Canadian Cannabis Stocks CRASH as Canopy Growth Hits a Dead End

Companies / Cannabis Dec 14, 2019 - 01:00 PM GMTBy: Stephen_McBride

It was supposed to be a routine police raid…

It was supposed to be a routine police raid…

But when the cops stormed an illegal pot operation in California earlier this year, even grizzled veterans were shocked by what they found.

They went in expecting to confiscate marijuana plants from a farm. Instead, they found a pot factory cranking out 500 pounds of pot a day. That’s nearly enough pot to supply all legal pot shops in California!

As you may know, California legalized recreational pot in 2018… an act that was supposed to put an end to the illegal pot black market. Instead, the total opposite has happened. Black market pot is thriving.

Two years after legalization, 80% of the pot sold in California still comes from the black market. And get this… spending on legal pot has DROPPED 17% since California legalized pot, according to Arcview.

This development is a huge, overlooked threat to pot stocks. If you own any, especially Canopy Growth, here’s what you need to know...

Have You Seen Canadian Pot Stocks Lately?

It’s a bloodbath.

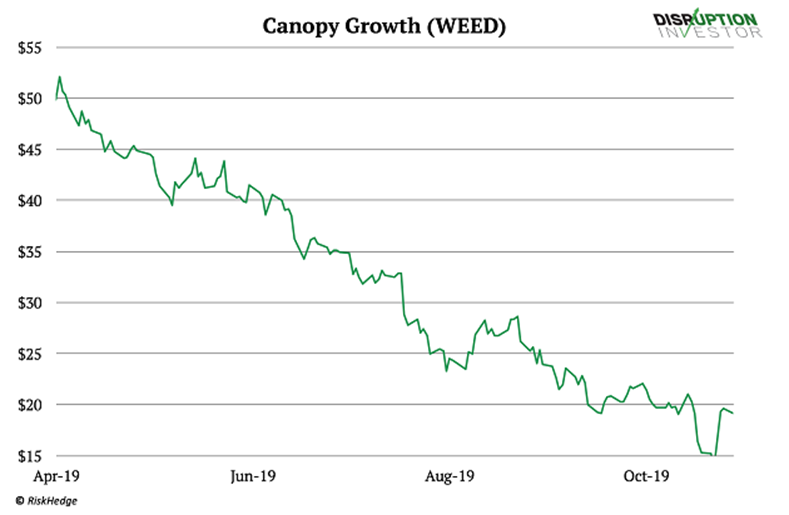

Here’s Canopy Growth (WEED)… down 65%.

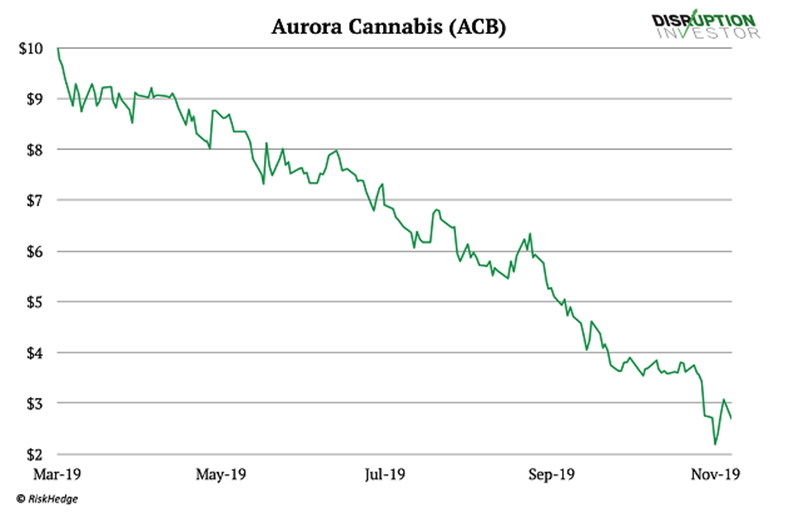

Aurora Cannabis… crashing 74%.

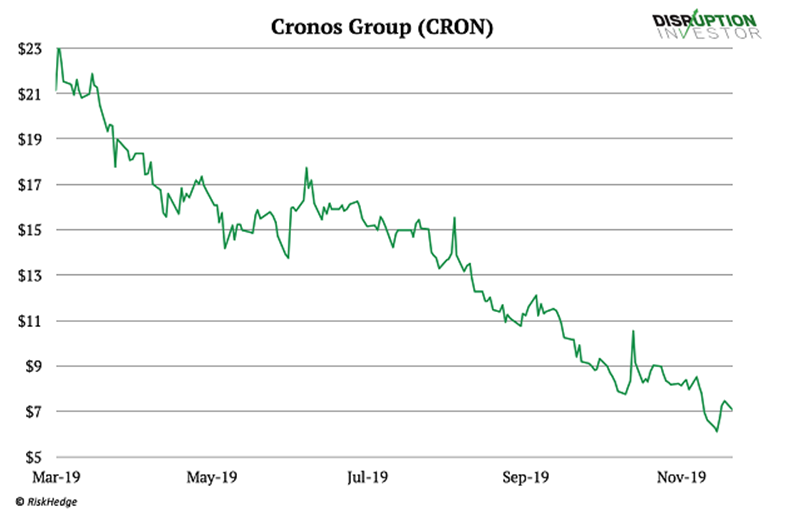

And Cronos Group… slipping 71%.

If you’ve been following my work on pot stocks, you saw this coming from miles away back in August. But make no mistake, pot stocks aren’t merely “taking a breather.” They’re crashing. And I don’t see them going anywhere but down for at least the next six months, for one simple reason.

The Canadian Black Market

Pot was legalized in Canada last year. But 2018 was not the first time most Canadians tasted pot. Millions of kilos of pot had been smoked in Canada way before the legalization. It’s been a multi-billion dollar industry for a hundred years.

The only difference is that it was conducted on the black market, illegally.

Just like in California, legalizing pot was supposed to kill the black market in Canada. Just like in California, the opposite is happening.

A year after Canada’s historic legislation, the Canadian pot black market isn’t just alive—it’s booming! Today, 4 in 10 Canadians buy at least some of their pot from illegal sources, according to StatsCan. And in 2019, the black market is expected to make up 71% of all pot sales in 2019.

The Biggest Pot Lie

Mark Zekulin, CEO of Canopy Growth, appeared on TV the other day. He commented on the company’s record-high losses for returned products and excess inventory. The company lost $1.6 billion in the past six months… 3X more than last year.

As you may know, Canopy Growth is the world’s largest pot producer...and one of investors’ favorite pot stocks. Here’s what Mark said:

“There are not enough stores in Canada to sell our products… and it’s very hard to take on the black market”

In other words, the lack of legal pot stores is Canada is at the root of Canopy Growth’s struggles. Once more pot stores open up, black market competition will vanish. That’s a big, capital-L lie.

If California is any indication, access to legal pot won’t disrupt the black market. Quite the opposite… it will make it thrive.

It All Comes Down to Price

"One customer told me, ‘I love you and I want to support you, but I can't buy all my cannabis here. It's too expensive,’ " said Jeremy Jacob, co-owner of a Vancouver pot store. That’s one of the many stories you hear from owners of the first Canadian pot stores. It reflects the main problem with the legal pot industry.

Legal pot is expensive!

In Canada, you can buy a gram of pot on the street for $5.59. In a legal store, you must shell out over $10.23 for the same amount of pot, according to Statistics Canada.

You see, the government of Canada levies huge taxes on legal pot… which inflates its price to practically double that of black market pot. This makes it impossible for a legal producer like Canopy Growth to compete with street dealers.

Canopy Growth Is Sitting on Mountains of Pot

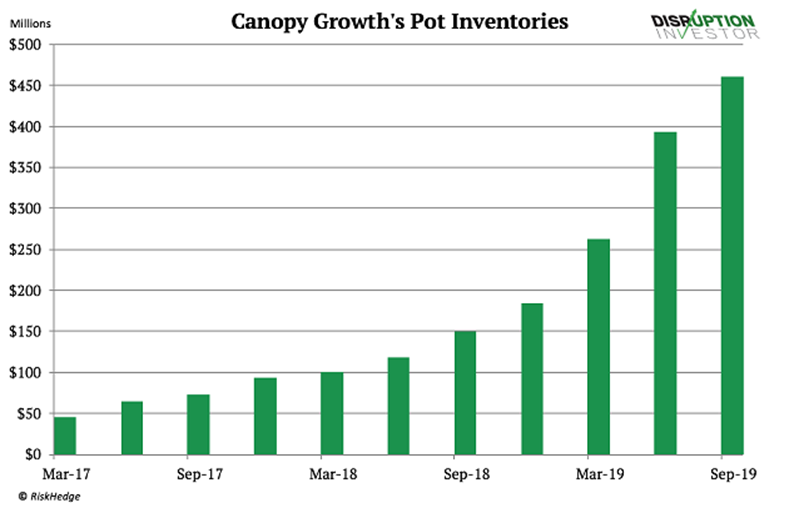

Let me show you the most important chart about Canopy Growth. It shows how it’s piling up bigger and bigger inventories of pot…

It took just a year for the company to fill up its warehouses to the brim with hundreds of thousands of kilos of pot. But because of the black market, only a fraction of it has been sold.

While Canopy Growth is falling over itself to produce more and more flower, most folks are still buying their pot from street dealers.

The Math Doesn’t Add Up

I ran the numbers. Canopy Growth has to sell over $3 billion worth of additional pot a year to get its head above water. That’s 300,000 to 600,000 kilos per year.

This is more than half of what the entire Canadian market consumes in an entire year, according to Statistics Canada. Since the black market makes up 71% of the Canadian pot market, most of Canopy Growth’s pot will stay in warehouses to rot.

Meanwhile, the company’s losses are mounting by the day. This can’t go on forever.

My recommendation: don’t buy the dip in Canopy Growth or other pot stocks. As tempting as a 60% discount sounds, Canopy Growth is a money-burning machine that has hit a dead end.

I see much more blood on the streets from here.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.