What Will Trump’s Immigration Fight Cost You?

Economics / Immigration May 28, 2019 - 09:01 PM GMTBy: Rodney_Johnson

Just like investors tend to buy high and sell low, politicians tend to react to most major issues (ahem… immigration) by doing the wrong thing at the right time.

Just like investors tend to buy high and sell low, politicians tend to react to most major issues (ahem… immigration) by doing the wrong thing at the right time.

It’s no secret that almost all developed countries, and China in the emerging world, are slowing in workforce and demographic growth – many outright declining. Rodney talked about this just last Thursday. Five of the six smaller ones (which include Australia and New Zealand) that aren’t have one thing in common: strong and high-quality immigration.

You would think, with clearly predictable further slowing in demographic trends, that the developed countries would be competing for the best global immigrants. But most are restricting or fighting against it just as we need them the most. The U.S. fought against immigration going into the Great Depression. It’s doing it again now…

Immigration is slowing down…

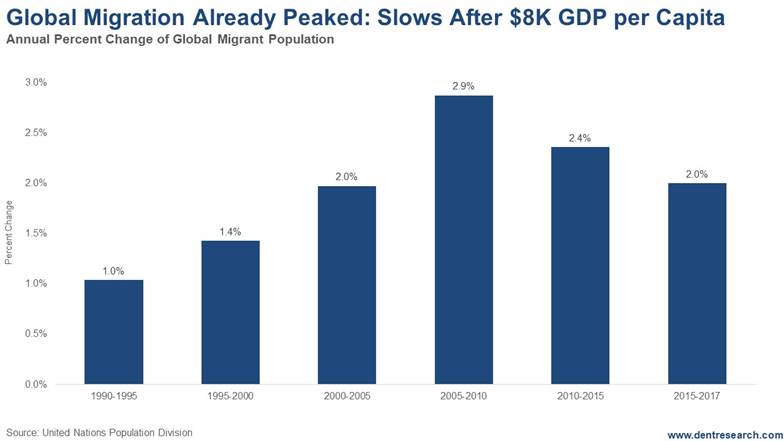

The global migrant population is already slowing and peaked in 2005-10. Immigration into the U.S. peaked in 2001. And with the lowest number of births recorded in the U.S. since 1987, this spells trouble.

Look at this chart…

This should be a long-term trend as emigration slows after countries reach $8,000 GDP per capita PPP (purchasing power adjusted). The Factfulness book I so highly recommend also shows that life expectancy sees most of its acceleration by $8,000 GDP per capita. It doesn’t take a lot for people to have a decent and longer life and have less motivation to migrate, which is both costly and disruptive.

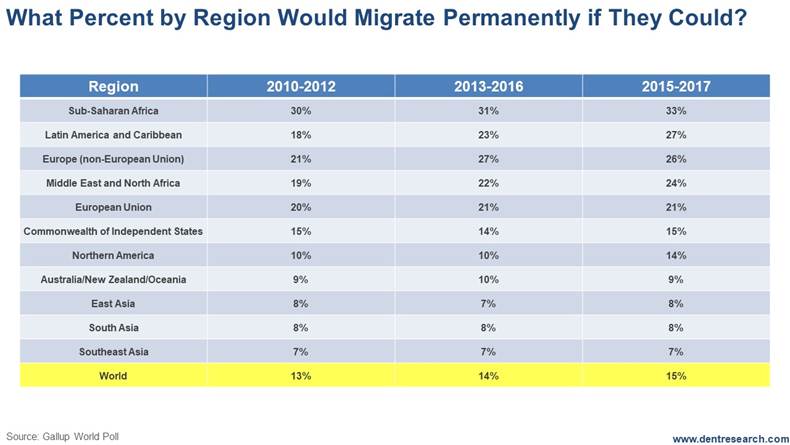

A recent Gallup poll showed that over 750 million people globally would emigrate permanently to another country if they could. This next chart shows where the highest percentages are by major global regions.

Not surprisingly, the highest, at 33%, came from the poorest region, Sub-Saharan Africa; followed by Latin America, non-EU Europe, and the Middle East/North Africa.

The surprise…

The surprise here is that the wealthier EU is the highest in the developed world, at a whopping 21% with North America second at 14%.

Note that numbers in North America have risen dramatically from 10% to 14% since Trump got elected… go figure!

The very highest percentage countries, where the most people would emigrate if they could, are the poorest ones, including Haiti, El Salvador, Honduras, the Congo, and Nigeria. However, they’re not necessarily the immigrants we would want to go after. To have a positive impact on our economy, we need more of the educated and ambitious immigrants.

That means we should encourage immigrants from China, Southeast Asia, India, the EU, East Europe, Puerto Rico, Chile, Argentina, and Mexico. Unfortunately, these countries are wealthier than their peers and will have fewer and fewer such candidates looking to move to America in the future.

Attract immigrants or die…

But we’ve got to figure something out, especially with the severity of the Baby Bust we’re experiencing. It’s simple: Attract immigrants or slowly die.

More importantly, attract skilled immigrants, and make the path to America clear and legal. We should emulate countries like Australia, New Zealand, Canada, and Singapore, who have effective immigration policies.

So, write to your congressperson. Send them this article. If we all say something, maybe someone in government will hear and begin to do the right thing at the right time. Our country – and your future wealth – depends on it.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.