British Pound Brexit Chaos GBP Trend Forecast

Currencies / British Pound Oct 18, 2019 - 03:03 PM GMTBy: Nadeem_Walayat

The Pound fell sharply following the announcement that Parliament would be suspended so as to enable a hard Brexit. However subsequent chaos of the Governments loss of control of Parliament with Remainer's taking control of business of the house has seen a sharp bounce in sterling which is contrary to what one would expect given extreme chaos and uncertainty.

The Pound fell sharply following the announcement that Parliament would be suspended so as to enable a hard Brexit. However subsequent chaos of the Governments loss of control of Parliament with Remainer's taking control of business of the house has seen a sharp bounce in sterling which is contrary to what one would expect given extreme chaos and uncertainty.

Taking a look at the British Pound since Theresa May took office July 2016 against key Brexit events paints a different picture of what is driving the British Pound where the Brexit factor is concerned.

The message from the chart is that Sterling favours Britain REMAINING in the European Union and the further Britain is from that Objective then the weaker Sterling tends to be. So certainty or uncertainty of outcome does not matter as much as the direction of travel. For instance sterling entered into a mini bull market following Theresa May's disastrous June 2017 general election, as the result had crippled her chances of achieving a Brexit in anything other than name only. Likewise the Chaos of a paralysed May government since the publication of the EU Brexit deal in November 2018 with it's Northern Ireland backstab resulted in sterling rally from 1.26 to 1.32. Against which Brexiteer Boris Johnson taking control saw sterling fall from 1.27 to a low of 1.195 before Remainer's took control of Parliament.

Therefore for sterling strength there needs to be NO Brexit or a very weak Brexit. Whilst sterling weakness would accompany a Hard No Deal Brexit which is what the market had been pricing in since Johnson took office. However on the flip side the market has already priced in a NO deal brexit to some degree which is on par with the original drop of October 2017 on No deal fears.

In terms of the range of possibilities for sterling for the remainder of this year then GBP could range as high as 1.34 or as low as 1.10. And no one knows which is more likely given the state of extreme chaos in Westminster.

However, I am not going to just leave things at that, instead will seek to conclude in the most probable direction of travel for sterling over the coming months.

This analysis is part 2 of 2 on the British Government and Parliaments ongoing extreme Brexit Chaos that concludes in a detailed trend forecast for the British Pound GBP.

- Westminister BrExit Chaos Puts Britain into a Pre-Civil War State

- Boris Johnson a Crippled Prime Minister

- Boris Johnson's "Do or Die, Dead in a Ditch" Brexit Strategy

- General Election 2019 - Opinion Polls

- UK General Election Forecast 2019 - Betting Market Odds

- British Pound vs Brexit Chaos

- British Pound Fundamental Analysis

- USD Index Analysis

- GBP Long-term Analysis

- GBP Trend Analysis

- British Pound GBP Forecast Conclusion

However, the whole of this analysis has first been made available to Patrons who support my work: https://www.patreon.com/posts/british-pound-vs-29840414

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

British Pound Fundamental Analysis

Political Implications

An expected Tory general election win favours GBP strengthening as it delivers political certainty even if under BJ implies a hard Brexit outcome is more probable.

Fundamentals - GDP

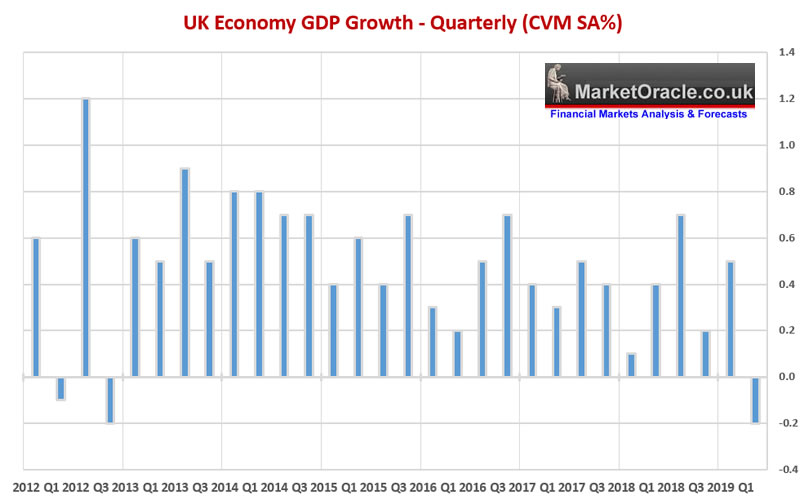

Extreme Brexit uncertainty is translating into business and economic uncertainty so it should not come as much surprise that the UK economy has slowed down against the recent trend of about +2% per annum. This year has seen growth slow to 0.5% for Q1, -0.2% for Q2, to currently stand on a weak +0.3% for the year that has had the remainer mainstream press collectively pronouncing that the UK economy is on the brink of a Brexit recession.

Yes 0.3% is bad, and we may even get a technical recession i.e. two quarters of marginal negative growth. But I suspect that the UK economy will rebound strongly during the remainder of this year, especially if BJ enacts his recent end of austerity spending pledges of pumping upwards of £20 billion into the UK economy, where even the expectations of are enough to galvanise economic activity in anticipation of stimulus spending. So I don't expect a recession this year. Instead Q3 and Q4 should show increasing positive growth whilst 2021 depends on what happens to the global economy.

So just as the Q2 0.2% dip was accompanied with sterling weakness, so should a stronger economy over the next few months (Q3,Q4 data) be accompanied with sterling strength which implies GBP trading north of 1.30.

US Dollar Index Trend Analysis

A good technical starting point would be a quick look at the prospects for the US Dollar.

A quick take implies:

a. The dollar is in a bull market, though in a shallow peak to peak uptrend.

b. Is at resistance of between 99 to 100.

c. Trading higher in a 4 cent trading range,.

Therefore implies to expect the US dollar to correct over the next month or so which is supports GBP strength over the next couple of months of about 4-5 cents so to around 1.27. Beyond which dollar trend strength could bring GBP down off its high by about 5 cents so to the low 1.20's.

GBP Long-term Trend

What stands out from the long-term chart is that GBP has been in a downtrend for many years, a good 20 years in fact for I recall sterling trading at over £/$ 2.0 a few years earlier than this graph. So whilst the clueless mainstream press have been crowing since 23rd of June of how the Pound has collapsed following Brexit. What they fail to understand is that Pound would have fallen regardless of the results of the 23rd June 2016 referendum because it's in a bear market.

All that the rally in run up to the referendum was is a counter rally in a bear market. How low would the British Pound have fallen if the UK had voted to REMAIN? Well to at least to 1.30. So maybe not as low as recent sub 1.20 levels 20 but 1.30 was still doable in GBP's long-term bear market.

The second thing that stands out is that after sterling breaks to new lows it then tends to settle into a multi-year trading range as was the case from 2009 to 2015, a 25 cent trading range of between 1.675 and 1.42.5.

The current range is for an approx 30 cent trading range from 1.15 to 1.44. This suggests that the downside is limited to around 1.15 with probability current price action resolving in a bull run higher towards the upper end of the trading range resistance area of 1.37.5 to 1.44 with key resistance on the way at 1.33.

GBP Trend Analysis

GBP is in a downtrend off of the 1.33.5 high. Most recent price action saw a bounce off of support at 1.20. Which given the spike nature of the 2016 1.15 low then could hold. However Westminister chaos induced volatility is high which means on a short-term basis sterling could revert to trending lower, as GBP was / is over sold so was due a technical bounce. So the most recent move higher could just be that and nothing to do with Westminister Brexit chaos.

Support is at 1.20, Resistance is at 1.28, then 1.30 and 1.33. Further is 1.37 and 143.

Formulating a forecast conclusion.

Contrary to the doom and gloom in the press of seeing £/$1.10 or lower. Instead this analysis is painting an overall bullish picture for sterling over the next few months i.e. into late November. Whilst GBP trend during December is harder to determine due USD dynamics.

So GBP should have already or be very near to making a bottom at around 1.20 for a bull run higher. How high? First stop would be 1.28, then 1.30, 132, 133.5 which would likely prove a significant hurdle to overcome, though a break above would likely propel sterling to over 1.40.

GBP Forecast Conclusion

Therefore my forecast conclusion is for sterling to target a trend to at least £/$ 1.32 by late November 2019.

On face value this does not bode well for Boris Johnson's "do or die", "dead in a ditch" Brexit. as sterling has a tendency to favour REMAINING in the EU. However, sterling rallying could also be implying that the markets will discount a Tory majority government at the next general election and given trend expectations into late November then that is the most likely time for when the next general election will be held.

The whole of this analysis was first been made available to Patrons who support my work: https://www.patreon.com/posts/british-pound-vs-29840414

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Gold and Silver Trend Forecasts

- US Dollar Index

- Stock Market Trend Forecast Update

- NASDAQ

- EuroDollar Futures

- EUR/RUB

Recent Analysis includes:

- Dow Stock Market Trend Forecast Oct to Dec 2019

- Bitcoin Price Analysis and Trend Forecast

- British Pound Trend Forecast vs "Dead in a Ditch" BrExit Civil War General Election Chaos

- Stock Market Trend Forecasts When Mega-Trends Collide

- How to Invest in AI Stocks with Buying Levels

- China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- Silver Investing Trend Analysis and Price Forecasts 2019 Update

Your Analyst

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.