The Death Of U.S. Shale Has Been Greatly Exaggerated

Commodities / Shale Oil and Gas Dec 10, 2020 - 01:55 PM GMTBy: OilPrice_Com

The current year marks the 15th anniversary of the U.S. shale boom, a period in which fracking technology across such states as Texas, Colorado, New Mexico, North Dakota, and Wyoming helped establish the nation as a top oil and gas producer.

Unfortunately, high costs of production compared with conventional drilling has led to the sector consistently printing red ink and resulted in considerable destruction of shareholder value. The Covid-19 pandemic and subsequent oil price crash has led to investors souring on the industry further, credit becoming harder to come by, and a cross-section of Wall Street calling the end to the sector.

But the death of the U.S. shale sector might have been greatly exaggerated.

Whereas U.S. shale has recorded a steep production decline due to sharp fall in oil and gas prices, the industry could be primed to recover much faster than what we have been led to believe.

There’s no way to sugarcoat it: Since its inception, the U.S. shale industry has been a big money loser.

A June report from Deloitte revealed that during its 15 years of existence, the U.S. shale industry managed to write off a staggering $450 billion in invested capital while generating $300 billion in net negative cash flow. Further, the sector has recorded more than 190 bankruptcies since 2010, the highest by any sector in the United States.

The Covid-19 pandemic only served to make a bad situation much worse. According to Deloitte:

“The oil industry is currently experiencing a ‘great compression’ in which companies’ room to maneuver is restricted by low commodity prices, reduced demand, capital constraints, debt loads, and health impacts of COVID-19. Unlike in previous downturns, these effects are now simultaneous--creating a higher level risk of technical insolvencies and building intense pressure on the industry.”

Still, the shale sector is hardly on its deathbed as has been portrayed in some circles.

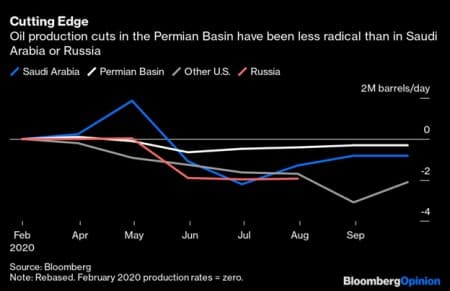

The U.S. shale patch has an estimated breakeven oil price in the $60-$65 range, well above the current WTI price in the mid-40s. The historically low oil prices have definitely taken a hit on production, with the Texas’s Permian Basin pumping 4.49 million barrels a day in September down from 4.9 million barrels in March. Yet, the September figure is actually higher than in any month prior to September 2019. In fact, the decline in Permian production has been less severe compared to the cuts undertaken by the likes of Saudi Arabia and Russia.

Source: Bloomberg

Indeed, the worst might be over for the U.S. shale patch thanks to a deluge of Covid-19 vaccines arriving just when the second, third, and even fourth waves of infections have been ravaging the world and causing widespread despair.

The UK has become the first country in the world to approve the Pfizer-BioNTech BNT162b2 vaccine, which has been shown to offer up to 95% protection against Covid-19. The first 800,000 doses will be available in the country starting next week, with another 40M doses on order.

Even better news: The U.S. could soon follow suit with an FDA approval and distribute enough of the Pfizer/BionTech vaccine to immunize 100M people--or a third of its population--by the end of February...

There are at least five other promising vaccine candidates from Moderna, Johnson & Johnson, AstraZeneca, CureVac, and Sanofi-GlaxoSmithKline already in the pipeline.

Further, a recent Bloomberg New Energy Finance (BNEF) report says that shale production costs have been falling, with E&P companies operating in the lowest-cost U.S. basin, Permian and Delaware, posting breakeven levels of ~$33 a barrel, down from a $40 per barrel just a year ago.

In an earlier report, Citigroup and Goldman Sachs projected that oil prices might hit $60 a barrel by the end of 2021. Given the high efficacy that the Covid-19 vaccines have so far demonstrated, do not be surprised if Bank of America’s prediction that oil prices will hit $60 during the first half of 2021 proves to be accurate. In other words, the majority of U.S. shale companies could turn cash flow positive in a matter of months.

The U.S. shale sector might be down but is by no means about to go out. Shale companies know it, and have been busy consolidating their operations so as to be better primed for the oil price recovery.

It’s not time for shale to surprise us--yet. An oil price rally on vaccines doesn’t exactly connect with the massive impact on demand the coronavirus has had. There’s an important time lapse here.

But if American shale has finally learned its lesson on resilience, we can expect some real value-focused growth once the dust settles on multiple crises.

Link to original article: https://oilprice.com/Energy/Crude-Oil/The-Death-Of-US-Shale-Has-Been-Greatly-Exaggerated.html

By Alex Kimani for Oilprice.com

© 2019 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.