Cannabis, Alternative Agra, Mushrooms, and Cryptos – Everything ALT is HOT

Commodities / Cannabis Feb 18, 2021 - 11:33 AM GMTBy: Chris_Vermeulen

The recent rally in Marijuana and Alternative Pharma/Agriculture stocks has been impressive, to say the least. One thing we have to remember about this sector is that it rallied to highs in 2018 and 2019, then fell out of favor for many months. The anticipation of this new sector emerging within the US, and across many areas of the globe, prompted quite a bit of excitement after 2016 when many US states voted to legalize Marijuana. Even before this date, the alternative medicine and consumer product use related to Marijuana has been heavily speculated on by investors/traders.

If we were to consider the out-of-favor phase of this sector over the past 15+ months, after the rally/hype phase which took place in 2017 and early 2018, we’ve seen many cannabis stocks collapse 70% to 85% or more recently. This downward price trend likely set up a number of incredible opportunities based on expanded marketplace opportunities, enterprise valuations, and longer-term consumer/pharmaceutical use applications for CBD and other chemical extracts. Additionally, we need to also consider what would happen if a consolidation phase were to take place in this industry – how would cannabis leaders play a role in acquiring smaller, yet important, firms with innovative technology/solutions.

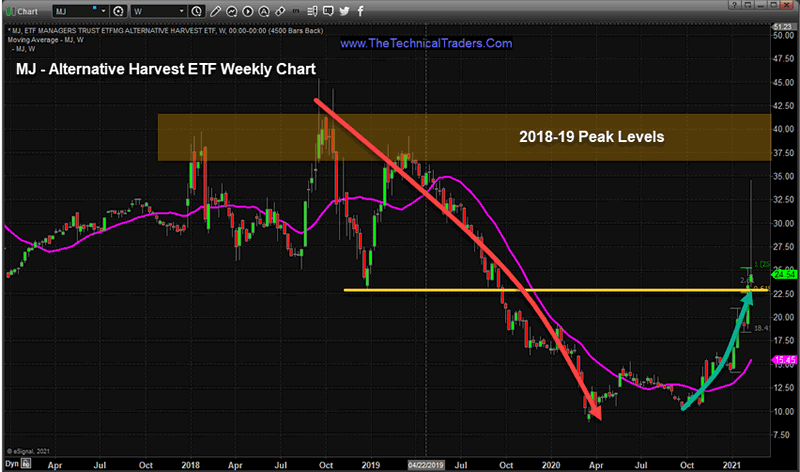

The MJ Alternative Harvest ETF Weekly chart below highlights the incredible decline in the cannabis sector after the August 2018 peak. MJ fell from a high of $45.40 to a low of $9.34 – representing a -86% decline. Aurora Cannabis (ACB) peaked at 150.34 in October 2018 and recently bottomed near $3.71 – representing a massive -97.5% decline.

Over the past two months or longer, this sector has started to heat up again with a moderately strong rally setting up. Over the past 14+ days, a big upside rally initiated pushing price levels upward by +80% to +150% or more from recent lows. Historically, when one considers the longer-term potential for growth, revenues and consolidation within this industry sector, we believe this rally may be just starting.

If we were to consider a potential continued focus on the Cannabis/Alternative Agriculture supply and industry sector over the next 4+ years, we would have to take a look at the deep decline in price levels recently and the opportunity for some type of industry consolidation over the next 5 to 10+ years. Obviously, this industry/sector is here to stay, and, much like the Alcoholic Beverage industry in the 1960s to early 2000s, we are in a very early stage of the legalization, expansion, and consolidation phase of this sector.

Using these two sectors for comparison, the first question is just how big is the Cannabis/Alt marketplace compared to similar types of markets? The Cannabis sector currently makes up about 1/10th of the total US Alcoholic beverage annual sales ($25.3B Cannabis: $252.82B Alcohol – https://www.statista.com/topics/1709/alcoholic-beverages/). From a conservative standpoint, Cannabis consumers very likely cross-over into the Alcoholic beverage consumer market on a fairly high basis. This means the consumer market for Cannabis is very likely 60% to 75%, or more, of the Alcoholic-beverage market.

Sign up now to receive information on the launch of the Technical Traders’ options trading courses and newsletter!

The second question should be what additional advantages does the Cannabis/Alt sector have that differentiate it from the Alcoholic-beverage industry? That answer lies in an unknown factor – the pharmaceutical/consumer product use that is currently in its infancy. CBD has already shown great promise, but the long-term capabilities, use, and application of various alternative chemical compounds found in various strains of plants, mushrooms, and other organic sources are still part of the “X-Factor”.

The third question in our minds becomes, how long before these unknowns/X-Factor components become a reality? We can’t attempt to put the answer into dates or predictions, but we do believe the speed at which these organic compounds will be introduced and mapped-out into potential medical-use solutions has been clearly illustrated by the speed at which the COVID-19 vaccines/medical advancements have been delivered. These solutions only took “months” to come to market. If the same type of capabilities were applied to the Cannabis/Alternative marketplace, and thus toward the multiple supply/innovation companies within this sector, a massive boost of growth, innovation, and consolidation within this sector over time. Let’s take a look at some current statistics & data below.

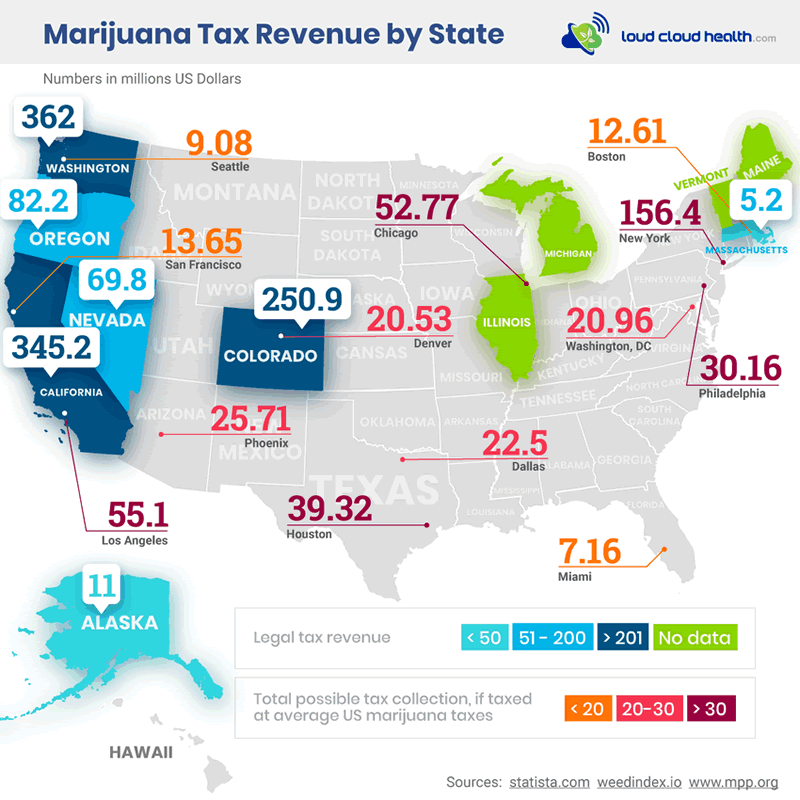

Marijuana Tax Revenues by state appear to be strong and growing. One thing to consider about this Tax data is that a relatively large portion of actual sales are still going unreported (as illicit transactions).

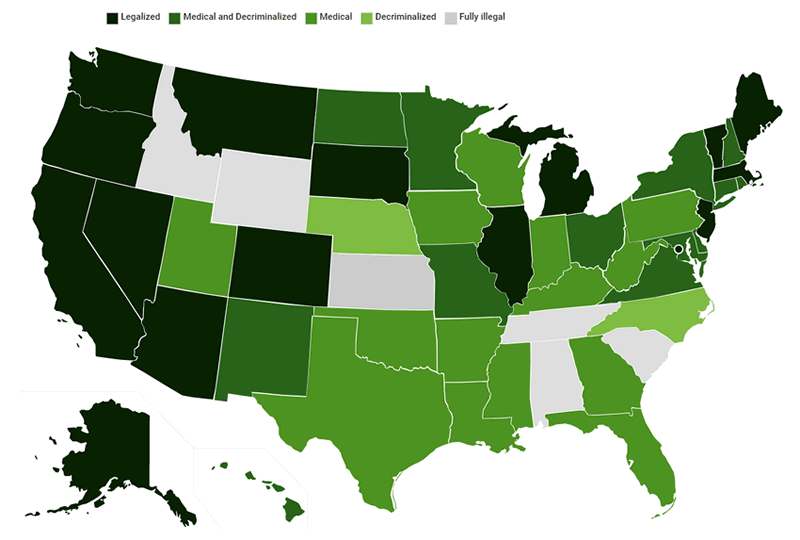

Legalization & Acceptance of Marijuana within the US has now reached almost every state – with only six states still showing Marijuana is fully illegal. All other states have adopted Marijuana use in some form over the past 5+ years.

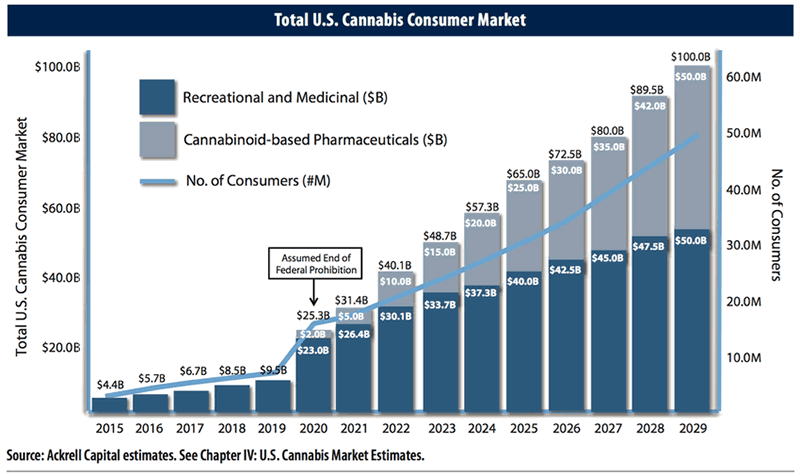

The US Cannabis Consumer Market is expected to increase by more than 15 to 20% in 2021 after more than doubling in 2020. From 2018 to 2021, the total consumer market was expected to increase by more than 350%. By the end of 2022, that ratio increases to levels beyond +450% compared to the 2018 levels.

Obviously, the deep price decline in the Marijuana sector, which recently ended, did not properly reflect the market capabilities and expectations for future growth and earnings. We believe this sector could become one of the hottest sectors for growth over the next 2+ years and it may prompt a massive consolidation phase within this industry which will create potential behemoth conglomerate Cannabis firms – very much like the Alcoholic Beverage industry.

I am able to find these trends, like MJ, by using my Best Asset Now strategy. My subscribers and I are loving the strategy as we closed our MJ trade last week after taking profits at the 7,%, 15%, 20%, and 48% levels in two weeks! This is how we make consistent profits from the BAN strategy while still getting that awesome, excitable feeling from being in an explosive trade!!

Don’t miss the opportunities in the broad market sectors over the next 6+ months, which will be an incredible year for traders of the BAN strategy. You can sign up now for my FREE webinar that teaches you how to find, enter, and profit from only those sectors that have the most strength and momentum. As some sectors fail, others will begin to trend higher. Learn how BAN Trader Pro can help you spot the best trade setups; staying ahead of sector trends is going to be key to success in these markets.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you. In addition to trade alerts that can be entered into at the end of the day or the following morning, subscribers also receive a 7-10 minute video every morning that walks you through the charts of all the major asset classes. For traders that want more trading than our 20-25 alerts per year, we provide our BAN Trader Pro subscribers with our BAN Hotlist of ETFs that is updated each day. We issued a new trade alert for our subscribers today and all four trades are well on their way to great returns!

In the second part of this article, we’ll explore various Marijuana sector charts showing where traders may find real opportunities for profits if the current rally phase continues. This exciting industry sector may become one of the hottest sectors for traders and may prompt a massive consolidation phase within this industry over the next 5+ years. Get ready for some big trends and opportunities.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.