500 before basing for a run higher to resistance of $10,500 that 'should' break to propel the Bitcoin price towards the next resistance level of $12,000. Thus the bitcoin price could drift lower for the next couple of months or so before resuming a bullish trend as illustrated by this chart.

Your analyst wishing all my Patrons a happy and prosperous covid free 2021

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.