FOURTH TURNING ECONOMICS

Economics / US Economy Aug 05, 2019 - 03:12 AM GMTBy: James_Quinn

If you feel you’ve recei“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe

If you feel you’ve recei“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe

The quote above captures the current Fourth Turning perfectly, even though it was written more than a decade before the 2008 financial tsunami struck. With global debt now exceeding $250 trillion, up 60% since the Crisis began, and $13 trillion of sovereign debt with negative yields, it is clear to all rational thinking individuals the next financial crisis will make 2008 look like a walk in the park. We are approaching the eleventh anniversary of this crisis period, with possibly a decade to go before a resolution.

As I was thinking about what confluence of economic factors might ignite the next bloody phase of this Fourth Turning, I realized economic factors have been the underlying cause of all four Crisis periods in American history.

The specific details of each crisis change, but economic catalysts have initiated all previous Fourth Turnings and led ultimately to bloody conflict. There is nothing in the current dynamic of this Fourth Turning which argues against a similar outcome. The immense debt, stock and real estate bubbles, created by feckless central bankers, corrupt politicians, and spineless government apparatchiks, have set the stage for the greatest financial calamity in world history.

Rather than taking the bitter medicine of purging the system of bad debt and allowing zombie banks and corporations to die, the ruling class has chosen to ramp up the debt orgy and reward themselves and their cronies with ill-gotten riches, while impoverishing the masses. Their arrogance and hubris have grown to vast proportions and will eventually result in a bloody backlash from those they have screwed over.

The election of Donald Trump over the hand-picked candidate of the oligarchy, was a reaction to the raping and pillaging of Main Street by the greedy soulless psychopaths in suits on Wall Street and in the halls of the Eccles building in Washington D.C. The average hard-working American has seen eight years of “government of the bankers, by the bankers, for the bankers”.

Wall Street was bailed out and rewarded with the ability to borrow at 0% from their captured Federal Reserve. Zombie corporations were kept alive with low interest debt, with no adjustment for risk. The cowardly politicians drove the national debt from $11.5 trillion to over $20 trillion, while accomplishing minimal GDP growth (negative growth using a real inflation rate), and enriching mega-corporations and the top .1%. Meanwhile, risk averse senior citizens, depending upon some interest income to survive, were thrown under the bus by Bernanke, Yellen and Powell.

It was the deplorables in flyover country, the blue-collar workers in Pennsylvania, Michigan, Wisconsin and Ohio, and senior citizens in Florida who voted their wallets, which had been picked by establishment politicians for the previous eight years. Good paying manufacturing jobs with health benefits have been replaced with low paying retail and service jobs with minimal benefits.

Retail store closings continue to accelerate, while credit card debt hits all-time highs, surpassing the 2008 levels. A critical thinking individual might conclude millions of Americans are running up their credit card balances by paying their utility bills, property tax bills, medical bills, and other necessities on credit. Thousands of retail stores wouldn’t be closing if people were still buying shit they didn’t need on credit.

After campaigning as if he would be a fiscally responsible president, Trump has been a disappointment regarding the budget. His “best economy ever” is nothing but a government spending driven, low interest rate, stock market boosting bubble. After promising to eliminate the debt during the campaign and railing against the low interest rate driven stock market bubble, Trump and the Republicans have added $2 trillion to the national debt, thus far.

The original projection for FY19 was around an $800 billion deficit, but the economy is “booming” so much, it will now reach at least $1.1 trillion. The rate of growth in the debt is outpacing the rate of growth of GDP, therefore we are regressing fiscally. Pointing this out is considered traitorous among Trump can do no wrong acolytes.

![]()

The two parties proved they have absolutely no interest in reducing or even slowing spending. They agreed to a two-year deal that will add at least $200 billion more to the annual deficits and increased the debt ceiling so they can keep borrowing. And this is even before the mandatory spending for Social Security, Medicare, and Medicaid kick into high gear in the coming years.

The fact doubling the national debt in the last ten years has not caused a catastrophe – yet – has created an arrogant hubristic ruling oligarchy who are sure they can run the debt to infinity with no adverse consequences. They have bought off the politicians, control the media, and use their Deep State surveillance assets to insure their continued control of the system and obscene riches. Meanwhile, the average American continues to be screwed and ripped off by both parties.

“Wherever we’re headed, America is evolving in ways most of us don’t like or understand. Individually focused yet collectively adrift, we wonder if we’re heading toward a waterfall. Are we?” – Strauss & Howe

The president and congress no longer even pretend to be fiscally responsible. They didn’t even pretend to try and pay for the increased spending. Trump’s tax cuts were sold as a way to have mega-corporations repatriate hundreds of billions from overseas and reinvigorate the economy with a surge in job creation.

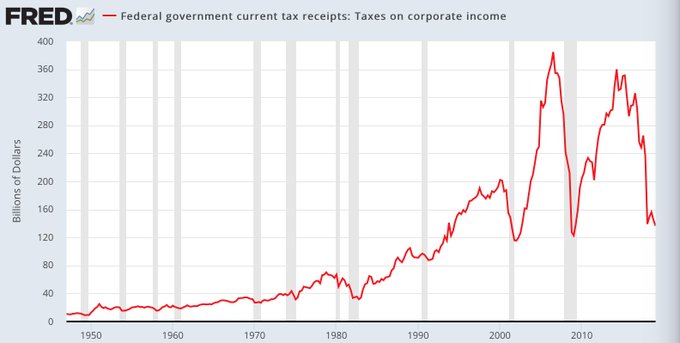

With half the working public already paying little or no taxes, the tax cuts heavily favored the .1% and put $200 billion more into the coffers of the biggest corporations with the most powerful lobbyists. So, the politicians keep spending more on the military industrial complex and corporate tax revenues have plunged by two thirds, which will leave us with a $1.3 trillion deficit next year, even if we don’t fall into recession.

The three previous American Fourth Turnings were all initiated by economic issues. The American Revolution began due to a decade of increasing tax repression by Britain over the American colonies. The Navigation Acts forced all trade on British ships, making it easy for British authorities to tax and regulate trade by cutting down on smuggling. The Stamp Act of 1765 was designed to increase revenue for the British, to pay their debts from the Seven Years War. The Sugar Act was designed to closely regulate the trade of products such as rum, molasses, and sugar. The Colonists became upset at such taxation without sufficient representation in Parliament.

Rebellious patriots began to boycott British goods. The Townsend Acts led the Sons of Liberty to dump British tea into the Boston Harbor, known forevermore as the Boston Tea Party. In retaliation, the British passed a series of acts later known as the Intolerable Acts, all designed to punish and reshape the colonial governance system to make it easier for the British to control the colonies. Ultimately, the economic warfare devolved into a shooting war that led to the existing social and political order being swept away.

The Civil War is commonly seen as a conflict only over slavery, but there was a huge economic component to the war. The industrial revolution in the North, during the first few decades of the 19th century, brought about a machine age urban economy that relied on wage laborers, not slaves. At the same time, the warmer Southern states continued to rely on slaves for their rural farming economy and cotton production. In 1805 there were just over one million slaves worth about $300 million; fifty-five years later there were four million slaves worth close to $3 billion.

In the 11 states that eventually formed the Confederacy, four out of ten people were slaves in 1860, and these people accounted for more than half the agricultural labor in those states. In the cotton regions the importance of slave labor was even greater. The value of capital invested in slaves roughly equaled the total value of all farmland and farm buildings in the South. More than two-thirds of all urban counties were in the Northeast and West; those two regions accounted for nearly 80 percent of the urban population of the country. By contrast, less than 7 percent of people in the 11 Southern states lived in urban counties.

Southerners viewed any attempt by the federal government to limit the rights of slave owners over their property as a potentially calamitous threat to their entire economic system. The South’s economic investment in slavery explains the willingness of Southerners to risk war when faced with what they viewed as a serious threat to their “peculiar institution” after the electoral victories of the Republican Party and President Abraham Lincoln the fall of 1860.

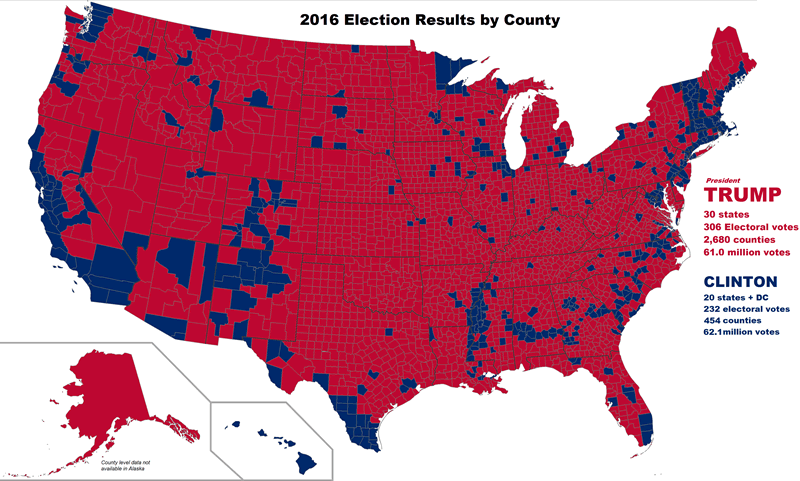

The industrial power of the North virtually insured victory, the longer the conflict extended. This may explain Lee’s aggressiveness in trying to strike a knockout blow during the early years of the war. The clear delineation of states based on their beliefs in 1860 sure resonates today when you view how the country voted in 2016. Will the drastic discrepancy in beliefs about how to govern this country lead to a similar outcome?

The last Fourth Turning, from 1929 until 1946, was most certainly propelled by economic disaster. The Great Stock Market Crash of 1929 and subsequent Great Depression followed five years of reckless credit expansion by the Federal Reserve. The Federal Reserve credit expansion in 1924 was in reaction to a business downturn and to assist the Bank of England in its wish to maintain prewar exchange rates. The strong US dollar and the weak British pound were to be readjusted to prewar conditions through a policy of inflation in the United States and deflation in Great Britain.

The credit expansion led to the Roaring Twenties. The volume of farm and urban mortgages expanded from $17 billion in 1921 to $27 billion in 1929. Large increases occurred in industrial, financial, and state and local government indebtedness simultaneously. This Federal Reserve spurred expansion of money and credit led to skyrocketing real-estate and stock prices. Sound familiar? The Federal Reserve is good at one thing – creating bubbles and subsequent busts. Notice how politicians always tell you everything is great. Best economy ever!!!

“No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment…and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding.” – Calvin Coolidge December 4, 1928

The politicians in Washington exacerbated the recession and created the Great Depression by trying to reverse the economic cycle. The Smoot-Hawley Tariff Act raised American tariffs to unparalleled levels, virtually closing our borders to foreign goods. American exports fell from $5.5 billion in 1929 to $1.7 billion in 1932. Our main exports were agricultural. The main creditors of American farmers were rural banks. When agriculture collapsed, the rural banks closed their doors collapsed.

Some 2,000 banks, with deposit liabilities of over $1.5 billion, closed their doors between August 1931, and February 1932. The whole nation, in fact, the whole world, fell into the cataclysm of despair and depression in 1931. American unemployment jumped to more than 8 million and continued to rise. Economic conditions collapsed and unemployment in 1932 surged to over 12 million. Again, politicians spewed happy talk as the situation worsened.

“While the crash only took place six months ago, I am convinced we have now passed through the worst — and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us.”– Herbert Hoover, President of the United States, May 1, 1930

Three years later a new president closed all the banks and confiscated gold from American citizens.

“All safe deposit boxes in banks or financial institutions have been sealed… and may only be opened in the presence of an agent of the I.R.S.” – President F.D. Roosevelt, 1933

The causes for World War II are many, but the underlying source for the deaths of 65 million people was economic. The Treaty of Versailles, blaming the Germans solely for the First World War and demanding crippling reparations, was the nexus of World War II. Germany was forced to surrender colonial territories and militarily disarm, creating German resentfulness of the treaty. In 1923 the Weimer Republic delayed reparation payments, leading France and Belgium to occupy the Ruhr Valley, effectively appropriating the coal and metal production that took place there.

As much of German manufacturing was dependent on coal and metal, the loss of these industries created a negative economic shock leading to a severe contraction. This contraction, as well as the government’s continued printing of money to pay internal war debts, generated spiraling hyperinflation. This economic suffering and humiliation ultimately led to the population turning to Adolf Hitler as their savior.

The global trade contraction exacerbated the mistrust and anger building throughout the world. Tariffs and counter-tariffs made the Great Depression greater than it had to be. The protectionist policies of countries around the globe denied key raw materials to countries dependent upon imports. While the British, French, Soviets and Americans had large colonial empires to turn to for access to much needed raw materials, countries such as Germany, Italy and Japan did not.

“Have-not” nations found it increasingly necessary to use military force to annex territories with the much-needed resources. Such military force required extensive rearmament and, the case of Germany, meant a direct violation of the Versailles Treaty. This ultimately resulted in war breaking out in Europe. The American oil embargo on Japan ultimately resulted in the attack on Pearl Harbor and the start of the Pacific war.

In Part Two of this article I’ll ponder how the coming years will play out, based upon the dynamics of Fourth Turnings.

ved some value from this article and this blog dedicated to free speech and truth in the face of lies, corruption and fake news, feel free to make a Donation to keep the lights on at The Burning Platform.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2019 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.