Coronavirus - Don’t Ask, Don’t Test

Stock-Markets / Stock Markets 2020 Mar 21, 2020 - 01:31 PM GMTBy: John_Mauldin

My friend Ben Hunt wrote two weeks ago that we were in a period of “don’t ask, don’t test.” He has been extremely critical, and rightly so, about the slow response in getting tests available.

When we actually start testing at scale, I suspect we will find a lot of people have the coronavirus. My extremely informed sources consider it quite reasonable to expect 100,000 people in the US will test positive in a relatively short time.

The mainstream media will breathlessly report each increase and their locations and what is happening at the local hospitals. How do you think people will respond as the number of cases approaches 100,000 with no sign of slowing?

Eventually, the number of cases will begin to decline. Dr. Mike Roizen, chief wellness officer at the Cleveland Clinic, thinks there is an 80% chance that by the end of April we will have seen the total number of cases peak and begin declining, and that the coronavirus is like its predecessors.

This particular coronavirus is worse in that it is more contagious and that it will live outside the body for a period of time. Warm weather in the past generally helped.

There’s been a great deal of concern about the outbreak and number of deaths in Italy. The Italian hospital system is, to be kind, simply inadequate for this scenario. The WSJ noted a few days ago:

In Italy, which has the oldest population in the world after Japan, 58% of COVID-19 patients who died so far were over 80 years old, and a further 31% were in their 70s, according to the National Institute of Health, Italy’s disease-control agency… It should also be noted that, like many socialized medical systems, Italy’s system has a personnel challenge… There aren’t enough specialized doctors and nurses to staff intensive-care units.

On a positive note, the US has three times the per-capita number of ICU beds as Italy, and they are far better equipped. So hopefully we will fare better, if it reaches that point.

Meanwhile, the coronavirus have helped to spark thousand-point swings in the Dow Industrials … to the upside and the downside.

On Friday, it was 2,000 points to the upside, which has investors asking when they should think about getting back into the market.

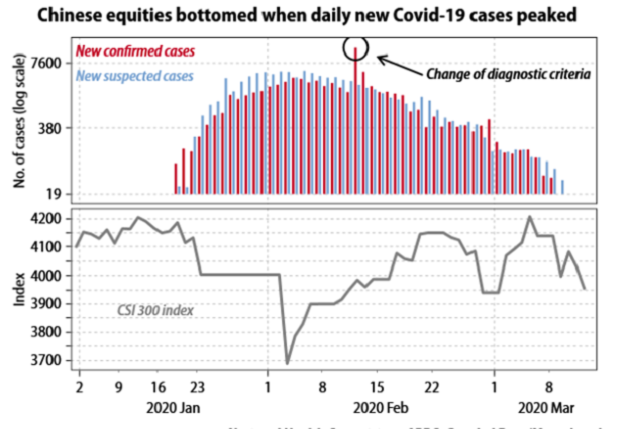

For answers, consider this chart from Gavekal, which came out Friday morning. It shows Chinese equities bottomed when daily new COVID-19 cases peaked.

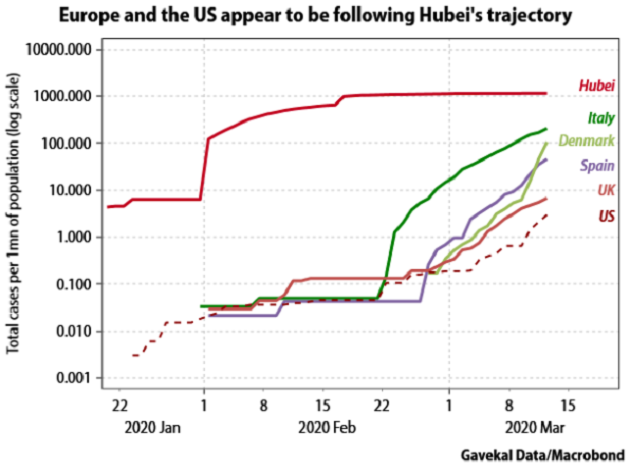

Europe and the US seem to have the same pattern of cases as China. Which means that we will peak as well at some point.

My personal plan for my own portfolio, other than the private funds that I own, is to wait until the number of US COVID-19 cases begins to peak, as I believe that will probably be the time of peak panic, and then I will get back into the market.

I will be looking for dividend and fixed income opportunities, as after all I am 70 years old, and I tell all my clients at that age they should be looking for more fixed income. Right now, I don’t have enough but I think there’s going to be a great buying opportunity in the not-too-distant future.

There are going to be some opportunities of a lifetime in the not-too-distant future. Please be prepared to take advantage of them.

Seriously, as troubling as this pandemic is, I’m confident humanity will invent vaccines and treatments while hospitals develop ways to deal with it. Next year, and for a few years after that, it would not surprise me if we all get our COVID-19 vaccine just like normal flu shots.

Right now, the corporate bond market seems to be relatively (and I use the word loosely) not acting as badly as you might expect. However, the oil price crisis brought on by Saudi Arabia and Russia could push some energy companies to the brink of insolvency.

Those assets will be bought by firm hands, as it was in the last oil crisis. But if it triggers a problem in the high-yield and junk bond markets, this recession can get a lot worse.

It is something we have to pay attention to.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.