Want to See What's Next for the US Economy? Try This.

Economics / US Economy Jul 17, 2019 - 12:04 PM GMTBy: EWI

Don't listen to the naysayers -- there IS a way to forecast the general health of the economy. This method has repeatedly proven itself.

Don't listen to the naysayers -- there IS a way to forecast the general health of the economy. This method has repeatedly proven itself.

Yes, you can anticipate the likelihood of a recession, even a depression -- or, conversely, when major economic measures -- like jobs -- will be robust.

That surefire way is the performance of the stock market.

That's right, despite the widespread belief that the economy drives the stock market, it's the stock market which leads the economy. Why not the other way around? Because the economy is a slow boat.

Think about it: When people are optimistic about the future, many of them buy stocks and can do so almost immediately. But that same optimism takes time to play out in the economy. It might take months to draw up plans to expand a business, hire new employees and so forth. So that's why the economy lags the stock market.

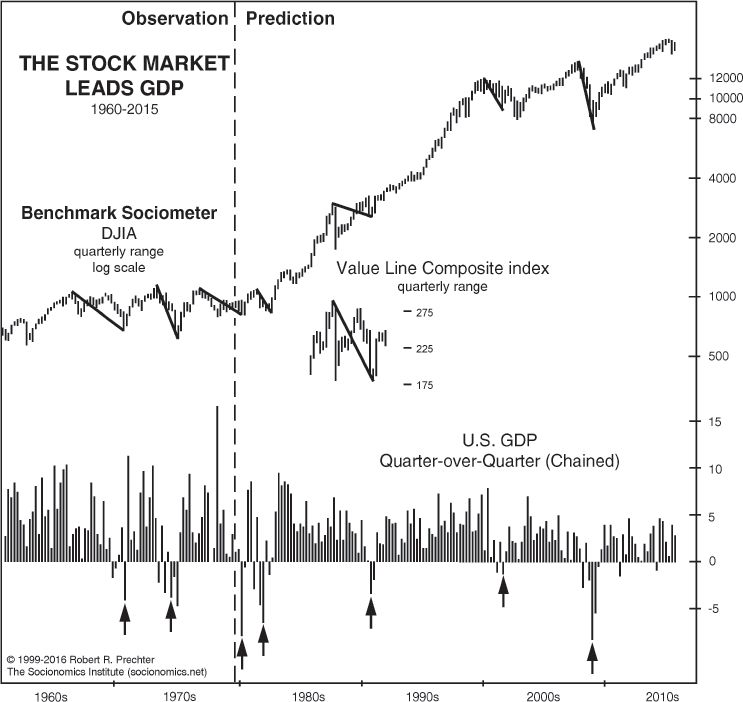

The evidence is supplied by a chart and commentary from Robert Prechter's 2017 book, The Socionomic Theory of Finance:

The stock market leads GDP. As the stock market fell in Q1 1980 and again in 1981-1982, back-to-back recessions developed. As the stock market rose from 1982 to 1987, an economic boom occurred. After stock prices went sideways to down from 1987 to 1990, a recession developed. As stock prices resumed rising, the economy resumed expanding. As the stock market fell in 2000-2001, a recession developed. As the stock market recovered in 2002-2007, an economic expansion occurred. As the stock market fell in 2007-2009, a recession developed, and it was commensurate with the size of the drop: The largest stock market decline since 1929-1932 led to the deepest recession since 1929-1933. As the stock market has recovered since 2009, an economic expansion has developed.

This brings us to the June 2019 jobs report (July 5, The New York Times):

U.S. employers sharply stepped up their hiring in June, adding a robust 224,000 jobs

Given that the stock market's latest push higher has been in place since the December low, this positive jobs report was not a surprise.

Which is to say, if the stock market turns lower, don't anticipate any major consistently negative economic news to follow only weeks later. As Elliott Wave International President Robert Prechter once put it, "The stock market doesn't top on bad news, it tops when the news is good."

So, it's a myth that the stock market follows the economy. The evidence shows that it's the other way around.

Learn about several other market myths in the free report, "Market Myths Exposed."

Begin reading Market Myths Exposed now.

EWI is the world's largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.