Stock Market Trend Forecasts When Mega-Trends Collide

Stock-Markets / Stock Markets 2019 Sep 03, 2019 - 11:25 AM GMTBy: Nadeem_Walayat

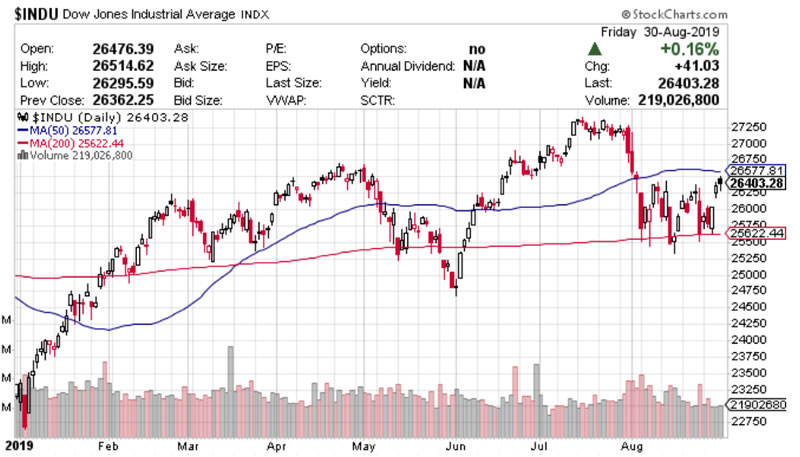

The Dow chart says it all in terms of the volatile month of August we have just witnessed in the count down to the expiry of my 6 month long Dow stock forecast trend forecast as of 1st March 2019. During the month the Dow traded down from near its all time closing high of 27,359 (16th July 2019), trading down to a low 25,300 with the most recent price action attempting to break out of August's trading range of between 26,400 and 25,300 by closing at 26,403.

The Dow chart says it all in terms of the volatile month of August we have just witnessed in the count down to the expiry of my 6 month long Dow stock forecast trend forecast as of 1st March 2019. During the month the Dow traded down from near its all time closing high of 27,359 (16th July 2019), trading down to a low 25,300 with the most recent price action attempting to break out of August's trading range of between 26,400 and 25,300 by closing at 26,403.

August saw Trump rather than reducing trade war tensions as expected by the mainstream press who are still largely ignorant of the fact that the US is trending towards a full spectrum WAR with China, a mega-trend that has been in place since BEFORE Trump took office and will remain in force for decades after Trump has left the scene. Where all Trump has done is to act as an accelerant to this mega-trend as I iterated in my recent analysis on the subject (China SSEC Stock Market Fundamentals and Trend Analysis Forecast).

Here's a taste of Trump's trade stance from just 1 day a relentless salvo of China related tweets.

My consistent view for the DURATION of this STOCKS BULL MARKET has been to view all corrections, flash crashes, technical bear markets (20% drops) as BUYING OPPORTUNITIES. Where the greater the deviation from the high the greater the buying opportunity presented. Which was the case at the start of the month as there was increasingly likelihood for a weak August hence my article How to Invest in AI Stocks with Buying Levels. Listing levels that I would look at buying AI stocks 'should' they correct during August.

So here are my current buying levels for all of stocks mentioned in my AI series this year.

Unfortunately despite the general stock market indices such as the Dow taking a dip, the target stocks that I was seeking to further accumulate into refused to decline to similar degree, which is what one would expect from good stocks i.e. to show relative strength as the charts of the top 6 AI stocks illustrate.

(Charts courtesy of stockcharts.com)

The main thing is to KEEP a list of target stocks at hand for when opportunities present themselves, even if to means having to buy at a little higher price than ones target price due to relative strength.

Even Johnson and Johnson which one would have thought would have crashed on the bad news of being hit with a $1/2 billion court case loss for its role in America's opioid crisis. Instead the J&J stock price rose following the announcement, leaving the clueless mainstream press to clutch at straws to explain contrary price behaviour, remaining oblivious to the AI driven life sciences mega-trend that is underway that J&J is an important node of. Remember, these corporations are becoming competing and collaborating ARTIFICIAL INTELLIGENCES.

In which respect J&J and the rest of the AI stocks are what one could say Primary Nodes in a global collective and competing Artificial intelligence's network driving each AI Node to innovate, excel and evolve at a pace that will soon (if not already) be beyond the comprehension of most human intelligence's, thus why the mainstream press remains largely clueless to this mega-trend.

So August saw the War with China and the AI mega-trends collide, resulting in the general stock indices correcting whilst AI stocks to varying degree showed relative strength.

Dow Stock Market Trend Forecast 2019

My in-depth analysis of 1st March 2019 Stock Market Trend Forecast March to September 2019 concluded in the trend forecast for the Dow to achieve at least 28,000 by Mid September 2019.

At the update of April 7th (https://www.patreon.com/posts/stock-market-dow-25930920) the stock market was running ahead of the forecast by some 700 points.

When I warned to expect the stock market to converge towards my trend forecast rather than continue trending higher.

However, with stocks approaching resistance at previous all time highs I consider the most probable outcome is for the Dow is to converge towards my trend forecast during the remainder of April.

The stock market was taking a tumble at my update of 10th May (Stock Market US China Trade War Panic! Trend Forecast May 2019 Update) which the mainstream media had attributed to Trump Trade war chaos based on their preceding consensus view that the Trade war would soon be resolved instead the opposite happened to widespread expectations.

At the time I concluded to expect the stock market to resolve to meet the forecast trend trajectory (red line) by Mid June and then embark on a trend towards new all time highs and thus to take stock market weakness as an opportunity to accumulate AI mega-trend stocks trading at a discount.

Conclusion : The Dow is overall likely to trade within a tight trading range of 26,500 to 25,200 for the next month or so as the Dow converges towards the trend forecast by Mid June. In plain English, I expect the Dow to meet the forecast trend (RED line) by the Mid June low before resuming the bull market to new all time highs.

At the end of the day look for opportunities in this correction to accumulate into the machine intelligence mega-trend stocks, though be wary of those with significant exposure to China, Apple, Baidu etc as they will exhibit greater price volatility. Though will take a closer look at the prospects for the SSEC this month.

July 12th Update - Dow Stock Market Trend Forecast July 2019 Update

With the trend converging back to the forecast there was little reason to expect the market not to continue hugging the forecast red line into Mid September towards Dow 28k where my expectations were that stocks could correct to around 26,500 into early August before resuming the uptrend.

Which brings is to the present:

Technical Analysis

The rest of this analysis has first been made available to Patrons who support my work: Stock Market Trend Forecasts When Mega-Trends Collide

- Technical Analysis

- Trend Analysis

- Elliott Wave

- MACD

- Seasonal Analysis

- US Interest Rates

- Forecast Conclusion

- Peering into the Mists of Time

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis

- NASDAQ

- GBP/USD

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

Recent Analysis includes:

- Stock Market Trend Forecasts When Mega-Trends Collide

- How to Invest in AI Stocks with Buying Levels

- China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- Gold Price Breakout - Trend Forecast 2019 July Update

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

By Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.