Gold Price Breaks to the Upside

Commodities / Gold & Silver 2019 Jun 12, 2019 - 03:41 PM GMT COMEX speculator positions post largest single gain on record

COMEX speculator positions post largest single gain on record

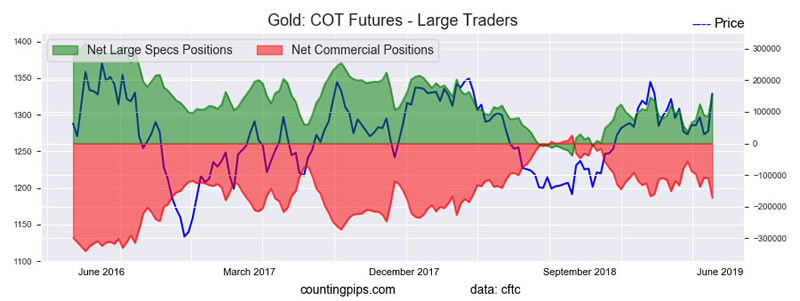

Gold suddenly broke to the upside on the morning of Thursday, May 30th, 2019. After rising nearly $70 – a 5.4% gain and eight-straight days of posting gains, it took a breather on news that Mexico would take steps to stem migrant flow to the United States, thus avoiding the imposition of new tariffs. We asked Zac Storella from Counting Pips, a widely-acknowledged expert on the COMEX Commitment of Traders reports, what he saw in last week’s numbers. His response is worth noting:

“This week’s change in speculative positions (Commitment of Traders) for gold jumped by a total of +69,427 net contracts. This is the largest one-week gain on record, according to the CFTC data dating back to 1986. The current net position (long positions minus short positions) is now at the most bullish level in over a year – showing that sentiment for gold is coming back into favor.

Speculator sentiment is and has been an important aspect to a strong gold price. Speculators are generally trend-followers (buying higher prices, selling lower prices) and on a running three-year basis, we have found a strong correlation between speculator net positions and the gold price.

The week’s change did include a healthy amount of speculators covering their short positions as the total number of short positions fell by -23,413 contracts. However, the stronger case for gold is that almost twice as many long contracts positions were initated (+46,014 long contracts) compared to the short covering. With a combination of new long positions and declining short positions, any which way you look at it, this was a strong week for gold and gold bulls.“

Mish Shedlock summed up the psychology at the heart of gold’s upside move. “Some view gold as an inflation hedge. It isn’t,” he said at his MishTalk blog. “Gold is a hedge against the notion that the Fed has things under control. Gold fell from $850 an ounce in 1980 to $262 an ounce in 1999 with inflation every step of the way. People believed Greenspan, the great ‘maestro’ had everything under control. It was an illusion. Faith in central banks is about to be tested again.”

Similarly, in this year’s edition of In Gold We Trust, Incrementum’s Ron Stoferle and Mark Valek say that “Gold looks to a future in which the natural value of this unique precious metal is once again fully appreciated. In our opinion, the currently high trust granted into the skills of central bankers and the supposed strength of the US economy are the main reasons for the somewhat weak development of the yellow metal. If the omnipotence of the central banks or the credit-driven record upswing is called into question by the markets, this will herald a fundamental change in global patterns of thinking and help gold to old honors and new heights.”

Update from Billionaire’s Row

Billionaire Stanley Druckenmiller has been in and out of gold in recent years. He generally has a positive view of the metal and spoken favorably about owning it on a number of occasions. Apparently, he was one of those mysterious “investors” mentioned in countless press reports over the past few weeks who moved into safe havens. “When the Trump tweet went out, I went from 93% invested to net flat, and bought a bunch of Treasuries,” Druckenmiller told Bloomberg referring to the May 5 tweet from President Donald Trump threatening to increase tariffs on China. ‘Not because I’m trying to make money, I just don’t want to play in this environment.” . . . Druckenmiller says Treasuries are “the best game in town . . . “Gold’s not bad either,” he adds.

Ray Dalio, another billionaire with an interest in gold, once said: “If you don’t own gold, you know neither history nor economics.” Market Realists reports Dalio’s Bridgewater Associates, the world’s largest hedge fund, as having increased its gold positions over the last few months. “Bridgewater Associates,” she writes, “didn’t have any major positions in gold ETFs until the second quarter of 2017. By the end of the third quarter of 2017, GLD formed 3.18% of the fund’s portfolio. Dalio likes gold due to its diversification and hedging properties. In a LinkedIn post last August, Dalio wrote, ‘If you don’t have 5–10% of your assets in gold as a hedge, we’d suggest that you relook at this. Don’t let traditional biases, rather than an excellent analysis, stand in the way of you doing this.'”

Electrum Group’s Thomas Kaplan is another billionaire who subscribes to gold ownership for longer-term fundamental (supply and demand) and economic reasons. “I like those things where the scarcity is assured,” he told Bloomberg in a Peer-to-Peer interview recently. He also said that the yellow metal was on the cusp of a new decade long bull market capable of lifting it ultimately to between $3000 and $5000 per ounce.

Still firing on all cylinders: China’s physical gold market

“While headlines may be on the Sino-US trade war,” says Bullion Star’s Ronan Manly, “China’s gold market continues to fire on all cylinders, with physical gold continuing to flow into, and through, the world’s largest gold hub. Year-to-date, Chinese wholesale gold demand is on a par with recent years, Chinese central bank gold purchases have officially recommenced after a two-year halt, and gold import data into China is now more transparent than ever before.”

China still leads the world in physical gold demand and it is no small number: Year to date 688 tonnes have moved from the vaults of the Shanghai Gold Exchange into the hands of Chinese investors. At that pace, China will have imported over 2000 tonnes of physical gold by the end of the year, an amount equal to 61% of annual global mine production. “Therefore,” says Manly, “2019 is shaping up to be another very strong year for Chinese gold demand as physical gold continues to move from West to East.”

Regime change for the Fed – honest rates

James Grant, the editor of Grant’s Interest Rate Observer, recently delivered a speech in acceptance of the 2019 Bradley Prize in Washington, D.C. He was honored along with two other recipients – The New Criterion‘s Roger Kimball and Judge Janice Rogers Brown. The Bradley Prizes honor scholars and practitioners whose accomplishments reflect The Lynde and Harry Bradley Foundation’s mission to restore, strengthen and protect the principles and institutions of American exceptionalism. The following is an excerpt from that speech:

“The trouble is that the costs of radical monetary policy are dark and prospective; the gifts they bestow are bright and immediate. Those gifts are likewise transitory. Over-encumbered businesses finally fail, inflated asset prices ultimately revert to lower, more reasonable levels. The dividends and the yields that income-needy people have stretched sadly prove illusory. New federal regulations follow hard on the Congressional hearings called to ventilate society’s rage at the bankers — not the central bankers, mind you — who brought down the chaos.

What’s to be done?

An overhaul of the Ph.D. standard, for starters. The 700 doctors of economics on the Fed’s payroll seem not to understand the limitations of economic modeling or the relevance of the financial past. Send them to NASA, which is where they wanted to work in the first place. Replace them with a half dozen historians, a couple of philosophers and a physician. The historians would study the recurring patterns of economic and financial affairs, the philosophers would contemplate the true nature of money and the physician would repeat at intervals, ‘First do no harm.’”

The New York Sun/James Grant speech . . . . . Also, see Grant’s Interest Rate Observer

A coming financial crash as bad or worse than 1929 or 2008

James Rickards is out with a new book titled “Aftermath–Seven Secrets of Wealth Preservation in the Coming Chaos.” “The Bernanke choice of stoking asset price inflation via zero rates and QE is not something that can be reversed without a great deal of pain,” he says in an interview with R. Christopher Whalen. “Once you make that trade-off between promoting inflation and future market instability, you have no way out. You’re much better off taking the pain and accepting a lower level of economic growth in the short-run rather than deferring the pain but creating far larger asset bubbles down the road. There is no way out of the Bernanke policy choice without bigger bubbles and much larger market crash that results. This is why I believe that we face a financial market crash as bad or worse than 1929 or 2008.” Ricards’ positive views on gold ownership are well-known.

The ignore them, then panic dynamic

“Healthy markets,” writes Doug Noland (Credit Bubble Bulletin), “would adjust and correct to reflect heightened uncertainties and deteriorating prospects. Speculative markets instead promote excess and the ongoing accumulation of imbalances, maladjustment and impairment. There’s no operable release valve. Pressure builds and builds – risks accumulate in all the wrong places – Then Panic. The flaw in contemporary finance – especially within market psychology over recent years – is to believe central bankers have nullified market, economic and Credit cycles. They have certainly averted a number of market crises over recent years, in the process significantly extending cycles. Along the way, risk market participants grew greatly overconfident in the capacity of central bankers to permanently forestall crisis. Moreover, they have turned completely blind to the historic crisis festering just below the surface of their delusional view of a ‘Permanently High Plateau’ of global peace and prosperity.”

In his famous work on financial bubbles – Extraordinary Popular Delusions and the Madness of Crowds – Charles Mackay writes “We find that whole communities suddenly fix their minds upon one object, and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.” But before the millions move on, they are generally relieved of a generous portion of their wealth. . . .Unless, of course, they have taken pains to properly hedge the financial madness of the era (or found the discipline to avoid it altogether). Most of the delusions covered in Mackay’s work are built on the misguided belief that the new and enlightened era had rendered the age-old market cycle obsolete. It never does. . .

By the way, Michael Lewis, the financial journalist, rates Mackay’s book one of the six great studies in economics in league with the work of Adam Smith, Thomas Malthus, David Ricardo, Thorstein Veblen, and John Maynard Keynes. It is featured at our Gold Classics Library here.

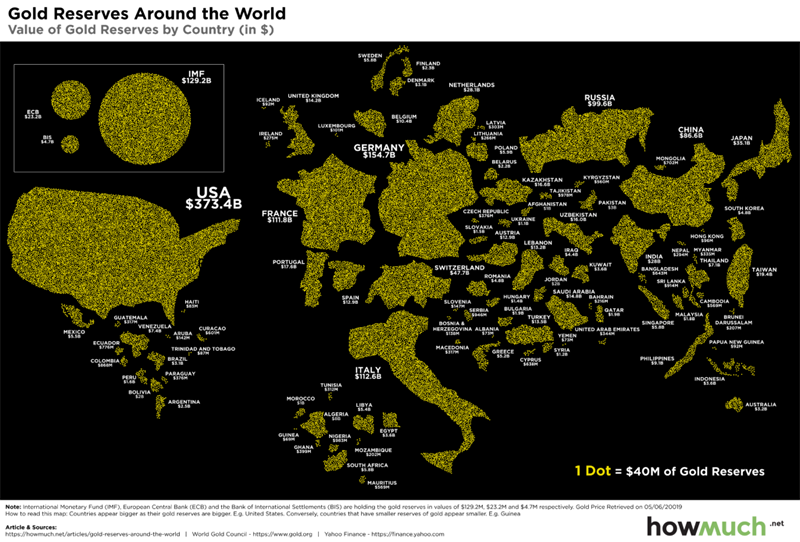

“In 2010,” says HowMuch, “the world’s central banks stopped selling gold and started accumulating it. As gold provides a hedge against economic uncertainty and currency manipulation, the action of these central banks gives us insight as to which countries are most capable of handling an economic storm. . .A common theme in economics is ‘those who own the gold make the rules.’ Recent statistics suggest a large disparity between the top gold holders in the world and those governments holding less of the yellow metal.”

Visualization courtesy of HowMuch.net

East Asian states contemplate gold-backed common currency

“Malaysian Prime Minister Mahathir Mohamad,” reports Reuters, “mooted the idea of a common trading currency for East Asia that would be pegged to gold, describing the existing currency trading in the region as manipulative. Mahathir said the proposed common currency could be used to settle imports and exports, but would not be used for domestic transactions.”

If East Asian states were to agree to a gold-backed currency, it would present an immediate challenge to the yen, dollar and yuan as a reserve asset particularly when you blend in the region’s cultural affinity for gold. “The currency that we propose,” Mahathir says, “should be based on gold because gold is much more stable.”

Mahathir’s proposal raises a question. Where will the gold come from to back this new currency? Local production could become one source – a slow and tedious process for building reserves as China and Russia are finding out. Still, it would likely take production from those countries off the market. Where the market could really get a major boost, though, is from open market purchases – something that might be required to achieve the desired end Mahathir envisions. The fact that such a currency is even being discussed shows how far gold has come over the last five to ten years – a time featuring massive repatriations, a virtual halt to central bank sales and outright acquisitions by a number of nation-states and/or their central banks for reserve purposes.

The next downturn could see a radicalization of the policies used during the financial crisis

“Essentially,” writes CNBC’s Jeff Cox, “the view is that next time around policymakers will go even further. That means the use of ‘Modern Monetary Theory’ — in which even more government debt is used to spur growth — along with negative interest rates and the possible step of distributing ‘helicopter money’ or direct cash from central banks like the Federal Reserve.”

We’re not making this up, folks. And a large number believe that there is nothing wrong with the mad-hatter policy alternatives just listed. If you do not believe that a gold hedge might be the personal policy position of the future than perhaps you aren’t paying attention. In a recent Gallup poll, 43% said they believe socialism would be a good thing for America

Why Judy Shelton’s views on gold would be good for the Fed

Normally, we do not worry ourselves and our readers about the appointment of Federal Reserve Bank governors. We kind of take those appointments as they come – for better or worse. The situation with Judy Shelton’s possible appointment, though, should be a matter of more than casual interest to gold owners. I say that not just because she has been a staunch advocate of the gold standard. Shelton, if approved, would bring a thorough understanding of gold to the Governor’s table at a time when the world’s views toward the metal are rapidly changing – and in particular with respect to its treatment as a central bank reserve asset.

Cato Institute’s Lawrence H. White tells us that Nobel laureate Robert Mundell was a major influence on Shelton’s thinking. We should remember that when Mundell, often referred to as the ‘Father of the Euro,’ advised Europe on the euro, he did not recommend a gold-backed euro. Rather he advised that gold should play a role as a freely-priced, marked-to-market central bank reserve asset to hedge currency risk – much in the way that ordinary investors treat gold in their private portfolios. Europe did as Mundell suggested.

Gold was once a pariah in central bank circles. Paul Volcker referred to it as “the enemy” of central bank monetary policy. Now, with many nation states building their gold reserves, others repatriating metal held overseas, and the new de-dollarization movement that encourages central bank gold ownership, that is all changing. As a matter of fact, it could be argued that the nation states now acquiring gold are doing so precisely for the reasons Mundell advocated. Perhaps the time has come for the United States to change its official viewpoint as well. After all the United States does own some 8000 tonnes of the metal. Properly marked to market, it would create a very large asset on the national balance sheet – nearly $400 billion at $1500 per ounce.

“A heterodox appreciation for the classical gold standard, and a desire to see the Federal Reserve perform at least as well, should not be grounds for disqualification from a seat at the table where monetary policy is made. After all, that is what is presently at stake: one seat out of seven. The Board of Governors nomination process is not a referendum on restoring the gold standard, and there is no risk that one Governor today can restore the gold redeemability of the US dollar when Alan Greenspan never did so in more than 18 years at the helm.” – Lawrence H. White, the Cato Institute

Silver Eagle sales on strong pace for 2019 – up 40% over last year

(USAGOLD-May 1, 2019) – The U.S. Mint reports sales of American Eagle gold and silver bullion coins running ahead of last year’s pace at the end of May. Silver Eagle sales have been notably robust – up 40.39% over the same period last year with 866,000 one-ounce coins sold in May as opposed to 380,000 sold in May of last year. Gold Eagle sales are up 8.33% over the first five months of last year. Month over month, Gold Eagle sales were down significantly from May of last year when 24,000 ounces were sold as compared with 4000 ounces this year. Silver Eagle sales, on the other hand, were more than double sales for May of last year.

Many analysts consider bullion coin sales a bellwether for overall interest in the precious metals among investors. This year’s uptick over last year indicates increased activity among American investors interested in including gold and silver in their holdings as safe-haven hedges and an underpriced asset class with that latter motivation particularly striking in the Silver Eagle category.

NotableQuotable

“The gold trade is shining bright. Investors rushed into the commodity on Thursday, pushing it to a four-month high. Gold is now just 1% away from its 52-week intraday high of $1,349.80 from February, and TradingAnalysis.com’s Todd Gordon believes it may soon surpass that level. After examining the charts, he says bullion could climb as high as $1,500.” – Todd Gordon, TradingAnalysts.com (CNBC interview)

“An epic gold bull market is on the menu for 2019. I’m not talking about a garden-variety cyclical gold bull market, but rather one of the biggest gold manias in history. This gold mania will be riding the wave of an incredibly powerful trend… the re-monetization of gold. The last time the international monetary system experienced a paradigm shift of this magnitude was in 1971.” – Nick Giambruno, Casey Research

“Investors should brace for market turmoil over the next 12 months. That’s the warning from Morgan Stanley’s cross-assets team, who says their cyclical indicator has flipped to ‘downturn’ from ‘expansion,’ a shift that has historically led to weaker returns for stocks and other risky assets, along with an elevated chance of a recession. In a note dated on Sunday, the bank advised market participants to go on the defensive, eschewing U.S. stocks for the safety of Treasurys and cash.” – Sunny Oh, MarketWatch

“We have found that gold typically thrives amid deeper, longer-lasting and fundamentally driven bear markets, which are usually associated with a deteriorating macroeconomic outlook. Alternatively, gold’s performance is usually tepid when equities rise. A good analogy is home insurance: homeowners pay an insurance premium each year hoping the house doesn’t burn down, but if it does you redeem the policy. Here, we see gold’s “insurance characteristics” as becoming increasingly relevant for investors. But even if the insurance is not needed, gold could still offer value. If the US dollar slides (which we expect), emerging economies become wealthier while mining costs increase. Prices could therefore advance irrespective of US inflation, making gold more than just an insurance asset.” – Wayne Gordon, UBS Wealth Management

“Why own gold? Because it makes sense, within a properly diversified portfolio, to have portfolio insurance. If you own a home, it makes sense to have fire insurance. Your investments are no different. And gold is now back, more relevant than ever. Since the start of the millennium gold, as expressed across a wide variety of currencies, has generated average annualised returns of over 9%.” – Tim Price, Master Investor

“We remain positive on the outlook for gold. First, the decline in gold prices came to a halt above and relatively closely to the 200-day moving average, and thereafter prices bounced higher. This is a positive development from a technical point of view, and strengthens our case that gold prices will rally towards the end of this year. Our year-end target is USD 1,400 per ounce.” – Georgette Boele, ABN Amro

“I always find it quite surprising that many people do not have a proper idea about the value performance of gold. So let’s take a closer look at it. In the period 1970 to 2018, for instance, the annual increase in the US dollar price of gold (per ounce) was 9.9 per cent on average. Subtracting the annual increase in consumer prices (which was around 4 per cent per annum on average), the real increase in the price of gold was 5.9 per cent per year on average. That said, gold’s long-term value performance looks pretty good.” Polleit believes that “there is good reason to expect that gold’s value performance in the years to come will match, perhaps even exceed, the one seen in the last 50 years.” – Thorsten Polleit, Degussa’s Market Report

“The received wisdom is mistaken on how recessions are made. They are not simply caused by shocks. They are caused by a window of vulnerability in the economic cycle where the cyclical drivers of the economy have weakened to the point where it’s susceptible to a negative shock. Within that window of vulnerability, virtually any reasonable shock becomes a recessionary shock. That’s how you get a recession.” – Lakshman Achuthan, Economic Cycle Research Institute

“This is clearly a panic move triggered by the stockmarket breaking down below key support – the intention is to head off a stockmarket crash, but it looks unlikely to succeed because they have much less room to drop rates than they had back in 2008, however, what they are likely to succeed in doing is breaking the dollar down into a severe bear market, and a storm is already bearing down on the dollar due to the accelerating global trend to dedollarize which has been given added urgency by the US administration’s overt bullying of enemies and allies alike by means of sanctions, tariffs and in some cases the threat of military action. This is why gold has been rallying, and this time it does not look like it will be a false dawn – instead it appears to be the start of a major breakout drive that will see gold launch out of its gigantic 7-year long base pattern by breaking out above key resistance at the $1400 level, a development that we have been anticipating all this year.” – Clive Maund, technical analyst

“History shows that countries in conflict have seen that such conflicts can easily slip beyond their control and become terrible wars that all parties, including the leaders who got their countries into them, deeply regretted, so the parties in the negotiations should be careful that that doesn’t happen. Right now we are seeing brinksmanship negotiations, so it is a risky time.” – Ray Dalio, Bridgewater Associates

“Almost two-thirds of those surveyed [Swiss citizens] consider precious metals to be a ‘sensible’ form of investing; one-fifth plan on investing in precious metals in the next 12 months . . . wealthier respondents were more likely to own precious metals and were more likely to say they would buy precious metals in the next 12 months; just shy of two-fifths cited ‘security’ as being the reason for investing in precious metals.” – Alistair Hewitt, World Gold Council

“Throughout history financial bubbles have only been recognized in hindsight when their existence becomes ‘apparently obvious’ to everyone. Of course, by that point far too late to be of any use to investors who have already suffered a significant destruction of invested capital. This time will not be different. Only the catalyst, magnitude, and duration will be. Believing the ‘Fed has it all under control’ has historically been a bad bet.” – Lance Roberts, Real Investment Advice

“Start then with inflationary fire. Much of what is going on right now recalls the early 1970s: an amoral US president (then Richard Nixon) determined to achieve re-election, pressured the Federal Reserve chairman (then Arthur Burns) to deliver an economic boom. He also launched a trade war, via devaluation and protection. A decade of global disorder ensued. This sounds rather familiar, does it not? In the late 1960s, few expected the inflation of the 1970s.” – Martin Wolf, Financial Times

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.