Retail Sector Isn’t Dead, and These 6% Dividend Paying Stocks Prove It

Companies / Retail Sector Dec 14, 2019 - 12:45 PM GMTBy: Robert_Ross

I’m sure you’re familiar with the “retail apocalypse.” Brick-and-mortar retailers are dying off as people buy more stuff online, or so the story goes.

This trend has taken out household names like Circuit City, Blockbuster Video, and Payless ShoeSource. Even luxury retailer Barneys filed for bankruptcy this year.

All told, about 9,000 brick-and-mortar stores closed in 2019. Meanwhile, e-commerce sales are growing around 5% per year. But there’s more to this story...

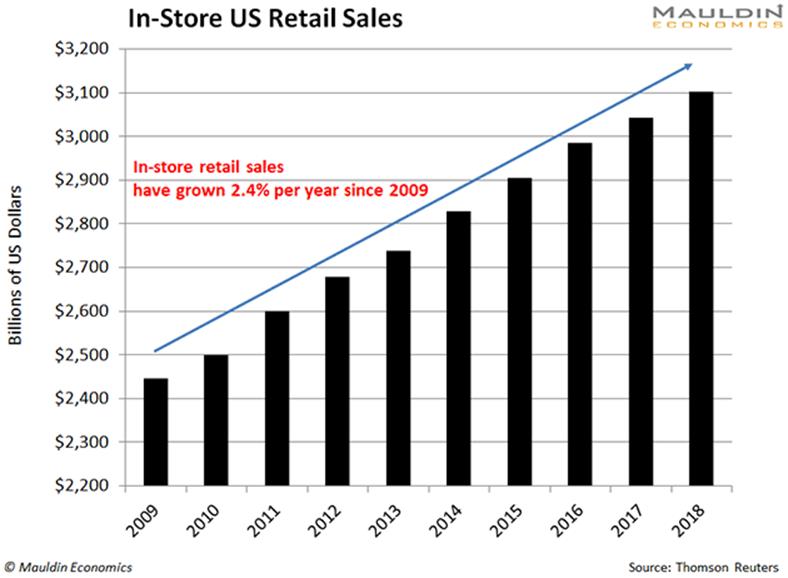

Despite the headline-grabbing bankruptcies, about 90% of US retail sales still happen in person.

In fact, brick-and-mortar retail sales have grown 2.4% per year since 2009. And they’re poised to keep growing around 2% annually through 2024.

Now, two percent represents steady growth. But select corners of brick-and-mortar retail are absolutely thriving…

We Still Buy Furniture the Old-Fashioned Way

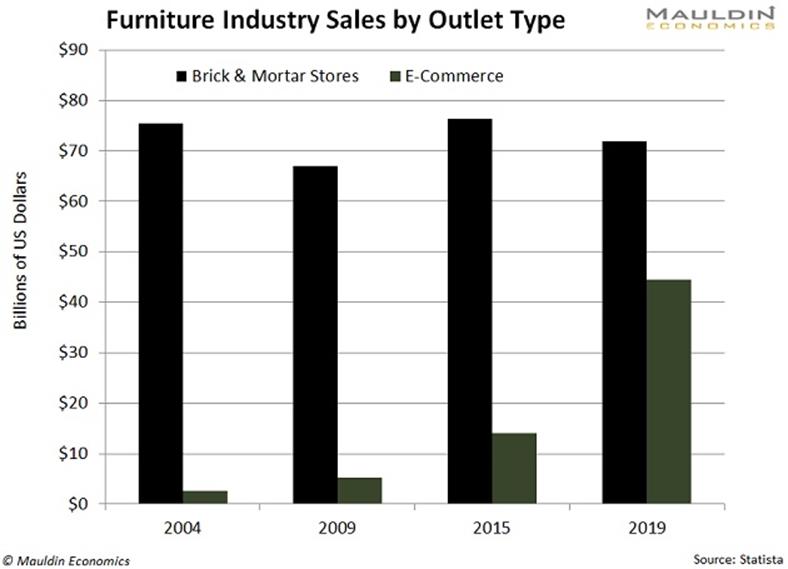

Scroll through a list of retail stores that have closed over the last decade, and you’ll notice one segment that’s largely missing: furniture.

The way we buy couches and cabinets hasn’t changed much. Nearly 85% of Americans still buy their furniture at brick-and-mortar stores.

This isn’t changing anytime soon. In-store furniture sales are expected to grow 5% per year through 2024.

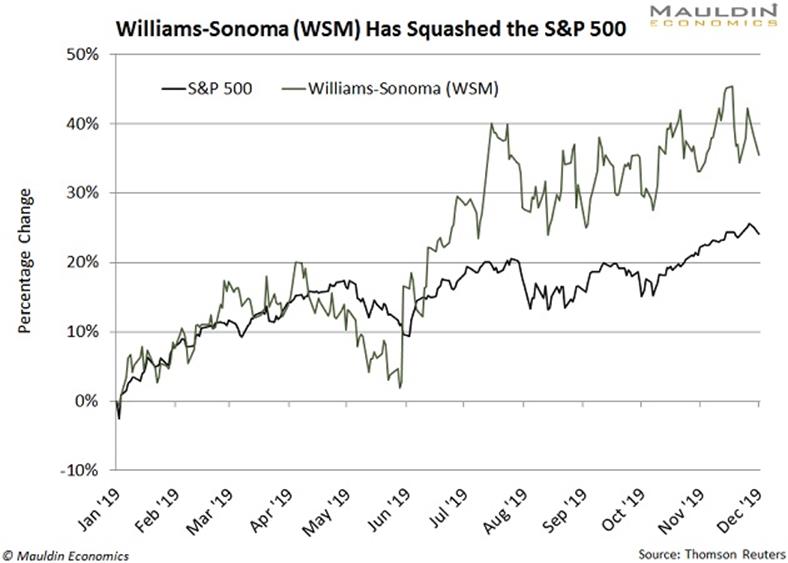

The stability of this retail niche shows up in stock prices.

For example, home furnishing giant Williams-Sonoma, Inc. (WSM), has soared 38% this year, squashing the S&P 500.

Williams-Sonoma owns the popular Pottery Barn and West Elm brands. The company makes it easy for customers to shop both in-store and online. This has helped it thrive in the new retail landscape.

Williams-Sonoma also boasts a solid 2.9% dividend yield.

Nike’s Enjoyed a Solid Year

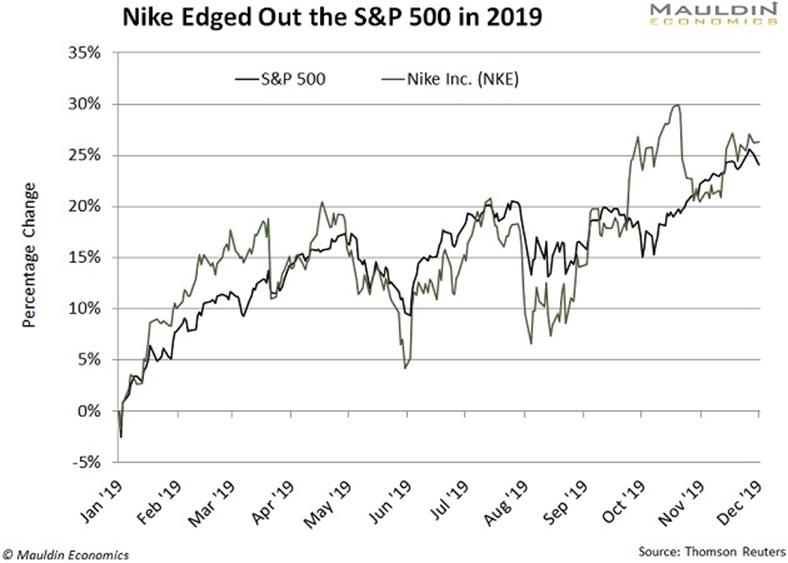

Many apparel companies are taking a similar hybrid approach.

Take Nike, Inc. (NKE), for instance. The athletic apparel giant has over 1,100 retail stores and a convenient online platform. Plus, the overwhelming majority of sporting goods companies sell Nike products in their brick-and-mortar stores.

This is part of the reason Nike’s stock has beaten the S&P 500 over the last year:

Nike also has a safe 1.1% dividend yield.

The Best Way to Invest in Retail

Buying shares of high-performing retailers like Williams-Sonoma and Nike would give you a piece of the action. But there’s an even better way for income investors to profit from the stable US retail market: retail real estate investment trusts (REITs).

They’re special business entities that own different kinds of properties—trailer parks, hospitals, factories, commercial real estate, and everything in between.

Retail REITs own the buildings where traditional retailers operate. This gives them exposure to a range of different stores, which diversifies your investment.

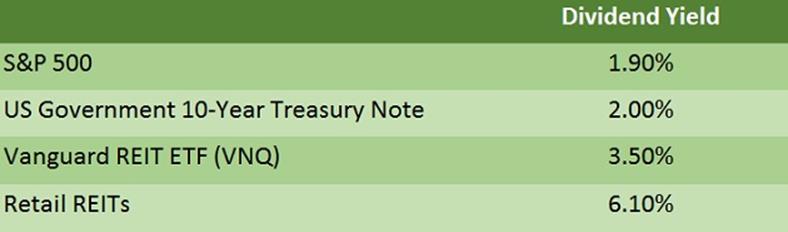

All REITs are required to pay out 90% of their income as dividends. So retail REITs often pay huge dividends—sometimes 3 or 4 times higher than their tenants.

Retail REIT dividends even outshine other types of REITs:

A lot of high dividends aren’t that safe. That’s why I developed a proprietary system called the Dividend Sustainability Index (DSI) to measure dividend safety. In a nutshell, the DSI looks at three key metrics: payout ratio, debt-to-equity ratio, and free cash flow.

These three retail REITs passed the DSI with flying colors.

Three Retail REITs with Big, Safe Dividends

Simon Property Group (SPG) sits at the top of my list.

When you look at Simon’s financials, there’s no sign of a retail apocalypse. Since 2009, the company’s operating income (the equivalent of profits for REITs) has grown an average of 9% annually.

At the same time, Simon has increased its dividend 14% per year over the last decade. Its dividend yield is now 5.7%. So it’s a great addition to any income investor’s portfolio.

Next up is grocery REIT Weingarten Realty Investors (WRI). The company leases stores to major grocers like Whole Foods, Publix, and BevMo!

Online grocery sales are expected to make up 5% of grocery sales by 2024. But people will keep buying most of their groceries in-store for the foreseeable future.

Overall, grocery sales are expected to grow 3.1% per year through 2023. This bodes well for Weingarten. Plus, the company sports a juicy 5.1% dividend yield.

Our final retail REIT is SITE Centers Corp. (SITC). The company owns and operates 33 shopping centers throughout the US.

SITC pays a reliable 5.7% dividend yield. It also has a low payout ratio of 48% and a very healthy debt-to-equity ratio of 47%. So it should continue to meet its sizable dividend payments for the foreseeable future.

All three of these REITs should continue to profit from the stable US retail market. And their robust dividends make them attractive to income investors like us.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.