Gold Silver Miners and Stocks (after a quick drop) Ready to Explode

Commodities / Gold & Silver 2020 May 23, 2020 - 06:04 PM GMTBy: Submissions

The move of a lifetime is just beginning!

The senior mining companies have led this rally for the past year. In the metals sector you get leadership rotation from bullion, silver, senior miners, and junior miners. Silver and the junior miners have yet to break out of their 2016 highs, but it's coming. We believe the junior miners will be next and break through the elusive $52 level.

Once this price is broken expect $60+ within a very short period of time. A testing of the 7 six year consolidation level of $52 should occur shortly. The seniors moved first based on earnings as they are income-producing companies and with the price of gold recently elevated for a sustained period of time they began to soar. As the boom phase begins for the senior miners they start looking for expansion and acquisition with their cash flow. This next phase can set off an incredible rally in the Junior miners and exploration companies.

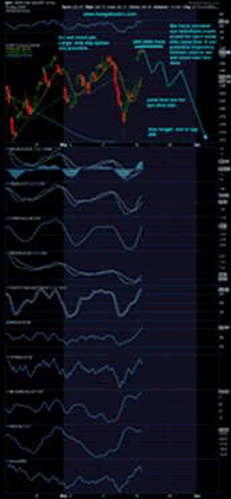

The second half of May into mid-June should be explosive for all of the Gold mining companies. Our AI machine learning projected a strong rally in early April. We took positions for our own accounts weeks ago at signficantly lower prices. Expect some consolidation the week of May 18th before the next leg up begins.

We expect GDXJ to outpace GDX the next 30 days. Worst case scenario the juniors will not be left behind. They should at a minimum keep pace with the Senior Miners.

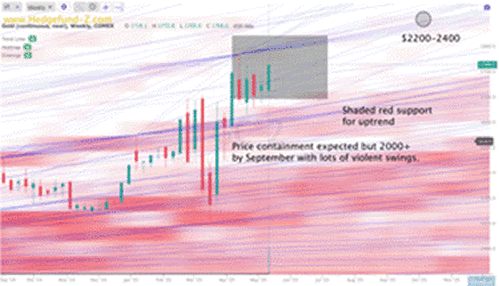

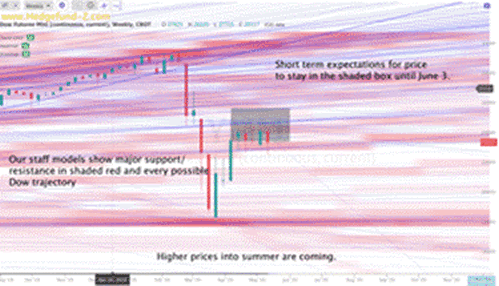

Below is a look at Gold.

Now for the stock market.

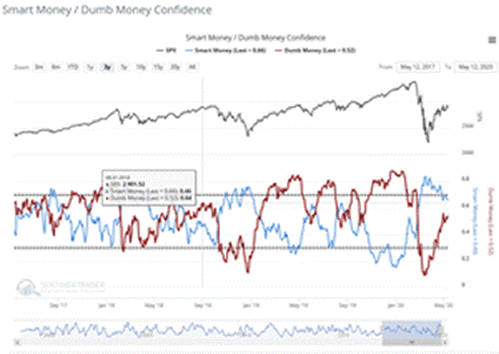

A choppy sideways week lies ahead with a Friday, rally into Memorial day weekend. Expect a sharp drop into Tuesday May 26th which should be followed by a bounce and sell off into a low June 2nd. Expect SPX 2650 to hold. Then a very sharp rally into the end of June. Bottom line we are still in buy the dip mode.

As one can see following the smart money, the 1%, is a perfect toool to use for the majority of investors. Follow the 1% , the smart money is buying.

The Nasdaq may shock everyone as the leaders of this bull market, nano technology, robotics, semi- conductors, and AI are based there and will draw all of the hot money early on as capital is redeployed. America is not going out of business and where else is the elite going to safe keep all of their cash? Real estate? Government debt? I think not, follow the money.

Our complimentary research is for educational purposes. If you choose to use it to execute trades based on our posts remember you are responsible. If you are seeking a detailed analysis and the very trades we execute for our own accounts visit us at www.Hedgefund-Z.com.

By Hedgefund-z

© 2020 Copyright hedgefund-z - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.