Three More Reasons We Love To Trade Options!

Stock-Markets / Options & Warrants Feb 19, 2021 - 06:30 PM GMTBy: Chris_Vermeulen

Hi everyone, it’s me Neil Szczepanski again and I’m back to finish off telling you why I love to trade options! If you missed the first half of this article entitled “5 Reasons Why People Prefer To Trade Options Over Stocks” then click on the title to revisit it. In this second and final installment, I will walk through how adjustments and risk management of options can help give you better control of your trades and profits. I hope everyone enjoys the information and I look forward to helping everyone win with options trading!

REDUCE RISK

Everyone has heard a story about someone who mischaracterized or misunderstood their options trade, then having their account blow up when the underlying stock goes the wrong way. This happened recently with a Robinhood trader who woke up one morning to see his account at -$730,165. In this tragic event the kid took his life because he thought he had lost $730,165 and couldn’t reach his brokerage to understand his account. We learned later that the negative balance did not represent uncollateralized indebtedness at all, but rather his temporary balance until the stocks underlying his assigned options actually settled into his account. In short it was a delay in processing of the options contracts in his account, and not the actual trade that went awry. This is why it is very important that in this game of trading you get the proper training so you understand your risk. The risk is real.

So how can options be less risky? Simple: because you can define your risk right at the outset of the trade. Further, you can adjust your risk/reward ratio 24/7, and not just during market hours with a stop loss like stocks. In very volatile markets risk management becomes even more important and your exposure to unlimited risk can destroy your account very quickly. Think back to the tech bubble in 2002, or the subprime mortgage crisis, and don’t forget the consequneces of the great recession. Or even the Covid-19 pandemic of 2020! The most successful traders are good at maximizing their winners, but more importantly, they are even better at minimizing their losses on losing trades. This includes making sure you prepare for black swan events.

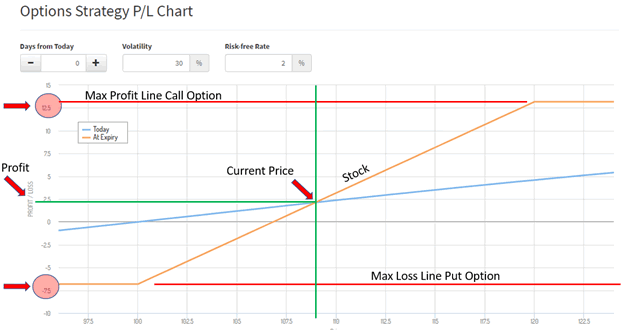

One of the questions I always get is how do you control and/or manage your risk with options? In the following diagram, you can see that if you use options around your existing positions you can cap your max loss at about $7. To achieve this, the trade-off is to cap your upside at about $13. In this scenario, we own stock the orange line represents this. Let’s assume the price is $110 so the profit is about $3. We sell a call to pay for a put that we buy. So the max profit in the line created by selling the call and the max loss is defined by the buying of the put. This is called collaring your stock position using stock options. As I mentioned this trade is on 24/7 and not just during market hours like a stop for stocks.

FLEXIBILITY TO REACT TO MARKET VOLATILITY

You don’t need to always be right on direction. With options, you can put on a position and adjust and move with the market minimizing your losses or turning a losing trade into a winning trade. You can sell premium with options and make money even when the underline stock goes nowhere. You get paid for the time by selling the rights to the stock that you can either own or not own. With stocks it is more limiting, you can either buy more or sell and take your loss if the price goes against you, that’s it.

Sign up now to receive information on the launch of the Technical Traders’ options trading courses and newsletter!

If you are trading options you have way more flexibility than stock. With stock you can buy, sell short and buy more. I hate adding to a losing position and quite frankly not sure why anyone would do that. With options you can roll out of a leg in your option spread and adjust to where the market is going. Think of this as steering a boat through a series of rocks rather than just running them over and damaging the ship. You control where you want to go and avoid the disasters. You can also turn losing positions into winning ones by adjusting. With my new Options Trading Signals newsletter (“OTS”) we will go through these steps and show how you can create winning positions or minimize your losses in ways that is simply not possible with stocks.

CONSISTENT RETURNS WITH less severe DRAWDOWNS

Consistent returns and less dramatic drawdowns can be achieved with an options strategy rather than a just buying stock strategy. I usually only allocate 50% or less of my overall account into options positions yet achieve better returns than if I were to invest 100% into stocks. I also don’t have nearly the same levels of drawdowns, or the sudden trend reversal risk, that one would take by being 100% in stocks. Holding cash also allows me to capitalize on opportunities like if a black swan event. When such an event does eventually hit, I have cash available to buy in while all stocks are on sale. So, I can still get a better return, with fewer drawdowns, and with cash to be ready to jump on buying opportunities. One can get all of the best of all worlds!

I am really excited about sharing my knowledge and strategies with you. I will be writing another article this week that walks you through my simple strategy to consistently generate profits from the market. I will be walking through a few trades with you so make sure you don’t miss out.

Selling options is the best way to get consistent returns that are undeniable and consistent. Nothing in the market is guaranteed except the premium you sell on an options contract. The best part about selling premium is the stock can go against you, with you, or do nothing and you can profit on any of those scenarios. Today’s current market conditions are RIPE for selling premium since there are many new options traders piling into the market, buying options, and inflating the premium on options. This is a supply and demand game and because the demand is high and the supply is low this is creating a premium price skew to the upside.

This is clearly an edge we can take advantage of but in order to do so, you must understand how the market works and more importantly how options work. My new OTS service will detail our weekly trades and walk you through how to take advantage of this edge.

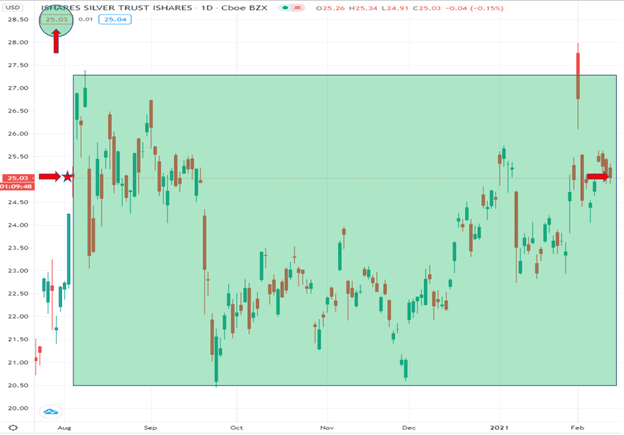

To further my point that options can simply provide better returns, let us look at the below Silver chart to see why buy and hold is a tough game to play. If you entered Silver in August 2020 at roughly $25, then you would have zero gains 7 months later if you had bought the stock. However had you sold a Put Option at $24 for 7 months it would have expired worthless and paid you the entire premium that you sold it for. Currently, an option contract 7 months out on Silver is trading at $296 at the time of this article being written, so, this trade would have netted a $256 gain even though the underlying SLV stock went absolutely nowhere.

If you want to learn more about options, then join me in March when I will start teaching basic options trading, as well as offering courses on more advanced strategies. Anyone can learn how options work but the most important thing is what strategy you use. You also need to know how and when to use the right strategy. I love teaching people how to trade options and live by two principles when doing so: “Trading can be simple but it is not easy” and “I want EVERYONE to win not just me and in fact, I have no desire to win if everyone else loses.”. I am really excited to get to know some of you soon when I launch my LIVE options courses and get you on the path to winning trades!

I will also be running The Technical Traders’ new service – Options Trading Signals – where I will share my knowledge, model portfolio, a weekly trade, and opportunities report, and trade alerts with subscribers. Look for the launch of my newsletter and courses at the end of February! Make sure you sign up now to keep informed of the launch of my newsletter and courses. You can sign up at www.thetechnicaltraders.com/options-trading.

All my best,

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.