Credit Crisis Analysis and Conclusions

Stock-Markets / Credit Crisis 2008 Sep 23, 2008 - 06:41 AM GMTBy: John_Mauldin

This week we look at a very solid piece of analysis on the world economy from my friends and London business partners Niels Jensen and Jan Wilhelmsen of Absolute Return Partners ( www.arpllp.com ). I find it is quite useful to read the considered opinions of those from outside the US and particularly from people who have developed keen insight from years in the trenches. Niels and Jan are certainly in that category. The world economy is clearly out of balance and they point out where some of the opportunities and problems lie. I think you will find this edition of Outside the Box quite useful. If you care to, you can write them at info@arpllp.com .

This week we look at a very solid piece of analysis on the world economy from my friends and London business partners Niels Jensen and Jan Wilhelmsen of Absolute Return Partners ( www.arpllp.com ). I find it is quite useful to read the considered opinions of those from outside the US and particularly from people who have developed keen insight from years in the trenches. Niels and Jan are certainly in that category. The world economy is clearly out of balance and they point out where some of the opportunities and problems lie. I think you will find this edition of Outside the Box quite useful. If you care to, you can write them at info@arpllp.com .

From South Africa

John Mauldin, Editor

Outside the Box

Observations on a Crisis

By Niels Jensen and Jan Wilhelmsen

The Absolute Return Letter

September 2008

If a loose monetary policy and rapid asset price inflation were the route to economic prosperity, Argentina would be the richest country in the world by now." Albert Edwards, Co-Head, Global Cross Asset Strategy , Societe Generale

August is my month off. Every year I go to Mallorca where my favourite pastime is the occasional glance at the sea whilst reading a good book. This year Peter Bernstein's 'Against the Gods' was top of the pile. Not that I hadn't read it before. But my last encounter goes back about ten years and I decided that it deserved a re-read. After all, the book is about risk management and few books deal with the subject of risk management better than this one.

I didn't spend many days on the island before I realised that Mallorca was not in its usual ebullient mood. Clearly the credit crunch had started to bite here as well. My friends on the island, most of whom are in the property business, confirmed my casual observation. The banks are tightening they said. Loans which could easily be obtained only six months ago were no longer available.

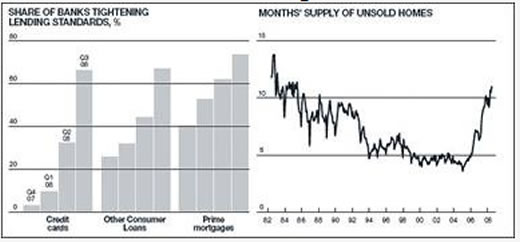

A few days later I ran into an article in the Daily Telegraph which illustrates the magnitude of the problem (see chart 1 below). Although this chart is based on U.S. data, the behaviour of banks around the world is broadly similar. It is clear that tightening lending standards are no longer a phenomenon exclusively linked to property loans. Consumer loans in general, and credit card loans in particular, are now subject to much closer scrutiny.

Chart 1: U.S. Lending Standards

Source: The Daily Telegraph

From my vantage point in the Serra de Tramuntana, I started to philosophise about the roots of the current predicament. How could it possibly go so wrong? Is the end in sight yet? What can we learn from this mess? These are obviously big questions, although the answer to the first question is pretty straightforward, the way I look at things. It all went so terribly wrong because of hubris combined with excessive use of leverage. It is funny how we always think that this time it is different . This time we really figured it out, or so we thought. However, the ever present invisible hand had other ideas.

In short, not just the United States but the entire world is dealing with the implications of a near perfect storm which has created havoc on three fronts - falling asset prices, a weakening capital base amongst financial institutions and high inflation. It is the interaction of these dynamics which explains the mess we are currently in, but it is also here we are likely to find the answers to our questions, so let's jump straight into things:

Observation # 1

It all began with housing and it will end with housing.

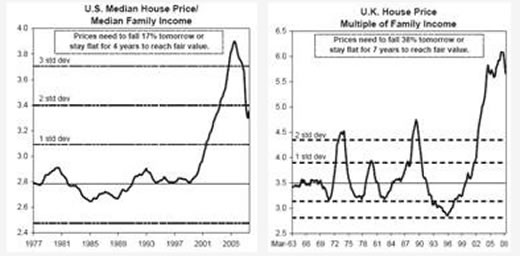

When U.S. home prices began to skid, the damage inflicted was swift and devastating. We know now that that the quality of many loans was poor, causing large write-offs across the industry. With house prices in the US and the UK still well above their long-term averages relative to disposable income (see chart 2 below), there is no reason to believe that they will not continue to fall for quite some time yet. The write-offs will spread from sub-prime to prime and to many other countries as well, a process which has, in fact, already begun. Two criteria must be met before property will start to appreciate in value again - house prices must reach (or fall below) their long term equilibrium values and the current overhang (see chart 1) must be dramatically reduced. All this will take time - years rather than months.

Chart 2: Current overvaluation of U.S. and U.K. homes

Source: GMO Quarterly Letter, July 2008

Observation# 2

Don't trust central banks to always do the right thing.

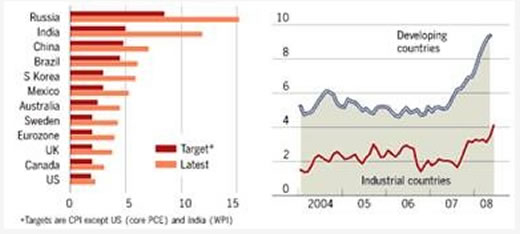

The Financial Times ran an interesting piece back in early August which pointed to the "collective action problem" - i.e. the fact that the right policy for each and every country does not necessarily add up to the right policy for the world 1 . As is evident from chart 3 below, although most countries are currently challenged with significant inflationary pressures, the problem is much bigger in emerging economies than in the 'old world'.

Chart 3: Inflation - Targets and Actual

Source: Financial Times

There is no question that it would be good for the world, should Asian central banks revalue their currencies against both the dollar and the euro. And a great deal of inflationary pressure in Asia could be eliminated through rising exchange rates. Asian countries, on the other hand, insist on using their currencies to grow the economy at an accelerated pace by allowing local exchange rates to be perpetually undervalued. The Europeans and Americans call it cheating. The Asian say mind your own business. Until this attitude is changed, there is little chance of a globally coordinated exchange rate policy which would be to the benefit of everybody.

Observation # 3

Policy mistakes are likely to be repeated.

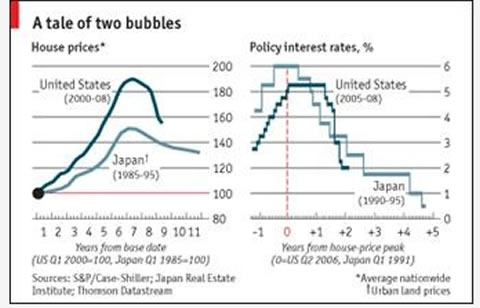

Talking about policy makers, back in 1991, when the Japanese property bubble finally burst, few investors imagined that it would take at least a couple of decades to work off the excesses which had accumulated after years of rising property prices. Some commentators have made the point that the overheating in the Japanese property market was much more severe than anything we have witnessed in the U.S. in recent years, but that is factually incorrect. As pointed out in The Economist last week (see chart 4), residential property prices have actually risen more in the U.S. during the boom years 2000-06 than Japanese property prices did during their boom years in the late 1980s.

Chart 4: The American versus the Japanese bubble

Source: The Economist

Likewise, as far as the monetary policy response is concerned, a case cannot be made that the Japanese were slow to respond to the crisis. If anything, the Bank of Japan reduced the cost of money more quickly than the Fed has done (see chart 4).

What worries me the most, though, is that the Americans, who were extremely critical of the Japanese approach back in the 1990s ("Let the weak banks go out of business" was the advice given by the libertarian Americans) are now at risk of making exactly the same mistake as the Japanese. A number of U.S. banks have capitulated over the past year, and both Fannie Mae and Freddie Mac are in pretty serious trouble at the moment. What do the Americans do? They spend tax payers' money to try and fix something which is unfixable, not at all dissimilar to the policy mistakes made in Japan 10-15 years ago. This could have quite severe implications for U.S. GDP growth for years to come.

Observation # 4

The golden era of investment banks is over.

For the past couple of decades investment banks have been operating like mega hedge funds. An ever larger part of profits has been derived from proprietary activities. I remember once, not that many years ago, when I worked for one of the largest investment banks, it was explained to me that the bank's gearing was around 40-45 times during the month. Then, every month, as we approached month-end, the gearing would be brought down to below 30 in order to satisfy the regulator. I would be surprised if this practice was not widespread, but I would be even more startled if this sort of activity has not been seriously curtailed in the current environment. As markets have frozen, investment banks have had to reconsider their business model.

Obviously, once a new equilibrium has been established, the de-leveraging induced selling will dry up and markets will stabilise. But the banks will be far less profitable. In fact, when you think about it, the historic high level of leverage in the investment banking industry is not the real story. What is truly disgraceful is that investment banks could only manage returns on equity of 15-25% with a balance sheet that was often leveraged to the sky.

Observation # 5

The final shoe hasn't dropped yet.

One of the most heated debates of recent months is whether the commodity bull market of the past year has been driven by economic fundamentals or it is just another case of greed caused by "a couple of handfuls of hedge funds" which seem to get blamed for pretty much everything these days.

Readers of the June 2008 Absolute Return Letter will know our take on it. There is no way that fundamental factors alone can explain the rise in oil prices we have experienced in 2008. That has always been our view and the rather steep drop in the price of oil since I wrote the June letter has only served to reinforce our beliefs that the oil price still has some way to go before the fundamental equilibrium price has been reached.

Despite some masterful attempts to convince us of the opposite, the global investment banks have failed miserably to persuade me that the commodity bull market is (mostly) based on fundamentals. To me, it still represents the last leg of the liquidity super cycle which has been in full vigour ever since Greenspan decided he couldn't distinguish a bubble from a mere bull market.

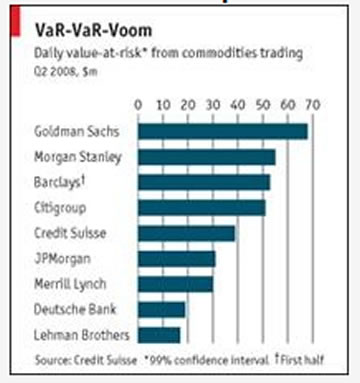

The first shoe that dropped came off the credit leg. Then the property shoe dropped to the ground rather ungracefully and, in recent months, the equity shoe has fallen off as well. Only the commodity shoe is still attached to the four legged beast and only just. What I find most interesting, though, is that the most vocal supporters of the notion that the bull market in commodities is driven by fundamental factors are the same investment banks which stand to lose the most, should commodity markets collapse (see chart). Case closed.

Chart 5: Investment banks' exposure to commodities

Source: The Economist

Observation # 6

Leverage is 'dead' but capital is not.

The global pool of capital continues to be quite strong, primarily driven by a continued rise in the global savings rate. Although American consumers have not yet discovered the need to save more, in other parts of the world, the penny has dropped, and the global savings rate (as a % of global GDP) is well over 20%. This will soften the impact of the crisis as these savings can be made available for new investments.

The question is whether investors around the world have the appetite for allocating this capital to where it is most needed - to re-capitalise the world's banks. As long as asset prices, and most importantly property prices, continue to fall, then investors will fear that we haven't seen the last of the big write-offs yet. And without a re-capitalisation of the large banks, the global economy will only fire on four of its eight cylinders; hence the absolute necessity for property prices to stabilise before we can realistically hope for better times.

Observation # 7

The end of the crisis looks further away than it did a year ago.

As pointed out by Larry Summers in a recent article in the FT 2 , policy makers are still behind the curve, mostly as a result of the commodity-induced rise in inflation which has made it difficult for central banks around the world to stimulate economic growth through a reduction in interest rates.

This view is reinforced by an observation made by Joachim Fels in a recent research paper produced by Morgan Stanley 3 . Fels points out that real short term interest rates (which he defines as the policy rate minus consumer price inflation) are currently negative in 20 of the 36 countries in Morgan Stanley's research universe. Monetary policy is hence more accommodating than many investors realise - particularly in North America, Eastern and Central Europe and across Asia - and there is little room for the authorities to cut rates aggressively.

This brings me back to a point raised earlier. When banks struggle, the usual fix is a steeper yield curve. The simplest way to do this is through a reduction in short term rates. With the yield curve already quite steep in the U.S., the current environment should in principle be conducive to making lots of profit for U.S. banks. The fact that they don't, illustrates the extent of the current problems. Therefore do not expect a further reduction in the policy rate to fix the problem. We are dealing with a different kind of beast in this crisis. An accommodating Fed (or, for that matter, ECB or BoE) won't necessarily make the crisis go away!

Observation # 8

Traditional risk management has lost its way

Last but certainly not least, it has become crystal clear to me that the general approach to risk management has lost all credibility over the past twelve months. Paul McCulley of Pimco touched on the subject in the July 2008 issue of Global Central Bank Focus:

"[...] every levered financial institution - banks and shadow banks alike - decided individually that it was time to delever their balance sheets. At the individual level, that made perfect sense. At the collective level, however, it has given us the paradox of deleveraging: when we all try to do it at the same time, we actually do less of it, because we collectively create deflation in the assets from which leverage is being removed."

As I pointed out in the October 2007 Absolute Return Letter, the issue at heart is that returns in financial markets are not normally distributed, but the risk management tools which are used by pretty much everyone are based on the assumption that they are. In a brand new book authored by Cuno Pümpin and Maurice Pedergnana 4 the authors make the following point:

"The tragedy of the worst financial crisis since the 1930s was enhanced by almost every investment bank, all rating agencies and all bank regulators using the same measurement and the same mathematical risk model for market evaluation of securities. This example shows how dangerous the use of the standard deviation based approach is. If most of the market participants make decisions based on the same risk control of a false distribution assumption, and oversimplified risk model, it could cause a complete failure of the system."

I believe this book is one of the most important new books out this year. Few investors understand risk better than Pümpin and Pedergnana. Unfortunately, the first edition is published only in German. However, the authors are keen to get it translated into English as quickly as possible. I will keep you posted.

Conclusion

With the global banking industry bleeding, with galloping inflation limiting the options of monetary authorities, with house prices showing no signs of recovery and with policy makers set to repeat the mistakes of the past, it is hardly surprising that we find it difficult to be bullish about the economic outlook.

The first stage of the credit crunch is now all but over. Forced liquidations are no longer an everyday occurrence and hence some sort of normality has returned to global markets. The big question going forward is how much damage has been inflicted on the real economy?

Over the summer, the world has gone from being quite sanguine about economic prospects to being very negative. However, the economic data points are all over the place: In Denmark, the leading financial newspaper ran with the following header yesterday: "The economy grows again - the recession has been cancelled."

You'd better get used to this sort of story. There will be several false dawns before we finally come through this crisis. And the recovery is still quite some way away. The consumer is in for another shock in a few months' time when the heating season kicks off again. We find it hard to believe in any sort of recovery until the spring of 2009 at the earliest.

On the other hand, if the economy does recover next spring, then the turnaround in global stock markets is not far away, as it usually leads the real economy by 6-9 months. Having said that, what would you rather own? Equities which currently trade at 15-20 times earnings or credit instruments trading at a fraction of that cost? Deutsche Bank has calculated that senior secured loans are now trading at an implied price earnings ratio of about 5 - less than a third of the cost of equities. There is no question that the real value is to be found in credit instruments. This is where most of the damage has been inflicted and it is where the big bargains are in today's market.

[1] "Shifting down the gears", The Financial Times, 6 th August 2008.

[2] "How to build a US recovery", The Financial Times, 7 th August, 2008.

[3] "Less than meets the eye", Morgan Stanley Global Economic Forum, 22 nd August, 2008.

[4] "Strategisches Investment Management - Wie Investoren nachhaltige Wertsteigerungen erzielen"

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.