Don't Worry About a Recession

Economics / US Economy Sep 09, 2019 - 01:47 PM GMTBy: Steve_H_Hanke

Everyone seems to be wringing their hands about what they fear is an oncoming recession. Indeed, as a sign of the level of the public’s angst, The Economist magazine reports that Google searches related to the word “recession” have surged.

Everyone seems to be wringing their hands about what they fear is an oncoming recession. Indeed, as a sign of the level of the public’s angst, The Economist magazine reports that Google searches related to the word “recession” have surged.

If that wasn’t enough evidence of the hand wringing, the Chairman of President Trump’s Council of Economic Advisers, the respected Tomas Philipson, recently indicated that he was worried about the steady negative drumbeat in the press: that a recession might be just around the corner. Philipson put his finger on the problem when he said, “The way the media reports the weather won’t impact whether the sun shines tomorrow. But the way the media reports on our economy weighs on consumer sentiment, which feeds into consumer purchases and investments.”

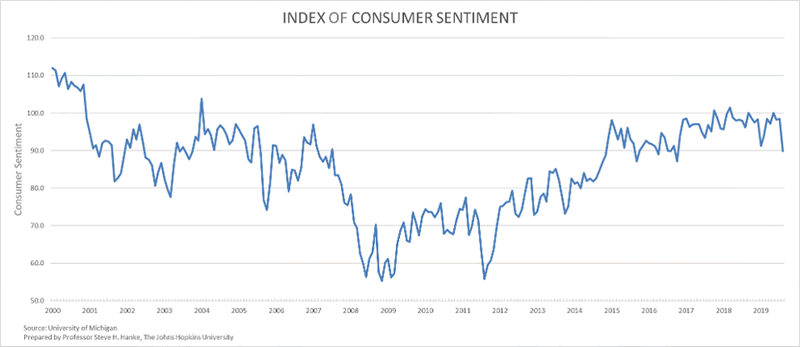

Philipson understands very well that negative news can become part of a negative feedback loop that can result in a plunge in the public’s state of confidence and a recession. He also knows how to follow metrics that gauge the public’s expectations and confidence in the economy, like the University of Michigan’s Consumer Sentiment index. The chart below shows the course of that index. The last reading on the chart is for August. It is notable that Consumer Sentiment took a dive, falling from 98.4 in July to 89.8 in August. That’s the lowest reading since October 2016. It’s clear that the President’s Council of Economic Advisers took note, causing Chairman Philipson to spring into action.

Prof. Steve H. Hanke

The state of confidence argument which sometimes flies under the “animal spirits” rubric goes back to earlier ideas about the business cycle; ideas that stress the importance of changes in business sentiment. For example, members of the Cambridge School of Economics, which was founded by Alfred Marshall (1842-1924), all concluded that fluctuations in business confidence are the essence of the business cycle. As John Maynard Keynes argued in the General Theory:

“The state of confidence, as they term it, is a matter to which practical men always pay the closest and most anxious attention. But economists have not analyzed it carefully and have been content, as a rule, to discuss it in general terms.”

Frederick Lavington (1881-1927), a Fellow of Emmanuel College and the most orthodox of the Cambridge economists, went even further than Keynes. In his 1922 book, The Trade Cycle. Lavington concluded that, without a “tendency for confidence to pass into errors of optimism or pessimism,” there would not be a business cycle.

But, this animal spirits approach to the business cycle, while it contains a grain of salt, fails to offer much of a theory of national income determination, as Keynes himself concluded. The monetary approach fills that void.

The monetary approach posits that changes in the money supply, broadly determined, cause changes in nominal national income and the price level. Sure enough, the growth in the supply of broad money and nominal GDP are closely linked.

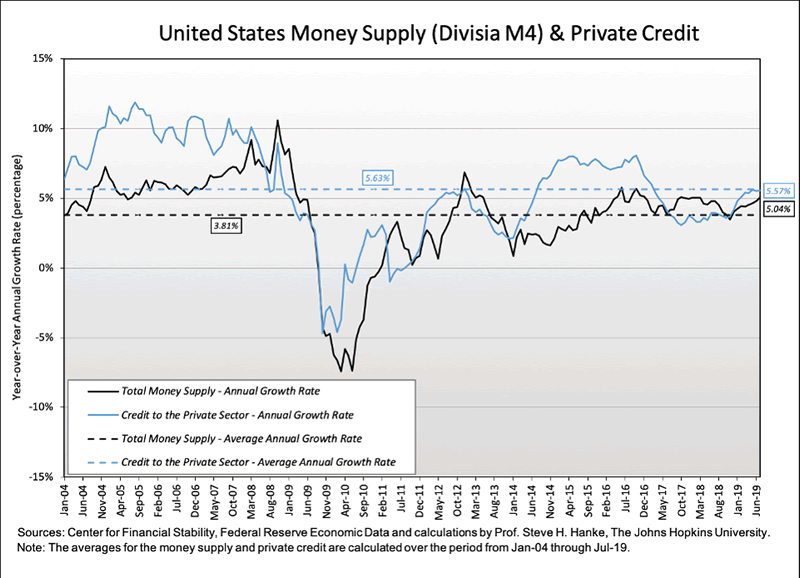

So, just where do things stand in the U.S.? As shown in the chart below, the growth rate of the money supply, broadly measured by Divisia M4, is growing at 5.04%/yr. That puts it above the trend rate since 2003 of 3.81%/yr. And what’s more, the broad money growth rate is right in line with the “golden growth” rate. That’s the rate of growth in the money supply that would allow the Fed to hit its inflation target of 2%/yr. The money supply, broadly measured, is in the sweet spot: not too hot, not too cold. Also, private credit is growing at 5.57%/yr, which is very close to its trend rate since 2003 of 5.63%/yr.

Prof. Steve H. Hanke

While the daily drumbeat of negative news—particularly that which is related to President Trump’s counter-productive and futile trade war with China—is worth paying attention to, it is somewhat of a sideshow. The main event is money. Money dominates, and at present, it’s not too hot, not too cold—about right. Perhaps that’s why Fed Chairman Jerome Powell, while in Zurich yesterday, confidently said, “Our main expectation is not at all that there will be a recession.” Powell could have added the word: “Relax.”

Follow me on Twitter. Check out my website.By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2019 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.