Seeing Stock Market New Highs Through the Prism of AI

Stock-Markets / Stock Markets 2020 Dec 24, 2020 - 08:00 PM GMTBy: Nadeem_Walayat

Stock markets are soaring on the back of vaccines that herald the end game to the Covid nightmare that as I speak is hitting new highs in the US and fast worsening second peaks across Europe. However, much as was for the March crash, the vaccines, covid-19 are all mere blips in the long-term trend trajectory that is being driven by AI and it's full spectrum application. For instance these are the key areas that I identified to focus upon some 5 years ago, though the number is always expanding as AI encroaches on every aspect of our lives which is why my focus is on core AI itself rather than derivatives of AI.

This article is an excerpt from my following in-depth analysis (AI Stocks Portfolio Buying Levels Q4 2020 Analysis) covers the following topics:

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

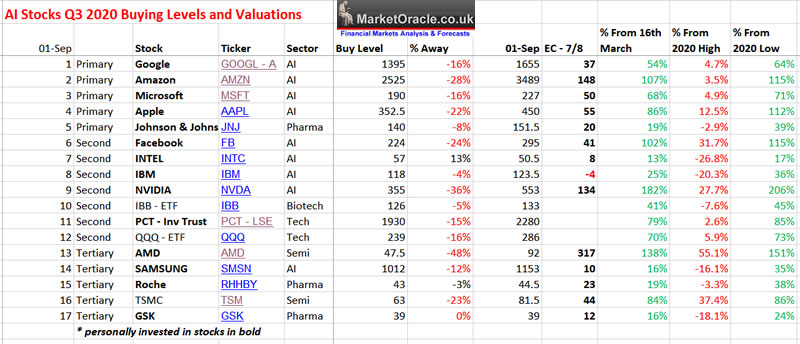

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

The bottom line is that we are on exponential curve in terms of technological developments, which means expect things to change FAST! And likely most of us won't even beware of most of critical changes as they take place given the rapid pace of development, just that the implications of the developments WILL be discounted by the stock market through higher stock prices.

For instance, imagine a world where super conductors operate at room temperature! We'll that world could start becoming manifest as early as next year with EXPONENTIAL CONSQUENCES across a wide spectrum of sectors starting with applications that currently require liquid nitrogen cooling such as Quantum computers. Another key sector that is waiting on room temperature super conductors to deliver several orders of magnitude of efficiencies is in electricity generation, transmission and storage (batteries).

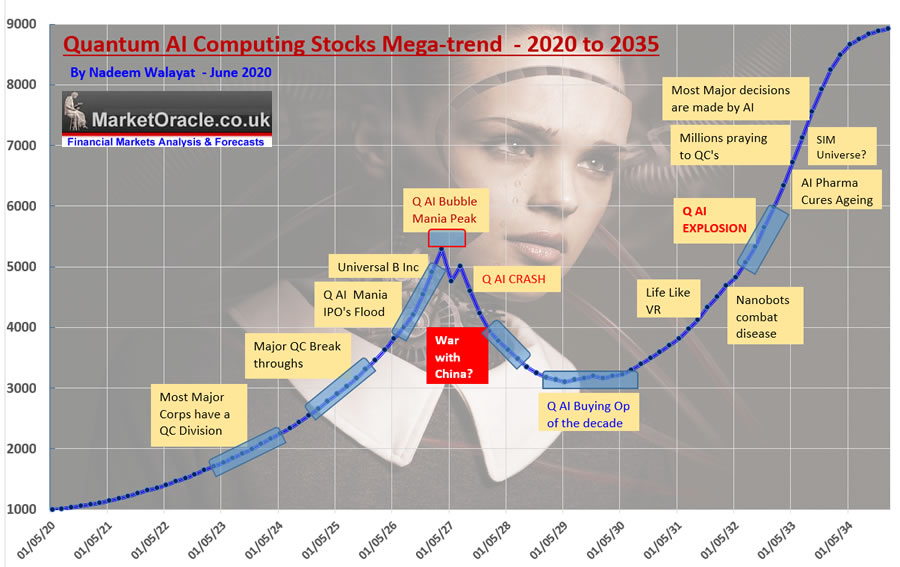

And here's a reminder of the stock market BIG PICTURE, where basically I am expecting AI stocks on average to increase 6 fold on where they were trading in June 2020 by 2027. (Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!)

Yes there will be stocks that over perform and stocks that underperform as illustrated by AMD currently Killing Intel in the CPU market, a trend which I have been iterating for a few years from now, and it looks like Intel's in for another couple more rough years.

However, Intel IS leveraged to AI, SO I do expect Intel to eventually start performing, for which I am keeping an eye out for signs of, forget 2021, possibly 2022. Anyway both are on my list.

Also remember folks the AI mega-trend favours the tech giants for the tend to be exposed to multiple AI derivative sectors given the advantage that AI gives them over the rest.

And they have very deep pockets SO can BUY up any small or medium cap that shows promise. So unlike mega-trends of decades past, think BIG TECH! And regardless of what happens, even a deep depression courtesy of a once in a century global pandemic, good AI stocks will not only survive but PROSPER, which is pretty much what I stated going INTO the Pandemic crash of 2020 and warned not to make the mistake of SELLING AFTER the initial bounce.

This trend is only just beginning for we have yet to pass human level intelligence after which it's off to the races! When AI is smarter than us, you, me, even the smartest guy in the room! In respect of which all we can do is to?

OWN THE AI! Or a small piece of it via the stock market.

So think of each stock holding as owning a piece of THE AI. Where whilst on the surface they may appear as individual corporations fronted by CEO's under the hood they will become ONE AI, and most people won't even be aware of that fact.

So GET INVESTED and KEEP INVESTED then at the least we will protect our wealth and at best get mega-rich, easy money. In fact I could retire today (metamorphically since I am my own boss) and then 6 years down the road cash in my stocks portfolio for a SIX TIMES return (on June 2020 valuation). It's literally that easy. I've done it before over the decades and know the secret to investing is to REMAIN INVESTED in Mega-trends, buy when cheap and then forget it, if the stock is good then it WILL deliver! Hence my educational investing articles, 20%, 30% even 100% stock gains are nothing to what to expect, regardless of crashes or even bear markets as March 2020 illustrates. Go back and read my articles AND comments during March 2020 and you should see how to think about investing, there is no doubt, if the market is dumb enough to offer AI stocks at 30% to 40% DISCOUNTS then BUY! I ploughed every penny at my disposable into AI stocks during March, though the crash in sterling to below $1.20 limited my window of opportunity to throw more sterling at the market, which is why I like to keep a good chunk of my liquid cash in dollars as I primarily invest in US tech stocks, cannot trust chinese corps and anything else of value eventually gets bought by a US tech giant!

Of course becoming six times more wealthy is not of much use unless there is tech around the corner to use it to capitalise upon, exponential human longevity which should start materialising during the 2030's as I covered in my following article of Mid 2019 (Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies). I'm up for cybernetic implants during the 2030's. Becoming a literal six million dollar man as I alluded to in my 2016 video.

It's going to happen, so get invested and get rich so we can buy the health tech that is coming a decade or so down the road courtesy of AI and then maybe we'll all see out the 2099 New Year together.

Again the whole of this analysis has first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

AI Stocks Portfolio Buying Levels Q4 2020 Analysis

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.