Waiting for Gold Price to Erupt

Commodities / Gold and Silver 2018 Dec 10, 2018 - 02:15 PM GMTBy: Chris_Vermeulen

As we are watching the US and global markets rotate dramatically lower over the past few days, we have been advising our members that we believe this rotation is an over-reaction to economic impetuses and trade issues – not a massive downside price break. Overall, some of our longer-term technical indicators are currently bearish, as one would think technical indicators would react to price activity and trends. Our ADL, predictive modeling system, is still suggesting upside price activity and we believe our research team has hit on something that helps to put this end of year turmoil into perspective.

As we are watching the US and global markets rotate dramatically lower over the past few days, we have been advising our members that we believe this rotation is an over-reaction to economic impetuses and trade issues – not a massive downside price break. Overall, some of our longer-term technical indicators are currently bearish, as one would think technical indicators would react to price activity and trends. Our ADL, predictive modeling system, is still suggesting upside price activity and we believe our research team has hit on something that helps to put this end of year turmoil into perspective.

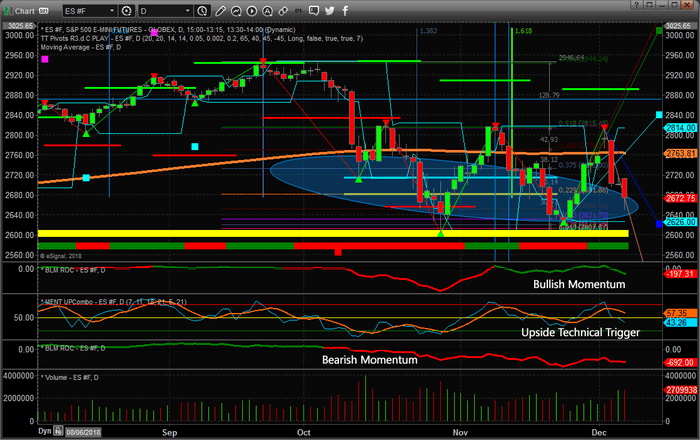

Where is the fear? The news cycles had indicated that much of the “big money” investors had already exited the markets prior to Nov 1. This leaves the retail investors and the market-makers to manipulate the markets. Volatility has been much higher than the previous two-Quarters average and volume has been moderately strong in the ES. This leads us to believe that quite a bit of retail and foreign investor activity has been taking place in the US Equities markets.

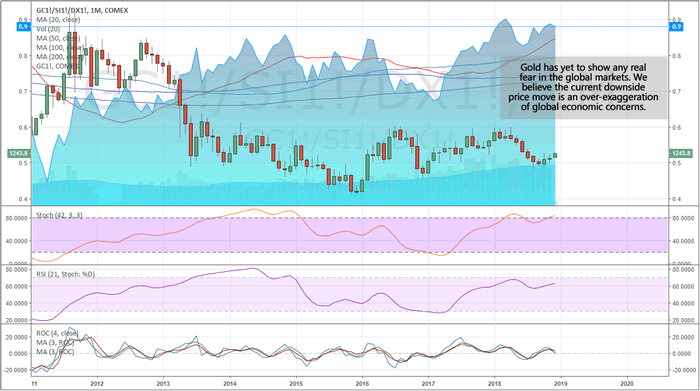

Yes, there are concerns arising from the likes of Apple, Caterpillar and other blue-chip symbols. These arise from some concerns regarding future earnings capabilities in the face of increasingly complicated trade and global market conditions. Yet, we have yet to see any of this fear fall into the normal outlets – GOLD.

When we take a look at monthly gold using one of our custom pricing indicators, we are seeing very moderate upside gold price activity over the past 60+ days. All of this is taking place near a very tight pricing channel, setting up as a pennant or flag formation, that should prompt a bigger move in Gold in 2019. But as of right now, nothing is evident to show that a massive amount of fear has entered the markets and is driving capital into the traditional safe-haven investment.

Therefore, we still believe this downside move is more technical in nature and will likely end near the 2620 level on the ES as support continues to hold near recent lows. As we have been suggesting for many months now, we continue to believe this is the time to establish small long positions near these support levels in preparation for a broader market recovery near the end of December and into early 2019.

Please take a minute to visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades in 2019 and how we can help you navigate these market moves more clearly. Our research team is dedicated to helping you understand these markets and find greater success. Join our other members in making 2019 a fantastic year.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.