Most Popular Financial Markets Analysis of 2018 - Trump and BrExit Chaos Dominate

Stock-Markets / Financial Markets 2018 Jan 01, 2019 - 11:22 AM GMTBy: Nadeem_Walayat

Donald Trump and Britain's countdown to BrExit Independence (29th of March 2019) proved to be the weapons of mass financial distraction of 2018 that dominated politics and the financial markets. Both born out of 2016 elections seeking to upset the status quo

of an elite that had taken their electorates for granted for decades that culminated in the failure of politicians to hold the banking crime syndicate to account for the financial crisis which ushered in a decade of economic depression for most of the electorate.

Donald Trump and Britain's countdown to BrExit Independence (29th of March 2019) proved to be the weapons of mass financial distraction of 2018 that dominated politics and the financial markets. Both born out of 2016 elections seeking to upset the status quo

of an elite that had taken their electorates for granted for decades that culminated in the failure of politicians to hold the banking crime syndicate to account for the financial crisis which ushered in a decade of economic depression for most of the electorate.

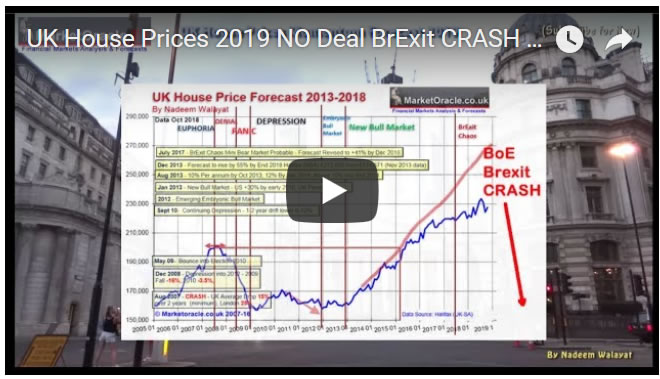

In the UK a Remainer Prime Minister has been determined to subvert the will of the British people with most Westminister politicians encouraging calls for a further chaos inducing Second Referendum that the establishment are certain to engineer to deliver a REMAIN outcome as illustrated by the economic collapse propaganda surging out of the Bank of England downwards.

Propaganda spread thickly across the mainstream media, that has been busy speculating on how a second referendum question would be engineered so as to split the LEAVE vote and thus ensure that REMAIN would win as illustrated by the Financial Times.

The jist of the London metropolitan elites argument is that those outside of London did not understand what they were voting for and thus a second, and maybe if needed a third referendum must be run until the country bumpkins outside of London deliver the requisite referendum result they want.

This despite the fact that the referendum offered a clear choice, one of choosing to LEAVE or REMAIN within the European Union. Everything since which has been REMAIN establishment BS towards subverting the election outcome that in my opinion has put Britain into a Pre-Civil War State!

Whilst in the White House we have the master con man Donald Trump who never thought he would actually win the 2016 Presidential Election and so has been on the defensive ever since in attempts to cover up his dastardly deeds from the glare of the likes of the FBI by adopting divide and rule tactics putting Americans against one another in his quest to remain in office and prevent investigations into his conduct from concluding in impeachment. In fact before Trump took office I had penciled in a forced exit date for him from office of June 2019, and so it remains to be seen if he manages cling on past mid 2019 or whether the chickens finally come home to roost.

The most evident single example of who Trump is was his fake nuclear agreement with North Korea's dictator. A pure media exercise and totally worthless in practice. Similarly NAFTA was rebranded as USMCA. Then we had the bubbling trade war with China where my consistent view has been that China lost the Trade War even before it began.

And finally Trump going to war against America's central bank for withdrawing easy money, then shutting down the government coupled with a slowing economy forewarned by expectations of a yield curve inversion going into 2019 which tend to be harbingers for a recession, all finally impacted the financial markets as the Dow instead of delivering a santa rally took a nose dive during December that looks likely to have brought the 9 year old bull market to a end, a harbinger of worse to come in 2019, which in my opinion would present a great Buying Opportunity.

The bottom line is to expect even wilder swings from both Trump and the markets during 2019.

Market Oracle Top 10 Most Popular Articles of 2018

1 |

Best Cash ISA Savings Account for Soaring UK Inflation - February 2018 |

Feb 11, 2018 - 05:44 PM GMT By: Nadeem_Walayat

As the financial year draws to a close, many ISA savers will be busy seeking to capitalise on their 20k annual tax free ISA savings allowance, buoyed by mainstream financial press coverage as apparently UK interest rates are heading much higher which includes for savers as well as borrowers as the Bank of England is expected to continue hiking UK base rates and withdraw some of its support for Britain's banking sector such as the funding for lending scheme that has resulted in a catastrophic downwards death spiral in UK savings interest rates for the past 5 years. Resulting in savers literally being ripped off by the tax payer bailed out banking sector that for the duration have continued to bank bonuses on the basis of artificial profits engineered by the Bank of England in an attempt at recapitalisng the bankrupt banks all whilst the savers continue to suffer and pay the price in terms of loss of real terms purchasing power of savings as inflation continues to erode the heard earned wealth of savers.

2 |

Dollargeddon - Gold Price to Soar Above $6,000 |

Aug 16, 2018 - 03:57 PM GMT By: P_Radomski_CFA

In our regular gold trading alerts, we focus on the short- and medium-term outlook and we rarely discuss the very long-term issues or price targets. The reason is simple – the long-term issues and price targets don’t change often, so usually there’s little new to say about them. Consequently, it’s been a long time since we last discussed our view on gold’s explosive upside potential. In fact, it’s been so long that those who do not take the time to read our analyses thoroughly and those who have been reading them for only a short while may think that we are bearish on gold in the long run. Or that we’re perma-bears. Naturally, it’s nonsense and those who have been diligently following our articles know it. What we’re aiming for is to help investors position themselves to make the most of the upcoming rally in the precious metals market and one of the best ways to do it is to help people prepare for the final bottom in gold.

3 |

Gold Price Forecast 2018 - February Update |

Feb 01, 2018 - 06:49 PM GMT By: Nadeem_Walayat

The gold price had a good start for 2018, rising from 1310 at the start of January to a high of $1367 with the most recent trading price of $1351. Which is set against my forecast for 2018 for the gold price to first target resistance $1375, an eventual break of which would propel the Gold price towards a 2018 target of $1500, and then further for the Gold price to ultimately target a trend towards $1800

4 |

Is Gold Price On Verge Of A Bottom, See For Yourself |

Aug 22, 2018 - 04:21 PM GMT By: Chris_Vermeulen

The recent downward price swing in Gold has kept Goldbugs frothing at what they believe is a very unusual and unexplained price function in the face of so much uncertainty throughout the globe. With Turkey, Russia, China and many others experiencing massive economic and currency crisis events, Gold has actually been creeping lower as the US Dollar strengthens. It is almost like a “Twilight Zone” episode for Gold Bulls.

5 |

Next Financial Crisis Is Already Here! John Lewis 99% Profits CRASH - Retail Sector Collapse |

Sep 13, 2018 - 09:42 AM GMT By: Nadeem_Walayat

This week the mainstream press has been busy focusing on remembering the 'start' of the financial crisis of September 2008 "Lehman's Brother Collapse" that most of whom never saw coming. In act the financial crisis actually began much earlier than September 2008 with the first obvious signs of a credit crisis brewing being the collapse of two Bear Stearns hedge funds during July 2007, but it would take the mainstream financial press another year before they started to connect the dots for the train wreck well in motion.

6 |

Bitcoin Crypto Currencies Crash 2018, Are We Near the Bottom? |

Feb 05, 2018 - 06:50 AM GMT By: Nadeem_Walayat

The crude oil price collapse of 2015 has continued into 2016 with the price of oil plunging to a 12 year low of just under $30 per barrel as a consequence of a perfect storm of falling demand, primarily due to the slowing Chinese economy and relentlessly rising output that is not just limited to the usual OPEC suspects but is as the natural consequences of the fracking boom that continued to ripple out from the US to across the world during 2015.

7 |

Why Trump WANTS Iran to Develop Nuclear Weapons for Israel and End Time Prophecies |

May 11, 2018 - 03:47 PM GMT By: Nadeem_Walayat

Trump has once more pressed the reset button on what has come before by resetting the middle east to where it was before the 2015 Iran nuclear deal as President Trump declared to the masses that he 'keeps his promises' whilst breaking America's promise in respect of the Iran Nuclear deal (JCPOA) which had put Iran's nuclear weapons programme into reverse gear as verified by regular IAEA inspections, in exchange for the lifting of economic sanctions that have now been reimposed. Unfortunately, Iran NOT engaged in developing nuclear weapons is not in the interests for large section of Trumps delirious electoral base, the Christian fundamentalists who desperately crave the End Time apocalypse prophecies to be fulfilled in their life time so that the Messiah may return and they all be raptured straight to paradise, an ideology backed by the Israeli state and its own Jewish fanatics who have their own prophesies for the coming of the Messiah and perceive everything that Israel does being towards that end. Whilst of course the Islamic fundamentalists also await their own version of the End Times prophecies to be fulfilled which was the primary reason why Islamic State came into existence in Syria as a means of making prophecy become manifest.

8 |

Will Gold Price Breakout? 3 Things to Watch… |

Mar 24, 2018 - 06:24 AM GMT By: Jordan_Roy_Byrne

Gold has firmed above $1300 in recent days and is holding comfortably above $1300 for now. We think the market will break to the upside sometime this year. The question is when. Here are 3 things to watch that will tell us if Gold is on the cusp of that break-out soon or later.

First, keep your eye on Gold’s close at the end of next week. It’s not only the end of the week and month but also the end of the quarter. While Gold has traded above $1350 multiple times in the past two years, it has not made a quarterly close above $1330 since 2012. Since this is a quarterly time frame, we would need to see a close above $1340 or even $1345 to mark a significant breakout. If Gold can make such a close next Friday then the odds are good that it could break above $1375 fairly soon.

9 |

China Invades Saudi Oil Realm: PetroDollar Kill |

Mar 25, 2018 - 02:23 PM GMT By: Jim_Willie_CB

China is working a strategy with the Saudis. Since the last months of 2017, the Jackass has been firm that the ARAMCO deal for IPO stock introduction might never occur. And if it did, then Hong Kong might be the only location for the IPO launch. It seems that disclosure and transparency is non-existent to this Arab kingdom. Now the stock listing might be in Riyadh and nowhere else. Imagine the risk to brokerage houses if the truth comes out, that the Saudi oil reserves are only 20% to 40% of the disclosed amount, a grand lie and deep fraud. Such will not stop China from investing privately in ARAMCO, since it would serve two purposes. It would enable huge diverse participation in the Saudi Economy, which contains a second treasure trove of minerals. It would enable the Chinese to purchase Saudi oil in RMB terms for payment. In the last month, the Russians confirmed an equally sized investment stake in ARAMCO. If the Chinese sit on the ARAMCO board of directors, they will surely convince the Saudis to alter the payment method in approval. It could be a primary part of the deal.

10 |

Gold Price Selling Exhausting |

Jul 07, 2018 - 06:41 PM GMT By: Zeal_LLC

Gold has been afflicted by relentless selling over the past few weeks or so, forcing it to major lows. While summer-doldrums weakness is typical, gold’s recent drop is on the large side even for this time of year. It was fueled by truly-extreme short selling by gold-futures speculators, which is quickly exhausting. That is paving the way for gold’s major autumn rally to start marching higher any day now, a very-bullish omen.

A month ago when gold was still near $1300, I published my latest research on its summer doldrums. The first halves of market summers including Junes and early Julies have long tended to be the weakest times of the year seasonally for gold. They are simply devoid of the recurring seasonal demand surges gold enjoys during most of the rest of the year. With investors not interested in buying, gold languishes.

Entering 2019

Going into 2019 my primary focus remains analysis of the housing markets towards concluding in a high probability multi-year trend forecast for UK and US house prices, and I will likely touch on other housing markets as well.

This analysis is first being made available to Patrons who support my work. So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my always free newsletter and youtube channel.

Your Analyst Wishing ALL of my readers a Happy and Prosperous New Year from Sheffield!

By Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.