The Prospects of Gold’s Next Upswing

Commodities / Gold & Silver 2019 Nov 26, 2019 - 03:23 PM GMTBy: Arkadiusz_Sieron

The USD Index rallied on Friday, and gold responded with an intraday decline – that’s normal. What’s not necessarily normal is the size of the daily change in gold compared to the size of USD’s rally.

USD Index Bounces Higher

Namely, gold futures ended Friday’s session exactly where they had closed on Thursday. There was no daily change in gold, even though it – theoretically – should have declined given USD’s upswing. What does it mean? Gold’s resilience means that gold has probably not finished its short-term upswing yet.

The general rule for any market is that if it doesn’t move in the way it “should” move given what’s going on in the world, it means that – for whatever reason – it’s not the direction in which the market is going to move next. This trading technique doesn’t specify what is the reason for a given market’s strength. The point is to detect and acknowledge this strength, and then to combine this information with other trading signals.

One of the biggest benefits of this approach is its widespread application. Knowing what is likely to move a given market and what kind of reaction would be normal, means that it can be applied – regardless of what the market is. It also applies to various terms, if one takes into consideration the likely time in which the effect of a given development “should” be in place. For instance, in case of long-term investment, one should pay attention to how the market reacts to the factors that matter in this time horizon, for instance demographics and shifts in supply & demand picture. In case of day trading, it’s a matter of checking if a given individual piece of news (or price action from a key influencing market) causes a price move that seems natural. The bigger the divergence from what would be viewed as normal, the stronger the bullish or bearish signal becomes.

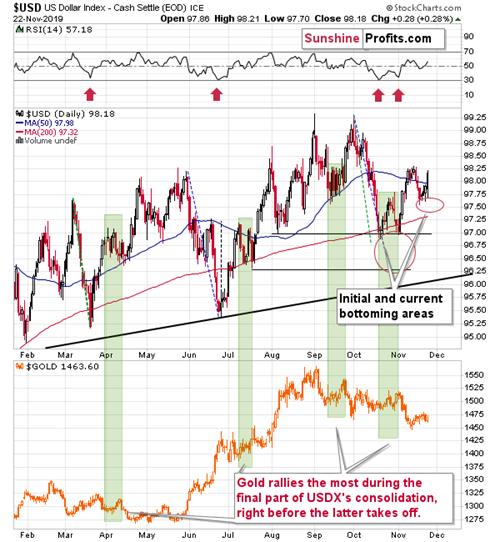

Moving back to the USD-gold picture, we previously wrote that the USD Index is quite likely to consolidate before rallying strongly and it seems that this consolidation is still taking place. The USDX didn’t break to new November highs and Friday’s rally is in tune with how the U.S. currency performed in case of previous consolidations that we marked in green.

Back and forth movement was common, and sometimes it took form of a day-to-day swings, and sometimes (such as in July and October), it meant two bottoms. There are no indications that would make Friday’s upswing look any different than what we saw in October and July and thus it seems that we could easily see yet another downswing (perhaps to the recent lows) before the rally really picks up.

And what would gold be likely to do in such an environment? It would likely rally more visibly than it rallied recently – similarly to how it performed in the final parts of previous USDX consolidations. Despite today’s few-dollar pre-market downswing, it seems that the top is not yet in and that gold will move higher shortly.

But what about the short-term, what else can we say about our long position opened right after the November 12 reversal? Apart from outlining the take-profit targets, the full version of this analysis dives into the lessons from the short-term precious metals’ moves. It’s an invaluable tool in planning when and where to profitably switch market sides – similar to what we have successfully done with the preceding short position. Please note that you can still subscribe to these Alerts at very promotional terms – it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

The above article is a small sample of what our subscribers enjoy on a daily basis. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.