The Exter Inverted Pyramid of Global Liquidity Credit risk, Liquidity and Gold

Commodities / Gold & Silver 2019 May 14, 2019 - 04:54 PM GMT In a recent edition of Credit Bubble Bulletin, Doug Noland, the long-time critic of contemporary monetary policy, writes about the odd times in which we live from a financial perspective. “Such a precarious time in history,” he laments. “So much crazy talk has drowned out the reasonable. Deficits don’t matter, so why not a trillion or two for infrastructure? Our federal government posted a $691 billion deficit through the first six months of the fiscal year – running 15% above the year-ago level. Yet no amount of supply will ever impact Treasury prices – period. A Federal Reserve governor nominee taking a shot at ‘growth phobiacs’ within the Fed’s ‘temple of secrecy’, while saying growth can easily reach 3 to 4% (5% might be a ‘stretch’). Larry Kudlow saying the Fed might not raise rates again during his lifetime. Little wonder highly speculative global markets have become obsessed with the plausible.”

In a recent edition of Credit Bubble Bulletin, Doug Noland, the long-time critic of contemporary monetary policy, writes about the odd times in which we live from a financial perspective. “Such a precarious time in history,” he laments. “So much crazy talk has drowned out the reasonable. Deficits don’t matter, so why not a trillion or two for infrastructure? Our federal government posted a $691 billion deficit through the first six months of the fiscal year – running 15% above the year-ago level. Yet no amount of supply will ever impact Treasury prices – period. A Federal Reserve governor nominee taking a shot at ‘growth phobiacs’ within the Fed’s ‘temple of secrecy’, while saying growth can easily reach 3 to 4% (5% might be a ‘stretch’). Larry Kudlow saying the Fed might not raise rates again during his lifetime. Little wonder highly speculative global markets have become obsessed with the plausible.”

In that essay, Noland goes on to note having been influenced by the highly regarded Dr. Kurt Richebacher (1918-2007). Although he actually worked directly with the Austrian economist/banker, my connection came only as an appreciative reader of the Richebacher Letter (in pre-internet times) and his Wall Street Journal editorials. Richebacher concerned himself regularly with the interplay between financial market credit leverage, ordinary investors and the real economy. Please see International Precious Metals & Commodities Fair – Munich, Germany Transcript of Dr. Kurt Richebächer’s Lecture (USAGOLD, November 19, 2005). In re-reading that lecture, I am struck with how much of Richebacher’s analysis at the time can be applied to the present and a very similar set of circumstances. Now that Noland has acknowledged Richebacher’s influence, it explains to a large degree why his writings – like the snippet above – strike a chord with those of us concerned with the financialization of the markets.

In this context, we reproduce at the top John Exter’s famed Inverted Pyramid of Global Liquidity. Exter, who was an economist at the Federal Reserve and highly-respected analyst, made a fortune by purchasing gold just before Richard Nixon’s devaluation of the dollar in 1971 and its rapid ascent in the ensuing decade.

“His pyramid,” explains Capital Wealth Advisor’s Lewis Johnson, “stands upon its apex of gold, which has no counter-party risk nor credit risk and is very liquid. As you work higher into the pyramid, the assets get progressively less creditworthy and less liquid. For instance, paper money here means cash, which is recognized everywhere but is ultimately dependent upon the creditworthiness of the U.S. government. Farther up the pyramid, we find longer-dated U.S. government debt, which like cash is dependent upon the full faith and credit of the U.S. government – but on a longer time horizon. The next level is debt of municipals and corporations, whose value is more safely assured than that of more junior claims, such as investments in stocks, the junior tranche of a corporation’s capital structure. A rough estimate of the global liquid financial markets would place their value close to $100 trillion. This number grows further still as less liquid assets are added, such as private businesses, real estate and ultimately bank derivatives, the largest and murkiest of all assets.”

In a credit crisis, he concludes, “this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up.” In short, what Lewis Johnson outlines is the bottom-line rationale for diversifying one’s portfolio with gold.

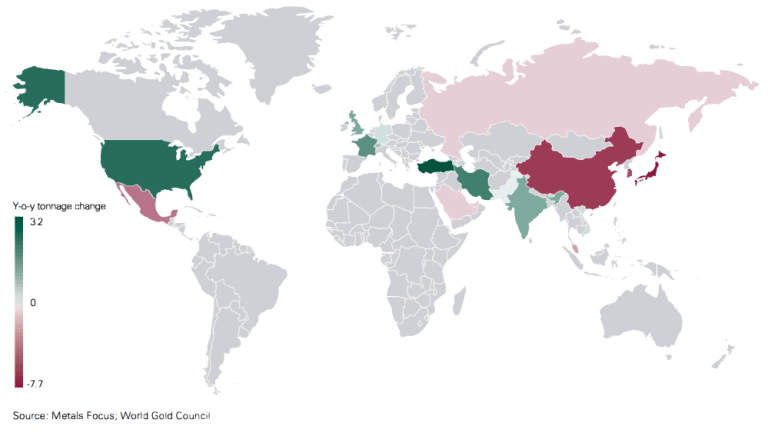

U.S. gold bar and coin demand up 38% over last year

Map courtesy of the World Gold Council

The World Gold Council reports U.S. bar and coin demand rose 38% over the past year (through the first quarter). Global central banks and financial institutions drove physical gold demand the past 12 months raising once again the question if professional investors know something that retail investors do not. As the map above illustrates, the United States ranked at the top globally for growth in gold coin and bullion demand over the past year, while Asian demand fell back. Most of the U.S. demand, as previously mentioned, originated with funds and institutions, not individual private investors.

Here’s the World Gold Council’s summary of demand trends through the first quarter of 2019:

“Central banks bought 145.5t of gold, the largest Q1 increase in global reserves since 2013. Diversification and a desire for safe, liquid assets were the main drivers of buying here. On a rolling four-quarter basis, gold buying reached a record high for our data series of 715.7t. Q1 jewellery demand up 1%, boosted by India. A lower rupee gold price in late February/early March coincided with the traditional gold-buying wedding season, lifting jewellery demand in India to 125.4t (+5% y-o-y) – the highest Q1 since 2015. ETFs and similar products added 40.3t in Q1. Funds listed in the US and Europe benefitted from inflows, although the former were relatively erratic, while the latter were underpinned by continued geopolitical instability. Bar and coin investment softened a touch – 1% down to 257.8t. China and Japan were the main contributors to the decline. Japan saw net disinvestment, driven by profit-taking as the local price surged in February.”

JP Morgan study ranks gold second best investment over the past twenty years

J.P. Morgan Asset Management released a report recently ranking investments over the past twenty years. It shows gold as the second best performer over the period at a 7.7% average gain annually. REITs (Real Estate Investment Trusts) were number one at a 9.9% gain. Stocks ranked fourth at 5.6%.

Why a 60%-65% stock market loss would be run-of-the-mill

Though the presence of bearish sentiment on stocks is widely acknowledged, it is also generally ignored. Too many believe that even if the stock market tumbles, it will quickly recover as it did after the 2007-2008 credit debacle. There is another scenario – the 1929 example – where the market does not return to peak values for decades (See chart below). “One might view the very comparison of present stock market conditions to 1929 market peak as exaggerated and preposterous, but then, one would be wrong,” says John Hussman of Hussman Funds, “The fact is that on the valuation measures we find most strongly correlated with actual subsequent long-term and full-cycle market returns across history (and even in recent decades), current market valuations match or exceed those observed at the 1929 peak.”

Chart courtesy of MacroTrends.com

Why the U.S. needs to encourage Americans to hold gold

We have always believed that citizen ownership of physical gold is in the national best interest, not just the best interest of its accumulators. In the event of a worldwide economic breakdown or a realignment of the global monetary system, it would be good for the country to have a storehouse of gold held by the populace. China encourages citizen gold ownership for precisely that reason.

“With a growing number of countries encouraging their central banks and citizens to acquire gold,” writes The Federalist‘s Sean Fieler, “it is increasingly reasonable to assume that gold will be part of the world’s monetary future, not just its past. The U.S. Treasury should embrace policies that will attract more of the world’s gold to America and better position our citizens and our nation for whatever the monetary future may hold.”

German citizens own a staggering 8918 tonnes of gold

Along these lines, Bullion Star‘s Ronan Manly published a stunning revelation that the German people have accumulated a “staggering” hoard of gold – 8918 tonnes – a hoard larger than that held by the United States government. The German central bank owns another 3370 tonnes, the second largest official sector holding after the United States.

In reading Manly’s analysis, we were reminded of the old aphorism – Those own the gold make the rules. “While the Chinese and Indian populations are well known for their insatiable appetite for importing, buying and hoarding physical gold,” he says, “there is one market in the West that does likewise but which flies under the radar slightly, garnering less attention than China and India. That gold market is Germany. Although German citizens are known for their fondness for holding gold, the vast size of the German population’s gold holdings was clarified recently in a newly published survey commissioned by Reisebank, a bank active in the German precious metals market.”

American Eagle bullion coin sales up sharply over last year

The U.S. Mint reports sales of American Eagle gold and silver bullion coins running well ahead of last year’s pace at the end of April. Gold Eagle sales were up 49.6% over the first four months of last year. Silver Eagle sales were up 35.2% over the same period. Month over month, Gold Eagle sales were nearly double the sales from April of last year. Silver Eagle sales were up 31% over March of last year. Many analysts consider bullion coin sales a bellwether for overall interest in the precious metals among investors. This year’s strong uptick over last year indicates increased activity among American investors interested in including gold and silver in their holdings as safe-haven hedges and an underpriced asset class.

OECD indicator flashing danger ahead

The Organization for Economic Co-operation and Development (OECD) measures consumer confidence in various economies including the United States. A reading above 100 indicates a positive outlook toward the future economic situation. Values below 100 reflect a more pessimistic outlook. As you can see, we are now at a level in consumer confidence that has signaled downturns in the past. In fact, consumer confidence is now ahead of where it was just before the 2008-2009 recession and just below the level it registered before the dot.com stock market bust in 2000.

Why gold could rise for the next ten years

Bert Dohmen, editor of the Wellington Letter, called the twenty-year bear market in gold that began in 1981 and ended in 2001. Now in Forbes article, he reminds us not only of that call but the one that went with it. “The second part of our forecast in 1981 said that according to our very long-term cycle study, that bear market would be followed by a 30-year rise in gold. We even said we had no idea what would cause it, but the cycles said it should happen. If the forecast I made in 1981 still holds true, gold could have a continued secular bull market until 2030. That means the gold bull market could have about 11 more years to go. Historically, the final phase of a bull market is the most spectacular.” [Emphasis added]

The lesson is one as old as the gold market itself: The best time to buy is when the market is quiet – a strategy that requires both discipline and conviction. As an old friend and client of USAGOLD used to say (he passed away years ago): “It is not a question of if, but when.” He accumulated a large hoard of the metal in the 1990s and early 2000s between $300 and $600 per ounce and lived to see his prediction come true. His estate though was the ultimate beneficiary of his wisdom. He was not one to sell gold once he had acquired it. We chatted regularly on the phone back then and I told him that I had used the story just told in one of my newsletters. He was in his late 80s at the time. “Tell them,” he said resolutely, “that I bought my first ounce of gold at $35.”7

NotableQuotable

“This single cosmic event, close to our solar system, gave birth to 0.3 percent of the Earth’s heaviest elements, including gold, platinum and uranium. ‘This means that in each of us we would find an eyelash worth of these elements, mostly in the form of iodine, which is essential to life,’ [Astrophysicist Imre] Bartos said.” – Carla Cantor, Columbia News

Editor’s note: And economists wonder why humanity has a dogged attachment to the barbarous relic. . . . .Was it Carl Sagan who used to say that “we are made of star stuff”?

“Gold should be about 15% higher over the next year and the basic reason is that eventually the US dollar is going to stop going up. At the same time with all these trade wars and confrontations between major powers of the world, Russia, China, the United States, there is a case for diversification away from dollars and the central banks are doing that. One of the things they are diversifying into is gold. I would say we like gold in the commodity space.” – Mark Matthews, Julius Baer

“Presently, cryptocurrencies seem to be marred by intellectual contradictions. Why does anyone think, for example, that crypto is a good payment mechanism or store of value when transactions are clunky and the value of a bitcoin has swung from $20,000 to $5,000 in the past 18 months?” – Gillian Tett, Financial Times

“All of the FED’s tools are failing to halt a race to buy physical gold as insurance. And there is only one source of no counterparty risk insurance that can hedge against a meltdown and preserve capital, and that is physical gold and silver. This insurance is now so artificially depressed that natural forces alone will cause the price of gold to rise rapidly…” – Andrew Maguire, London metals’ trader and analyst at King World News

“Federal Reserve officials are considering a new program that would allow banks to exchange Treasurys for reserves, a move aimed at ensuring liquidity during difficult times that also would help the central bank decrease the size of its nearly $4 trillion balance sheet. . . . In some quarters, the idea is viewed as a natural extension of current Fed policy. Others, though, think it in essence could be a repackaged form of quantitative easing and thus yet another iteration of the Fed’s decade-long tinkering in financial markets.” – Jeff Cox, CNBC

“I’m adamant that even the most diehard gold bug should have some capital in the US stock market, bonds, and real estate. Even if it’s just 10% of a gold bug’s portfolio, it’s important for all investors to hedge their bets.” – Stewart Thompson, 321Gold

“Financialization is the smiley-face perversion of Smith’s invisible hand and Schumpeter’s creative destruction. It is a profoundly repressive political equilibrium that masks itself in the common knowledge of ‘yay, capitalism!’. Financialization is a global phenomenon. In China, it’s transmitted through the real estate market. In the US, it’s transmitted through the stock market. Financialization is the zombiefication of an economy and the oligarchification of a society.” – Ben Hunt, Epsilon Theory

“The 7% increase in price [predicted recently by the Silver Institute] that is forecast to occur, if it will materialize, will be the beginning of a sustained silver price boom, which might last decades. The supply/demand dynamics make it imperative for this to happen, which is why I have been steadily buying physical silver in the past few years.” – Zoltan Ban, Seeking Alpha

Editor’s note: We will remind our readers too that when silver moves to the upside, it tends to move in grand fashion.

“They are snapping up the metal at the fastest rate in almost half a century in a trend that looks set to continue. Over the 12 months through March 31, they purchased a whopping 715.7 metric tons of gold bullion worth around $29.4 billion, according to a recently published report from the industry group World Gold Council.” – Simon Constable, The Street

“Xi said China would keep the Chinese currency stable within a reasonable range, but would not engage in any ‘beggar-thy-neighbour’ currency devaluation, one of the criticisms of the US towards China. . .Amid concerns that China had failed to live up to its reform pledges, Xi said, ‘China treasures its promises and commitments with a thousand taels of gold.’” – Teddy Ng and Lee Jeung-ho, South China Morning Post

“[Investing Haven’s Taki] Tsaklanos expects ‘the gold market to build up energy during the summer.’ Any breakthrough, he predicts, ‘is likely going to happen in October or November, and it would pave the way to $1,550.’” – Myra Saefong, MarketWatch

“Financial professionals frequently opine that asset prices are a function of economic conditions. Assets like stocks, bonds, and real estate rise in value when the economy is expanding. They fall in value when the economy contracts. The problem with those statements is that they represent a flawed understanding of 21st century credit cycles. In particular, recessionary pressures did not cause the tech wreck (2000-2002) nor the housing collapse (2008-2009). Rather, the bursting of each asset bubble sparked the recession that followed.” – Gary Gordon, Seeking Alpha

“Congressional Republicans are led on a short leash by a president who, as a candidate, vowed to not touch entitlement programs that are significant drivers of the deficit, and who breezily promised to eliminate the national debt (currently $22 trillion) in eight years. (Today, that would mean eight reductions of $2.75 trillion, a sum equal to 63% of the fiscal 2019 budget.) Republicans, now thoroughly disarmed concerning the issue of fiscal probity, struggle to frighten the 2020 electorate with the specter of spendthrift socialists threatening the Republic.” – George Will, TribLive

“In our business there is no place for certainty. With that in mind, I like to quote Henry Kaufman, who was the chief economist at Salomon Brothers. He said that two kinds of people lose a lot of money: ‘Those who know nothing and those who know everything.’ So, at best, the future is merely a probability distribution of future events. All you can do is get the odds on your side.” – Christopher Gisiger, DAS Interview

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.