Will Weak US Dollar Save Gold?

Commodities / Gold and Silver 2018 Dec 07, 2018 - 05:15 PM GMTBy: Arkadiusz_Sieron

Trade wars and lax fiscal policy are negative for the US dollar and positive for gold. Myth or fact? We invite you to read our today’s article about the effects of Trump’s actions on the greenback and find out whether weak dollar will save gold.

Trade wars and lax fiscal policy are negative for the US dollar and positive for gold. Myth or fact? We invite you to read our today’s article about the effects of Trump’s actions on the greenback and find out whether weak dollar will save gold.

Let’s look at the chart below. As one can see, the greenback has been in a bull market since February 2018. Yup, the chart does not lie. The US Congress widened the fiscal deficit, while President Trump engaged in trade disputes. But despite these disturbing developments for long-run economic health, the broad trade weighted US dollar index increased from 115 to almost 130 now. But why – shouldn’t it decline?

Chart 1: Trade Weighted U.S. Dollar Index against broad range of currencies from January 2014 to October 2018.

Not necessarily. The first reason is the American monetary policy. It might be just a coincidence, but in February 2018, Jerome Powell took reins at the Fed. The US central bank has been gradually raising the federal funds rate, putting the upward pressure on the greenback. Moreover, the new composition of the FOMC under a fresh leadership has been signaling a more hawkish tone, which lifted a market expectations of the future path of interest rates, also contributing to the dollar’s strength.

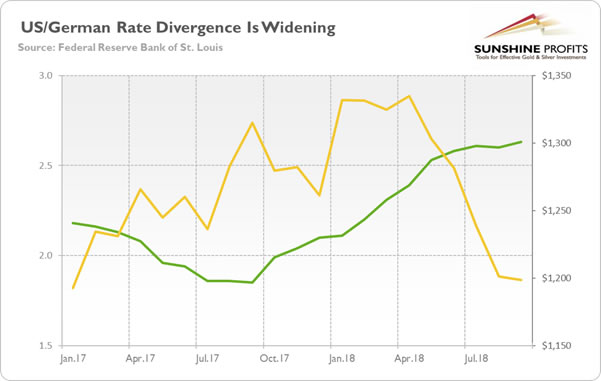

What is really important here is not the mere increase in interest rates, but the upsurge in relation to other economies. The chart below displays the difference between US and German 10-year government bonds. As one can see, the yield gap has widened since the mid-2017.

Chart 2: The 10-year Treasury Yield Divergence between US and Germany from January 2017 and September 2018.

The divergence in bond yields – which results from the fact that the US recovered from the Great Recession earlier pushing the Fed to adopt a more hawkish stance compared to the ECB – is a key here. Higher interest rates in the US attract international investors who can earn more money thanks to investing in relatively high-yield US assets. And to buy them, they need – yes, you guessed it – the American currency. Hence, less accommodative Fed than its peers strengthens the greenback, making gold struggle.

However the monetary policy is not everything. There is also a fiscal policy. Trump and the Congress have pursued a massive pro-cyclical fiscal expansion (composed of both the tax cuts and the increase in government spending), ballooning the budget deficit to unprecedented levels in the absence of a recession or a war. The following rise in interest rates is actually what the macroeconomic theory predicts. Higher yields attract capital from abroad which strengthens the US dollar, while weakening the gold.

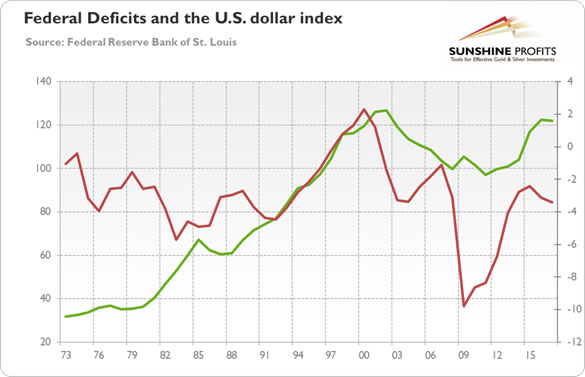

And this is not merely a theoretical possibility the economists model in their ivory towers. Just look at the chart below, which shows the US federal deficits and the trade weighted US dollar index. The correlation is not perfect, but this is because of what really matters for greenback and gold is the fiscal-monetary mix, not the fiscal or monetary policies in separation. So focus on period of 1981-1984, when Reagan-Volcker duo was in charge. The combination of rising deficits and monetary policy tightening made dollar rally, while gold entered its long-term bear market.

Chart 3: Federal Deficit (red line, right scale, as % of GDP) and broad trade weighted US dollar index (green line, left axis) from 1973 to 2017.

‘But what about the 2000s, when Bush has become the biggest spender in decades,” you could ask. He boosted the twin deficit and public debt, but the greenback weakened, while gold started its impressive bull market. That’s true, but Greenspan then conducted an easy monetary policy and slashed interest rates to very low levels. The combination of accommodative fiscal and monetary policies made investors lose their confidence in the dollar and shift their funds into the precious metals market.

Last but not least, we should not forget about Trump’s trade wars. He introduced import tariffs, wanting to improve the US trade balance and weaken the currency. But President, although believed to be a great businessman, does not necessarily understand all the intricacies of macroeconomics. If earning dollars is harder for foreign exporters, there will be dollar scarcity, and upward pressure on the currency while downward pressure on gold prices. In other words, dollars will remain in America, so they will not enter the international currency market. Fewer greenbacks in the market imply higher exchange rate between US dollar and other currencies, including gold.

To sum up, the puzzle of strong greenback during Trump’s presidency is apparent. The rise in US dollar is in line with the macroeconomic theory, which predicts that the combination of lax fiscal policy and hawkish monetary policy would lift the interest rates which should support the currency. This is bad news for gold. It implies that gold will not start rallying without material changes in the current policy mix. Another important implication is that precious metals investors should pay less attention to the geopolitical uncertainty (“Trump and his trade wars would for sure boost gold”) and focus instead on macroeconomic factors.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.