Green Tech Stocks To Watch

Companies / Renewable Energy Jul 19, 2019 - 08:10 AM GMTBy: Joshua_Rodriguez

Technology is a space that has printed millions upon millions for investors and continues to do so quite regularly. Within this industry, there are several sub-sectors, many of which are experiencing strong gains in demand, growth across the sector, and opportunities for investors. One of these areas is green tech.

Technology is a space that has printed millions upon millions for investors and continues to do so quite regularly. Within this industry, there are several sub-sectors, many of which are experiencing strong gains in demand, growth across the sector, and opportunities for investors. One of these areas is green tech.

Over the past decade or so, an incredible amount of light has shone onto the carbon footprint that the current infrastructure of human civilization is creating and the devastating effects that this footprint may have on the environment. As a result, we’ve seen a global push for green and clean across various sectors, including not just energy, but automobiles, construction, and many other facets of business.

As the green and clean movement continues to grow in strength, large opportunities are being born in the market. The green tech stocks below are some that I believe represent these potential opportunities.

Nio Inc (NIO): A Strong Recovery Is Likely Ahead

While 2018 was off to a strong start for Nio, late year concerns led to declines that have lasted for some time. In fact, the company reached a high of $11.60 per share in September of last year. By mid-June, the stock had fallen to below $2.40 per share.

The declines were the result of a mix of factors. Slumping sales, executive departures, build quality concerns, and Tesla building a factory in China have all plagued the stock, leading to the declines that we’ve seen. However, there’s a strong argument that we are finally seeing the beginning of a turnaround.

While Nio has experienced some pain as of late, this pain is likely creating an opportunity. In June, strong demand for a new model vehicle has led to the beginning of what may be a rebound.

The company’s newest model, dubbed the ES6, is a two-row, five-passenger, battery-electric crossover SUV. Demand for the vehicle is strong out of the gate, likely due to the fact that the vehicle has a longer driving range than the ES8 and a more appealing price.

Moreover, the vehicle comes with various high-tech perks. One of the most impressive of these perks is NOMI, Nio’s artificial intelligence assistant. Interestingly, many sports vehicle lovers will likely enjoy the SUV.

The ES6 is a dual-motor design with an intriguing twist; the motor driving the front axle is optimized for efficiency while the rear-axle motor is optimized for performance.

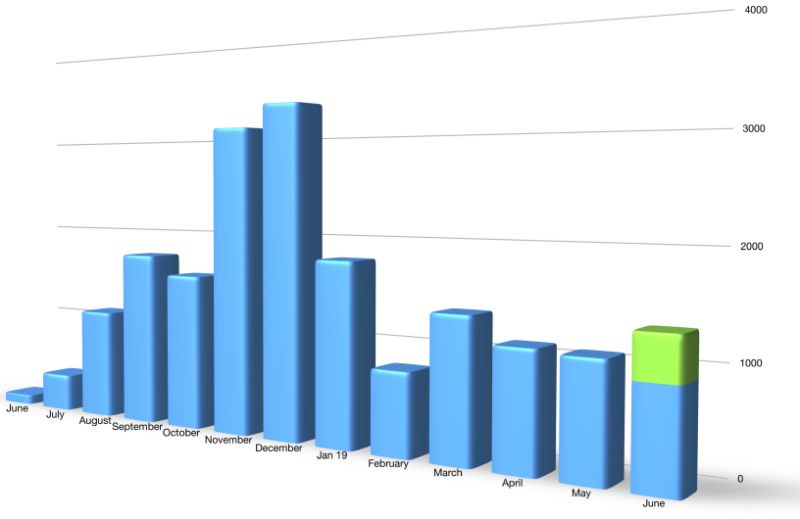

Nonetheless, many seem to want one of these vehicles. And it is leading to the first month-over-month increase in sales seen by Nio in about a quarter (see the chart below).

With recent declines pushing the value of Nio to new lows and recent sales reports suggesting an uptick in demand, now may be the perfect time to consider, Nio as it is quickly becoming a compelling potential opportunity.

CleanSpark (CLSK): Providing Stable, Green Energy

The energy industry is an interesting one for many reasons. Unfortunately, one of the most interesting parts of the energy infrastructure as we know it today is that it is likely to fail.

CleanSpark sees this problem and creates solutions for it, all while reducing carbon footprints put off by enterprise-level customers. The company specializes in providing microgrid products and services.

Taking control of every aspect of the microgrid, including design, hardware, software and maintenance, CleanSpark offers its customers an all-encompassing solution to both instability of the energy infrastructure and the increasing global carbon footprint.

While CleanSpark earns revenue from the design, development, and build of microgrid solutions for its customers, what I find to be most valuable is the company’s high-margin software business.

The company offers two key software solutions, mVSO, which helps enterprise energy consumers to make smart energy-related investments, and mPULSE, a program that helps to reduce energy costs and carbon footprint while maintaining stable loads.

The mVSO solution outlines key savings opportunities across various markets and provides insights that allow customers to make wise investment decisions based on these opportunities under high-load conditions in several different regulatory environments.

The mPULSE software looks for the lowest cost energy through various sources, including solar, wind power, the current power grid, and more. Moreover, the software allows customers to purchase energy in off-hours when prices are low and use the energy in peak-hours when cost is high.

Recently, CleanSpark has seen a strong increase in demand for its products and announced that it has entered into a partnership with two thought-leaders in cannabis. With increasing demand, strong positioning in the emerging cannabis market, and a solution that addresses multiple problems within enterprise-level energy consumption, CleanSpark is an opportunity worth looking into.

NextEra Energy (NEE): Stability In Scale And Opportunity Ahead

NextEra Energy is one of the world’s largest energy utility companies. In fact, it is the owner of several subsidiaries that provide energy to consumers in large areas. For example, the company owns Florida Power & Light, a company that serves more than 5 million energy consumers in the State of Florida.

While the fact that NextEra Energy is a large company offering strength and stability to investors is great, it’s not the reason that the company made the list today. We’re talking green tech here, and it’s an industry that NextEra has dug its roots deep into.

In fact, due to years of work building wind-energy and solar farms and their supporting infrastructure, the company has become the world’s largest producer of wind and solar energy in the world! That’s a huge statement!

At the moment, NextEra Energy’s wholly-owned subsidiary, NextEra Energy Resources, currently owns 120 wind facilities in North America. It also owns solar power facilities in seven states across the US and solar facilities in Canada. These wind and solar farms have the capacity to generate 13,000 megawatts and 2,000 megawatts of power, respectively. Moreover, the company continues to grow this capacity with the development of new wind and solar energy farms.

The company also displays quite a bit of diversity, with several subsidiaries across many aspects of energy, both traditional and green and clean. Nonetheless, with a strong shift toward leadership in clean energy, continued innovation, and impressive diversity of assets, this stock not only offers stability, it offers a potentially lucrative long-term opportunity.

Brookfield Renewable Partners (BEP): A Large Producer Of Clean Energy That’s Only Growing

Brookfield Renewable Partners owns and operates several clean energy facilities. The company also invests in third party clean-energy solutions companies that it sees as strong opportunities.

The company is one of the world’s largest publicly-traded renewable power platforms. In fact, it operates 880 green energy facilities across North America, South America, Europe, and Asia.

While Brookfield Renewable Partners generates various forms of renewable energy, the company is a global leader in hydroelectric power. In fact, hydroelectric power makes up about 75% of the company’s portfolio - a portfolio that contains more than 17,400 megawatts of energy production capacity.

Recently, Brookfield Renewable Partners announced that, with its partners, it has increased its ownership of TerraForm Power (TERP) from 51% to 65%. This happened through the purchase of 61 million shares in a private placement.

This was a key move, as the additional investment will generate about $80 million in annual funds from TerraForm power operations. With TerraForm being a leader in solar, BEP now offers a strong option to get in on solar, but to do so with a strong, highly diverse company.

With strong revenue, great margins, and continued investment in the growth of its diverse clean energy portfolio, Brookfield Renewable Partners is a stock that’s hard to ignore.

Taronis Technologies (TRNX): A Small Player That Packs A Big Punch

Of all the stocks listed here, Taronis Technologies is the smallest by market cap, but the stock does pack a big punch, and, in my opinion, it is on the verge of breaking into the big league.

The company’s claim to fame is a technology known as the Venturi Plasma Arc Gasification Unit. Through proprietary plasma-arc technology, Taronis Technologies enables a wide use of hydrocarbon-based renewable feedstocks to be rapidly converted into green substitutes for fossil fuels.

Recently, Taronis Technologies announced a key milestone. In the second quarter of 2019, Taronis Technologies produced nearly 250,000 cubic feet of MagneGas, a fossil-fuel substitute. Interestingly, 100% of this production came from the use of a single Venturi Plasma Arc Gasification unit.

This is interesting because the company recently brought a second unit into production and has plans to launch a third unit in August of this year. With more units being launched, production of MagneGas is only going to grow, and will likely do so at an impressive rate, generating value for investors.

It’s also worth mentioning that MagneGas isn’t the Taronis Technologies’ only product. In fact, the company recently announced the first successful commercialization of its water treatment service.

According to a recent press release, the company successfully purged Hibiscus Lake in Clearwater, Florida of a cyanobacteria blue-green algae bloom. The results showed a dramatic reduction of cyanobacteria in the lake, successfully fulfilling a contract with the City of Clearwater.

While this service is in early stages, it’s a promising value proposition. Municipalities spend large sums of money in an effort to keep their waters clean and free of potentially hazardous bacteria. With the recent success, we can expect to see strong growth in this arm of the company as well.

All in all, Taronis Technologies is focused on both green and clean, and its recent achievements through the use of its technologies are impressive. As a result, I believe that the company may be on the verge of a breakthrough that could lead to explosive value growth ahead.

Final Thoughts

The green and clean movement isn’t just creating a healthier environment, it’s creating strong investing opportunities as well. The stocks above are some of the potential opportunities that I find to be incredibly compelling.

This article is an advertisement. For all disclosures, click here!

By Joshua Rodriguez

This is a paid advertorial.

© 2019 Copyright Joshua Rodriguez - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.