Stock Market Roll Over Risk to New highs in S&P 500

Stock-Markets / Stock Markets 2019 Oct 16, 2019 - 08:19 AM GMTBy: QUANTO

As global risks continue to rise and collect, equity markets rise as wave of bond market flows lift the risk markets globally. As the old saying goes, buy equities when there is blood on the streets. With Turkey fighting in Syria, risks are tilted to the downside for equity markets.

As global risks continue to rise and collect, equity markets rise as wave of bond market flows lift the risk markets globally. As the old saying goes, buy equities when there is blood on the streets. With Turkey fighting in Syria, risks are tilted to the downside for equity markets.

we remain in a fragile period where the possibility of a phased trade deal may not be enough to bring buyers into the markets. With earnings season due to start next week, anxious investors will soon have even more to worry about.

We analyse some charts and key fundamental data points.

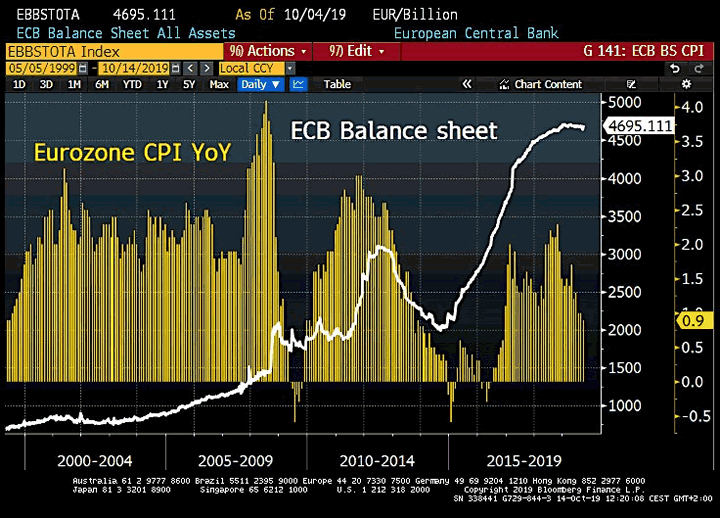

ECB Balance Sheet

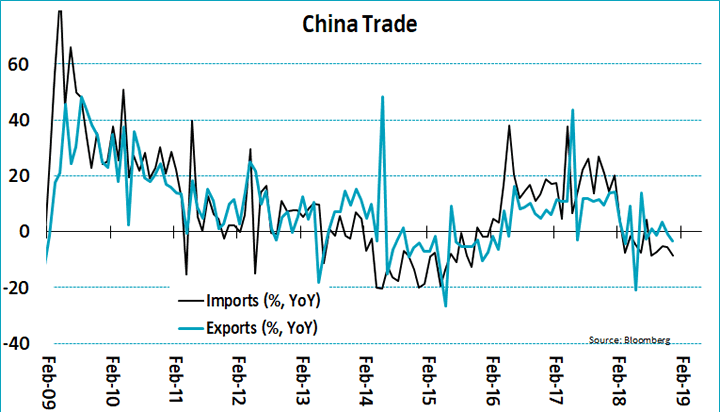

China Trade data

China has been powerhouse of the world economy. Both exports and imports have fallen. This is bad news for the rest of the world esp the US which is tied strongly to the Chinese exports to keep its economy buzzing at low cost. US companies operating costs will rise over 20% if China exports start to sowdown as seen above.

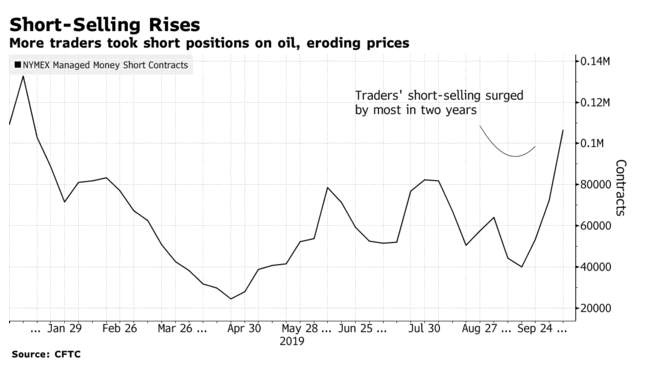

Oil Short Seller

Speculators are climbing into Oil shorts. The slowing world economy, US Oil has been pumping at record pace and Chinese growth worries are all potential triggers for a 20% correction in Oil prices. Geo political risks have been keeping prices high.

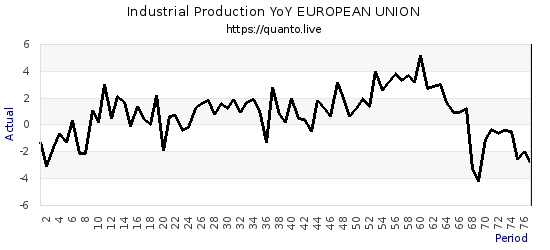

Slowdown in Industrial Production

Industrial production in EU has seen a dramatic fall in the last 4 quarters. Mainly driven by the export fall in Germany automobile sector.

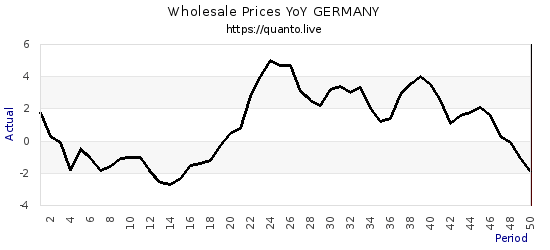

Wholesale Prices in Germany

The mainstay of EU economy, German economy, is under severe pressure. Prices are falling of the cliff. The demand destruction is evident in the above chart.

Oil Markets

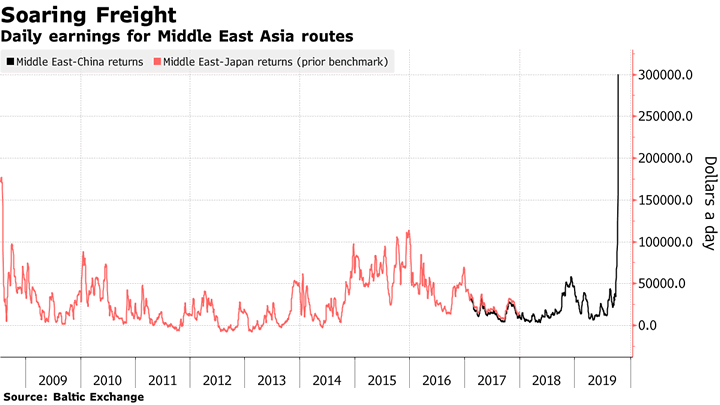

Iranian tanker was attacked last week and thus the tension is still very high. Look at the normally docile shipping rate charts below...

Oil supertanker rates are skyrocketing after the latest Middle East attack

Trading charts

Dollar Index

Dollar index is at key support 98.5. The index is now very much in the strongest part of its uptrend and we will see a significant surge higher into 103. The downside is limited. The hard brexit risk is very much an active threat. China - US tensions has not been solved. Turkish offensive have led to further increase demand for safe haven flows. Given the risks, dollar index will be well bid.

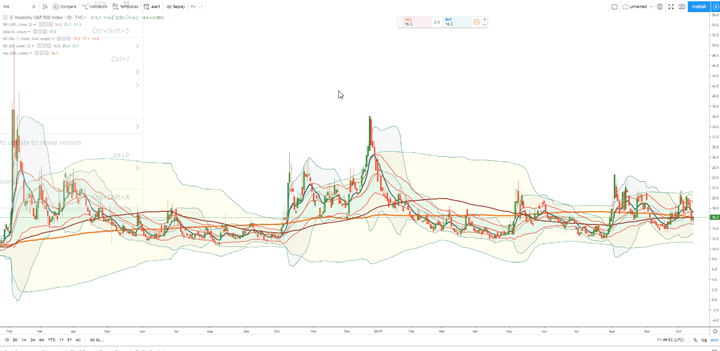

VIX: Fear index

VIX has again fallen to 16 from 19x. However the traditional 12 -13 range may not return. We see 16-24 as likely range in next 6 months. If VIX goes above 20, we will, see major risk to equity markets.

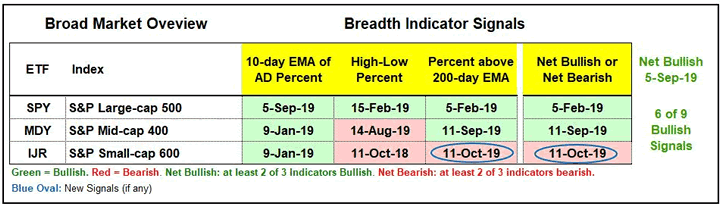

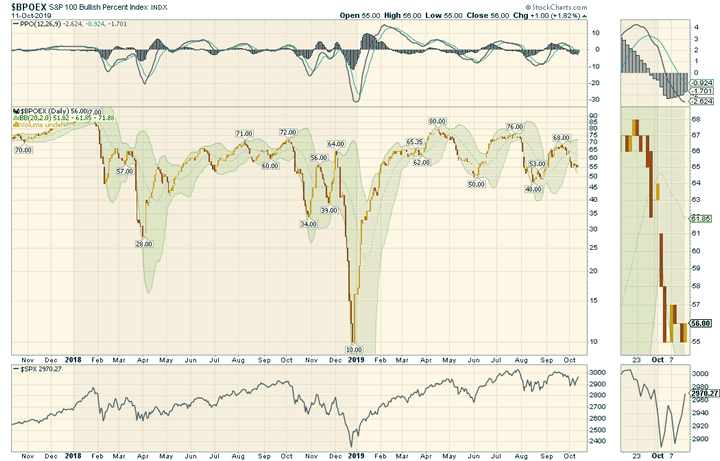

Market Breadth

A bearish signal triggered in small-caps as the S&P 600 %Above 200-day EMA ($GT200SML) moved below 40% and reversed the bullish signal from early September. All told, six of the nine breadth indicators are on active bullish signals and three are on active bearish signals. Large-caps continue to lead the charge with all three signals bullish.

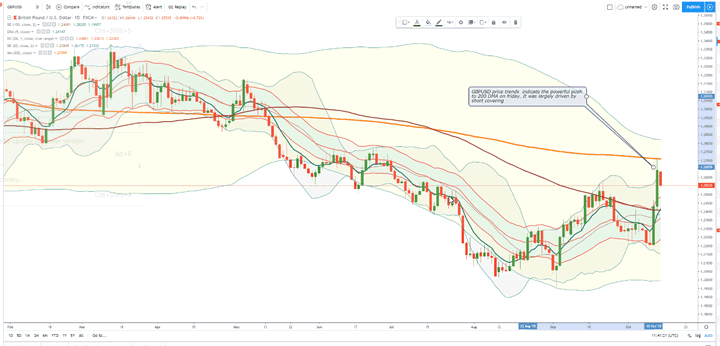

GBPUSD pushed higher to 1.2690. The level is near the 200 DMA. The move capped a two day rise of over +400 pips. The move was largely on account of short covering and we do not see the move being sustainable.

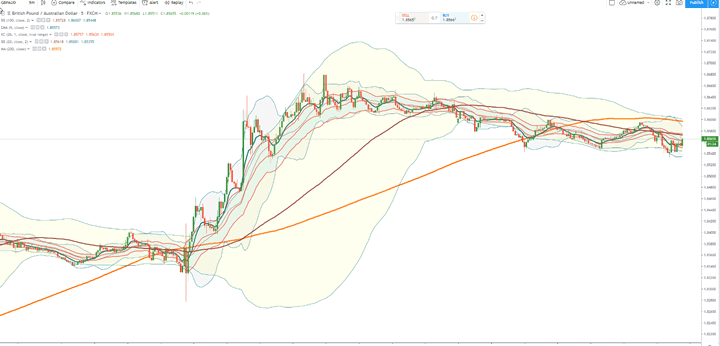

GBP/AUD too rose from 1,8250 to 1.8680. Prices have since eased down. Any positive news on US-China trade deal will first affect this pair before any other as both are dealing with significant fundamental issues.

To be updated of new research and trading performance, Please register: FREE REGISTER

TRADECOPIER

Our trading system has been churning out positive returns month after month since May 2019.

The current month return stand at +12%. Total Returns

Month Returns

October returns now stand at +12%. Last month generated +25% returned.

The QUANTO TRADE COPIER SYSTEM shown above is a high performance FX trading system. We send trades to your trading terminal (MT4 terminal). If interested, contact us below.

The TRADECOPIER SYSTEM CAN BE ACCESSED BY EMAILING US AT partners@quanto.live OR filling the form REACH US

To be updated of new research and trading performance, Please register: FREE REGISTER

Source: https://quanto.live/dailysetups/roll-over-risk-to-new-highs-in-sp-500/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.