Gold – US Dollar vs US Dollar Index

Currencies / US Dollar Mar 16, 2019 - 05:21 AM GMTBy: Kelsey_Williams

When it comes to analysis of gold, the U.S. Dollar Index finds nearly universal acceptance. Or rather, when most analysts refer to comparison/correlation of the U.S. dollar to gold, they usually illustrate their point with a chart of the U.S. dollar index.

When it comes to analysis of gold, the U.S. Dollar Index finds nearly universal acceptance. Or rather, when most analysts refer to comparison/correlation of the U.S. dollar to gold, they usually illustrate their point with a chart of the U.S. dollar index.

While they won’t say it straight out, most of them see the U.S. Dollar Index as a proxy for the U.S. dollar. But, is it? From Wikipedia…

“The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” (value) when compared to other currencies.”

The “basket of foreign currencies” used are: Euro, Japanese yen, Pound sterling, Canadian dollar, Swedish krona, Swiss franc.

Nowhere is there any reference to gold. The only thing the U.S. Dollar Index tells us is how the U.S. dollar compares to a select group of other currencies. It tells us nothing about gold.

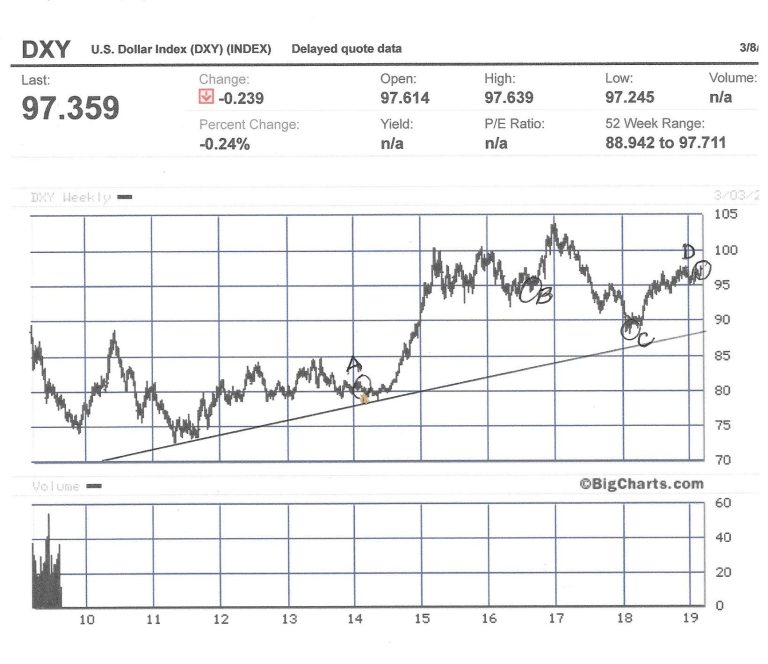

Below is a chart of DXY reflecting its price over the past ten years…

In February 2014 (point A on the chart) DXY (U.S. Dollar Index) was priced at 80. The price of gold at that time was $1328.00 per ounce.

More than three years later, in August 2016 (point B), the DXY had increased by more than seventeen percent to 94. Logically, one would assume that over that period of time, a change of such significance in the U.S. Dollar Index would be reflected in the price of gold.

In this particular example, the increase in the (relative) dollar value, is expected to be reflected by a lower price for gold.

However, that was not the case. Gold in August 2016 was priced at $1328.00 per ounce, the same price as three years earlier.

In February 2018 (point C), just over one year ago, DXY had retreated to 88. But the price of gold was again at $1328.00 per ounce.

Just recently (point D), DXY has increased to a nearly two-year high of 97. Gold’s price at the time – you guessed it – $1328.00 per ounce.

For the entire five-year period from point A to point D, there is an increase in DXY from 80 to 97, or twenty-one percent. Even so, the price of gold, net of all expectations, changes, and volatility remains unchanged at $1328.00 per ounce.

What does this tell us about gold? Absolutely nothing.

Which is the point. The U.S. Dollar Index tells us nothing about gold. It only reflects changes in the exchange rate of the U.S. dollar versus a mix of other paper currencies.

If we truly want to know how the U.S. dollar is doing relative to gold, all we need to do is look at the price of gold itself.

The price of gold at any given moment tells us exactly what the value of the U.S. dollar is, and how much it has declined over the years. And gold’s price includes people’s cumulative, current perceptions of – and expectations for – the U.S. dollar.

Furthermore, that is ALL that the price of gold tells us. Gold’s price is the inverse reflection of what is happening to the value of the U.S. dollar. And since the U.S. dollar is continually declining over time, the price of gold in U.S. dollars continues to rise over time.

There are periods of relative strength and stability in the U.S. dollar. During such periods of time, the price of gold will decline. We are in one of those periods now; and have been since August 2011.

No matter what your expectation for the price of gold, it will only come to pass if your expectations are consistent with changes in value of the U.S. dollar.

lf you are convinced that gold’s price is going higher, then it will only happen to the degree that the U.S. dollar declines in value.

If you are expecting stable, or lower gold prices, then it will occur only if the U.S. dollar maintains or improves its relative strength.

The U.S. dollar is terminally ill. It is currently in a state of remission which can (will) reverse at any time, with a vengeance.

But it may surprise you how long its current strength and stability lasts.

(also see: Gold, It’s Still All About The U.S. Dollar)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2019 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.