Gold and the Bond Yield Continuum

Interest-Rates / US Bonds Aug 11, 2019 - 02:21 PM GMTBy: Gary_Tanashian

Have you heard the news? US Treasury bonds are sky rocketing as it turns out there is no inflation amid a global central bank NIRP-a-thon and race to the currency bottom. Going the other way, our 30yr Treasury yield Continuum is burrowing southward.

Have you heard the news? US Treasury bonds are sky rocketing as it turns out there is no inflation amid a global central bank NIRP-a-thon and race to the currency bottom. Going the other way, our 30yr Treasury yield Continuum is burrowing southward.

If you check out yesterday’s post you’ll see proof that the 2018 NFTRH view that people should tune out the bond experts instructing BOND BEAR MARKET!! was 100% on target.

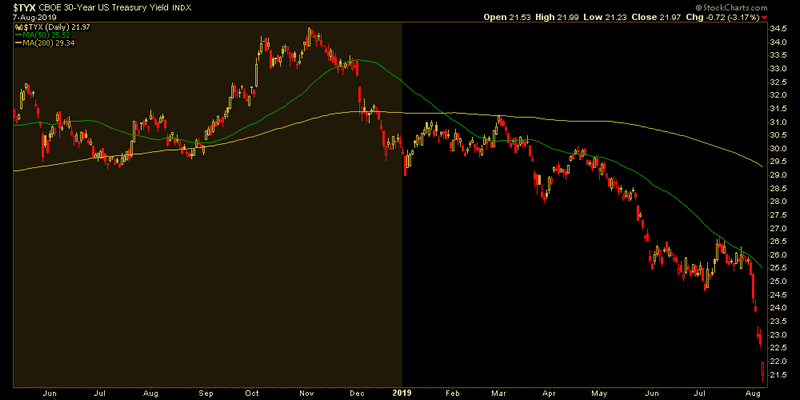

But today the din is coming from the opposite pole. Everywhere you look on the financial websites it’s now about tanking yields, decelerating growth, trade war damage and deflation. Here is the 30 year bond yield (TYX), which is front and center in this hysteria (click the charts below for the clearest view). That is one impulsive looking drop.

But just as we warned that the precious metals move was a “launch” (not a blow off as some were calling it) in June because it was at the beginning rather than the end of an extended move, we note that TYX is impulsively dropping into a potential climax. Everybody is on the opposite side of the boat they were on in H2 2018. That would be the BOND BEAR MARKET!! side of the boat with experts Gross, Gundlach and company. Now amidst the current Armageddon (the SPX is after all down a whole 4% from its all-time high, he said sarcastically) backdrop it’s all BOND BULL MARKET!! all the time.

Wash…

Rinse…

Repeat… the herds never catch on because they are the herds. They follow. Always.

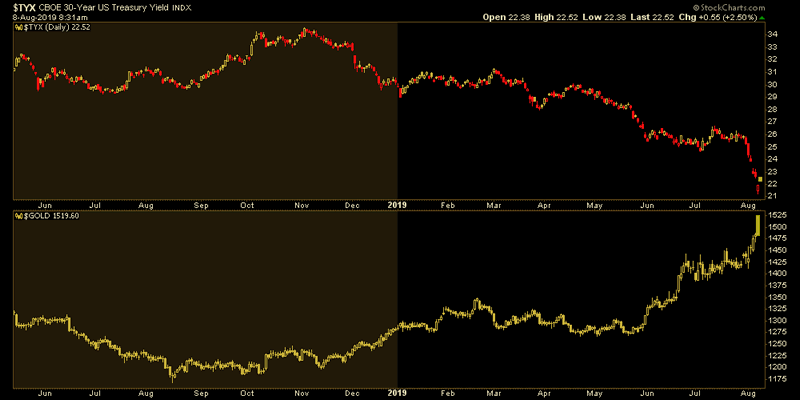

While it does not always work this way, since gold often plays well with inflation and bonds do not, during this slight global economic growth contraction gold has acted as have Treasury bonds in almost perfect sync. Here, check out the daily chart of the yield and gold.

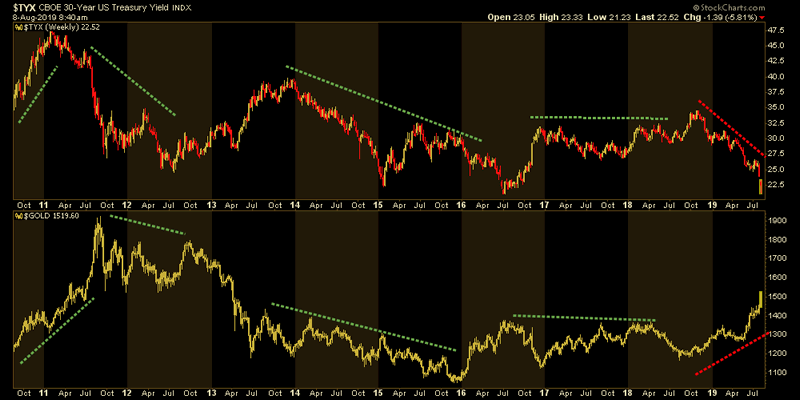

The green dashed lines on this weekly chart show phases where gold and 30yr yields were mostly correlated, which meant that gold and Treasury bonds were not. That relationship is violently interrupted on this cycle of fear, loathing and Armageddon obsession.

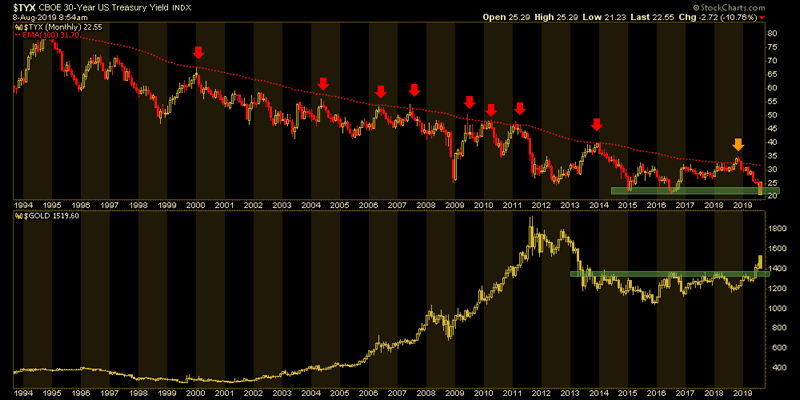

But maybe this is the big one (Elizabeth!). The Continuum has declined to the lows reached during the NIRP hysteria back in 2016 and the stock market correction before that in 2015. Armageddon ’08? Yields are below that terror stricken event and the 2012 launchpad to the financial media’s “Great Rotation” (out of bonds and into stocks) promotion of 2013.

This critical area of support is as important in a completely different way than the aborted breakout (orange arrow) above the Continuum’s limiter was last year.

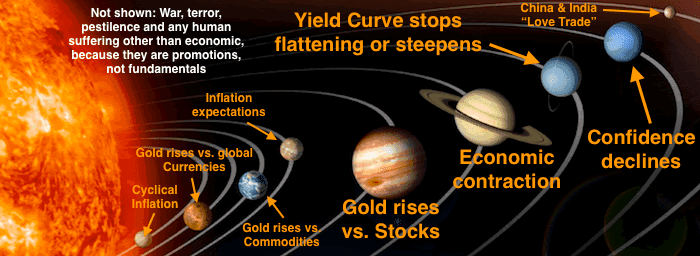

Gold’s vulnerability, in theory at least, is the fact that it has gone hand in hand with something that is stretched to an extreme. While there are compelling reasons that the gold price should be rising today (we are after all, in the minority of voices calling out that the case for gold goes far beyond inflation protection). Most of the key fundamentals are very well in line, but the yield curve has been hammered back to flattening in the post-FOMC action. That, taken at face value is not gold-positive. Here again, the cartoon representation of important factors for gold.

My job is not to tell anyone what is going to happen. My job is not to promote a viewpoint or ideology and least of all fear, although I’ve been on the case for the unsustainability of the system since I began writing about markets in 2004. But this system depends on ever-increasing credit. Thus far along the continuum, every time the yield limiter has been reached – or slightly exceeded, as in 2018 – the result has been a swing to the other side, the deflationary side (that’s a continuum of spiking and fading inflation expectations among other things).

As we noted at the time, a breakout in yields and inflation expectations would basically end the Fed as we know it; it’s gig would be up. And still people were wondering why Jerome Powell was so stern on the Fed Funds rate in the face of a tanking stock market. Today things may not be as simple as looking at some guy’s chart he calls the Continuum and expecting a continuation of the wash/rinse cycle. Among other complications, Powell should be going full dove right now and he is not. It cannot be that he’s trying to teach a bully on Twitter a lesson. Something could be lurking in the system that has not yet come to the surface.

Bottom Line

This debt-based system needs funding. It gets funded with herds of frightened market participants thundering into bonds. See? But as someone who believes the racket is not sustainable, I am ready for a breakdown below support in Treasury yields. That would see the most ardent gold bugs finally validated and the herds comfortably huddled in Treasury bonds (until the terms of the new system are enacted, that is).

But if we continue along the Continuum that has been in place for decades, as we did after 2018’s BOND BEAR MARKET!! hysteria, a bearish bond view could be well rewarded. And that may or may not paint risk into the price of gold.

Gold is different than T bonds. Gold is real, bonds are debt. So it’s all a matter of your expectations for a monetary asset that merely reflects confidence or lack thereof by the masses. But as gold rises (in more rapid fashion than originally anticipated) toward our initial targets, we should realize the power of the herds. If a few months down the road they are thundering in the opposite direction along the Continuum, they will not be in a mood to rationally discuss the merits of real value. They are died in the wool bond investors after all, not even a half a year after having been tended to a die hard BOND BEAR MARKET!! view.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.