2020 Will Bring 40+ IPOs That Could Double Your Money

Companies / IPOs Oct 24, 2019 - 04:40 PM GMTBy: Stephen_McBride

Justin Spittler writes:

Many people think the initial public offering (IPO) market is dead.

Justin Spittler writes:

Many people think the initial public offering (IPO) market is dead.

If you’ve been reading my essays, you know I specialize in IPOs. And I don’t want to spoil the punchline, but... I love that this rumor has taken hold.

I love that the average guy thinks IPOs are dead. Because it means hunting for big IPO profits is “contrarian.”

And the biggest profits usually flow into the pockets of investors who can think independently of the crowd.

I can tell you with 100% certainty that not only is the IPO market alive and well... 2020 is shaping up to be the “Year of the IPO.”

Let me show you...

2019 Has Been a Good Year for IPOs

118 private companies have gone public, and that number grows by the day.

Why would anyone think the IPO market is toast? Well, as you likely know, a handful of big, hyped-up IPOs have flopped.

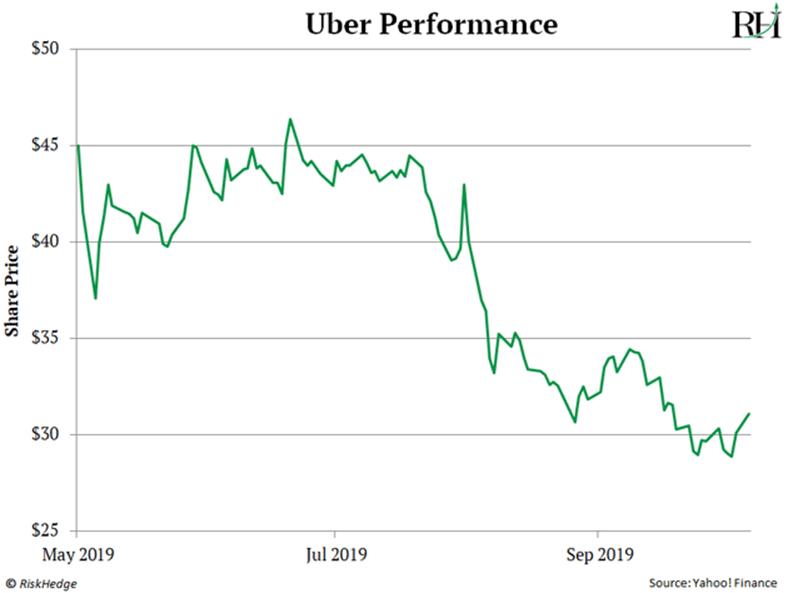

I’m sure you heard about Uber (UBER). The ride-sharing company went public in May at a staggering $82 billion valuation. It was ridiculously overvalued.

Not surprisingly, its stock fell straight off a cliff:

Uber has plunged 36% since it went public just five months ago.

Lyft (LYFT) has fared even worse. It’s plummeted 48% since its highly publicized IPO in April. Peloton (PTON) and SmileDirectClub (SDC) also suffered poor IPOs, which I warned was likely.

And don’t get me started on WeWork, which failed to even get its IPO out the door.

Mainstream Financial TV Loves Going on and on about Failed Big IPOs

I get it. It’s like an accident on the side of the highway. Everyone slows down to see the carnage.

But just like a car crash, failed IPOs are nothing more than a distraction. A distraction from great money-making opportunities.

You probably know about Beyond Meat (BYND) by now, which got its15 minutes of fame earlier this year when it soared 859% in less than three months.

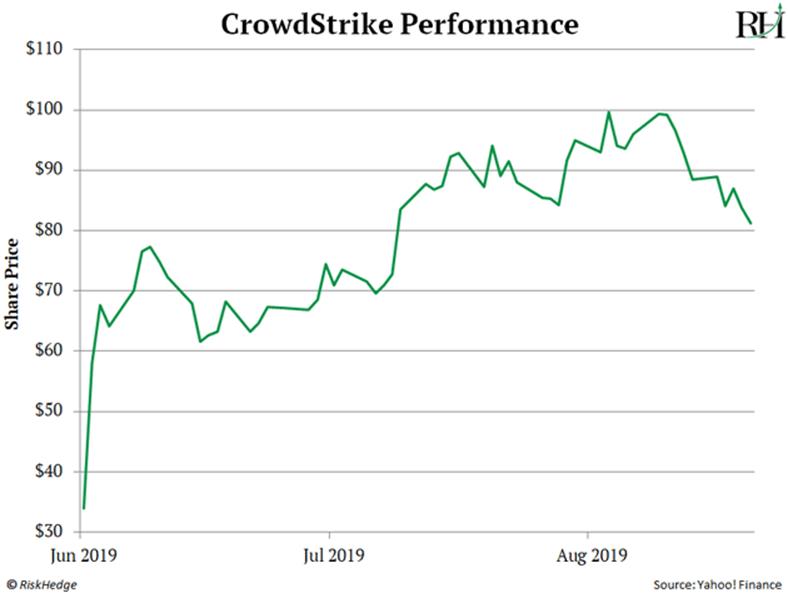

But when’s the last time you heard CNBC talk about CrowdStrike (CRWD)?

CrowdStrike is a cybersecurity technology company that went public in June. Cybersecurity isn’t a sexy business, so, its IPO didn’t get much press.

But it should have. CrowdStrike’s share price has tripled two months after going public.

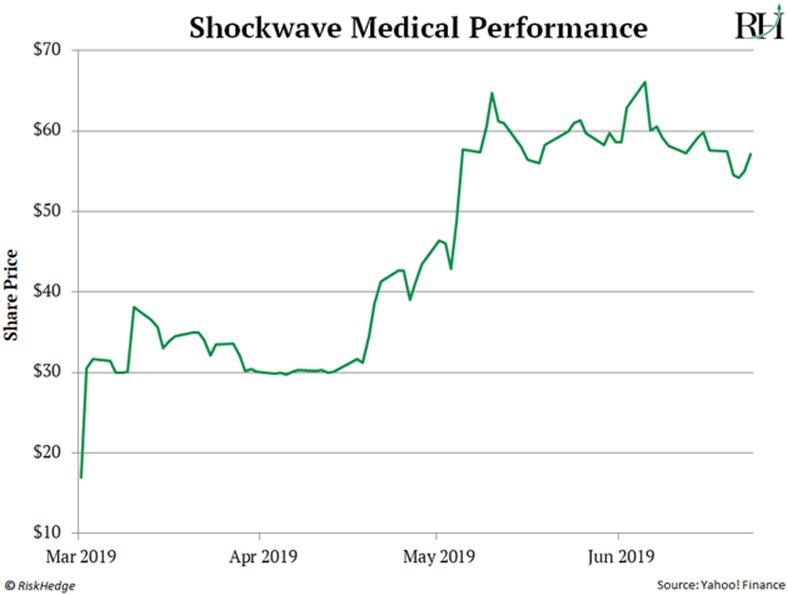

Shockwave Medical’s (SWAV) explosive IPO has also been overlooked. Shockwave is a medical services device company that went public in March. Its share priced zoomed more than 300% during its first three months.

Keep in Mind, the S&P 500 Is up 8% over the Past Year

Even if you’d bought just one of these big winners, you’d be blowing the average investor out of the water.

Of course, anyone can “cherry pick” a few big gains to prove a point. So let me give you the full picture...

Since October 2017, 21 IPOs are still up at least 100%. I emphasize still because markets have been a little shaky lately. But not nearly shaky enough to erase all those triple-digit IPO gains.

The best of this bunch delivered returns of 1,393%, 535%, 433%, and 315%.

And you didn’t have to do anything special to grab these gains. You didn’t have to be a venture capitalist, a Wall Street insider, or a “high-roller” client of Goldman Sachs.

If you had a brokerage account, these profits were available to you. All you had to do was buy these stocks shortly after their IPO day.

Still, Some Folks Think Uber or WeWork “Killed” the IPO Market

These folks are wrong.

Eight companies have gone public since WeWork shelved its failed IPO a few weeks ago. Three more are set to go public later this week.

And that’s just a taste of what’s to come. According to Renaissance Capital, 31 companies have filed or updated paperwork to go public in the last 90 days.

And let’s not forget…

Airbnb just announced its plan to go public in 2020. Airbnb is one of the world’s most disruptive companies. It was most recently valued at $35 billion—making it the fourth-biggest US “unicorn!”

402 “Unicorns” Are Coming to the Big Leagues

As you may know, a unicorn is a private company worth at least $1 billion. They’re called unicorns because they used to be rare. But that’s no longer the case.

According to CB Insights, there are now 402 unicorns. Together they’re worth more than $1.3 trillion.

Many of these companies are eying the public markets and planning their IPOs.

And what most people don’t realize is most of today’s unicorns aren’t startups. Instead, they’re mature businesses.

If you read my September 29 essay, you know why that’s important.

The average age of a company going public these days is 12 years. In 1999, the median age of a company at IPO was just four years.

The median IPO generates sales of $174 million today. That’s 15 times more revenue than the typical company at IPO in 1999 was doing.

In other words, unlike 1999, many of today’s IPOs are ready for the “big leagues.”

2020 Is Shaping Up to Be the “Year of the IPO”

Big Four accounting firm Ernst and Young (E&Y) sees a stampede of IPOs on the horizon.

It wrote in a recent report that it expects “a flood of IPOs to come to the market.” E&Y also expects “global IPO activity to pick up” as we enter the “traditional peak IPO season.”

I hope I’ve made it clear a lot of money will be up for grabs in IPOs in the next couple of years.

As I mentioned, 21 IPOs have handed investors a quick double or better in the last two years.

In the next two years, as the IPO market really gets rolling, I wouldn’t be surprised if we get 40–50 new opportunities to double our money or better.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.