Has Stock Market Waterfall Event Started Or A Buying Opportunity?

Stock-Markets / Stock Markets 2020 Feb 25, 2020 - 12:24 PM GMTBy: Chris_Vermeulen

Over the past 5+ days, a very clear change in market direction has taken place in the US and global markets. Prior to this, the US markets were reacting to Q4 earnings data and minimizing the potential global pandemic of the Coronavirus. The continued “rally to the peak” process was taking place and was very impressive from a purely euphoric trader standpoint. Our researchers found it amazing that the markets continued to rally many weeks after the news of economic contraction and quarantines setup in China/Asia.

Make sure to opt-in to our free market trend signals newsletter before you continue reading this or you may miss our next special report!

We believe a number of critical factors may have pushed global investors away from their comfortable, happy, bullish attitude over the past 5+ days – most importantly the reality that the virus pandemic was very real and would continue to result in a more severe global economic contraction process and the outcome of the Caucus voting where Bernie Sanders appears to be leading almost every early voting event. There are now two major concerns hanging over the global markets and the future of the US 2020 Presidential elections. These two major issues may be enough to change investor sentiment and present a very real volatility event.

Uncertainty breeds fear and can cause traders to move away from risk. We discussed these topics in research posts many months ago.

January 29, 2020: ARE WE SETTING UP FOR A WATERFALL SELLOFF?

November 11, 2019: WELCOME TO THE ZOMBIE-LAND OF INVESTING – PART II

September 24, 2019: IS SILVER ABOUT TO BECOME THE SUPER-HERO OF PRECIOUS METALS?

September 7, 2019: US STOCK MARKET HASN’T CLEARED THE STORM YET

Our researchers believe the underlying concerns that are becoming more evident to global traders are the very real facts that the global economy may continue to contract because of the spreading Corona Virus and risks of a global pandemic event and the fact that the US 2020 Presidential election process appears to be setting up to become a real battle between Donald Trump and Bernie Sanders. Our researchers believe the combination of these two unknowns is creating an environment where global traders are fearful of the future growth opportunities within the US and global markets.

Bernie Sanders has been dominating the Caucus events in the US as a Socialist/Progressive candidate. For many Americans, this is a frightening concept. Even early into the Caucus voting cycle, it appears Mr. Sanders has taken a very clear leadership role headed into the 2020 Presidential election event. Business and global investors are not going to like the concept of a Socialist/Progressive US Presidential candidate. This is going to cause investors and business owners to avoid engaging in projects and opportunities until after the November 2020 elections.

Add into this fear contagion the fact that the Coronavirus event may continue to add to the global fear component of the US and global economy. How much more risk is involved because of the spread of this virus over the next 12+ months and how will this concern complicate the concerns related to the US Presidential electing event?

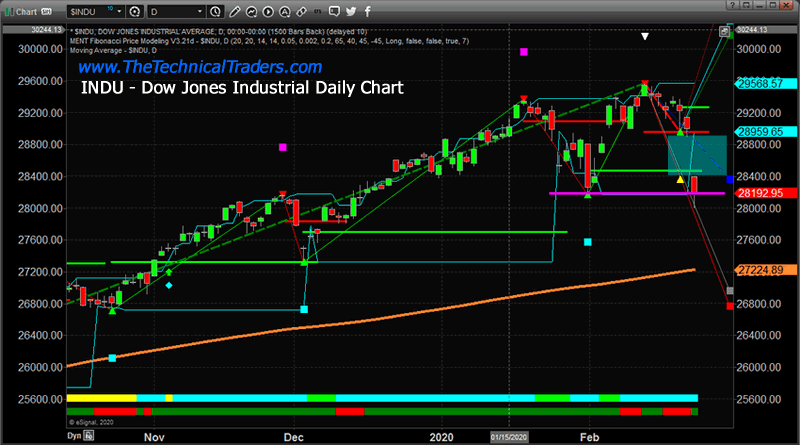

Daily Dow Jones Industrial Chart

This Daily Dow Jones Industrial chart highlights the huge Gap lower that took place early on Monday, February 24, 2020. This huge move resulted from an extended fear of a growing potential for a global pandemic event and a renewed fear that global economic activity may be greatly reduced over the next 12+ months. We believe the extended fear of a potential Socialist/Progressive Democrat candidate may be adding to this massive decline in the global markets.

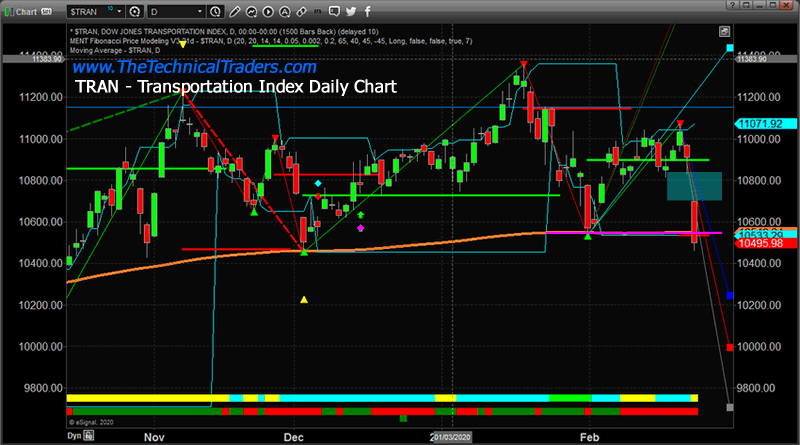

Transportation Index Daily Chart

The Transportation Index is an excellent measure of future economic activity expectations and investors belief that the global economy will recover from this potential contagion event. On Monday, February 24, 2020, the Transportation Index collapsed below 10,600 on a Gap Down move as the markets collapsed. This is a real sign that global investors suddenly believe the global markets will contract over the next 3 to 6+ months and are moving away from risky instruments in the US and global markets.

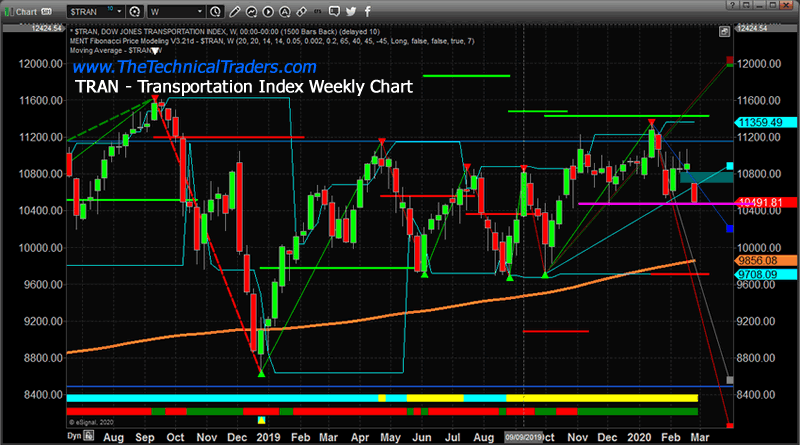

Weekly Transportation Index

This Weekly Transportation index chart illustrates just how far the TRAN could move while still saying within the range of price activity from 2018 to 2019. The TRAN could fall all the way to levels near 8,800 before reaching the lows of December 2018. Thus, from current levels near 10,500, we could see a continued price decline in the global markets of at least 15% to 20% before we near the 2018 lows.

As our research team has been predicting, it appears a Waterfall event is beginning to take place. This Gapping downside move may become the catalyst top in the global markets that presents a broader market rotation/decline. As we’ve been warning, be prepared for broad sector market rotation and for precious metals to skyrocket as greater fear sets up in the global markets. We hope you were paying attention to our research over the past 5+ months. We’ve been all over this setup and have issued multiple warnings for all our friends and followers.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you visit my ETF Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Bar!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.