From Global Virus Acceleration to Global Debt Explosion

Politics / Pandemic Apr 01, 2020 - 12:08 PM GMTBy: Dan_Steinbock

The novel coronavirus is exploding in the US and Europe, due to complacency and inadequate preparedness. The escalation will translate to debt explosion, which will further complicate and prolong the fight against the virus globally.

As the COVID-19 challenge moved from imported cases to local transmissions, I warned in the briefing of March 9 that the rise of local transmissions was a game-changer in the coronavirus escalation. Here's what I projected then:

“Even though many observers expected virus challenges to ease toward April, the acceleration of new cases outside China is only beginning and likely grossly under-reported. The number of confirmed cases worldwide is set to climb in the future – even faster as tests are broadened in major affected countries.”

So, what has actually happened in the past three weeks?

Explosion of new virus cases in the US and Europe

On January 9, the few known cases were in Wuhan. On February 9, the number of cases exceeded 40,000, most of them were in China. During the subsequent critical month, when China contained the virus, major countries outside China – especially North America and Europe – failed to mobilize against the virus.

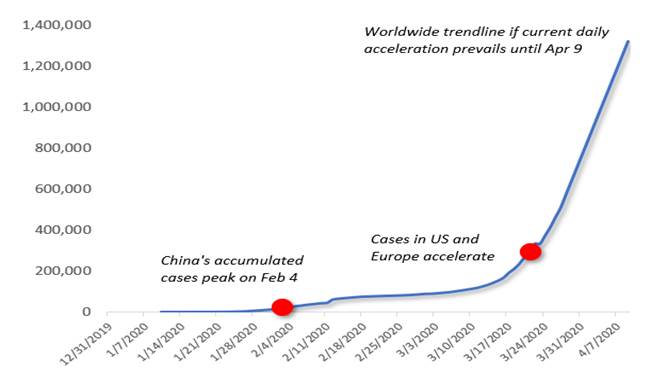

The net effect? On March 9, there were almost 315,000 cases, but most of them outside China. And if these cases continue to soar by 40,000-60,000 daily – nearly 4-6 times faster than 1-2 weeks ago, then by April 9 they could exceed 1.3 million. If the acceleration still intensifies, that figure will be even higher. If it decelerates, it will be lower (Figure).

Figure “Current acceleration” scenario (through April 9, 2020)

Source: Difference Group; data from WHO

In the worst phase of the Chinese outbreak, the comparable acceleration was barely 4,000; that is, less than 7% (!) of the current acceleration.

Over time, this acceleration may translate to huge collateral damage not just in North America and Europe, but particularly in emerging and developing economies of the Middle East, Latin America, Asia and Africa – through plunges in world finance, trade, investment, and migration.

Explosion of new sovereign debt

The early economic defense has been by the major central banks to cut down the rates, inject liquidity and re-start major asset purchases. But as the post-2008 decade has shown, monetary responses cannot resolve fiscal challenges.

The early damage has focused on a set of key sectors, such as healthcare, transportation, retail, tourism, among others. As a result, ultra-low rates, liquidity injections and asset purchases will be coupled with targeted fiscal stimuli in affected economies. Yet, current measures to restrict the infection and economic damage will contribute to further debt erosion in major advanced and emerging economies.

Recently, the White House signed the $2 trillion coronavirus bill, the largest ever US stimulus. In the Trump era, US sovereign debt has increased record fast and now exceeds $23.5 trillion (107% of GDP). Thanks to the bill, it will soar faster than ever before. Yet, unemployment rates and business defaults could prove devastating.

In view of the US Federal Reserve, there is no reason for concern because it can support the economy. As the only central bank in the world, the Fed can print more dollars to reduce the severity and limit the duration of the coronavirus economic crisis. That will ease the US crisis in the short-term, while worsening the severity and extending the duration of the coronavirus contraction in the rest of the world.

In other words, we are back in the post-2008 territory, but now, after a decade of ultra-low rates, rounds of quantitative easing and liquidity injections, the situation is potentially much worse.

Before the virus, Washington’s debt burden was expected to increase to 110% of GDP, which the stimulus bill (9% of GDP) will dramatically increase – to a level where that ratio was in Italy during its sovereign debt crisis in the early 2010s.

In Italy, the level of sovereign debt is today significantly higher (135%) and in Japan outright alarming (240%). In Europe, the Maastricht Treaty deems that member states should not have excessive government debt (60%+ of GDP). Today, no major European economy fulfills that criteria.

Nevertheless, to overcome their short-term challenges, the major European countries will take more debt, which will further erode their debt to GDP ratios.

Multipolar cooperation to deter nightmare scenarios

In advanced economies, the coronavirus contraction has potential to wipe out much of the past decade’s recovery, which the US tariff wars have already undermined for two years. Meanwhile, developing countries, which have weaker healthcare systems, already suffer from financial and debt vulnerabilities and may not be able to withstand still another external shock.

Moreover, supply-side measures alone cannot resolve pandemic challenges. If containment measures fail, or subsequent mitigation proves inadequate, or new virus clusters emerge after containment and mitigation, markets will remain volatile and economies will suffer further damage, particularly with multiple waves of secondary infections after the current restrictive measures.

Worse, current virus scenarios are based on the assumption that the virus won’t return and won’t mutate. Yet, increasing numbers of cases could raise the probability of both scenarios.

What is needed to avoid further nightmare scenarios is multipolar cooperation among major economies and across political differences. President Xi Jinping’s call on Trump to cooperate against the virus is a good start – but far more is needed in the US and Europe to defuse the virus acceleration.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2020 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.