3 Stocks You Should Own When the Fed Cuts Rates Next Week

Companies / Investing 2019 Jul 27, 2019 - 12:53 PM GMTBy: Robert_Ross

Looks like an interest rate cut could come as early as next week.

Looks like an interest rate cut could come as early as next week.

Federal Reserve Chair Jerome Powell hinted at lower rates earlier this month.

Now investors are pricing in a 100% probability that the Fed will lower interest rates when it meets next week, according to global brokerage company CME Group.

This would be the first rate cut since December 2008, when the Fed cut rates to effectively zero and kept them there for seven years.

The Fed started raising rates in late 2015. Then it pumped the brakes after the stock market fell 20% at the end of 2018.

Now it’s probably going to lower rates again.

This is good news for US stocks. And healthcare stocks in particular…

Interest Rate Cuts Boost Healthcare Stocks

As you might know, the Federal Reserve lowers interest rates when it’s worried about the economy.

A lot of the worry here stems from weak manufacturing, housing, and jobs numbers that have come in recently. In these cases, the Fed often lowers rates to try to boost economic activity.

In any case, lower rates are good for stocks across the board. The last six times the Fed cut interest rates during an economic expansion, the S&P 500 gained almost 10% on average over the following three months.

Healthcare stocks did even better. They outperformed the S&P 500 by an average of 7% in the nine months after a rate cut, according to Barclays.

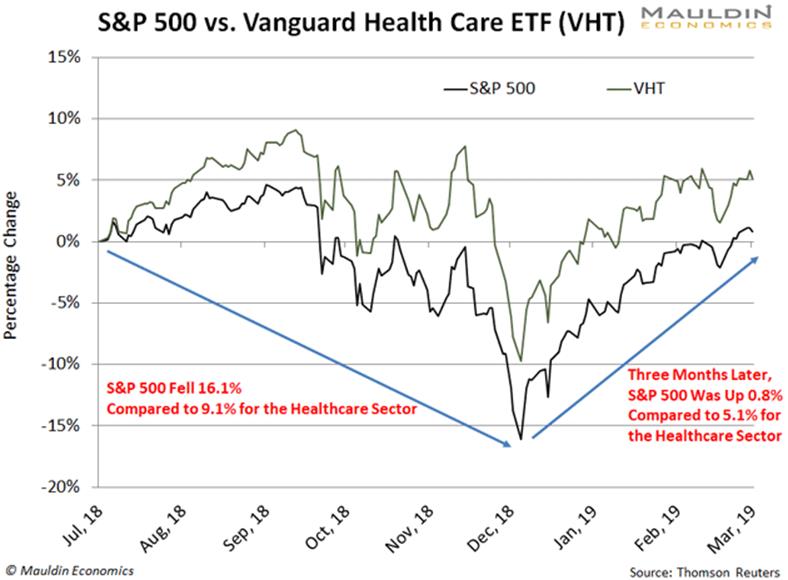

Even when the S&P 500 pulled back 20% from October to December last year, healthcare stocks only fell about half as much. You can see this in the next chart.

There’s good reason for this. Investors buy healthcare stocks during periods of economic uncertainty because the healthcare industry is remarkably consistent.

For the most part, people spend money on healthcare no matter what. That means healthcare companies enjoy stable revenues. And their stocks can pay reliable dividends.

Nothing Stops People from Buying Tylenol

America’s aging population is a part of the reason healthcare is such a safe bet.

It’s simple: 10,000 Baby Boomers are retiring every day. These people are getting older. And that means they need more medical care.

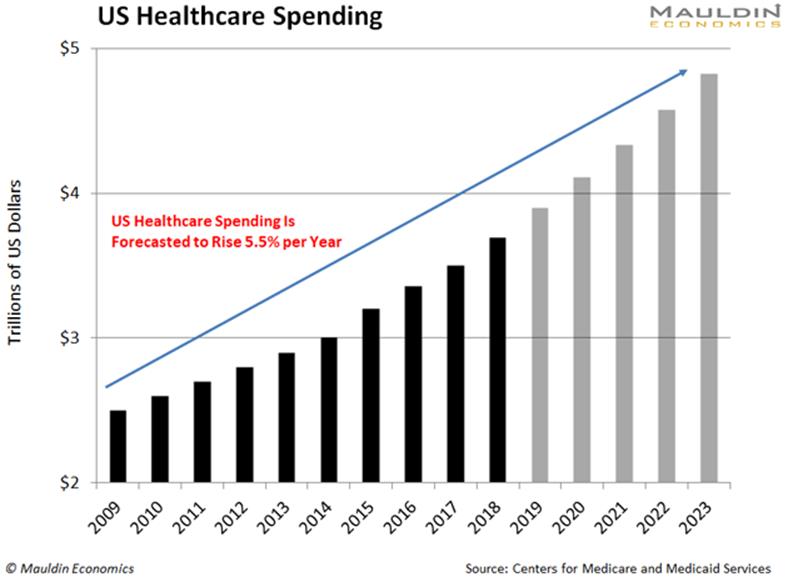

This translates into very consistent spending on healthcare. In fact, the Centers for Medicare and Medicaid Services (CMS) says US healthcare spending will grow 5.5% annually through 2027.

There isn’t much that could stop that growth.

Think about it… the weak manufacturing numbers I mentioned earlier won’t stop anyone from buying Tylenol, or arthritis cream, or diabetes medication.

This kind of reliable spending is why investors buy healthcare stocks when the economy is weakening. People pay for healthcare—period. That means healthcare companies earn stable profits no matter what.

So investors buy in, and stock prices go up.

On top of that, healthcare stocks often pay safe and reliable dividends…

My Top Healthcare Dividend-Paying Stocks

Regular readers know I’m always hunting for the safest and most reliable dividend-paying stocks. And healthcare stocks fit the bill.

See, the predictable growth in healthcare spending means healthcare companies can pay consistent dividends. Plus, many of these companies have long histories of increasing their dividend payouts.

Take Johnson & Johnson (JNJ), for instance—one of my top healthcare dividend-paying stocks.

Johnson & Johnson is the largest health company in the world. It sells everything from knee replacements to Tylenol, Band-Aids, and baby shampoo.

Johnson & Johnson pays a 2.9% dividend yield. That’s respectable. But the really impressive part: It’s increased its dividend payout for 47 years in a row. Only 19 companies can top that.

And, with a low payout ratio of 66%, it’s very safe. (Remember, a company’s payout ratio is the percentage of profits it pays as dividends. A lower ratio points to a safer dividend.)

Next on my list is AbbVie Inc. (ABBV). The company is one of the largest suppliers of immunology and cancer drugs in the world.

AbbVie pays a large 6.3% dividend yield. With a three-year average payout ratio of 79%, the company should have no trouble servicing the dividend.

Finally, we have Abbott Laboratories (ABT). The company sells medical devices, nutritional, and diagnostic products. Think pacemakers, catheters, and infant formula.

Abbott’s 1.5% dividend yield is small. But the company has increased its dividend for 45 years in a row. With a payout ratio of 79%, it’s almost guaranteed to increase the payout again in 2019.

As Close as It Gets to “Free Money”

While the dividend yields on these three companies are relatively low, their dividends are all safe and reliable.

Buying companies like these and holding them is the key to dividend investing. As I’ve mentioned before, when you reinvest your dividends, you can more than double your returns over the long run—without doing much of anything.

For instance, if you bought $10,000 worth of Johnson & Johnson (JNJ) stock in July 1999 and reinvested all of your dividends, your position would be worth $46,581 today.

But if you didn’t reinvest your dividends, that same $10,000 would only be worth $21,867. That’s a big difference.

Reinvesting your dividends takes advantage of the power of compound interest. Frankly, it’s as close as you get to “free money.”

So don’t overlook it.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

Until next time,

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.