The Fed Can’t Ease Interest Rates Until Stocks Collapse…

Interest-Rates / US Interest Rates May 02, 2019 - 03:48 PM GMTBy: Graham_Summers

Yesterday’s Fed meeting had one clear message:

Yesterday’s Fed meeting had one clear message:

The Fed needs a reason to cut rates.

The Fed has obviously laid the ground work for a rate cut by hinting at easing… but with the “official” GDP numbers at 3.2% and inflation under 2%… the Fed doesn’t have a clear reason to ease just yet.

It will soon… and that reason is going to be a stock market collapse.

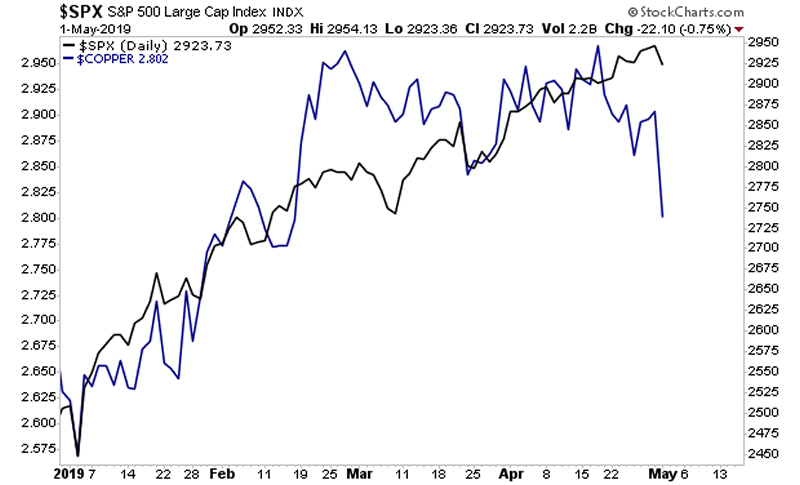

We are getting clear signals that the global economy is rolling over. Copper, perhaps the most economically sensitive asset in the world, has collapsed. Check out the divergence between Copper (blue line) and Stocks (black line).

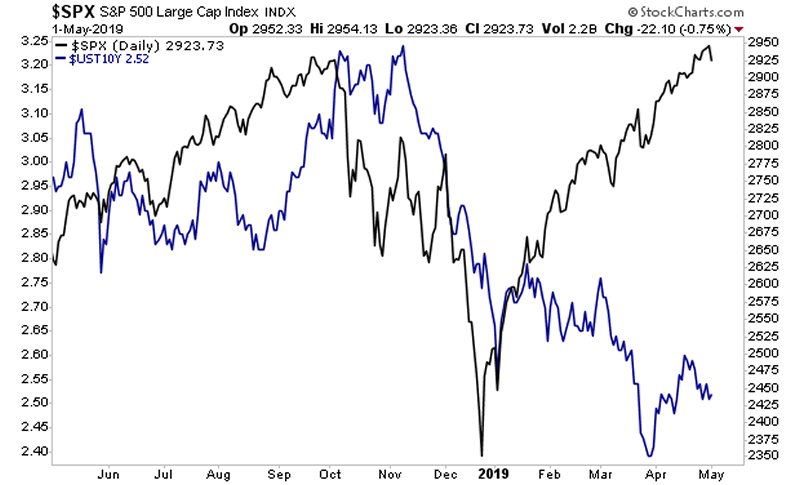

The divergence is even larger between stocks and bond yields. Remember, bond yields trade based on economic growth. Based on the below chart, the entire move in stocks since the December low was based on hopes of easing/liquidity from the Fed, NOT economic growth.

Stocks are in for a MAJOR surprise.

And when that surprise hits, it’s going to be too late for investors who weren’t paying attention. While everyone was distracted by the stock market, the Fed has been implementing plans to completely annihilate capital once the next downturn hits.

Did you know the Fed is reviewing monetary policies so extreme that it didn’t use them during the 2008 crisis?

Did you know the IMF is calling for nations around the world to introduce a wealth tax of 10% on NET WEALTH as soon as possible?

It’s all part of a nefarious plan the elites have been implementing for years.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.