Gold Pulled Back, But Coronavirus Did Not

Commodities / Gold & Silver 2020 Mar 03, 2020 - 06:21 PM GMTBy: Arkadiusz_Sieron

While viruses are counted among the simplest forms of life, they have quite a bearing on its advanced forms. And the coronavirus epidemic is, unfortunately, alive and well. What are the implications for the gold market?

Coronavirus Infects Europe

The coronavirus epidemic is, unfortunately, making its presence well known. Actually, it spreads quickly around the globe. The worldwide number of confirmed cases has reached almost 90,000, while the death toll has surpassed 3,000 people.

Three important developments have occurred over the weekend and since our last edition of the Fundamental Gold Report. First, the World Health Organization reported on Sunday that “the number of confirmed cases in Hubei province, China, has increased for two successive days after a period of decline.” It means that the epidemic in China may not be peaking yet, especially as China counting methods (excluding asymptomatic infected individuals) may underplay extent of outbreak, according to Caixin.

Second, the new coronavirus infections soared across Europe on Sunday. The situation is particularly grave in Italy, where confirmed cases jumped 40 percent in 24 hours to 1,576 (and to 1,713 on March 2), adding a great burden on the country’s healthcare system. However, the number of infections have also jumped in France (to 130 cases), Germany (130 cases), Spain (74 cases), and the UK (36 cases). As the whole continent will be infected soon, the economic effects will become greater. The French government has already admitted that the effect of the coronavirus will be larger than previous estimates and promised to provide the necessary support to companies. With slower economic growth across France and the whole continent being already fragile, guess what Christine Lagarde will do? Yup, she will hurry with help and the ECB will remain accommodative or even ease its monetary policy even more.

Third, the more decisive spread of the coronavirus across the United States is a matter of time. The number of cases has increased to more than 80, while two people have already died. The governor of Washington, where these deaths occurred, has already declared a state of emergency. The Vice President Mike Pence admitted that we “could have more sad news”. These developments will lead to the intensification of fear among Americans, spurring possibly some safe-haven demand for gold.

Implications for Gold

What does it all mean for the yellow metal? Well, from the fundamental point of view, growing fears that the spreading coronavirus will weigh on global growth, the dovish central banks, a weaker US dollar and the stock market volatility should all support gold prices.

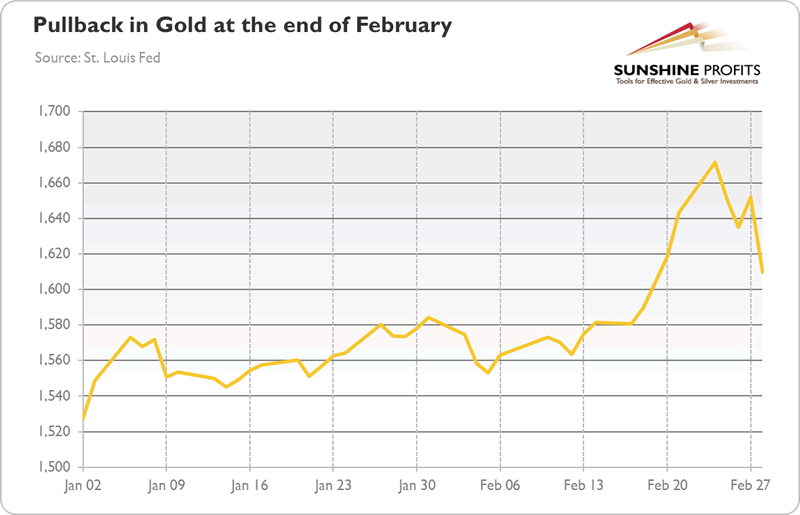

We are, of course, fully aware that the price of gold plunged on Friday, as the chart below shows. But we warned our Readers that a downside move was likely, given the scale of previous huge rally. The sell-off could be, thus, a normal profit-taking for those wishing to cash in on the runup.

Chart 1: Gold prices in 2020 (London PM Fix, in $)

Another issue is that the greenback strengthened on Friday against the euro, maybe because investors focused on the much more grave epidemiological situation in Europe. However, the epidemic should arrive in the US as well but with a certain lag. And even with the scale of the outbreak smaller than in Europe, the new coronavirus will negatively hit the profits of US international companies.

Should we panic? No, after all, the risk of the coronavirus-related death to the average person remains low. And each year, between 291,000 and 646,000 people worldwide die from seasonal flu. So, when the fears recede, a move lower in the gold prices is likely.

However, we are rather before the peak of the epidemic and related worries, so there is more room for gold to shine as a hedge against viruses, especially if the Fed reacts and cut interest rates just as a vaccine to the new economic disease.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.