Please Don’t Buy the Dip in Nvidia or Other Chip Stocks

Companies / Tech Stocks Jun 14, 2019 - 08:03 AM GMTBy: Stephen_McBride

What do an iPhone and Nike sneakers have in common?

What do an iPhone and Nike sneakers have in common?

Both are made by iconic American companies. Both are also made in China.

American goods used to be made in America. Then cheap labor transformed China into the “world’s factory.”

Today we get 80% of our air conditioners, 70% of TVs, and 60% of shoes from China. But there’s one disruptive area that America still dominates.

Stocks in this area can produce huge profits (or losses) depending on how the US-China trade war shakes out. In fact, I picked a safe chip-making company as one of my three favorite disruptor stocks for 2019.

The Last Great “Made in the USA” Industry

It’s computer chips.

As you may know, computer chips serve as the “brains” of electronics like your phone and laptop.

These days, chips are no longer just in computers and phones. They’re part of everyday life.

Not long ago there was only a handful of chips inside the average car. Remember when you had to crank a knob by hand to roll your car window up?

Thanks to computer chips, that’s all changed. There are 1,500 computer chips packed into a Tesla Model 3 electric car, according to investment bank UBS.

No Country Can Challenge America in Chips

American companies like Intel (INTC), Qualcomm (QCOM), and Nvidia (NVDA) control over half of this colossal $469-billion market.

Chip demand has surged 15X over the past decade. As the use of computer chips has exploded, so has the revenue they generate.

Since 2009, Intel’s revenue has more than doubled. While Nvidia’s has surged 240% and Qualcomm’s has jumped 120%.

Computer chips are the US’s third-largest export, according to the Semiconductor Industry Association (SIA).

No country has been able to challenge America’s superiority in computer chips. The reason is their complexity. Computer chips are one of the most complicated and costly things on earth to develop.

It took American companies decades and hundreds of billions of dollars to master chip-making. It will likely take another decade, at least, for any other company to catch up.

The Achilles’ Heel of American Chip-makers

Despite their stranglehold on the market, US chip-makers have a big vulnerability.

They get over 80% of their revenues from other countries, according to SIA. Worse, more than half comes from China.

China is by far the world’s largest buyer of computer chips. It bought almost 60% of all the computer chips America produced last year, according to “Big 4” accounting firm PWC.

China spent $260 billion on computer chips in 2018. It now spends more on buying chips than it does on oil. That’s astounding when you consider it’s also the world’s #1 buyer of oil.

It’s scary how reliant many American chip-makers are on China…

Radio-frequency firm Skyworks Solutions (SWKS) gets 25% of its revenue from China.

Chinese companies account for close to two-thirds of 5G leader Qualcomm’s sales.

And graphics chip leader Nvidia (NVDA) gets 44% of its sales from China.

Doing business in China has been great for these companies. It’s been a main source of their tremendous sales growth over the past decade.

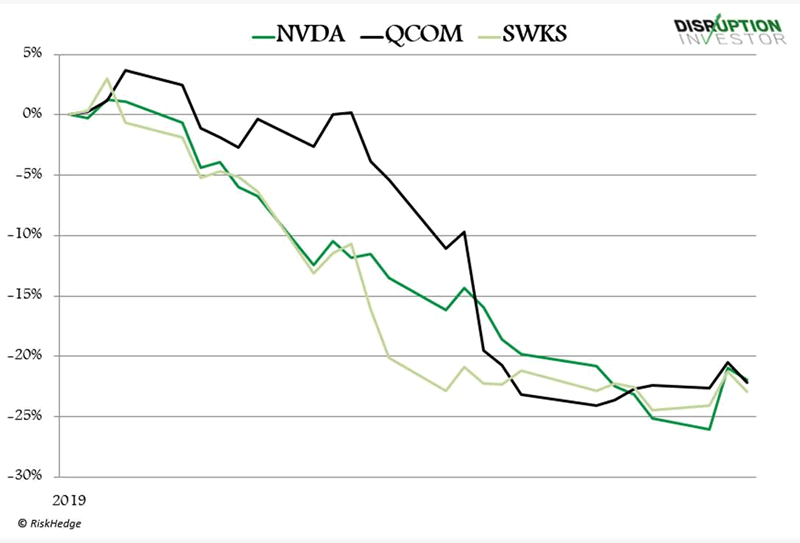

But with the “trade war” between the US and China getting worse, worried investors are dumping their stocks, as you can see here:

This Is a MUCH Bigger Problem for China than for the US

China’s largest and most important companies have a hopeless dependency on US chips.

As I mentioned last week, smartphone giant Huawei spent $20 billion on US chips alone last year. Almost every phone it makes runs on American chips.

China needs US chips, and the US Government knows it. That’s why Trump is using it to twist China’s arm in trade tasks.

Last summer, the US ordered a ban on chip sales to phone maker ZTE (ZTCOY). Without access to US chips, ZTE had to shut down production.

When I say “shut down,” I mean literally. Its factories had to stop making phones. ZTE, which employs over 75,000 people, was dead in the water without US chips.

Its stock plunged 55% in weeks. ZTE was on the verge of going out of business until the White House lifted the ban a couple of weeks later.

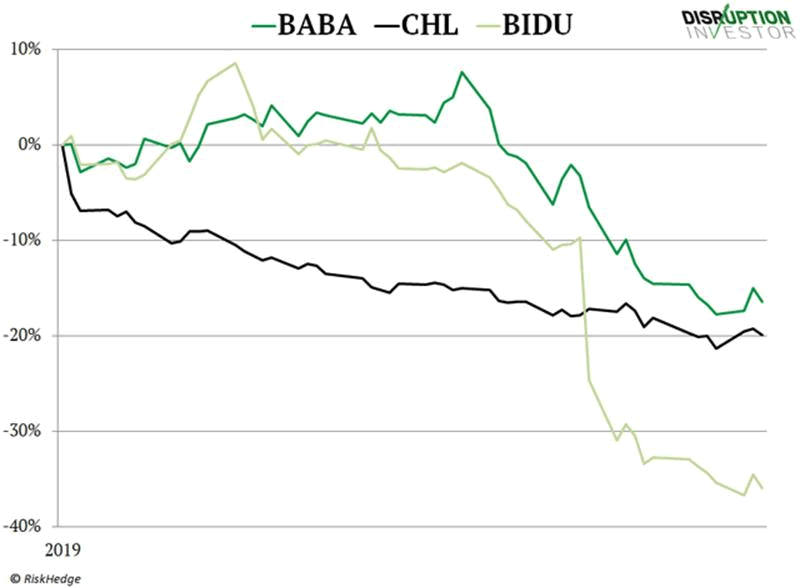

As you might know, China has its own versions of many big American companies.

Baidu (BIDU) is China’s Google. Alibaba (BABA) is China’s Amazon. China Mobile (CHL) is China’s AT&T.

All three are massive buyers of US chips. The US Government knows it can suffocate them by cutting off supply.

Look at how their stocks have crashed lately as trade talks have fallen apart.

Chip Stocks Will Be a Rollercoaster as Long as the Trade War Drags On

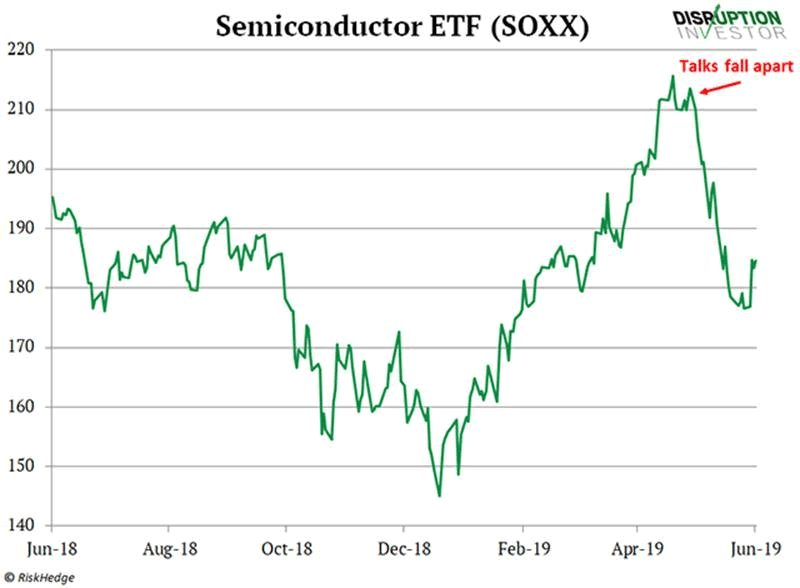

When a US-China trade deal looked to be headed in the right direction late last year, the US chip ETF (SOXX) shot up 48%.

But since talks fell apart in late April, it’s plunged more than 15%.

With such a huge number of their businesses linked to China, little will change until a deal gets signed.

Until then, I’m being cautious with American chip stocks and avoiding the Chinese companies dependent on them altogether.

Why invest in a company that could be crippled at the whim of a politician?

On the other hand, there’s hope this may help the US and China arrive at an agreement sooner rather than later.

China needs American computer chips. There’s no way around it. The optimistic take is that it has little choice but to “play ball” with America to get trade flowing more freely again.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.