Notice Savings Accounts Prosper as Interest Rates Rise to Seven-year High

Personal_Finance / Savings Accounts Jun 03, 2019 - 02:41 PM GMTBy: MoneyFacts

As a method to entice new savers, providers have improved their notice accounts over the years, and the latest wave of activity has led to a rise, not just in the rates on offer for the top deals, but also to the average market rate. This is positive news for consumers looking to secure a decent return without locking in to a fixed rate bond.

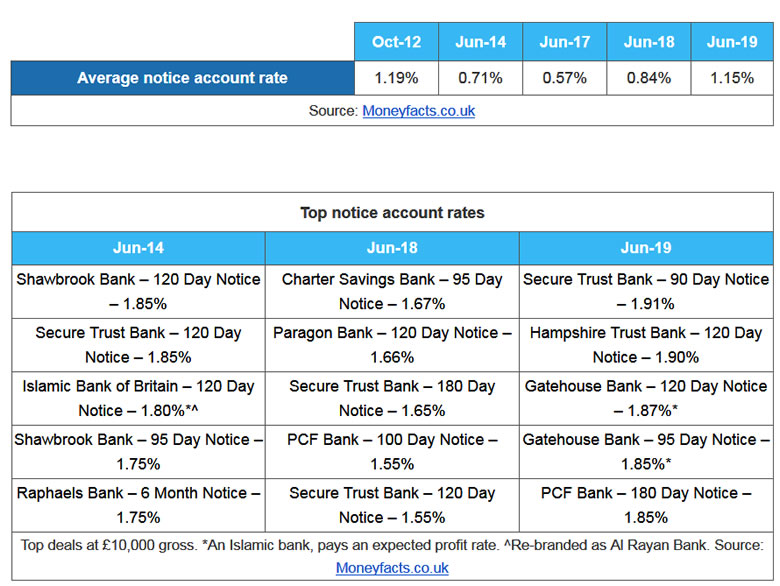

Indeed, the latest analysis by Moneyfacts.co.uk shows that the average notice account rate has risen to 1.15%, the highest seen since October 2012 when it stood at 1.19%. The current top five notice account rates in the market have also improved, now paying 1.88% on average, up from 1.62% a year ago and 1.79% five years ago (based on a £10,000 deposit).

Savers will also be able to beat the Bank of England base rate more easily with a notice account than with an easy access account, as 81% of the market pay more than 0.75%, a stark difference to just 37% of the easy access market.

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“Despite easy access accounts remaining a firm favourite among savers, it would be unwise for consumers to overlook the competition that has been occurring within the notice account market. Indeed, notice accounts typically offer higher returns and these deals may be more attractive to those who want to avoid dipping into their savings on a frequent basis – thanks to their requirement to give notice of withdrawal.

“Savers will also find more deals that beat the current bank base rate by choosing a notice account, as today 81% of the notice account market will offer an interest rate above 0.75%, and compared to the easy access account market where only 37% do the same, that’s a significant difference.

“Indeed, in the past 12 months alone, the average notice account rate has increased by 0.31% – from 0.84% to 1.15% – and many of these top rates continue to be on offered by challenger banks or Islamic banks. These brands have fuelled the market with a spate of activity to gain the attention of savers who may be looking for a new home for their cash and the general structure of a notice account is easier to manage the flow of funds compared to an easy access account where they could lose any deposits overnight.

“Today the top rate requires savers to give 90 days’ notice, which is a shorter timeframe than a year ago and pays 0.24% more comparing the top rate. Indeed, last year the top rate on offer paid 1.67% on a 95-day notice account from Charter Savings Bank, which is lower than the top deal today, a 90-day notice account from Secure Trust Bank paying 1.91%. In 2014, the top trio of deals required savers to give 120 days’ notice to access their cash, but the market-leading rate today requires 30 days less notice.

“Clearly, there is now much more choice of top rates within the notice account market and, as it continues to prosper, savers would do well to consider this type of savings vehicle and not overlook the less familiar brands who offer the most lucrative returns.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.