SPX about to Challenge 8/08 High

Stock-Markets / Stock Markets 2020 Jul 15, 2020 - 12:18 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – Having rallied well past a .618 retracement of the decline into March 2020, it is time to consider the possibility that the retracement was only an interruption of the bull market which originated in 2009.

Intermediate trend – Still in an uptrend since March

Analysis of the short-term trend is done daily with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please go to www.marketurningpoints.com and request a trial.

SPX about to Challenge 8/08 High

Important Cycle lows

40-wk cycle due 7/20 (inverting?)

Market Analysis (Charts courtesy of QChart)

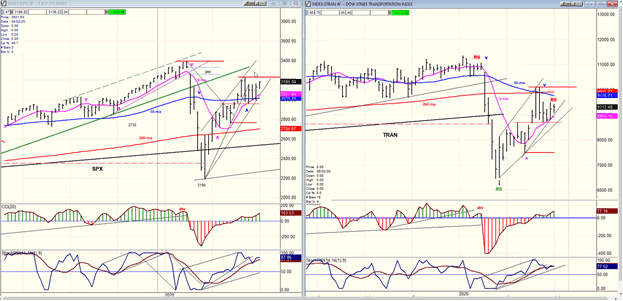

SPX-TRAN weekly charts

SPX made a new 4-week high last week which seems to be the result of the 37-td cycle making its low last week. The 40-wk cycle was expected to make a low in about another week, but Eric Hadik (INSIIDEtrack@aol.com) has suggested that it will make a high instead, this time. He appears to be correct! This means that SPX should proceed to at least 3210 before reversing – as long as TRAN remains negatively divergent over the short-term.

The market has been very responsive to positive economic reports in the past few weeks, but these may soon be replaced by the opposite as unemployment benefits run out at the end of this month.

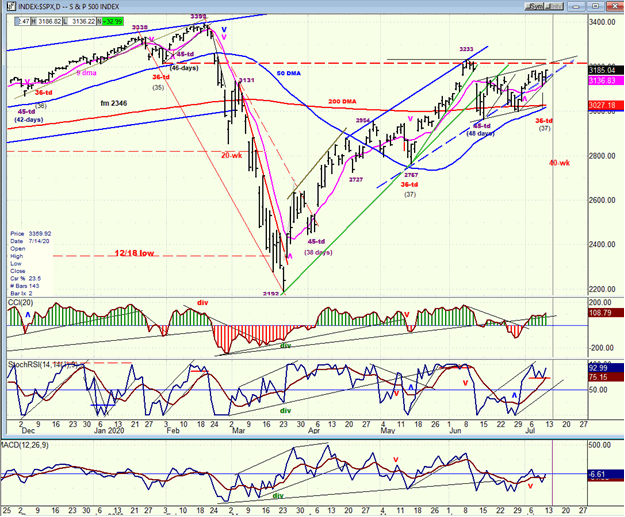

SPX daily chart

The 40-wk cycle was expected to make its next low on ~7/20, but signs that it had peaked and was about to bring a substantial correction never came. In the past couple of weeks, a periodic analysis by Eric Hadik suggested that, (this time) the 40-wk cycle would be making a high, not a low, in this time frame!

It looks like the right call! Last Friday, assisted by the 36/37-td cycle which bottomed during the week, the index made a new short-term high with a strong close at 3185 on Friday. With the short-term projection now pointing to at least 3210, we should expect more upside early next week.

On Tuesday, the hourly indicators gave a sell signal but the daily refused to go along, and the index continued up on its merry way. Until a sell signal at the hourly level is confirmed at the daily and weekly time frames, we cannot expect a meaningful reversal in the indices.

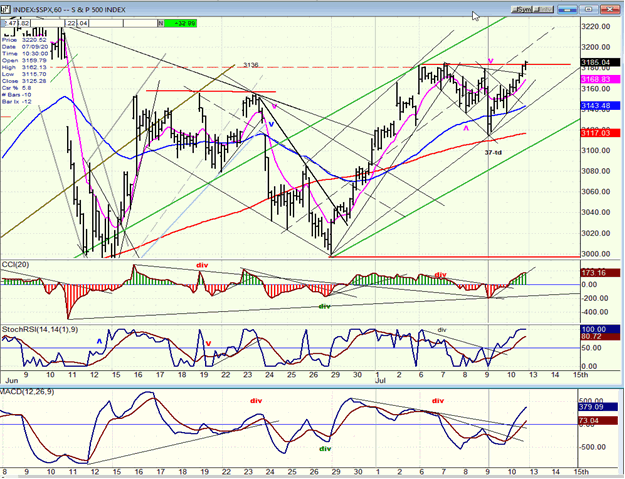

SPX hourly chart

The 37-td cycle low failed to bring about much of a correction and quickly turned prices up. It was a little misleading since it was not preceded by some positive divergence in the CCI, but there was no doubt that another short-term buy signal had been issued when it went green. Early Friday, the index broke out of a consolidation pattern and managed to eke a slightly higher high by the close.

According to the last short-term congestion pattern which formed at 3140, a minimum advance to 3210 is likely based on the strong count alone but stopping at that level is not guaranteed. IWM, TRAN and DJIA are all much weaker than SPX, which continues to be driven by NDX. But QQQ (264.31) may have a valid projection to about 236. If this turns out to be a high, we can expect SPX to reverse when it has met the 3210-15 target. If the 37-td cycle cannot push prices beyond that level, it will be a sign that bearish forces are about to assume control.

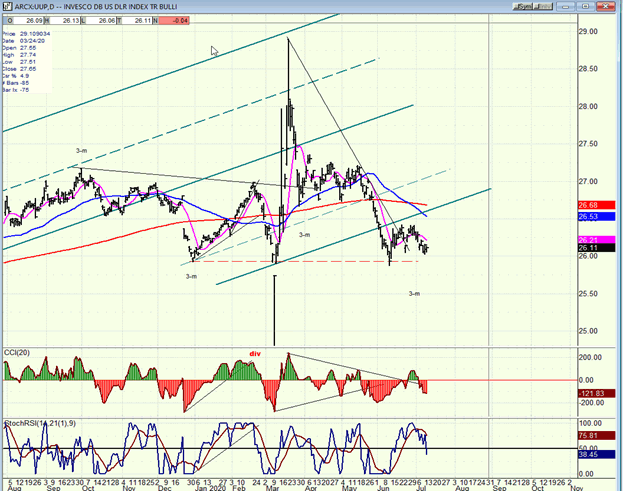

UUP (dollar ETF) daily

UUP has made a low in the vicinity of its 3-mo cycle. If it has the same effect on prices as most previous ones, a longer holding pattern, and perhaps a short-term uptrend should be generated as long as the cycle remains in an up-phase.

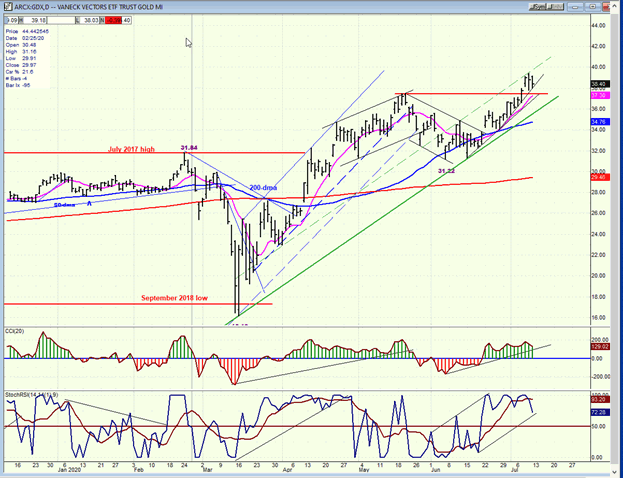

GDX (Gold miners ETF) daily

GDX could still push to 40 (which is the ideal short-term target) before correcting. The oscillators have started to look toppy but would have to decline further to suggest that a reversal is taking place.

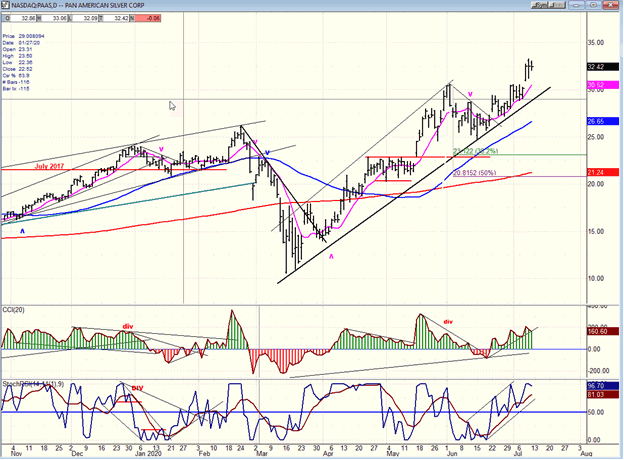

PAAS (Pan American Silver Corp.) daily

PAAS continues to make a chart pattern which is identical to that of GDX. Therefore, the same analysis can be applied. It too could move slightly higher before correcting.

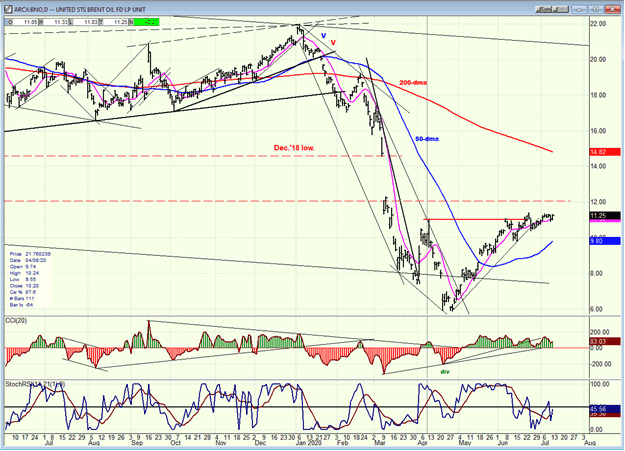

BNO (U.S. Brent oil fund) daily

BNO will hold up as long as the market does; but very strong resistance starting at about 12.00 reduces the possibility of improving its price by more than a small margin before pulling back to build a larger base.

Summary

Acknowledging Eric Hadik’s analysis that the 40-week cycle is in an inverted mode appears to be the correct step to take. We do not yet know how much weakness will come into the market after the inversion, but a clear warning that a significant correction may be starting would come from IWM if it cannot hold above 147, and then breaks below 144.

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.