Thomas Cook's Fall from Grace - A Cautionary Tale for the Entire Global Economy

Companies / Company Chart Analysis Oct 03, 2019 - 04:35 PM GMTBy: EWI

Since its very first 11-mile train tour on July 5, 1841, the Thomas Cook travel company has been taking adventure-seekers around the world, from river cruises down the Nile (a.k.a. "Cook's Canal"), railcars up to the mouth of Mount Vesuvius, and spaceships to the surface of the moon! (Between 1950 to 1996, Cook's "Moon Registry" had a 100,000-flight manifest).

Since its very first 11-mile train tour on July 5, 1841, the Thomas Cook travel company has been taking adventure-seekers around the world, from river cruises down the Nile (a.k.a. "Cook's Canal"), railcars up to the mouth of Mount Vesuvius, and spaceships to the surface of the moon! (Between 1950 to 1996, Cook's "Moon Registry" had a 100,000-flight manifest).

But on September 23, 2019, Thomas Cook filed for one of the most dismantling bankruptcies in recent history, shuddering the world's oldest travel firm and leaving hundreds of thousands of travelers high and dry. The stranding prompted the UK's largest-ever peace time repatriation effort, a 10-day long, 60 million-pound rescue effort coined Operation Matterhorn.

So how did Thomas Cook's fall from grace happen? Well, there's one easy target: "Why did Thomas Cook Go Bust? ... One factor towers above all others: the huge pile of debt." (Source: September 23, 2019 Guardian). Essentially, after decades of tamping down unpaid loans, the company's $2 billion debt burden erupted (as the volcano Vesuvius in 1944, which destroyed Cook's funicular railcar the "Vesuvio"), burning the business into a bankrupt crisp. But that isn't the whole story. Cook's massive debt didn't cause its collapse. Not finding someone to bail it out of said debt -- did.

To understand the distinction, late 2017/early 2018 becomes pivotal. At the time, Thomas Cook was flying high with renewed growth, the birth of a new tourism market in Turkey and Egypt, a revival of an old 1980's ad campaign "Don't Just Book It, Thomas Cook It!," its first-ever foray into commercial TV, and a soaring stock price which had increased five-fold since the dark days of the 2011 financial crisis. All of this, even though the firm was heavily indebted to its shareholders and strapped by credit-funded buyouts.

But the "D" word wasn't seen as a deterrent to future growth. You gotta spend money to make money: "Few in London's tourism industry have publicly suggested the capital will suffer" (Source: July 2017 Bloomberg). Specific to Thomas Cook, a February 8, 2018 news source cheered:

"We believe that Thomas Cook has reported a robust set of Q1 results which show that it has continued to grow booking volumes strongly, despite passing through material cost inflation to customers."

As late as April, analysts upwardly revised their ratings from "neutral" to "buy," prompting this April 30, 2018 The Times headline: "Sunny Outlook for Thomas Cook." The bullishness was predicated, however, on the idea that markets are driven into the future by present data, such as strong earnings, when in fact, they are driven by human behavior. An exclusive report from Elliott Wave International, "What You Need to Know Now About Protecting Yourself from Deflation",explains:

"When the social mood trend changes from optimism to pessimism, creditors, debtors, producers and consumers change their primary orientation from expansion to conservation. As creditors become more conservative, they slow their lending.

These behaviors reduce the "velocity" of money, i.e., the speed with which it circulates to make purchases, thus putting downside pressure on prices. These forces reverse the former trend."

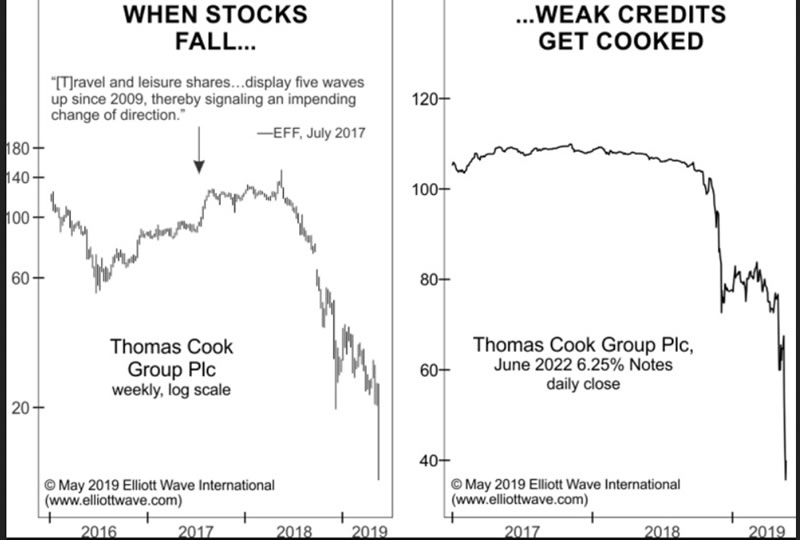

From an Elliott wave perspective, the shift in mood unfolds in the form of technical patterns on a company's stock chart. In July 2017, an important tourism bellwether, the FTSE 350 Travel & Leisure Index, displayed five waves up since 2009, thereby signaling an impending change of direction. The index bobbled along for 10 months, but, in May 2018, prices finally broke, and a mere 20% decline was apparently all it took to take down Britain's overindebted travel giant Thomas Cook. In just the past 12 months, Cook's investors have suffered through three profit warnings and watched the value of their stock plummet to 10 pence, a 93% decline. Some analysts argue that the shares are worth less than that.

From the June 2019 European Financial Forecast

Ultimately, highly indebted companies are fine so long as social mood is rising, which supports a willingness to assume risk and lend. The speed and extent of Thomas Cook's fall from grace shows what can happen when that mood reverses. The question now isn't if, but who will be the next industry icon left stranded with no one willing to come to the rescue?

Club EWI's exclusive report, What You Need to Know Now About Protecting Yourself from Deflation, pivots off the idea that the signs of major sea change in the global economy are underway and writes: "If you miss that, you miss the warning. Meaning: you won't see the beast in time. " Fortunately, the entire report is available for FREE to all Club EWI members. Get instant access.

Who is Elliott Wave International?

EWI is the world's largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.