Could You have Seen Tesla Stocks 200% Rally Ahead of Time? Yes -- Here's How

Companies / Company Chart Analysis Feb 05, 2020 - 01:53 PM GMTBy: EWI

New High in TSLA: Riding an Electric 200+% Move

Excerpted from the Asian-Pacific Financial Forecast:

The electric vehicle revolution approaches critical mass

The CEO of Tesla Inc., Elon Musk, held a ground-breaking ceremony outside Shanghai in January 2019 for his company’s first Gigafactory in China, which will be the first factory in the nation wholly owned by a foreign automobile manufacturer. Looking out over barren fields in the rain, the CEO promised that the factory would begin producing its first cars for the China market by late 2019.

(Wave labels removed to protect paying subscribers.)

Tesla was the leading producer of EVs globally in 2018—the company sold about 138,000 units of its Model 3 Sedan, which represented about 10% of the global market, compared to 92,000 units sold by the second-largest producer, China’s BAIC Group. The company sports a market cap of about $50 billion, which looks set to get even bigger in coming years, as the stock price appears to be [heading higher] since its IPO in 2010.

Excerpted from the January 2020 Asian-Pacific Financial Forecast (published January 10, 2020):

Tesla makes its first cars in China

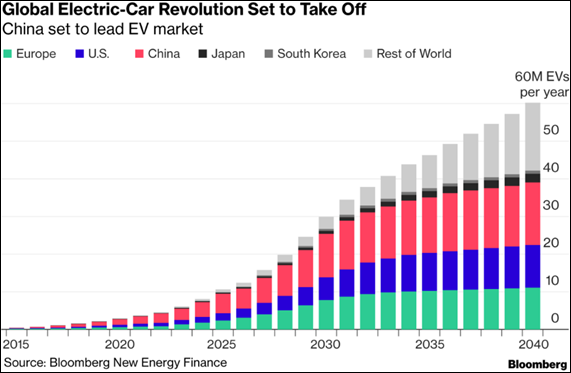

Electric vehicle maker Tesla Motors delivered its first cars made in China during the final week of 2019. China is key for all automobile manufacturers because the nation is the largest market for electric vehicles and it should remain so for decades, according to Bloomberg New Energy Finance (see chart). The research institute expects demand for electric vehicles to soar after 2024, when it estimates that the declining cost of batteries will make electric vehicles more competitive with gasoline-powered vehicles in terms of price.

Our March 2019 issue said that Tesla stock was [heading higher] since its IPO in 2010. Its recent surge to record highs is consistent with that outlook.

Here's an updated chart of Tesla through Tuesday morning (Feb 4):

(Wave labels removed to protect paying subscribers.)

Free, Read Our New Asian-Pacific Forecasts

(Now Thru Feb. 6)

Asian-Pacific markets have been extremely volatile lately -- and you want to capitalize on it.

Let us help, free. Through February 6, read our latest Asian-Pacific forecasts as part of our FreeWeek event.

This article was syndicated by Elliott Wave International and was originally published under the headline New High in TSLA: Riding an Electric 200+% Move. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.