Europe is Burning

Politics / European Union Jan 14, 2019 - 05:33 PM GMTBy: Raul_I_Meijer

There will be elections for the European Parliament on May 23-26 2019. They will likely change the face of Europe more than anything has done since the EU was founded. That is not some wild prediction. Many European countries have held elections since the last European elections in 2014, and just about all had outcomes that shook up domestic political ratios.

There will be elections for the European Parliament on May 23-26 2019. They will likely change the face of Europe more than anything has done since the EU was founded. That is not some wild prediction. Many European countries have held elections since the last European elections in 2014, and just about all had outcomes that shook up domestic political ratios.

In most cases, countries went from traditional parties to newly founded ones. France erased the Socialists and center-right in 2017, and the final round of the presidential elections was between Marine Le Pen’s Front National and Emmanuel Macron’s brand-new En Marche. Macron won sort of by default, because France as a country would never have voted for Le Pen.

In Italy, M5S and Lega have taken over. In Germany, Merkel’s CDU/CSU coalition lost bigly though it remained the biggest party, but Angela lost her ‘socialist’ SPD partner which gave up so much it didn’t want to be in government anymore. In Spain, Mariano Rajoy’s center right lost enough to cede power to the Socialists who came up tops because they played a smart game, not because the Spanish wanted it to rule.

We don’t have to go through all 27/28 different countries to establish that there are almost tectonic shifts happening all over, away from traditional parties and towards whoever showed up without insanely extreme views. And if you think this move is now completed, you may want to think again.

It’s amusing to realize that the country with the biggest political shift, the UK, is the only one that still hangs on to its traditional parties, and seeks its protest voice in a different way, namely through Brexit. That is, Britain shows it can get no satisfaction from the EU, whereas in the other major EU nations the dissatisfaction is projected onto domestic parties.

The underlying thought is the same: people are fed up with incumbent politicians and their affiliation with the European project. And nobody in Brussels really appears to be willing to realize this: the only thing they talk about is more Europe. But all these changes will now be reflected in the power politics of the European parliament.

And they do know that. They just hope they can limit the damage through the model in which power is divided in Europe. And to get any of that power, national parties need to find partners from other countries to form European parties (blocks) with. You need parties from at least 7 other nations to run for the European Parliament.

There are really only two parties in that parliament that really matter: the center right European People’s Party (EPP) which has 217 MEPs (members of European Parliament), and the center-left Progressive Alliance of Socialists & Democrats (S&D) which has 190 MEPs. Then there are the European Conservatives and Reformists – 74 MEPs, the Alliance of Liberals and Democrats for Europe (ALDE) – 70 MEPs, the European United Left/Nordic Green Left (GUE) – 52 MEPs, and the European Greens/European Free Alliance – 50 MEPs.

These numbers, like the national ones, are set to change, a lot. How exactly is hard to predict, because it’s not clear which block which -relatively- new party will be part of. But it’s not a wild guess to think that at the end of May the division of powers will not be left vs right (both of which are pretty much fake anyway), but pro-EU and anti-EU. Or rather, More Europe vs Less Europe.

Germany’s up-and-coming real right-wing AfD at their conference this weekend voted in a resolution that calls for getting rid of the European Parliament itself, calling it undemocratic, and claiming the “competence to make laws is exclusively for nation states.” Similar sentiments play out in Italy, Poland, Hungary and many other member states.

Given the changes in vote ratios mentioned before, it’s hard to see the More Europe model survive the elections. But that of course doesn’t keep the main parties (blocks) from running outspoken pro-Europe candidates to replace Jean-Claude Juncker as head chief after the elections. The EPP has German Europe stalwart Manfred Weber as ‘Spitzenkandidat’, the so-called Socialists/Democrats have Dutch Frans Timmermans, Juncker’s right-hand man.

They think they will be able to continue business as usual, and accumulate more power and sovereignty in the process, while support for the EU crumbles more by the day. But that’s all in the far far future, that is a whole 4 months away. And who knows what Europe will look like by then? Brussels sure doesn’t seem to know, or want to.

In Germany, the entire political system will have to reinvent itself after Merkel. And as said before, with an entire new look as far as vote numbers go. Far right and the Greens are on their way to becoming new power blocks, the Christian center right CDU/CSU and the formerly left SPD are on their way to much less support.

This is a pattern that plays out all over Europe, but what happens in Germany is, because of the way the EU is set up, crucial for all EU member states. Nothing happens in Europe without approval from Berlin. And what will the other 26 remaining members do when that level of power moves towards the AfD?

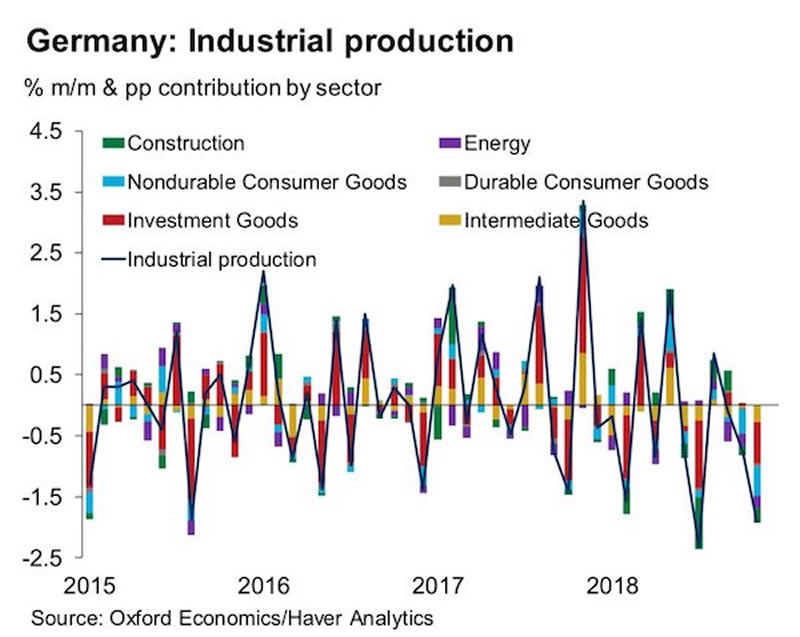

Of even more immediate concern may be Germany’s economic performance. Because the latest signs are not encouraging. Germany and Holland have done very well, but that is because they have all the others as their ‘domestic’ market. And now not even that turns out to be enough. Germany’s numbers are going down fast:

Then again, for now, worries about Germany will be trumped by those about France and Britain. The numbers of Yellow Vests in the streets of France was much larger again the past weekend than the last few ones. Macron keeps on making ever bigger mistakes. This Saturday, his riot police was filmed carrying semi-automatic weapons with live ammo. As he claimed that many of his people want to get things without making any effort.

Macron all along has tried to drive a wedge between the protesters and the people. But a large majority of the people support the protests, even if they don’t don a yellow vest. Still, Paris claims that the protesters are not the Republic, and they’re trying to overthrow democracy. When the Yellow vests approached government buildings last weekend, government spokesman Benjamin Griveaux fled, saying: “It wasn’t me who was attacked, it was the Republic.” Ergo: Not the people are the Republic, the government is. That should sell well.

For a very large number of French this sounds like they are not actually considered French by their own government. And now Macron insists on holding a national debate, in which everyone can have their say, but at the same time he insists he will not change his policies, which are what the Yellow Vests are protesting in the first place.

What they see is that Little Napoleon hasn’t hardly appeared in public for a very long time (big no-no!), but he does try to dictate to them what democracy is, and then in the same breath that they only have the choices he gives them. Protests are only allowed if the government gives permission, Paris proclaims.

Macron has cancelled his spot in the upcoming Davos spectacle for the wealthy and powerful, and I bet you the thought has crossed his mind that if he went he wouldn’t be allowed back in to his country. Not decisive, but that thought surely counts. He’s seen the whole Let Them Eat Cake scenario play out in his mind’s eye. Before putting his hand over his heart while looking in the mirror.

Macron does everything wrong than he can. And in that France has a lot in common with our for now last topic, subject, victim, take your pick, the UK.

Tomorrow Theresa May is going to lose another vote, and even if she doesn’t, chaos is still guaranteed. Both the Leave and the Remain camps, opposites as they are, are divided into countless other camps, and there is no way there will ever be an agreement. You’d have a hard time finding even just two people who think Brexit means the same, let alone millions.

I wrote earlier today I wondered how come Britain is so quiet in the face of that, with the Yellow Vests example just a few miles away. And I really don’t know. Maybe we’ll find out tomorrow. The EU has hinted Brexit may not happen until the summer, not on March 29. But that’s the EU, and that’s what the Brexit vote was meant to move away from, not let them dictate even more.

Theresa May basically sat on her hands for two years, and wanted to do the work in 6 months, but that was always going to be a pipedream. The UK, in 40-odd years of EU membership, signed up to thousands of pieces of legislation, which contain hundreds of thousands of pages of legalese. All that must be checked, if need be changed, negotiated about, voted on, etc.

Not something anyone can do in half a year, and that has nothing to do with liking the EU or not. May has held her country hostage for the entire time she’s been PM, and she does that even more now, as she’s saying it’s either her deal or no Brexit at all. She’s decided No Deal is not an option. Which may be wise in view of all those documents, but who is she to decide eth entire nation future for decades to come? She wasn’t even elected as PM.

We’ll know more tomorrow after that Parliament vote, which May will lose. Or will we? If Brussels accepts a major delay in Brexit, chances are May will stay in office, and we’ll have 4-5-6 more months of the same road to nowhere. Second referendum, general election? Poisoned chalices all of them.

Even if May wins the vote Tuesday, because she’s scared a sufficient number of MPs into a catatonic state, nothing will change either. All possible outcomes are guaranteed to have a large group of people standing against them. All options will create the appearance of a small group of people dictating life-changing events for everyone else.

Where are the British Yellow Vests? The mayor of Poland’s second-biggest city, Gdansk, was stabbed to death in public on a stage where he held a speech, Is that where we’re going?

And lest we forget, what happens in Europe is not very different from what happens in the US; things merely play out slightly differently in different locations. In the US, as in the UK, there are no whole new parties taking over, no AfD and Macron and Yellow Vests and Salvini, but there is Trump and Brexit.

The common denominator is people’s anger with the economic models that leave them scrambling to make do, all the while seeing their lives being taken away from them bit by bit while whoever’s in power keeps bankers and other rich folk contented.

It’s not much use seeing all this as separate incidents or developments. It’s a big wave that will reshape the world as we know it. Let Them Eat Cake has gone global, and there’s not nearly enough cake to go round.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2019 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.