India's Nifty 50 Stocks: Does the Bad Jobs Outlook Spell Trouble for Stocks?

Stock-Markets / India Feb 27, 2020 - 05:47 PM GMTBy: EWI

India's "employment outlook" just reached its lowest level in 14 years.

There are a lot of mouths to feed in India -- north of 1.3 billion.

That means a lot of jobs are required to put food on the table for a lot of people. But there's a problem: the jobs picture in the world's second most populous nation isn't pretty.

As far back as a year ago, the Washington Post said (Feb. 1, 2019):

**India's jobs crisis is worse than people thought ...

At the time, a private survey had shown that the number of people working had contracted by 11 million in 2018.

Here in February 2020, the jobs outlook remains bleak.

So, what should investors make of this?

Well, a chart and commentary from Elliott Wave International's February 2020 Global Market Perspective provides insight:

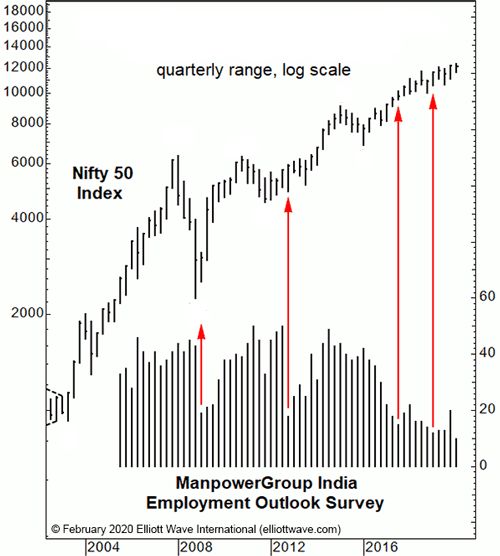

**ManpowerGroup India reported the results of its Q1 2020 Employment Outlook Survey, which showed that only 10% of managers planned to increase staff -- the lowest level in the survey's 14-year history.

**For the past few years we have interpreted apparent troughs in the survey results as bullish for stocks, as prior troughs were in Q1 2009 and Q4 2012. So far, that interpretation has been correct.

"Bullish for stocks"? How's it possible for bad employment data to be bullish for stocks?

Helping you understand seeming paradoxes like these is a unique feature of Elliott wave analysis. It's not that bad news is bullish for stocks. It's more nuanced than that. Our research shows that bad news often coincides with the end of a downtrend in a market's Elliott wave pattern.

That's why EWI's Global Market Perspective rightfully interpreted two prior employment troughs as bullish signals for Indian stocks -- you can see those moments marked on the chart with the first two red arrows.

Unfortunately for them, most investors continue to make a big mistake when they invest with the news, bullish or bearish. As EWI President Robert Prechter stated in a classic Elliott Wave Theorist:

**One of the most important things to understand about the stock market is its relationship to news. Aside from emotional reactions lasting just minutes, news does not cause the market to move in any meaningful sense.

Get important insights into what really drives markets from Robert Prechter in a free 12-minute video, "Learn What REALLY Moves the Markets," a presentation that Robert Prechter made to The International Federation of Technical Analysts.

Who is Elliott Wave International? EWI is the world's largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.