The Stock Chart That Has the Fed in a Panic

Stock-Markets / Financial Markets 2019 Jul 26, 2019 - 11:22 AM GMTBy: Graham_Summers

Just what exactly is terrifying the Fed?

Just what exactly is terrifying the Fed?

Over the last week, multiple Fed officials have surfaced to suggest the Fed needs to start cutting interest rates right now.

Indeed, on Thursday, John Williams, who runs the NY Fed (the branch in charge of market operations) suggested the Fed needs to cut rates to ZERO again.

Not 2%, or 1%, ZERO.

This is happening at a time when economic data is rebounding, unemployment is below 4% and GDP growth is north of 3%.

So what exactly is going on? What does the Fed know that has it so terrified, because it’s obviously not the US economy.

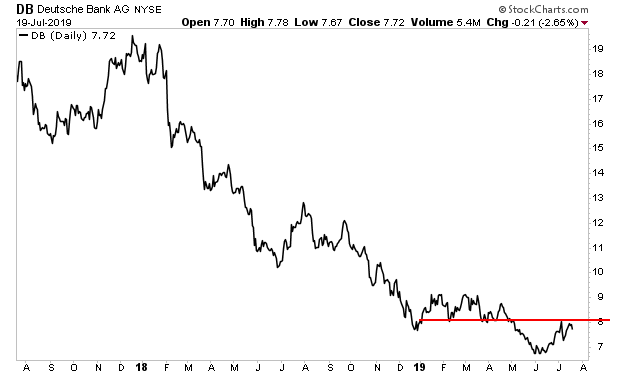

1) Deutsche Bank (DB) is imploding.

Sitting atop over $49 trillion in OCT derivatives, DB is like Lehman Brothers 2.0. And despite the best efforts of management and the authorities, the bank is imploding. DB shares were rejected by resistance last week, ending the “hope bounce” from recent moves to curtail the blow up.

2) China’s banking system is freezing.

China experienced its first financial institution failure in 21 years in June. Depositors and creditors lost 30% of their deposits in the process.

Put another way, nearly 30% of their money is GONE.

The Chinese banking authorities are attempting to piece the system back together, but it’s not working. The duress has yet to spill over into the Chinese stock market, but on Friday interbank lending in the mainland temporarily spiked to 1,000%, meaning a large bank was willing to pay ANYTHING in order to get access to capital.

This is EXTREMELY similar to what happened to the US credit markets n 2008.

And finally…

3) The Everything Bubble has burst.

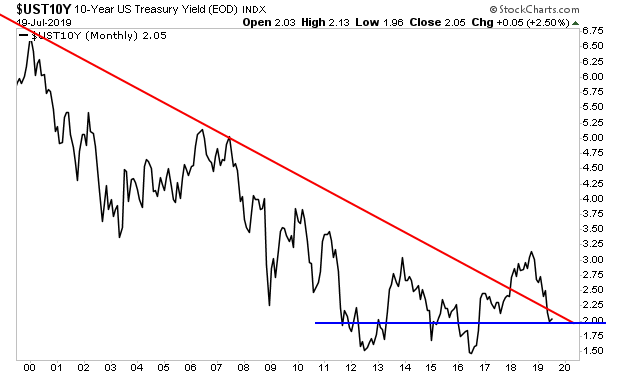

The single most important bond in the world is the 10-Year US Treasury Bond. And thanks to the Fed’s tightening policy in 2018, it burst, with the yield on the 10-Year US Treasury breaking its 20-year downtrend.

The Fed is trying to get yields back into this downtrend. But it’s not going well. The yield temporarily broke back below the downtrend last month, but is beginning to bounce again.

If the Fed cannot get this situation under control, there’s $555 trillion in derivatives at stake. Yes, TRILLION with a T.

Something BIG is coming and the Fed knows it.

Now we do too…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.