3 Top Oil Stocks to Buy Right Now

Commodities / Oil Companies Apr 16, 2020 - 12:29 PM GMTBy: Sumeet_Manhas

Due to several recent events, including a price war initiated by Russia, the price of oil has declined to record-low levels these past couple of weeks. Subsequently, the price decline resulted in a massive worldwide panic which pushed the price down even further.

Due to several recent events, including a price war initiated by Russia, the price of oil has declined to record-low levels these past couple of weeks. Subsequently, the price decline resulted in a massive worldwide panic which pushed the price down even further.

While the panic might reasonable and based on a real fear of what the situation might lead to, there are still ways that investors can protect their funds. And for those willing to risk a little extra, some investments could even pay off in the short run, especially when investing in stable oil stocks.

What Happened to the Oil Market?

Generally speaking, two main events have caused this unprecedented oil price decline. The first being a decision made by Russia and OPEC to start a price war with the United States. When the markets opened the day after that decision was made, the price dropped to record-low levels, eventually falling below $30.

The second event is the spread of COVID-19 which has been devastating to most financial markets, including the commodity and stock markets.

As mentioned, following these two events, panic started spreading among investors which initiated a large sell-off which made a bad situation even worse.

Now, there hasn’t been enough time since this happened for anyone to be sure of how bad it could get and how long a potential recession might last. However, as any experienced investor would tell you, plummeting prices and a recession is not all bad and there are always ways to benefit. Learn more about how to benefit from a recession at this top-shelf trading website: https://bullmarketz.com/

That’s why we’ve analyzed the market in search of three oil stocks that will likely produce a decent return for their investors, even during a relatively short time span.

1. Chevron

Chevron is, by far, one of the strongest oil companies in the world. Even though the company stock is affected by everything that happens on the oil market, it will take a lot more for Chevron to crash.

With a history that spans more than 140 years and an unmatched influence on the global energy market, chances are high that Chevron will be one of the first companies to fully recover from the ongoing instability.

The energy giant is also well-known for their ability to make money on low oil prices, meaning they’re likely to continue their production and distribution even during a complete market melt-down.

Chevron is traded on the NYSE as CVX.

2. Exxon Mobil

Exxon is another massive American oil company that shares many similarities with Chevron. For example, Exxon is known to remain rather stable regardless of the global market conditions and the company is more than fit to survive and even thrive during a stubborn recession.

With that said, Exxon does not have the same influence on the market as Chevron and they are slightly smaller in terms of production and revenue. Therefore, Exxon is a slightly riskier investment while the potential pay-off is slightly higher.

Compared to many other companies in the industry, Exxon is so well-established that it could even experience growth during situations like this.

Exxon is traded on the NYSE as XOM.

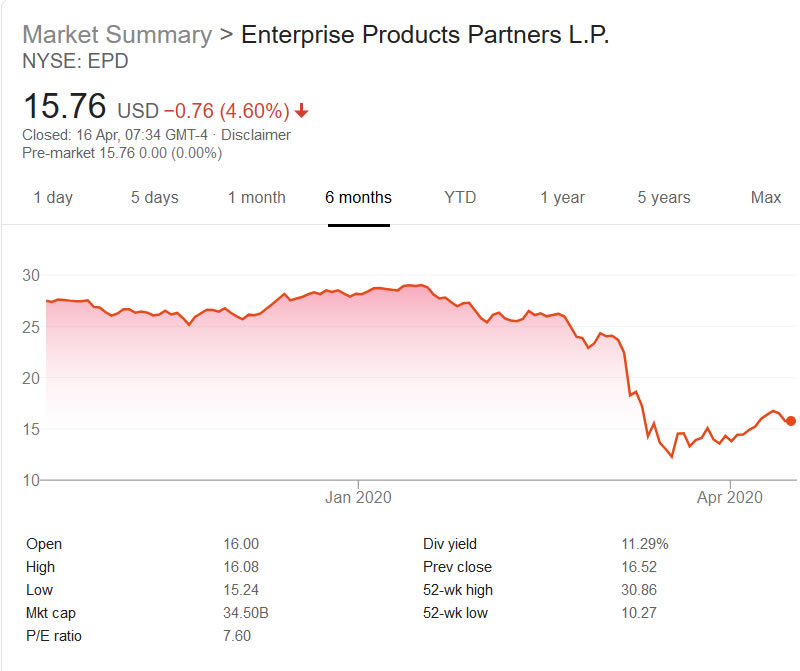

3. Enterprise Products Partners

Enterprise Products Partners is another company that is showing little to no signs that they have been affected by the ongoing chaos on the oil market. In the past, Enterprise has been able to increasing its distribution when the price of oil has dropped below $30; a unique ability in the sector.

Because of that, we believe that Enterprise Products Partners is one of the best oil stock investments that one can make at the moment.

Another benefit to Enterprise is that a majority of its business is tied to contracts which are easily renegotiated, meaning they can continue its distribution even when drillers go bankrupt.

Enterprise Products Partners is traded on the NYSE as EPD.

Invest in Oil

As firm believers that the price of oil will always bounce back, we think this might be a good time to invest in oil as a commodity. According to most experts, oil will not be stuck under $30 for that much longer, creating a great opportunity to buy now and reap benefits in the short-term.

Note: Keep in mind that the above-mentioned tips are not meant to be used as guarantees. Investments are always associated with risks and those risks are inflated during market instability.

By Sumeet Manhas

© 2020 Copyright Sumeet Manhas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.