Is the Vaccine a Game-Changer for Gold?

Commodities / Gold & Silver 2020 Dec 15, 2020 - 06:23 PM GMTBy: Arkadiusz_Sieron

The vaccines are coming – we’re saved! Although the arriving vaccines are great for humanity, they are bad for the price of gold.

The vaccines are coming – we’re saved! Although the arriving vaccines are great for humanity, they are bad for the price of gold.

In November, Pfizer and BioNTech announced that their mRNA-based vaccine candidate, BNT162b2, had demonstrated evidence of an efficacy rate above 90% against COVID-19, in the first interim efficacy analysis. As Dr. Albert Bourla, Pfizer Chairman and CEO, said:

Today is a great day for science and humanity. The first set of results from our Phase 3 COVID-19 vaccine trial provides the initial evidence of our vaccine’s ability to prevent COVID-19.

Indeed, the announcement is great news! After all, the vaccine is the ultimate weapon against the virus. There’s no doubt that we will get the vaccine one day. Thank God for scientists – they are really clever people who work hard to develop a safe vaccine! Why can’t we have more of them instead of so many economists? As well, the pandemic triggered unprecedented global cooperation to develop a vaccine as quickly as possible. The funds are enormous, while the bureaucrats eventually decided to behave like decent human beings for once and eased their stance in order to speed up the whole process. Great!

But… there is always a “but”. You see, there are some problems related to Pfizer’s vaccine . First, all we know comes from the press release, but the company didn’t provide any data for a review. Second, the efficacy rate announced by the company pertains only to the seven days after the second dose is taken – we still don’t know how effective the vaccine is in the longer term, and how long immunity lasts. Third, we still don’t know the efficacy of the vaccine among the elderly and people with underlying conditions – or, the most affected people by COVID-19. Fourth, the vaccine is based on mRNA technology, and such a vaccine was never approved for human use. There is always a first time, but new technologies always give birth to some concerns, which could ultimately reduce the public’s preference to get vaccinated.

Another problem is that this vaccine requires two doses that are taken 21 days apart. It delays the moment of immunization and again reduces the motivation to take the vaccine – yes, some people are so lazy, and/or they don’t like injections so much (for whatever reason; we’re not debating whether it’s justified or not) that they can refuse to be vaccinated.

Moreover, Pfizer’s vaccine must be stored at a temperature of about -70°C (-94°F), which is quite low indeed, and can be quite chilly in shorts (unless you are Wim Hof ). The problem is transportation and distribution – you see, many hospitals - to say nothing of rural physicians and pharmacies, and healthcare systems in developing countries - do not have adequate freezers to store the vaccine. Last but not least, even if scientists develop the best possible vaccine, it remains useless unless people accept to take it – and this is far from being certain, given the pandemic denial movement and fear of vaccines.

Sure, one could say that all these points are not very problematic. After all, Pfizer is not the only company working on the vaccine. There are actually more than 150 coronavirus vaccines in development across the world. For example, Moderna’s vaccine can be stored at a much higher temperature – a more comfortable -20°C (-4°F), So even if Pfizer’s vaccine turns out to not be the best, other, even better vaccines will arrive on the market – and a lack of any vaccine can transform into a crisis of abundance.

That’s true, but the sad truth is that it’s unlikely that any vaccine will be widely available until mid-2021 . Pfizer, for example, announced that it hoped to produce 50 million doses by the end of 2020. As the vaccine needs two doses, only 25 million people could be vaccinated this year. So don’t count on being among this group – countries will prioritize healthcare workers, social workers and uniformed services first, and the elderly next. It means that we will not return to a state of normalcy very soon, and most of us will still need to wear masks, practice social distancing and… wash hands!

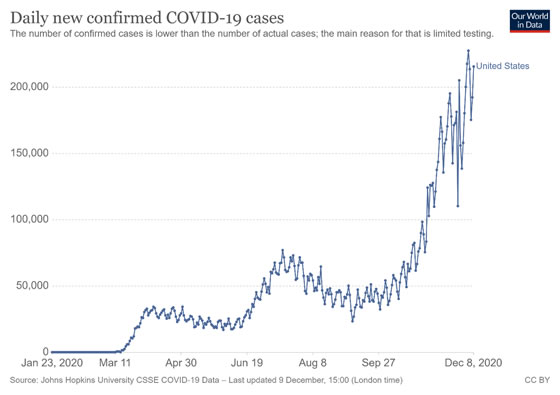

In the meantime, the U.S. is about to enter Covid hell , as Michael Osterholm, one of Biden’s advisers on the epidemic , said . Indeed, the country is nearing 11 million reported COVID-19 cases, and the coronavirus has already killed more than 240,000 Americans. But the worst can still lie ahead for the U.S. As one can see in the chart below, the epidemiological curve is clearly exponential and the daily number of new cases has touched 200,000! Yup, you read it correctly, about two hundred thousand people are infected each day. You don’t have to be a mathematician to figure out that at such a rate of infections, the healthcare system will collapse soon.

What does it all imply for the gold market? Well, although the arriving vaccines are great for humanity, they are bad for the price of the yellow metal. The pandemic greatly supported gold prices. So, the expected end of the epidemic in the U.S. should be negative for the shiny metal.

However, there are two important caveats to this statement. First, there is still a long way to go before widespread vaccination and a true end to the pandemic. In the interim, we still need to face the COVID-19 challenge, so gold shouldn’t suddenly fall out of favor.

Second, gold reacted not only to the pandemic itself, but also – or even more – to the world response of governments and central banks to the health and economic crisis . The easy monetary policy and accommodative fiscal policy will not disappear only because of the vaccine’s arrival. Actually, the harsh winter or “Covid hell” that awaits America will force the Fed and Treasury to continue or even to expand their stimuli, which is good news for gold prices from the fundamental perspective .

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.