Stock Market Market Review

Stock-Markets / Stock Markets 2019 Dec 16, 2019 - 12:19 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – There are no signs that the bull market is over.

Intermediate trend – Most likely approaching an intermediate top.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

Market Review

Point & Figure Overview of SPX

Correctly predicting the market trend requires an objective analysis of the supply and demand forces which are constantly in play. In my opinion, the methodology of P&F is one of the best ways to demonstrate graphically this perennial struggle.

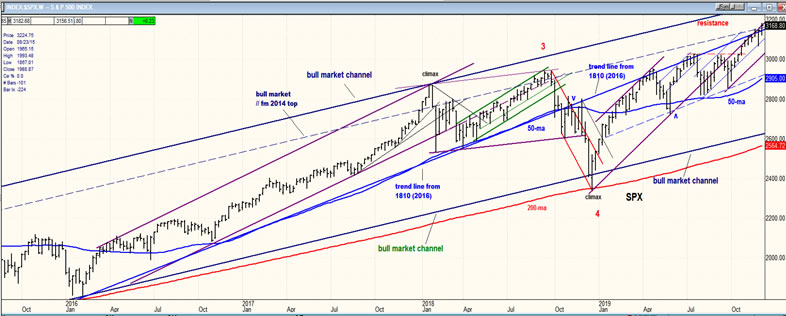

Long-term trend: The bull market which started in 03/09 shows no sign of having run its course. A rough count taken on the long-term Point & Figure chart gives us a potential target to as high as 4080.

Intermediate trend: Based again on the long-term P&F chart, if 3160-3180 fails to bring about an intermediate top, we could see the index run up to ~3240 after a minor correction has taken place. The 3180 target has been met!

Short-term trend: SPX pushed to the 3180 projection and is forming a congestion pattern which may not be complete. Short-term high could see max 3190-95.

Market Analysis (All charts are courtesy of QChart)

SPX-IWM weekly charts

Both indexes made a new weekly high and closed higher, persisting in their intermediate uptrend with no significant alteration of their relative strength. SPX did reach 3180, which could turn out to be an intermediate high if it cannot be exceeded, but this would require that a more important congestion (distribution) formation be built in this general area before the start of a correction.

SPX daily chart

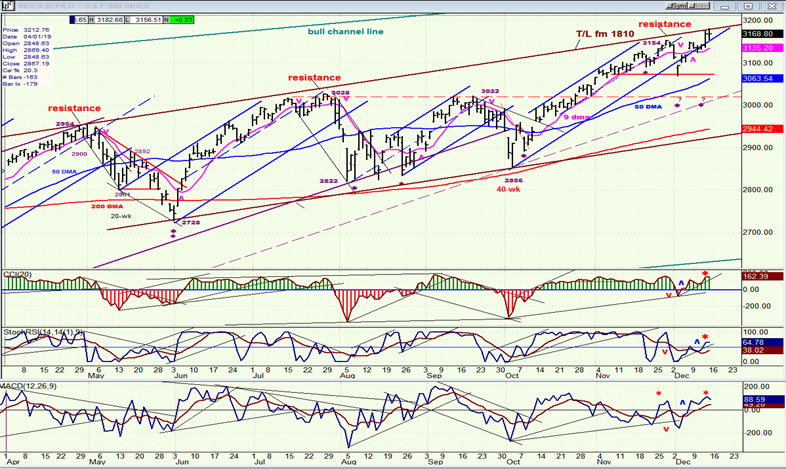

On Friday, buoyed by bullish news, SPX poked its head slightly above the trend line from 1810 which has proven to offer major resistance to all uptrends since the 2346 low of a year ago. On Friday, it was challenged once again, but the move was repulsed and the index closed practically unchanged.

The trend line from 1810 has now formed the top of an intermediate channel. The bottom channel line has been drawn as a parallel at the 2728 level and it has already arrested three short-term declines. The index appears to be trading comfortably within the confines of that channel and does not seem ready to come out of it on either side.

Considering the negative divergence which has formed in the oscillators at the bottom of the chart and the resistance just above Friday’s close, it is likely that we are about ready to put an end to the trend from 2856. Furthermore, the important 3180 projection has now been met, which is an additional warning that the odds favor a price reversal from this level. It would take a daily close below 3135 to create a sell signal.

SPX hourly chart

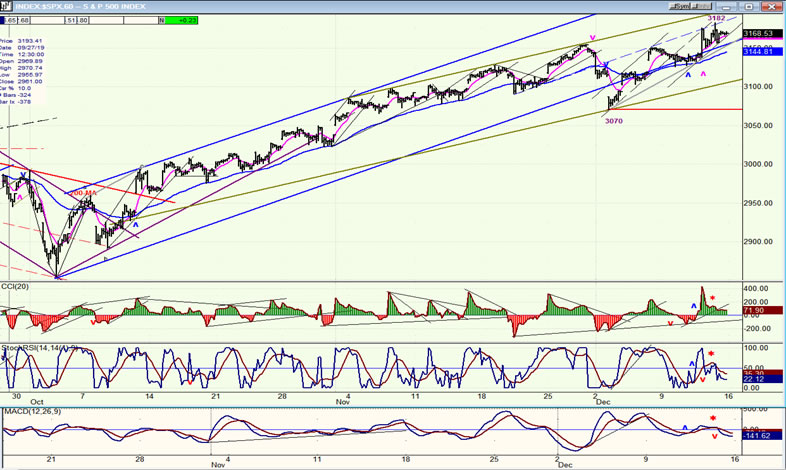

It’s highly probable that SPX’s run from 2856 (326 points) is coming to an end. Besides filling the P&F projection to 3180, negative divergence has also formed on the hourly oscillators, and two of the three have already given a sell signal.

To begin a correction of intermediate nature, the index would have to trade below 3070, but since there has not been enough distribution above that level to warrant this kind of a decline, this is unlikely to occur in the near future. The long-term P&F chart also suggests that SPX could push up to ~3240 before finding an intermediate top. Consequently, our best bet is to form only a short-term top around 3180 and then attempt to push a little higher before we are in a position to complete a top of intermediate proportion.

If we should start to correct immediately, it’s unlikely that we will see a decline totaling more that 30-50 points over the short term.

UUP (dollar ETF) daily

UUP has declined to the lower trend line of its blue channel, and this may be just about all we get for now although, for the sake of the P&F chart, I would prefer to see it touch 26.50 before reversing. This is entirely possible since the best support comes at the junction of the two dashed lines.

GDX (Gold miners ETF) weekly

GDX had another little spurt on the upside, but stopped short of overcoming the resistance created by former peaks. If it cannot get past that resistance before UUP completes its short-term correction, it will be pushed back, perhaps even to a new low before it ends its corrective move from the 31.00 peak. I had expected it to retrace 50% of the previous uptrend, but GDX found support a little above and bounced in a pattern which does not look very aggressive and which could easily be stopped and reversed by the resistance band where it now finds itself. Furthermore, the GDX oscillators are developing negative divergence, while UUP’s are doing the opposite. The technical picture does not look all that bullish and warrants caution.

BNO (U.S. Brent oil fund) daily

BNO has reached the junction of two trend lines which should halt its advance, at least temporarily; but until it begins to trade below its lower channel line, it should remain in an uptrend.

Summary

Now that SPX has reached its 2180 projection at the same time that strong negative divergence has appeared at the hourly level, a short-term retracement of the uptrend from 2156 should be expected -- although Friday’s close has not yet brought a sell signal..

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.