Will the US Dollar Drown in an Ocean of Debt?

Currencies / US Dollar Sep 24, 2008 - 12:40 PM GMTBy: Gary_Dorsch

About $3.6 trillion of market value was wiped-out from global stock markets in the three-days between Sept 15-17 th , triggered by the bankruptcy filing by Lehman Brothers, and fireworks in the $62 trillion credit default swap market. The collapse of Bear Stearns, Merrill Lynch's eleventh-hour flight for safety into the arms of Bank of America, and the meltdown at American International Group, were all linked to credit default swaps on mortgages that led to the fall of these titans.

About $3.6 trillion of market value was wiped-out from global stock markets in the three-days between Sept 15-17 th , triggered by the bankruptcy filing by Lehman Brothers, and fireworks in the $62 trillion credit default swap market. The collapse of Bear Stearns, Merrill Lynch's eleventh-hour flight for safety into the arms of Bank of America, and the meltdown at American International Group, were all linked to credit default swaps on mortgages that led to the fall of these titans.

Investors pulled-out a record $144.5-billion from US money-market funds on Sept 17 th , and yields on three-month US Treasury bills plunged to 0.02%, the lowest since World War II, after the Reserve Primary Fund became the first money-market fund in 14-years to “break the buck” and exposed investors to losses. The TED Spread, the difference between US Treasury bill and Eurodollar rates, soared to a record 3.13%, far above average of 0.90% over the past two years.

The panicked selling in money market funds was directly linked to the seizing up of the credit markets - including a $52 billion contraction in commercial paper - and rumors of additional money market funds “breaking the buck,” or dropping below $1 net asset value. The Fed injected $250 billion of liquidity worldwide on Thursday during European trading hours to head-off an avalanche of sell orders that could have brought large tracts of the US credit markets to a complete halt.

“The US was literally days away from a complete meltdown of our financial system, with all the implications here at home and globally,” said Senator Christopher Dodd. Around 3-pm on Sept 18 th , US Treasury chief Henry Paulson leaked word to CNBC that a massive government led bailout of the banks would soon be launched. Speculators scrambled to cover short positions in financial stocks, fueling a 1,000-point advance in the Dow Jones Industrials from the depths of hell.

Traders on the floor of the New York Stock Exchange erupted into cheers, as word spread of a grand Treasury plan to unclog the arteries of the banking system and prevent the US economy from suffering a fatal heart attack. But the US-dollar began to suffer a massive hangover from the Treasury's plan due to a soaring debt burden. The $700 billion the US Treasury is seeking from Congress to buy toxic mortgages comes at a time when the federal budget deficit is already soaring.

The US budget deficit for the year that begins Oct 1 st is expected to hit $482 billion, a record in dollar terms, but Goldman Sachs predicts the number could reach $586-billion, if tax revenues slow. It does not include $300 billion for the Federal Housing Administration to refinance failing mortgages into new, reduced-principal loans with a federal guarantee, passed as part of a broad housing rescue bill. Federal takeovers of Fannie Mae, Freddie Mac, and AIG, the central bank's expansion of lending to financial firms will add $455 billion to borrowing demands.

And at least $87 billion in repayments to JP Morgan for underpinning trades with bankrupt investment bank Lehman Brothers is also part of the taxpayer tab. It's not certain if the entire $700 billion the Treasury is seeking to soak-up bad mortgages will be needed. But when all the numbers are tallied up, in the worst-case scenario, the US government's borrowing demands could reach $1.8 trillion in fiscal 2009, or about 13% of US gross domestic product .

President George Bush's secretive Working Group on Financial Markets, (aka: the infamous “Plunge Protection Team” – PPT) will be working overtime, pulling all the strings at their disposal, in order to find a way to prevent a tsunami of new government debt from swamping the bond markets, and sending interest rates sharply higher. But the US government's choices are clear - either increase taxes to cover the debt, instruct the Federal Reserve to print more money to inflate the debt away, or allow interest rates to rise sharply to attract overseas lenders.

The Fed opted for monetization on Sept 19 th , when it printed $69 billion out of thin-air, in order to buy debt issued by Fannie Mae, Freddie Mac and Federal Home Loan Banks through primary dealers. According to the Fed, the agency discount notes amount to about 5% of the assets of the money market mutual fund industry, so the step was an effort to firm up this market, and prevent money funds from falling under $1 /share. Word of the Fed's monetization sent the Euro soaring 3.5 US-cents the next day to a high of $1.4825.

The amount of US Treasuries outstanding has been rising at a rapid clip, and stands at $9.6 trillion, up from $4.5-trillion when President Bush took office in 2000. The cost of servicing the interest on the debt has risen to $400 billion annually. The US Treasury relies heavily on wealthy investors from overseas, who own $2.7 trillion of the Treasury's debt, to help keep US bond yields artificially low.

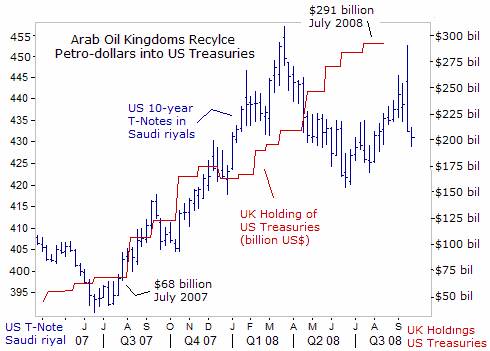

In the first half of 2008, the OPEC cartel collected $645 billion from oil exports, and Saudi Arabia accounted for one-third of that total, raking in $192 billion. High oil prices keep petrodollars flowing into the coffers of the Arabian oil kingdoms, which peg their currencies to the US-dollar. Trading through their brokers in London and Dubai , the Arab oil kingdoms recycled $280 billion into US Treasuries over the past 12-months , to prevent their dollar- pegs from breaking apart.

Throughout the US-dollar's tortuous 40% slide over the past six-years, the Arab oil kingdoms in the Persian Gulf stayed loyal to their US-dollar pegs, even while the Fed's indifference to the sliding US-dollar sent inflation shock waves through their dollar-linked economies. In return, the US armed forces defend the Arab Oil kingdoms from Iran's mullahs, who are close to acquiring nuclear weapons, and are closely aligned with the Kremlin, and Venezuela's mercurial kingpin Hugo Chavez, - forming the “Axis of Oil. However, the cozy ties between the Gulf States and the US Treasury can change, if the Democrats capture the White House in November.

On August 31 st , South Carolina Senator Lindsey Graham reminded the Arab oil kingdoms that Democratic vice-presidential nominee Joe Biden lacked the backbone to stand up to powerful foes or to fix broken governments in the Middle East . “Biden voted against the first Gulf War to evict Saddam Hussein from Kuwait . He opposed the surge in Iraq . He wants to partition Iraq ,” Graham said. If Biden becomes the architect of US foreign policy in the Middle East , the Arab oil kingdoms might flee the US Treasury market, and take the US-dollar off artificial life support.

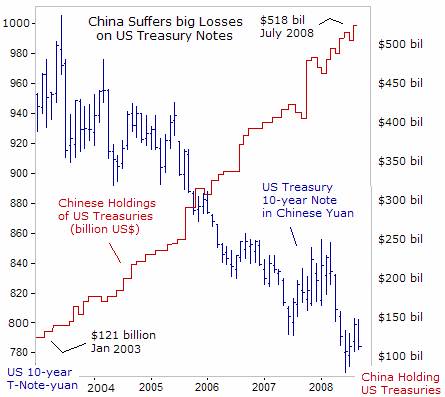

China is the second largest holder of US Treasuries, after Japan , and recycled two-thirds its trade surplus into the US Treasury and agency market. However, Beijing has suffered huge losses on its US debt investments, due to the US-dollar's 18% devaluation against the Chinese yuan since mid-2005. Beijing accepts the pain of holding depreciating US Treasuries, in return for free and unfettered access to the US consumer market, under a gentleman's agreement with the Bush clan.

However, if the Democrats gain control of the White House and Congress, Beijing could come under heavy pressure to speed-up the devaluation of the dollar against the yuan, or face big tariffs on its exports to the United States . Beijing could respond by dumping US Treasuries, thereby driving US mortgage rates higher and crippling the US banking system and real estate market.

Big changes in US foreign policy in the Persian Gulf and towards China , could dry-up the flow of capital to the US Treasury markets from abroad, at a time when it's needed the most. Worse yet, the Arab oil kingdoms and China could become net sellers of US Treasuries in the year ahead, if the Democrats enact a hasty US-troop withdrawal from Iraq, or fashion protectionist legislation aimed at Beijing.

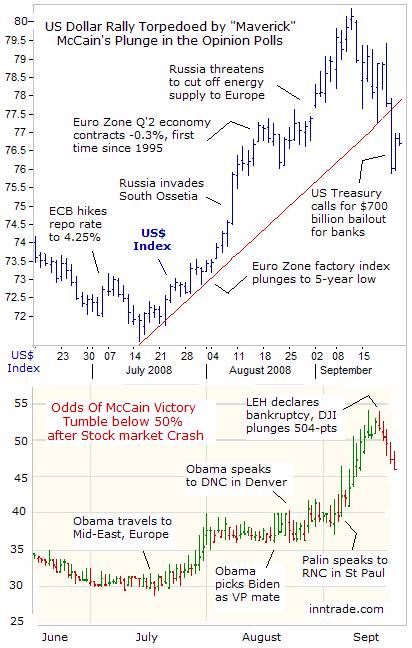

Republican nominee, John “Maverick” McCain is expected to continue the Bush administration's defense and trade policies with the Arab Oil kingdoms and Beijing , in return for the recycling of Petro-dollars and China 's trade surplus into US Treasuries. Therefore, expectations over the outcome of the upcoming US presidential elections, set for Nov 4 th , are having a big impact on the value of the US-dollar Index. Traders are tracking McCain's odds of winning the election at www.inntrade.com

If “Maverick” McCain loses the upcoming elections, pundits can point to his erratic and unbalanced performance during the chain of events that unfolded on Sept 15-17 th , - the demise of Wall Street giants Lehman Brothers and Merrill Lynch, the nationalization of AIG, the 1,000-point meltdown in the Dow Jones Industrials, and the nation's largest money market fund “breaking the buck,” which tarnished his “commander in chief” credentials in a time of crisis.

As a result, McCain watched his 4-point lead in the opinion polls, swing into a deficit of 3-points. In Dublin, Ireland's on-line betting parlor, where traders buy and sell futures contracts based on the odds of the eventual winner, the odds of McCain winning the White House fell 8-points from a week ago to 46% today, while the odds of Barack Obama residing in the White House, jumped 6-points to 52-percent.

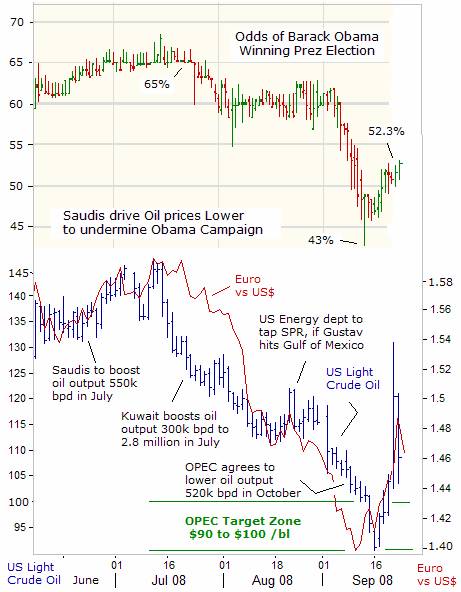

The Saudis would like to see “Maverick” McCain as commander in chief of the US-armed forces next year, and are trying to extinguish any sudden spikes in the crude oil market ahead of the US-election. Riyadh is exceeding its official oil output quota by 790,000 barrels per day (bpd), in a determined effort to drive oil and gasoline prices lower, and swing undecided voters to the McCain-Palin ticket.

Crude oil's slide from a record high of $148 /barrel in mid-July, to below $100 /barrel last week, led to a sharp plunge in Obama's odds of winning the election from 65% to just 43%, a sign that the Saudis' magic wand was working. But while the Saudis can control the supply of oil, they can't control speculative demand in the oil futures markets in London and New York , which is driven by the Euro /dollar exchange rate.

The Euro's rebound from a seven month low of $1.400 to as high as $1.4825 this week, enabled the crude oil market to regain its footing. Oil prices soared as much as $26 per barrel on Sept 22 nd , the biggest one-day gain on record , briefly touching $130 /barrel, and boosting Obama's odds of winning the election to 52%. The spike in crude oil to $130 /barrel last for just a few minutes however, before quickly collapsing to $105 the next day.

OPEC chief Chakib Khelil said the direction of world oil prices are still influenced by factors that are beyond the cartel's control. “I repeat that the sub-prime crisis, combined with a weakening of the dollar and a rising movement of speculation, is behind the big rise in oil prices until July 15 th .” Since July 15 th , “there was a drop in prices because of the strengthening dollar. Factors behind the weak dollar include speculation and the injection of liquidity by the Federal Reserve to help banks.”

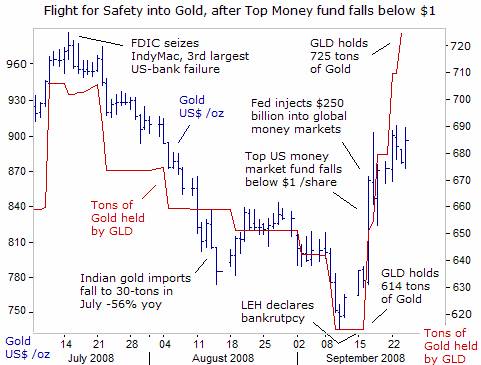

Gold logged its biggest advance ever on Sept 17 th soaring by $120 /oz within a 24-hour span to $900/0z, beating an $85 daily gain from the January 1980 bull market. Investors plowed paper assets into “safe-haven” gold, after the Fed injected $250 billion into the global money markets, by arranging swap agreements with foreign central banks, to get US-dollars circulating and head-off a crazed stampede out of money market funds, which hold $4-trillion. Gold bullion held by the Street-Trackers Gold Trust, ticker GLD, jumped 111-tons to a record 725-tons.

“These measures are designed to improve the liquidity conditions in global financial markets,” the G-7 central banks said. “Central banks work together closely and will take appropriate steps to address ongoing pressures.” Earlier, central banks in Japan , Australia , and India pumped $28 billion into the money markets, and the Kremlin injected $44 billion into Russia 's top banks. On Sept 19 th , the Fed monetized $70 billion of short-term debt issued by Fannie Mae and Freddie Mac.

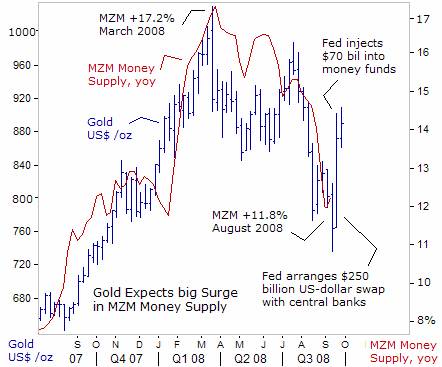

Prior to the Fed's massive money injections, banks were hoarding cash and curbing lending, which in turn, led to a sharp slowdown in the growth rate of the MZM Money supply. MZM is a measure of all liquid money supply that can be immediately redeemed without suffering a penalty or a capital loss. MZM represents all money in M2, including money market funds, but excluding time deposits and CD's.

Gold is a hedge against monetary inflation, or the expansion of the world's money supply, including MZM, which peaked at an annual growth rate of +17.2% in March, before slowing to +11.8% last month. The sharp slowdown in the MZM growth rate, contributed to a $300 /oz correction in the gold market. With gold trading around $890 /oz today, traders are betting the Fed's massive money injections over the past week will be long-lasting and not withdrawn anytime soon.

However, the Fed surprised the currency and gold markets on Sept 24 th , by draining $25 billion out of the US banking system, through reverse repos, capping the gold market at $900 /oz, and knocking the Euro lower. What other tricks does the Fed and the “Plunge Protection Team” have up their sleeves, to keep dollar bears and gold bugs off-balance? What contrarian scenario could support the US-dollar in the weeks ahead? The answers are in the Sept 26 th edition of Global Money Trends.

For now, a dark-grey cloud still hangs over the US-dollar, since it's the only currency that's seriously at risk of monetization by the central bank. “The situation we face here in Europe is less acute and member states do not at this point consider that a US-style rescue plan is needed,” said EU Economic and Monetary chief Joaquin Almunia on Sept 24 th . Mocking the US-government's bailout of Wall Street, European Socialist leader Martin Schulz declared, “Profits are being privatized, losses are being nationalized and that has got to stop. More than ever, the future requires supervisory powers over casino capitalism that never respected anything,” he said.

Kremlin Intervenes in Stock Market, Russian rouble

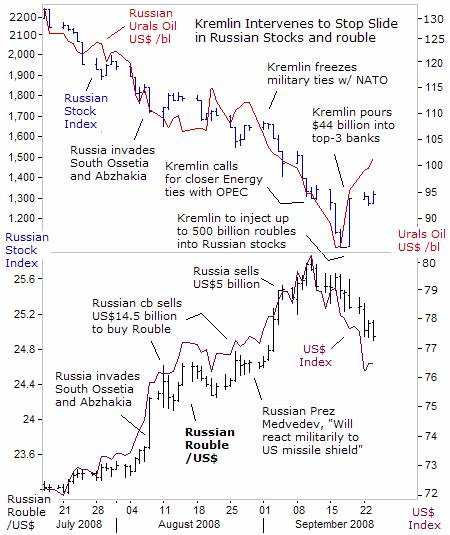

Government intervention in the stock market hasn't been limited to the United States . The Chinese and Russian authorities also ordered their agents to buy local bank shares, in order to put a floor under their stock markets, which lost 60% and 70% respectively, from their peak levels. The Kremlin suspended trading for two days, after a plunge of over 10% last week left the Russian Trading System Index (RTS) down 60% from its all-time high reached in May.

The Russian stock market is enduring its worst slump since the catastrophic economic collapse of 1998, due to a toxic cocktail of global financial turmoil, falling oil and natural gas prices, and a local credit crunch. Russian markets are also paying a big price for the Kremlin's decision to invade South Ossetia , which spurred $35 billion of foreign capital to flee Russia and weakened its currency, the rouble. Even after a bargain hunting rally last Friday, the RTS Index is still more than 50% lower since May, erasing nearly $800 billion in paper value.

But the Kremlin is much better positioned to confront the current crisis than the last time in 1998. With virtually no debt, a budget surplus and more than $550 billion in foreign currency reserves, and $172 billion in an oil trust fund, Moscow can prevent a run on banks and contain the financial turmoil. T he Kremlin offered $44 billion in emergency loans to the country's top banks and unveiled a plan to spend as much as $20 billion more to bolster the market by buying shares.

Russian kingpin Vladimir Putin has re-nationalized key industries and expanded his control over the economy, and the latest emergency measures will result in more state control over the banking sector. While the US government is forced to go deeper into debt to bailout its banks, Russia has a huge surplus to tap for stabilizing its banking system. And the US Congress also wants state-ownership in US-banks, by demanding warrants in exchange for purchases of toxic mortgages.

Buoyed by its vast oil wealth, Putin is shrugging off the worst stock market meltdown in a decade, arguing that Russia 's economy will emerge intact. This time around, oil prices are closer to $110 a barrel, and ten-times higher than in 1998, when the Kremlin's foreign exchange reserves were whittled down to $8-billion. The Russian rouble fell 10% against the deficit-ridden US-dollar since Russia invaded South Ossetia on August 8 th, but simply matched the Euro's 12% slide against the greenback to $1.400. This time around, Russia was able to defend its own currency, by dumping $20 billion dollars from its FX reserves, to prop-up the rouble. The Kremlin would profit from the intervention, if the US-dollar plummets.

If the US dollar's reign as the world's currency is in its twilight, highlighted by the toppling of Wall Street's Titans and America 's endless flow of budgetary red-ink, the Russian rouble would be in a position to strengthen against the dollar, despite its troubles with Western financiers. Putin is salivating at the prospect of an Obama-Biden administration, giving him the keys to create more tension in places like the Caspian Sea and the Middle East , to boost the price of Urals blend crude oil.

This article is just the Tip of the Iceberg of what's available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio for Q'1, 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2008 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.