Does Flat CPI in November Imply Flat Gold?

Commodities / Gold and Silver 2018 Dec 13, 2018 - 06:04 PM GMTBy: Arkadiusz_Sieron

Zero. The US inflation rate was unchanged in November. What does the flat CPI mean for the gold market?

Zero. The US inflation rate was unchanged in November. What does the flat CPI mean for the gold market?

What Happened With Inflation?

The CPI was unchanged in November, following an increase of 0.3 percent in October. It was the weakest number since March 2018, when monthly inflation fell about 0.1 percent. However, the flat reading was caused by a sharp decline in the price of gasoline – that subindex dropped 4.2 percent in November, offsetting increases in an array of prices including shelter and used cars and trucks. But the core CPI, which excludes food and energy prices, increased 0.2 percent last month, the same change as in October. So, don’t worry about the upcoming deflation.

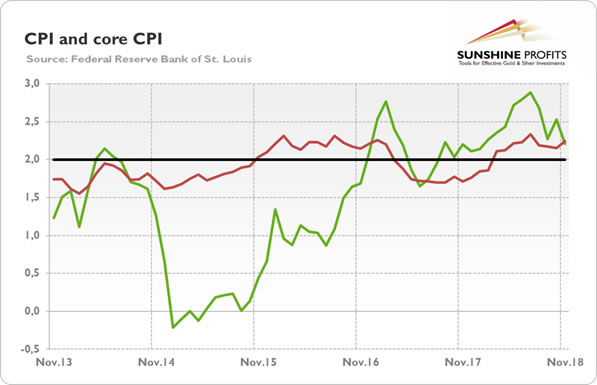

Over the last 12 months, the consumer prices increased only 2.2 percent, compared to 2.5 percent increase in October. The slowdown was obviously caused by a notably smaller increase in energy prices. The energy subindex increased just 3.1 percent on an annual basis, the smallest yearly increase since June 2017. However, the index for all items less food and energy climbed 2.2 percent, the same as last month, as the next chart shows.

Chart 1: CPI (green line, annual change in %) and core CPI (red line, annual change in %) over the last five years.

How To Interpret This Data?

Many analysts are shocked and interpret this data as a proof that inflation is waning. However, they are wrong. The underlying inflationary pressure is firm. The softer reading should not be actually surprising for anyone who carefully analyze the economic trends. As we do. The slowdown in inflation was precisely what we expected. In the Gold News Monitor published on November 20th, when we examined the October CPI reading, we wrote:

Inflation rose in October, but mainly because of jump in energy prices. The core inflation remains stable and the overall CPI may ease in the near future, given the fall in oil prices in November.

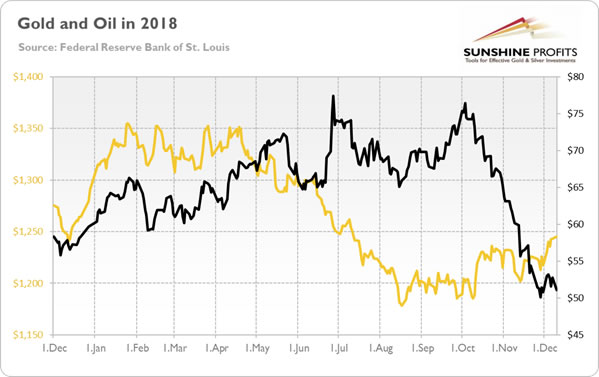

And, indeed, the overall CPI eased, as we predicted. If we did it once, maybe we will do it again – so let’s see what our crystal ball tells us. Hocus pocus, let’s focus! On the chart below, which shows the prices of oil (and gold) since December 2017.

Chart 2: Gold prices (yellow line, left axis, London PM Fix, $) and oil prices (black line, right axis, WTI, $) over the last twelve months.

As one can see, the oil prices collapsed in November, which lead to softer inflation reading. However, they have stabilized somewhat in December. Given that the recent slide is unlikely to persist, we could see a rebound in inflation. Of course, what we have in mind is the monthly rate, as the oil prices are now below the level seen last year.

Implications for Gold

That’s true. The inflationary pressure eased somewhat in November. However, inflation is still slightly above the Fed’s target. So we don’t expect any dramatic changes in the Fed’s thinking. The US central bank should continue its policy of gradual hiking the federal funds rate. It implies more of the same for the gold market.

What does it mean? Well, gold is trapped in the sideways trend for a couple of years. But that trend is quite turbulent. If history is any guide, gold should reach the bottom in December and rally after the FOMC meeting. But this year might surprise us. On the one hand, the Fed may slash its economic projections, which could help the yellow metal. However, the markets expect just one hike in 2019 – so, if the Fed sounds more hawkish than expected, gold may suffer. Next week will bring us the answer.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.