Stock Market Dynamics Changing for Year End Rally

Stock-Markets / Stock Markets 2019 Oct 27, 2019 - 06:58 PM GMTBy: QUANTO

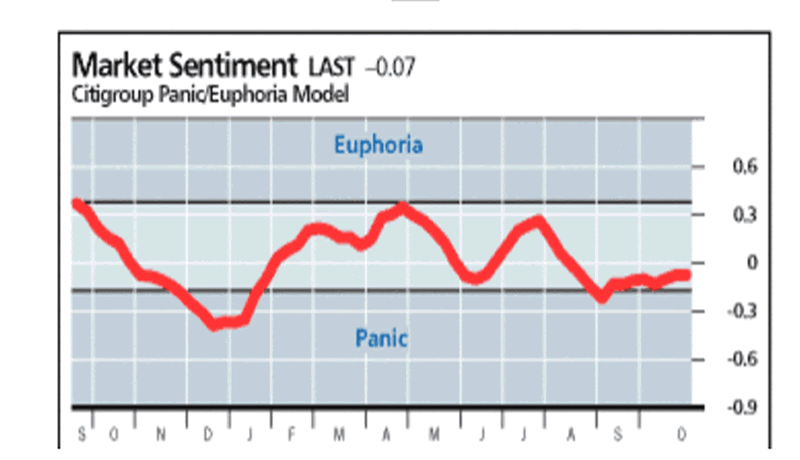

Last week saw the US equity markets testing the all time highs and moving back a little. The action has been healthy. Markets are almost sanguinely comfortable that everything everywhere is doing great. The risks to the downside in economy seems not as important to investors.

Last week saw the US equity markets testing the all time highs and moving back a little. The action has been healthy. Markets are almost sanguinely comfortable that everything everywhere is doing great. The risks to the downside in economy seems not as important to investors.

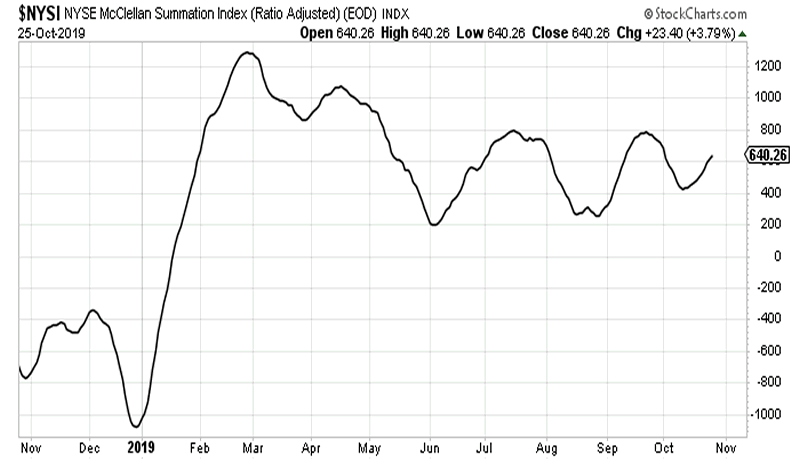

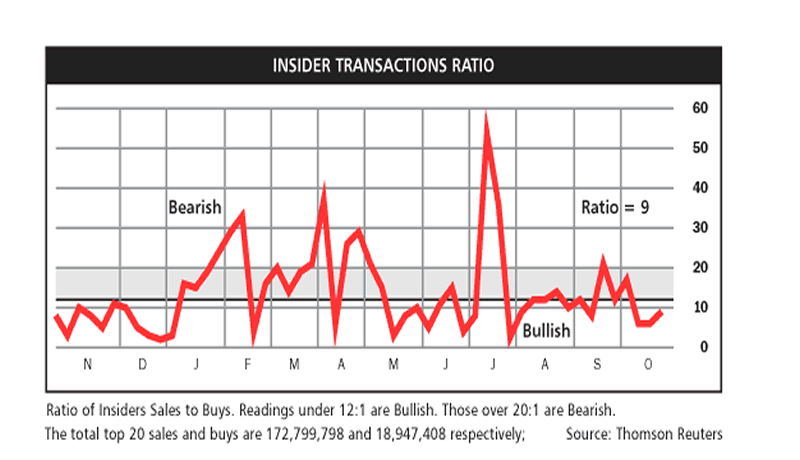

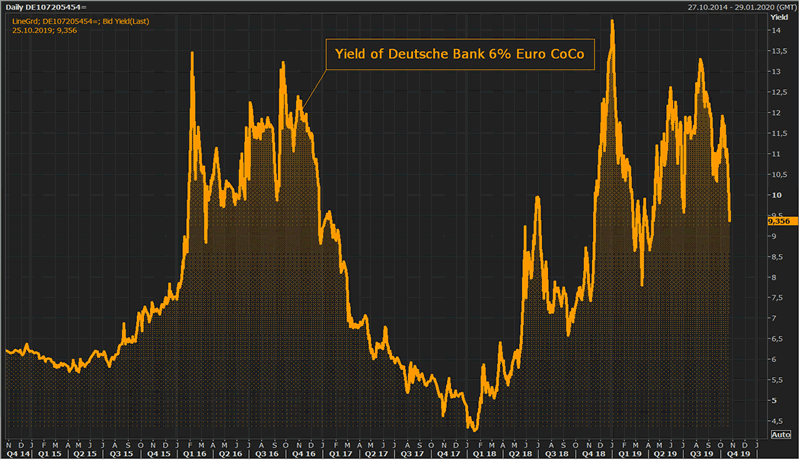

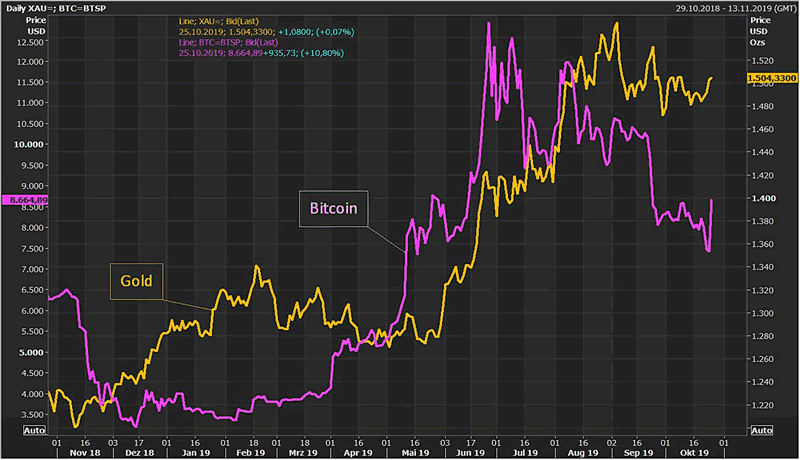

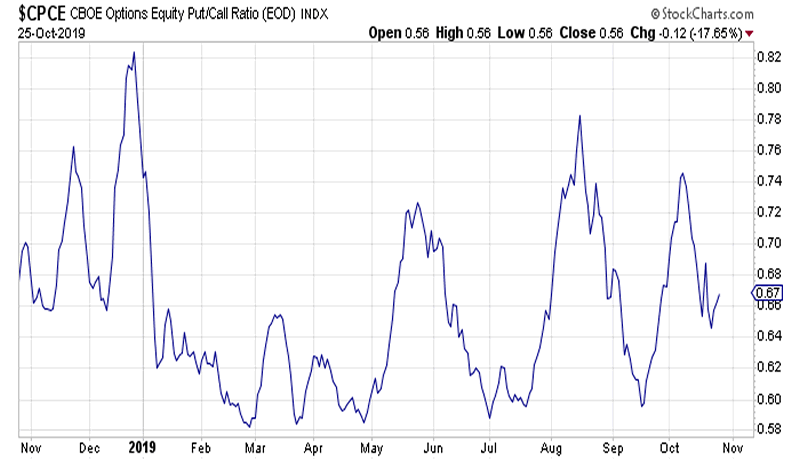

We look at a plethora of charts and setups to drive the point which we have been making that market crash is not coming and we have saying that for over 6 months now. There might be a blip here and there but things are healthy.

We have below a plethora of charts for you with little commentary. We let the charts do the talking here....

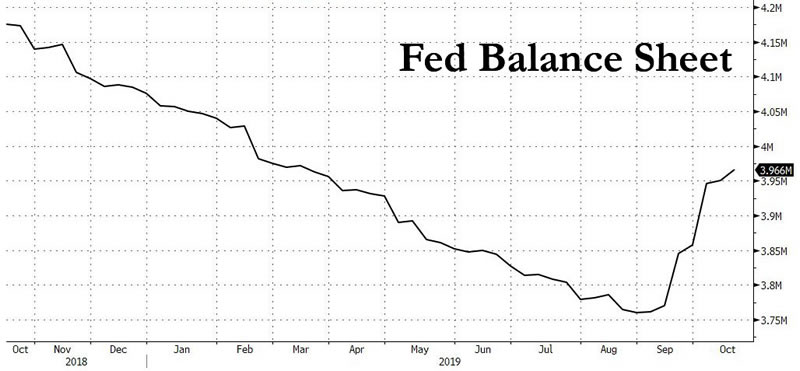

The FED balance sheet has started to rise again. It is a failed attempt at exiting the QE as FED starts to buy more bonds to ease up liquidity. This has announced with the same vigor as previous QE and almost seems a stealth way to get back to the old ways. Stocks have responded in kind.

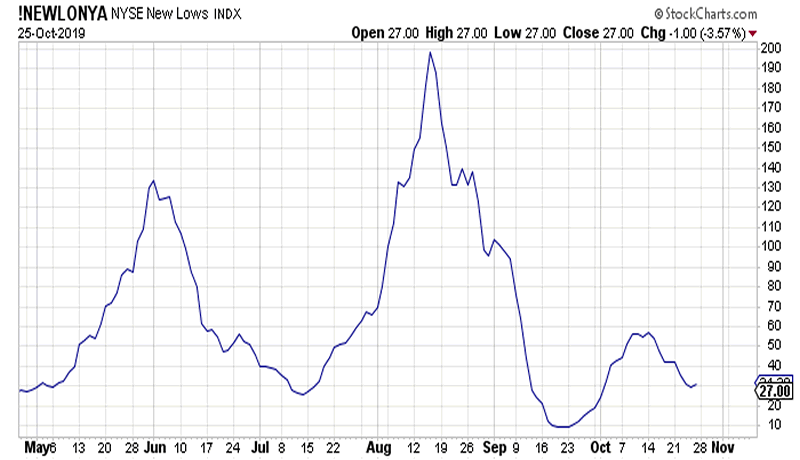

Stocks making new lows is on a 10 day average at the low end..

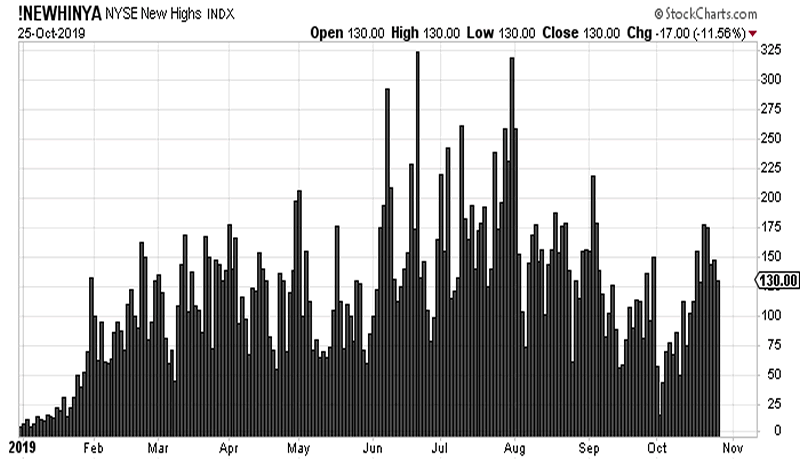

Stocks making new highs is again rising to those healthy levels of 130...

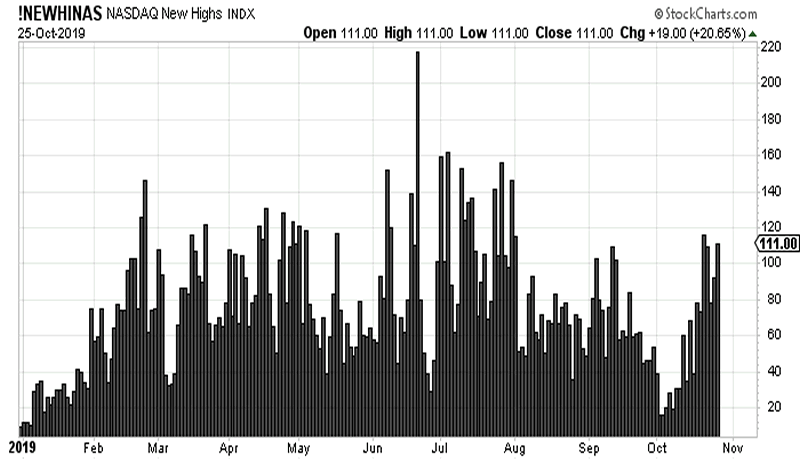

NASDAQ STOCKS making new highs rising sharply..Tech stocks finding the footing after a period of extended selloffs.

![]()

The semiconductor sector is leading the way strongly as it hits the upper trendline.

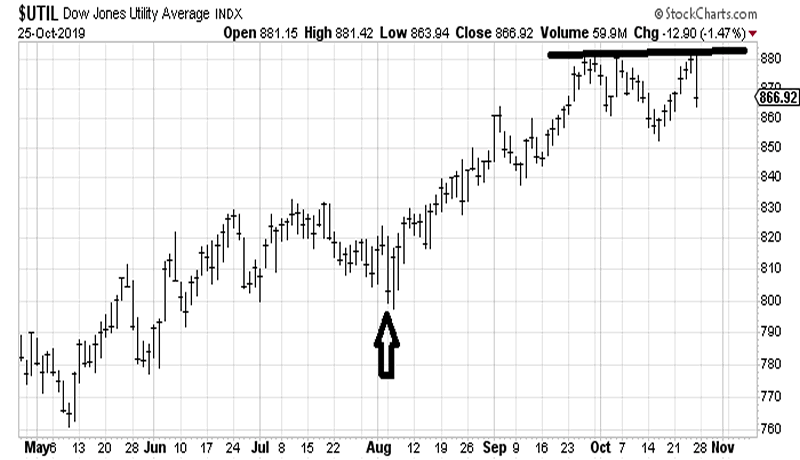

The Utility sector has sold off sharply as Investors are not looking for safety as of now. This will indicate distribution out of safety into riskier ventures and ties in with the breakout seen in Semiconductor sector above.

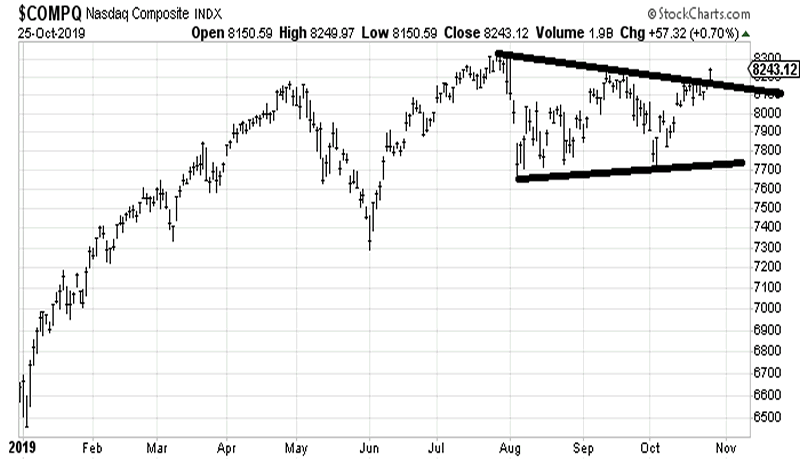

The NASDAQ sector shows the slow ticking above the consolidation of the last 4 months. Such breakouts are often sharp.

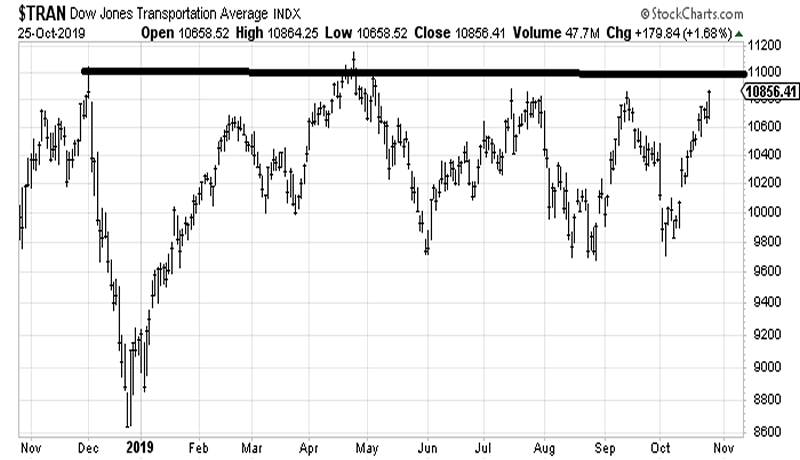

A sector that has troubled many macro technicians has been the Transportation sector...its apparent reluctance to match the general stock index breakouts is often frowned upon ..but here we see the sector now moving in tandem with general SPX and NASDAQ movement.. A move above 11000 will be confirm the bull market.

The SOX is now nearly at the horizontal breakout level . A break here looks plausible but also a smallish correction. Which ever we see this, the underlying stock dynamics is healthy as seen in the new highs and lows.

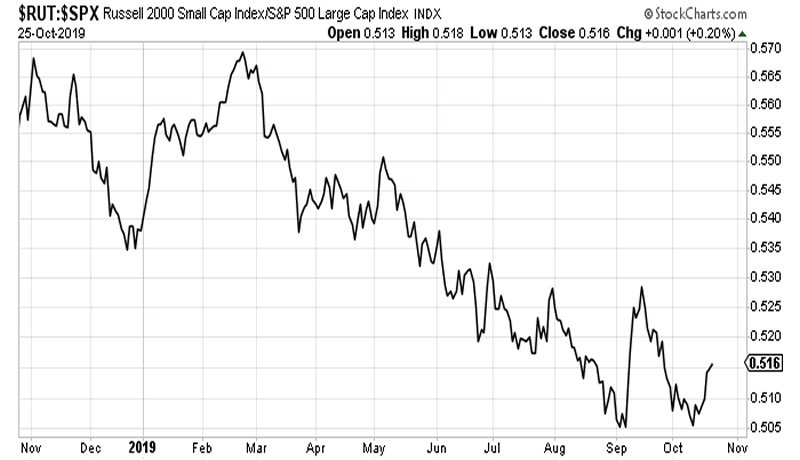

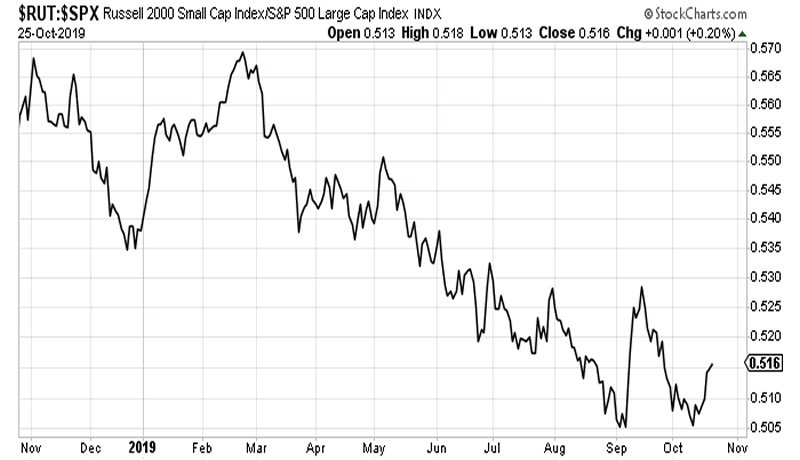

The small caps to the large cap index is the lows of the year. Thus we could see the small caps beating the large cap in this phase of the market really.

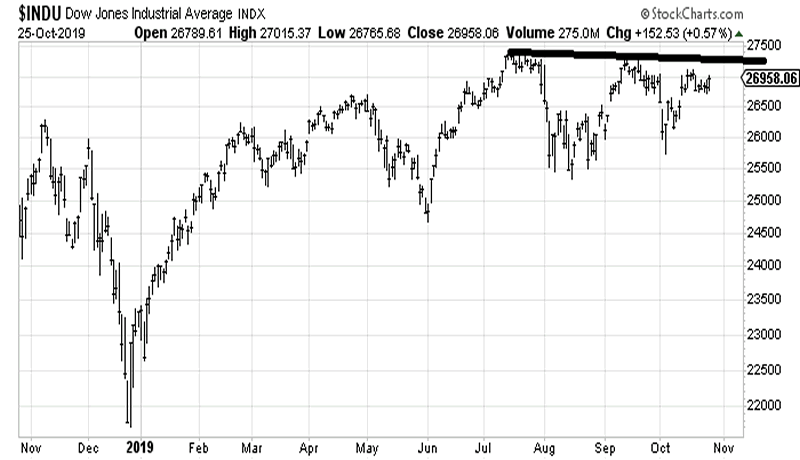

The DOW is often a laggard as it has more of the transport weight. The prices catching upto all time highs .

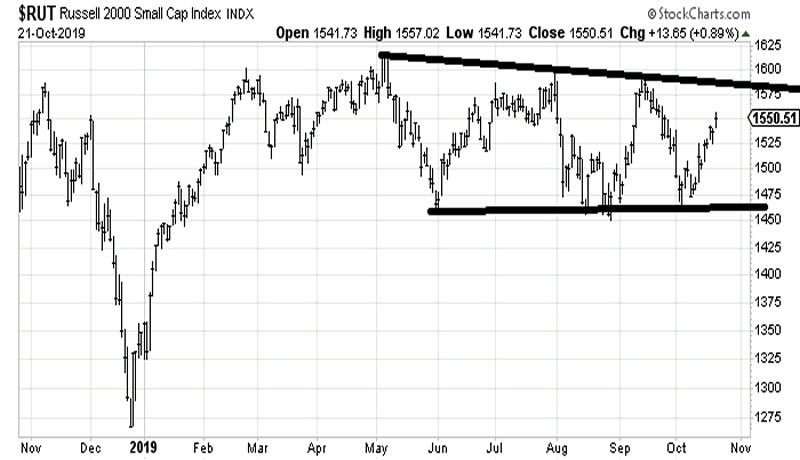

Small capp Russel index inside the consolidation but the breakout in SPX will give some comfort we can see a breakout.

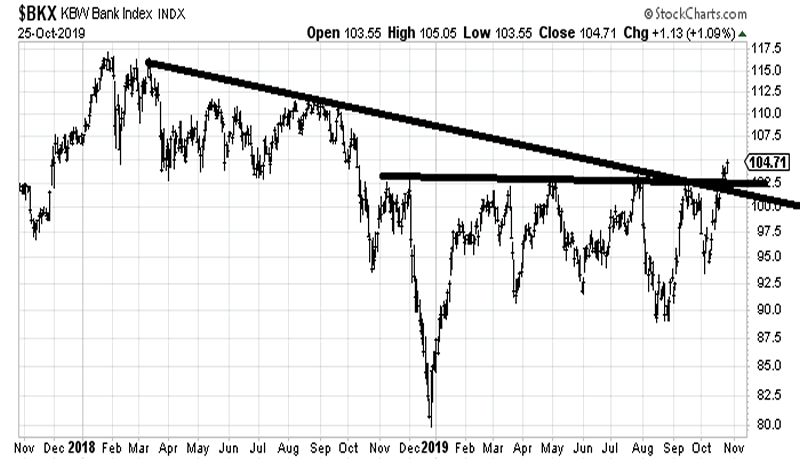

Another sector to watch will be the bank index. Breaking out of the key resistance zone.

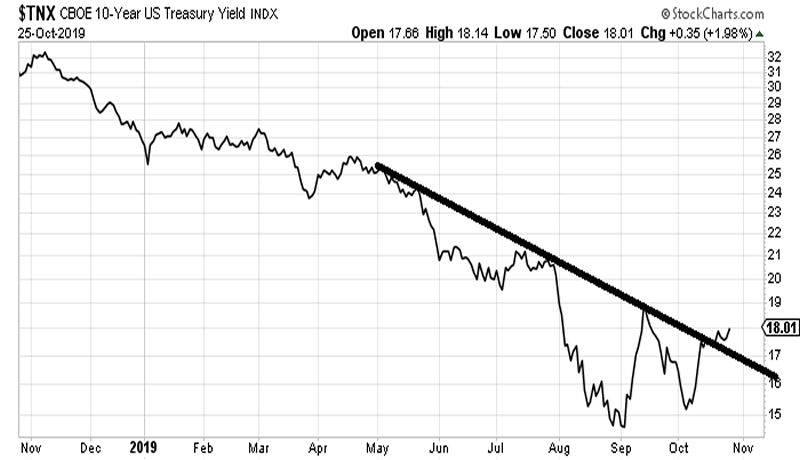

The 10 year yield has broken above 1.8%. As investors feel less need for safety, we see yield could move higher. However there is some more confirmation needed here on yields as its not the break of trendline that matters but rather what happens next.

Australian Economy

We believe there is a strong reason to believe in a year end mammoth rally in the Australian dollar esp as FED eases by and relaunches the QE as noted in the chart-1. The RBA has been reluctant to launch any QE as property prices are again starting rise sharply.

Three interest rate cuts that have taken mortgage rates to a record low and a loosening of lending curbs have sent buyers flocking back to the housing market. At current boom-time rates of growth, Sydney home prices could recoup two years of losses and be back at record highs as soon as May. The sudden turnaround is raising fears of a re-inflated property bubble and risks swelling an already worrisome pile of household debt. It’s also further concentrating banks’ reliance on mortgages for earnings growth and entrenching inequality by making it harder for first-time buyers to get a foot on the property ladder.

Source: https://quanto.live/dailysetups/market-dynamics-changing-for-year-end-rally/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.